The Fed as Bad Bank Ultimate Irony

Interest-Rates / US Federal Reserve Bank Jul 24, 2023 - 04:41 AM GMTBy: Jim_Willie_CB

A historical paradigm shift is in progress. The process of de-Dollarization began with Russia in response to the Maidan coup in Kiev back in 2016. The Russian reacted in multiple ways, but the Eurasian Trade Zone grew. That was the Jackass name given, which has emerged as the BRICS Union in recent years. Numerous nations have followed the Russian lead in removing the USDollar from their trade payments and banking practices. The American observers have dismissed this trend as trivial and not enduring. They are wrong, dead wrong. In the last 18 months, the Japanese had dumped $240 billion in USTreasury Bonds over a 12-month period. They continue. They accumulate Gold in their banking reserves, thus following the BRICS theme, their operating policy. The macrocosm, by contrast, will feature 20 nations dumping USTBonds en masse, and acquiring Gold for banking reserves. The UAE will become a primary office for the conversion, their Dirham notably pegged to the USD.

THE PETRO-YUAN EMERGENCE

A tremendously important development has occurred in recent months, which the US lapdog subservient press has ignored. The entire Persian Gulf has embraced the Petro-Yuan defacto Standard for oil & gas payments. This spring, France purchased a large long-term LNG supply from the United Arab Emirates, the contract calling for CHYuan payments. Iran, Saudi, UAE, Qatar, and the entire Gulf monarchies have discarded the USD payment standard, and have followed what the Saudis began. All oil & gas payments are to be paid in CHYuan. The Iranians and Saudis, joined by the Emirates, have declared peace and constructive economic engagement, much to the dismay, frustration, and vitriol of the Americans and Izzies. The entire Arab and OPEC community has followed the Petro-Yuan Standard. It has become the installed standard in the primary oil center, with very little recognition by New York mavens, who are overwhelmed by toxic health mandates and preoccupied by lesbian/gay norms. The implications are vast. Entire nations, acting as customers for energy shipments, will remove the USTBonds from their banking system. They will not purchase new USTBonds upon scheduled auctions. In effect, the OPEC and entire Energy world has gone to the PetroYuan, and all their customers will thus de-Dollarize.

The USGovt debt default and USTBond default are certain events, written in stone. The USGovt will monetize its own debt, and be subjected to debt downgrade. An international divestiture of USTBonds will ensue across the entire global financial sector. The USGovt will acquire a Ponzi reputation with a broad smear. Remarkably, no G-7 Sovereign debt has a bid for several months, as almost no global demand exists anymore. Such is the consequence of the growing crisis of confidence for the Biden Show, the tragic Ukraine War, the momentum of the emerging BRICS Union, the chaos in the European Union, and the backfire on the illicit economic lockdown. The USGovt is racking up a cool $1 trillion in fiscal deficits every six months, and foreign bondholders are talking openly about how they will never be repaid. As time passes, not only is a debt default likely to splash onto the financial rags, but accusations of the United States acting as a rogue nation. Then comes global economic embargo, and a trickle for import supply amidst price inflation and product shortage.

THE TOXIC VAT

As the BRICS Union progresses, though quietly, the process of dumping USGovt debt securities in large quantities and acquiring Gold in large quantities will make the news. The Japanese central bank has shown the way with one quarter $trillion in USTBonds discharged. They have earned assassinations of middle level officials in response. The US-UK-Swiss cabal responds in nefarious manner always. The French central bank dumped $70 billion during the same 12 months. Next comes several nations dumping USTBonds in big tranches. They will threaten Project Sandman, the two-day dumping of $2 trillion in USGovt bonds.

WHEN SOVEREIGN ENTITIES DUMP EN MASSE THEIR USTREASURYS, THE USDEPT TREASURY AND USFED WILL BE OBLIGATED TO SOAK UP THE SUPPLY, PRECISELY BECAUSE DONE IN GIGANTIC VOLUME. The USGovt and USFed cannot afford to have tens of $billions in USTBonds suddenly appear as supply upon the bond market, since it would cause a market seizure. When two or three, maybe more, sovereign entities dump the USGovt bonds on the market, the bond market can be quickly overwhelmed. Refer to central banks and sovereign wealth funds, managed by oil monarchies. Therefore, the USFed in all likelihood will be required to absorb an unusually large volume of USTBonds, expanding the Fed Balance Sheet from the current $9 trillion level to maybe $12 or $15 trillion quickly. In the past 20 years, the USFed has absorbed many impaired bonds, mostly of corporate type, since they did not wish to see the corporate bond market destroyed. But it too is a wrecking zone, especially after the 2017 downgrade of bellwether GE Bonds, the best in class. The shame of having a Bad Bank for unwanted unsellable USTBonds will make the greatest blemish in US financial history, the manifestation of a cancer. The ultimate ignominy, a grand decline cometh from global currency reserve for the King Dollar, to the chasm of Bad Bank and toxic vat for bonds with dubious value.

