Silver Price Between a Rock and a Hard Place

Commodities / Gold & Silver 2023 Nov 18, 2023 - 09:31 PM GMTBy: Submissions

Caught between conflicting forces, will pivot optimism outweigh the economic malaise that should unfold in the months ahead?

A Short-Lived Rally?

From war premiums to pivot hopes, silver sees sunny skies, as the international and domestic fundamental outlooks increase investors’ enthusiasm , as the international and domestic fundamental outlooks increase investors’ enthusiasm. However, the excitement is misguided, as silver often declines precipitously when recessions arrive. And with an economic downturn poised to bite in 2024, the white metal’s recent rally could be short-lived.For example, the University of Michigan released its Index of Consumer Sentiment on Nov. 10. Director Joanne Hsu said:

“Consumer sentiment slipped for the fourth straight month, falling 5% in November. While current and expected personal finances both improved modestly this month, the long-run economic outlook slid 12%, in part due to growing concerns about the negative effects of high interest rates.”

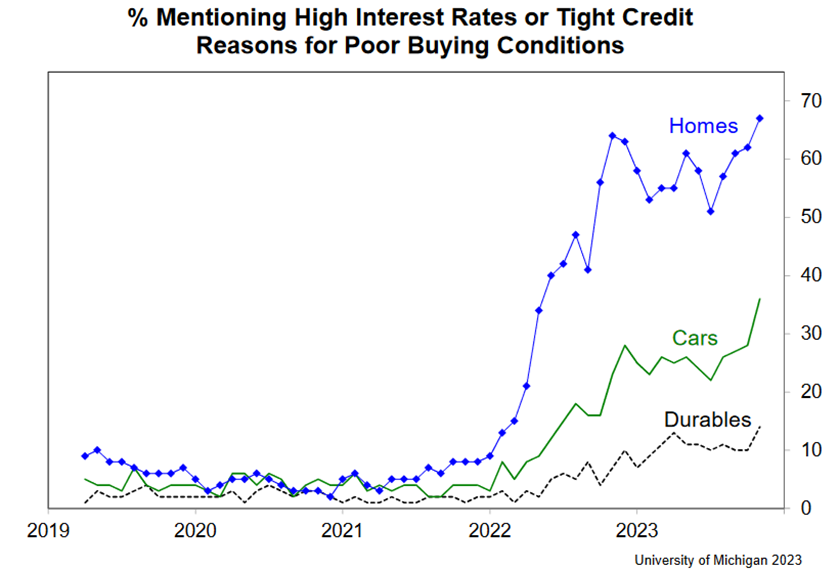

Please see below:

To explain, the blue, green, and black lines above track the percentage of respondents mentioning high-interest rates or tight credit conditions as reasons for avoiding purchasing homes, cars or other durable goods. If you analyze the right side of the chart, you can see that all three lines have risen recently, which highlights the impact of higher long-term interest rates. Moreover, we cautioned this would occur on Oct. 6. We wrote:

As for the medium-term outlook, we’ve warned on numerous occasions that higher long-term interest rates (not the FFR) create recessions. And with the recent rate surge dominated by the long end, the chickens should come home to roost in the months ahead.

So, while gold bounces and silver remains uplifted for now, their price action could look much different in 2024.

Unhappy Holidays

While the ‘bad news is good news’ narrative continues to percolate throughout the financial markets, that should shift as bad economic data worsens. And with cyclical assets like oil showcasing immense fear, mining stocks and silver should play catch-up over the medium term.

