Stock Market 2024 Rally to the MOON!

Stock-Markets / Stock Markets 2024 Jan 19, 2024 - 06:36 AM GMTBy: Nadeem_Walayat

Dear Reader

Understand this if you invested in the stock market to any significant degree during 2023 then you went AGAINST the herd because the herd (Institutions and retail investors) plowed most of their money into money market accounts having been talked into by the likes of the clowns on the CNBC cartoon network, MSM and the blogosfear. In fact it is even worse than that as Equity Funds experienced a net outflow of about $250 billion during 2023. so not only did investors not invest, they actually sold stocks. So what is going to happen when they see rates on their money market accounts drop? They are going to BUY STOCKS! Which will be NEAR ONE AND HALF YEARS LATE TO THE PARTY!

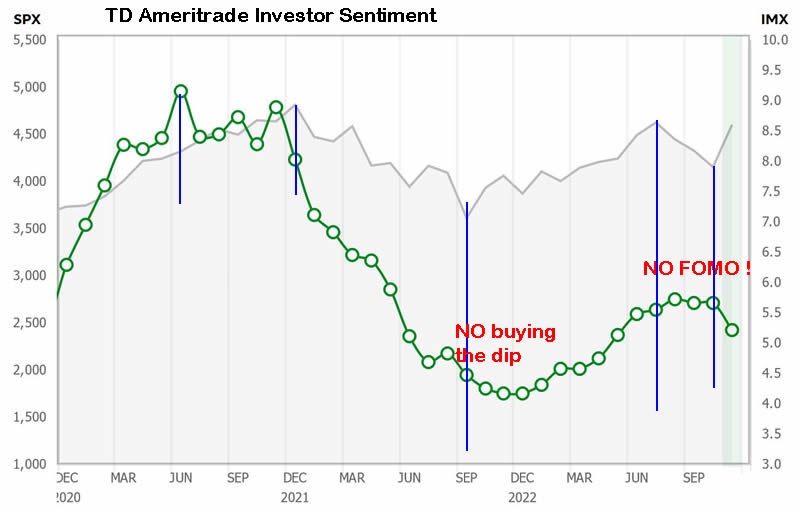

TD Ameritrades retail investors sentiment chart illustrates this fact, retail investors have been SELLING since the July high, which followed fairly feeble accumulation, convinced by the cartoon network's mantra that a recession is coming.... Just look at the chart, there is NO FOMO! The S&P is on the verge of breaking to a new all time high and most investors are sat on the sidelines waiting for their fantasy S&P 3200 to materialise! This SHOWS you where you would also be if you had followed the herd during 2023! Another reminder - DO NOT PAY ANY ATTENTION TO MSM which is populated by clueless journalists and fund managers (sales people).

This analysis Stock Market Santa Rally to the MOON! S&P 4800+ was first been made available to patrons who support my So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my most recent analysis -

- Stock Market Election Year Five Nights at Freddy's

- S&P Stock Market Analysis, Detailed Trend Forecast Jan to Dec 2024

- Last Chance to Get on Board the Bitcoin Crypto Gravy Train - Choo Choo!

Also gain access to my exclusive to patron's only content such as the How to Really Get Rich series.

S&P 4719, beating all expectations, though it's not that much of a surprise after all this is the first full calender year of the new bull market which does tend to be strong. S&P 4719! is now within touching distance of it's all time high of 4818, it's definitely doable within days of either this side of 31st Dec .with the actual trend coming quite close to my swing projection of several months ago despite that late October dip to 4100.

Though as I often repeat, the S&P to me is a nothing burger, Yes, every now and then I dabble in S&P options with mixed results, but it's not an index I even look at on a daily basis, I look at that which I am buying or selling i.e. the individual stocks, where some get trimmed, and others get bought, i.e. during the last week I bought some BABA, BIDU, TSLA and OXY whilst I sold some GPN, WDC and ABBV. One of the mistakes I often hear in the comments is 'Shall I buy and sell x,y,z stocks at S&P X. STOP LOOKING AT THE BLOODY S&P500! INSTEAD LOOK AT THE STOCKS YOU ACTUALLY HOLD! The S&P is good for generating an overall road map, but it is no good for making decisions of when to buy or sell individual stocks! What i look at each day is which stocks have moved up or down the most that day to see if there is as an opp to buy or sell those stocks. In fact I usually only look at the S&P when the markets closed i.e. it's more an analytical tool that forms the basis of studies towards giving a general direction of travel.

Furthermore whilst all eyes are on the S&P look at what the Dow has stealthy gone and done! Set a new all time high!

