Will UK House Prices Crash 2023?

Housing-Market / UK Housing Jul 24, 2023 - 10:27 AM GMTBy: Nadeem_Walayat

First a reminder of some of the primary drivers for UK house prices (in order of importance).

1. Population Growth

2. Inflation courtesy of money printing.

3. Growing economy.

4. Insufficient new housing construction.

Note these are all interlinked and not independant factors i.e. you don't get population growth unless you have a growing economy as a stagnating economy results in EMIGRATION as was the case for the UK during the 1960's and 1970's as Canada and Australia hoovered up million of Brit's to populate their sparsely populated cites to ward of threats of invasion from the north (Australia) and South (Canada).

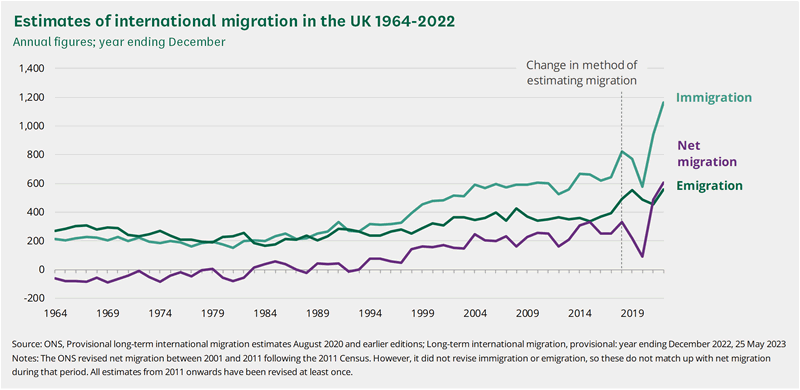

In terms of the metrics nothing much has changed since my in-depth analysis of early April 2022 (UK House Prices Trend Forecast 2022 to 2025), population continues to soar as illustrated by the latest net migration statistics that hit a a new record high of 606,000 for 2022 when the target is supposed to be 50,000! So much for Brexit!

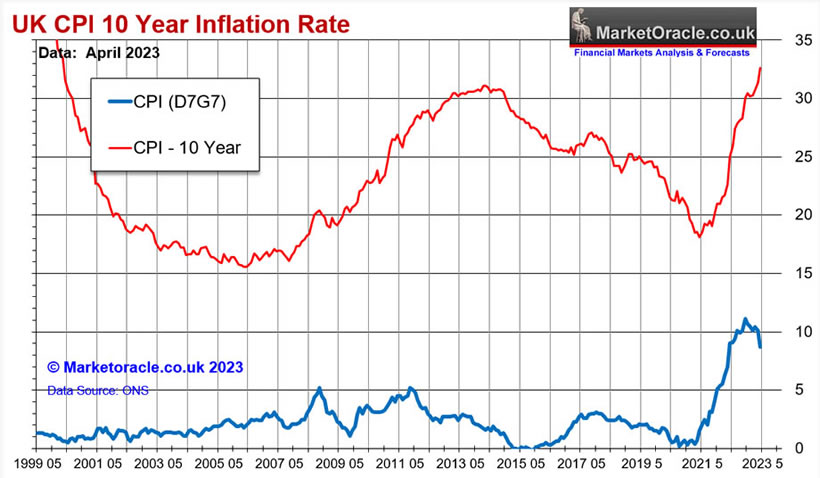

Whilst the UK economy is weak however one only needs to look at the basket case that is France to see how much worse others are fairing. Whilst house building NEVER lives up to the political promises, coming in at near HALF the targets. Meanwhile inflation despite Rishi's tweets of coming under control remains largely out of control even under their fake CPI:LIE measure.

As I stated BEFORE inflation took off into the stratosphere that the eventual drop in CP LIE won't make any difference to the real inflation pain that people will face as illustrated by the 10 year inflation graph.

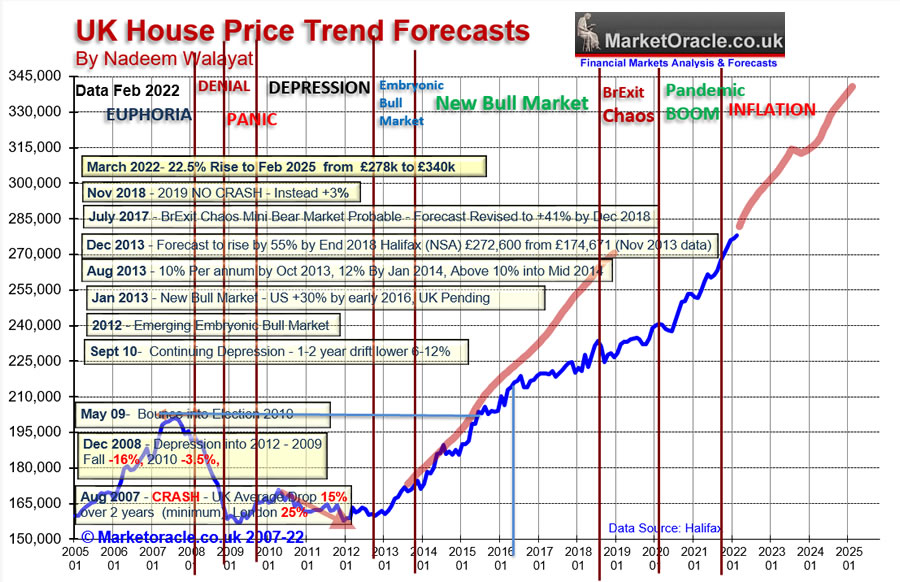

UK House Prices Trend Forecast 2022 to 2025

UK House Prices 2022 to 2025 Trend Forecast Conclusion

My expectations are for for average UK House prices (Halifax) to continue to trend higher over the next 3 years, punctuated by a brief pause during early 2023 in response to interest rate hikes, weakening economy and tax rises. However persistent high inflation, extreme over crowding and continuing strong population growth ensures that the bull market will remain in tact. Therefore my forecast conclusion is for average UK house prices (Halifax) to target a rise from £278,123 as of February 2022 over the next 3 years to £340,632 for February 2025 data (Halifax) targeting a price increase of 22.5% over 3 three years as as illustrated by my trend forecast graph below

This ARTICLE is an excerpt form my recent analysis on the current state of the stocks bull market as it FOMO'd to new highs Current State of the UK Housing Market as Stocks Climb a Wall of Worry that was was first made available to patrons who support my work, so for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

For Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! I am keeping my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, $5 month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile.

S&P

Targeting 4600 Mid Summer 2023.

And gain access to the following most recent analysis -

- Change the Way You THINK! How to Really Get RICH Guide 2023 - by Nadeem Walayat

- Stocks Bull Market Phase One End Game Sector Rotation

- Stock Market FOMO Maniacs Rug Pull Imminent? US House Prices Trend Current State

- Current State of the UK Housing Market as Stocks Climb a Wall of Worry

- Can AI Tech Stocks Mania Push the S&P Through 4300?

- Stock Market Fundamentals, Debt Ceiling Smoke and Mirrors Circus

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- How to Get Rich - FINISHED - Change the Way You THINK! How to Really Get RICH Guide 2023 - by Nadeem Walayat

- US House Prices Trend Forecast - 50%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trimming the FOMO rally analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.