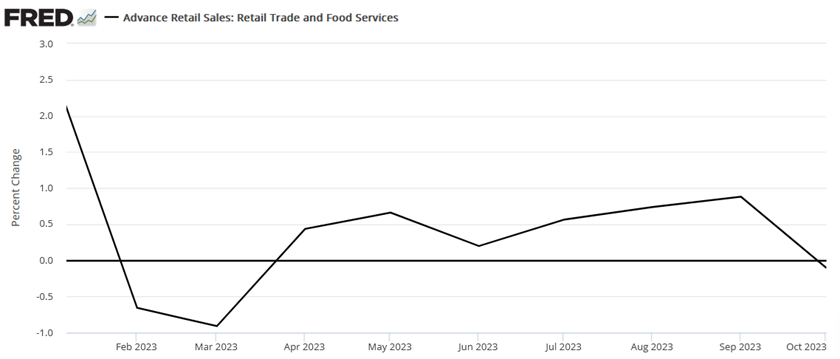

Please see below:

To explain, the drop on the right side of the chart above highlights how U.S. retail sales went negative month-over-month (MoM) for the first time since March. And with weak holiday sales poised to bite as well, the trend should continue as the unemployment rate rises.

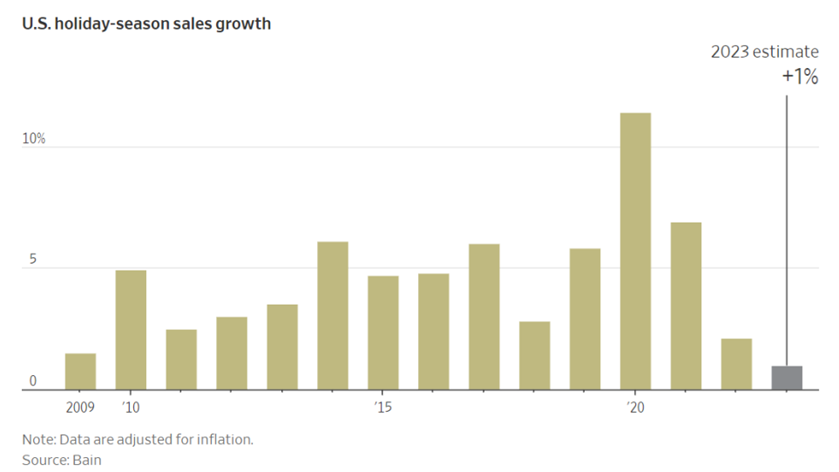

Please see below:

To explain, Bain Capital projects that U.S. holiday sales growth will come in at 1% YoY in 2023, which would be the lowest print dating back to 2009. Consequently, the ominous expectation highlights the tepid economic backdrop, and a continued decline should culminate with a 2024 recession, which is bullish for the USD Index.

As further evidence, Walmart – the largest U.S. retailer – released its third-quarter earnings on Nov. 16. CEO Doug McMillon said:

“In the U.S., we may be managing through a period of deflation in the months to come. And while that would put more unit pressure on us, we welcome it, because it’s better for our customers.”

CFO John David Rainey added:

“Our events have been strong. We’ve been pleased with those. Halloween was good overall. But in the last couple of weeks of October, there were certainly some trends in the business that made us pause and kind of rethink the health of the consumer.”

Thus, while we warned repeatedly that a recession, not inflation, has become the primary risk to financial assets, the medium-term outlook should be fraught with peril.

Overall, little has changed to alter our fundamental outlook. Higher interest rates are having their desired effect, and boom-and-bust cycles have occurred several times throughout history. As such, with over-optimism dominating the U.S. economy in 2021 and 2022, a major reversal should occur in 2024. And if that happens, mining stocks, silver, and the S&P 500 could suffer substantial declines.

To avoid missing important inflection points, subscribe to our premium Gold Trading Alert. Our expert technical analysis has allowed us to profitably trade in and out of positions on several occasions and has resulted in an 11-trade winning streak. And with future volatility poised to create even more prosperous opportunities, there has never been a better time to become a member.

By Alex Demolitor

Alex Demolitor hails from Canada, and is a cross-asset strategist who has extensive macroeconomic experience. He has completed the Chartered Financial Analyst (CFA) program and specializes in predicting the fundamental events that will impact assets in the stock, commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found above represent analyses and opinions of Alex Demolitor and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Alex Demolitor and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Alex Demolitor reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Alex Demolitor Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.