Which means a S&P new all time high is just a matter time, so what difference does it make if it happens this side of 1st of Jan or not? It's definitely coming!

Folks we have runaway gravy trains, they will do what needs to be done to satisfy the buying pressure despite the fact that numerous technical indicators are screaming overbought. Yes this rally will end in a correction where we will see stocks fall just enough so as to allow one to accumulate once more.

Meanwhile I am working on the road S&P map for 2024, Target date for completion and posting is weekend 29th / 30th Dec. In the meantime my base case remains for a bullish trend into April that targets a break above 5000, and that 2024 should be a bullish year i.e. end 2024 well above where it 2023 ends.

Quantum AI Tech Stocks Portfolio

Current state of portfolio is 87.6% invested, breakdown is AI 48.4%, Medium Risk 22.5%, High Risk 12.6%, Crypto's 4.1%, Cash 12.4%. Cash is the oil that allows your portfolio's engine to run smoothly, without cash the engine will seize so don't make the mistake of not carrying adequate cash on accounts to allow one to capitalise on opportunities, I see some folk making the mistake of getting convinced into putting their cash into money market ETF's when instead most of ones cash should be committed to limit orders as GPN illustrates the stock soared to $138 and then dumped to $121 last Thursday, I had a large SELL limit executed at $136 and small buys at $124-$123. Current price is $128, the buys would not have happened without cash on account and 2023 is littered with many similar examples such as AMD's dump during early May to $80. So don't make the mistake of chasing peanuts (money market ETF's) instead focus on capturing the opportunities (AMD $84-$80 dump, current $139).

Today's AI mantra in the MSM will in the not too distant future become a Quantum AI mantra. Whilst AI will reveal soon that humans are not as intelligent as we think we are, for instance we cannot even see the nights sky as it truly is only having evolved to see a tiny fragment of the electromagnetic spectrum, instead of a black void we would see a universe that literally glows in all directions due to being full of hydrogen gas. Unlike in the movies we don't stand a chance against AI!

https://docs.google.com/spreadsheets/d/10fM9Sk9syxj1r3UqMmei9zZSdfPMon4l63LjVMI0T7k/edit?usp=sharing

Primary AI Stocks

EGF's analysis, which stocks stand out in terms of what's good and what's bad.

Microsoft $371 - Remains on the expensive side, which means it should continue to underperform the others.

TSMC $102.5 - Has negative EGF's which means its going to find it tough to climb higher until these turn positive so I expect TSM to continue to under perform.

Qualcom $143 - Cheap - Finally coming alive, I've been banging the drum that Qualcom is dirt cheap all year so folks have had plenty of time to accumulate at under $110, the break higher was only a matter of time, probably destined for new all time highs, next resistance is at $152, then $171 before the $192 All time high.

Google, Nvidia, AMD, META - Have okay valuations relative to EGFS / PE's

AI - Secondary Stocks

Apple $197.5 - EGF's have turned strongly positive, so whilst not cheap it does look set to keep climbing higher. I would not buy it at X32.3 earnings! Maybe at around X25.

Micron $82 - Is an anomaly, All it's metrics are very bad but it keeps climbing higher on AI FOMO mania, the lack of good fundamentals means it could be prone to a swift stock price collapse, but we just don't know, I am good either way, if it drops I'll buy some more if it FOMO's I'll trim. I remain skeptical of Micron so will lighten my exposure from 67% invested if I see something like $95.

AMAT $162 and ASML $753 have weak fundamentals, I'll buy a significant dip in AMAT whilst continue to trim ASML as it trades higher.

Broadcom $1130 - To the MOON! Good fundamentals but the stock has run away with itself, now trading at 130% of it's PE range so it is expensive, I don't hold enough to trim so it's a case of just holding.

LRCX $773 - Another one that's got weak fundamentals and is expensive hence I have been trimming somewhat.

Amazon - $150 Metrics are all over the place, I'm comfortable with 56% exposure whatever the outcome.

Overall Secondary are in a much weaker fundamental state then the primaries.

SLEEPERS

INTEL $46 - Has surprised all by soaring like the phoenix, finally allowing me to trim into over exposure, fundamentals are weak but that is a function of heavy capital investment that the stock price is now starting to discount. Intel's trend is strong so I can easily see Intel trading at $55 during Q1 of 2024.

IBM $162 - is no longer a sleeper, STRONG fundamentals, it has rocketed higher! We have had so many false dawns with IBM but the fundamentals are strong, it's heading north of $200. So what's going on? A 1121 Qubit Quantum chip announced a few days ago, up from 433 and inline with IBM's roadmap that began in 2020 with a 27 qubit chip. I am 49% invested and will definitely be accumulating on the next dip. As I warned, investors who looked like geniuses trimming IBM at $152, not so much now at $162, thought he next correction could see IBM back down to $150.

SAMSUNG $1396 - Is weak, it's South Korean, it's not the same as the rest, difficult to gauge hence at the bottom of the AI list, definitely remains a sleeper!

HEALTHCARE

JNJ $155 - Weak fundamentals but it is dirt cheap so downside should be limited, same for ABBV - The whole sector is weak

Pfizer $26.5 - It was supposed to be a slow gainer that pays a dividend instead it's turned out to be a pain in the butt stock. Fundamentals are catastrophic, there is a limit to what investors can do when faced with a badly run company, it is NOT the same stock as it was a year ago, all we can do as investors is wait for a turnaround so as to reduce exposure. On the plus side bull markets tend to lift all boats,so I can imagine Pfizer trading to over $34 during 2024.

WAR WITH CHINA STOCKS

LMT $442 - Weak growth should deliver slow but steady stock price appreciation.

RTX $80 - A more volatile version of LMT.

MEDIUM RISK STOCKS

Arrow $123.5 - One of my long-term fav's that I have traded in and out of profitably several times, however it's fundamentals have turned BAD! So I am seeking to reduce exposure from current 109% down to about 90% and then look to buy any deep draw downs.

FLEX $29 - Very good stock, still await opps to to accumulate.

GPN $128 - Great fundamentals, price spiking all over the place went up $138 and then down to $122 all in one day!

Jabil - $133 - Good fundamentals, not given any opp to accumulate into so far.

WDC $50.6 - Stock price soaring on bad fundamentals has allowed me to trim exposure down to 109% from 125% will continue to trim during the rally, seeking to settle at around 90% invested. I don't know what's driving the price higher but I am grateful for whatever it is :)

DIODES $78 - The stock price COLLAPSED on bad fundamentals which presented an opp to BUY BIG, now recovering, when I say bad fundamentals not disastrously bad so I'll continue to hold and trim a little towards 100% invested from current 109%.

ON SEMI $85.6 - Another stock that collapsed on weak fundamentals after it had FOMO 'd to a ridiculous levels, the stock is bouncing given the huge drop, I am okay at 101% invested whatever happens.

MEDIFAST $68 - VERY BAD FUNDAMENTALS have annihilated the stock price, it what happens in every portfolio, there will be stocks where their fundamentals just keep getting worse and worse and worse and so DCA FAILS to do it's magic because there is no bottom, it's a case of invest and forget and see if the Management can do their job some years down the road, a reminder when you buy, you buy to INVEST not TRADE! So always be prepared to hold for the long-run.

ADSK $242 - The stock price is reacting to GOOD fundamentals and taking off, I never got to my 90% target, but around 70% invested is still fine.

CRUS $83.8 - Another stock that collapsed during October, which saw my exposure leap to over 100% invested. I don't see the reason why it fell because the fundamentals were and still are fairly good so CRUS could surprise to the upside! Be back to over $100 during 2024.

GFS $59 - For me GFS has been a great stock, excellent range trader! Traded in and out so many times. Bad fundamentals and weak stock price action has seen my exposure rise to 117%, stock is now soaring once more to target $71 to trim into to then seek to rinse and repeat on the next drop, the effect of which is to keep driving my average price paid lower where I currently calc it at $42, so it is unnecessary to try and buy the bottom or sell the top, all one needs to do is to trim and reaccumulate and the average price paid will keep dropping. Which is why I love range traders like GFS.

HPQ $30.7 - HPQ has been weak stock for some time, but the fundamentals are actually good! It is a very cheap stock that is clearly flying under the radar, so it should surprise to the upside, I can see HPQ back over $40 during 2024.

TESLA $253 - Fundamentals are mixed but the story is one of AI Robots coming soon! Probably before Full self driving cars! I want to accumulate a lot more, get to around 60% invested from current 45% before the herd cottons on to what's going on. Here's a video I did on the Gen 2 Tesla Bot - https://youtu.be/1sxSe3H5Gys?si=pVVfAbwNMdeaQE90

KLA $585 - Has always been a good stable stock, it's only ever given one big buying opp and that was into the October 2022 low and it's not given any further opps since. I am 57% invested and very reluctant to trim because I know it is so damn hard to buy back into it. I am seeking to get to 70% invested.

Baidu $114 - Excellent fundamentals, trading dirt cheap on a PE of 9.1 same as all chinese stocks, it's either a case of China is finished or this is what it looks like when a market is hated and no one wants to invest in stocks when they are dirt cheap, I've been buying the dips, building up exposure to 123% invested, if it falls I'll keep buying more.

LOGITECH $94 - Excellent fundamentals which the stock price has soared in response to! I have over trimmed to just 16% invested vs the 70% I seek, hindsight is always wonderful. Though it is over valued at 203% of it's PE range.

INMODE $22.8 - My exposure to the Israeli Fourth Reich, The fundamentals are GOOD, at least the stock price has stopped dropping, but is at the whims of what the Zionist Regime does next in it's genocide of Palestinians so we could see fresh waves of selling, it's a case of invest and forget, check back in a year or so's time. I'll donate any profits made at that time to what's left of the Gaza concentration camp that the fourth reich seeks to flatten to look like Auschwitz.

Hey! It could have been a lot worse, I could have ranted on for more several paragraphs!

ULH $26 - Fundamentals are okay, it should continue rallying along with the rest of the market to first target $33 and then $44, off it's $22 low, it appears to like the number 11.

I'll look at the Housing and Medium risk stocks in my next article

The Bond TRADE

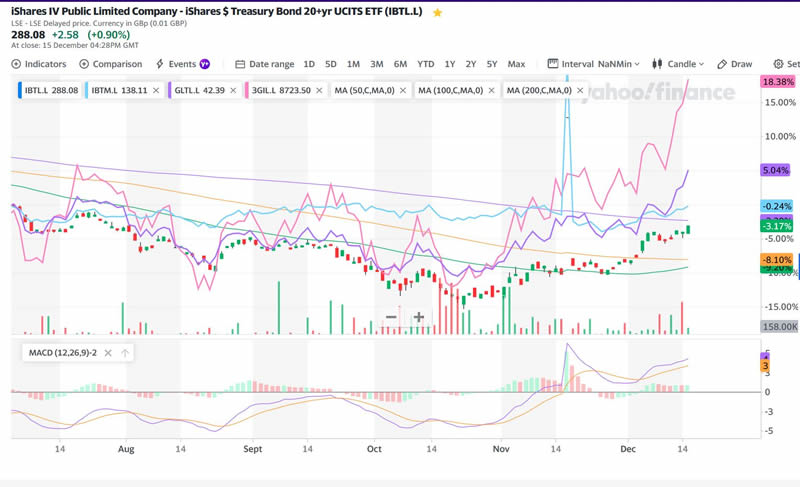

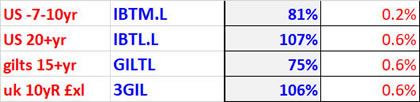

An opportunist trade to capitalise on the bond market blood bath, objective for about a 50% return over 2 years with my original analysis timed to coincide with the bond market bottom - 7th Aug 2023 https://www.patreon.com/posts/inflation-bond-87342150

The bond trade exposure equates to 2.2% of my portfolio.

The largest gainer is the 3x leveraged 3GIL +34%, smallest gainer is IBTL.L +5%

Bitcorn

Right now Bitcorn is correcting $40,500, alt coins even more so Link $13.8, Solana $68, an opportunity to accumulate...

Crypto's are now 4.1% of my portfolio, 5.3% including Coinbase, I am locked and loaded to party like it's 2024! First X2, then X3 and maybe some crypto's will X5 from here (Solana, Link). The only negative will be the tax bill! The sooner Bitcoin ETFS appear the better so I can cycle some of my exposure out of taxed holdings into tax free wrappers.

And lastly the AI God / Devil is Coming......

AI Messiah Sam Altman seeking to unleash the Alternative to Man, soon set to give birth to the AI God that won't be benevolent, instead beneviolent having been trained on the pet prejudices of those who are creating it, things are happening at a much faster pace then I imagined they would. We could be seeing the foot prints of the AI God / Devil as early as 2025!

https://youtu.be/3AqNebKQSR0

The only thing that can protect you when the armed bot's scan you will be your holdings in AI tech stocks! As the LED flickers from Red to Green.

This analysis Stock Market Santa Rally to the MOON! S&P 4800+ was first been made available to patrons who support my So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my most recent analysis -

- Stock Market Election Year Five Nights at Freddy's

- S&P Stock Market Analysis, Detailed Trend Forecast Jan to Dec 2024

- Last Chance to Get on Board the Bitcoin Crypto Gravy Train - Choo Choo!

Also gain access to my exclusive to patron's only content such as the How to Really Get Rich series.

Change the Way You THINK! How to Really Get RICH - Part 1

Part 2 was HUGE! >

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

Part 3 Is Huger! And Gets the Job Done! >

Here's what you get access to for just $5 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's this month.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst putting his neck on the chopping block for another year.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.