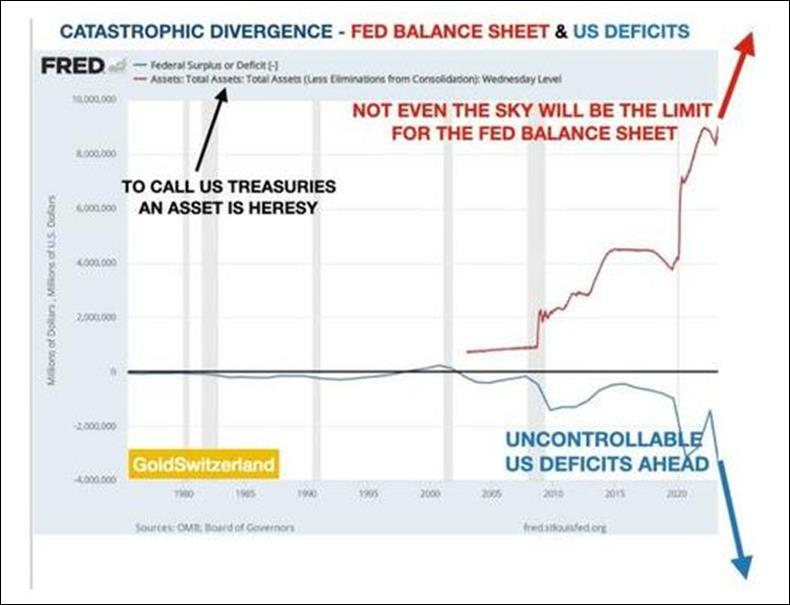

The USFed Balance Sheet has expanded tremendously, especially since the year 2020 when it was ONLY $4 trillion. A month ago it was around $9 trillion, without much corresponding attention or concern. The Balance Sheet was under $1 trillion when Obama the Kenyan roamed the White House with his sordid parties, whose activities are fully protected by the Secret Service and FBI. Thanks to Egon von Greyerz for the graphic with annotations.

IN THE PASSAGE OF TIME, PROBABLY WITHIN ONE YEAR, THE USTBONDS WILL BE CONSIDERED IMPAIRED BONDS. THEY CALL IT BAD PAPER IN THE BOND PITS. THEY ARE PROBABLY HERE AND NOW BEING SOLD AND REDEEMED AT CLOSE TO HALF PRICE, A 50% HAIRCUT. Last month, the Jackass heard rumors of USTBonds being redeemed at 40 cents on the dollar. No confirmation came afterwards. My gutt says that for redemption of large tranches like $10 billion or greater, when proceeds are delivered in the country’s local currency, expect a 30 to 40 cent haircut on the bond. This is a default liquidation in progress, a hidden default.

Some background on accounting practices during the gathering of large-scale impaired bonds and generally referred to bad paper. They must be written down in value as accounting losses. WHEN MERGER & ACQUISITIONS ARE DONE FOR AN AILING FIRM, THE NEW PARENT FIRM OFTEN CREATES WHAT IS CALLED A “BAD BANK” FOR PUTTING THE DEEPLY IMPAIRED (ALMOST WORTHLESS) SECURITIES. The Bad Bank is where impaired paper goes to die, later written off as total losses in a quarterly filing. The Bad Bank is an accounting category for rubbish, the various financial flotsam and jetsam. They might hope to sell some securities in the Bad Bank for 10 cents on the dollar. When Lehman Brothers was carved up, many of its securities were exotic rubbish, like the Collateralized Debt Obligations which bore falsely rated tranches of garbage interwoven in fraudulent deception. Today the commercial mortgages form vast reams of bad paper, impaired bonds, a product of the illicit economic lockdowns. My Jackass forecast is that the USFed will be transformed into the biggest Bad Bank in modern history, loaded down by at least $15 trillion in unresolvable impaired worthless paper.

The good faith of the USGovt is gone, since over-run by fascists, globalists, and mafias. The ransacking of the USDept Treasury is well underway. The Biden gangsters sacked control of the USFed printing press operations, and use the machinery to send palettes of $100 bills to Ukraine. The image of the USGovt will enter a terminal decline, where the fraud, waste, and pilferage will be the story in the annals of history. The USGovt has squandered $25 trillion in defense budgets, ineffective weapon systems, predatory wars, NATO corruption, and narcotics enterprise, with no economic benefit as a result. The USGovt has weaponized the USDollar, and foreign nations have reacted in kind with a financial war. These declining traits were evident and widespread for the last 40 years or more. In fact, they have been present since the 1971 abrogation of the Bretton Woods Gold Standard. The Bad Bank concept will emerge in the passage of time, a new crown to replace the discarded Golden chassis.

THE USGOVT WILL HAVE A POTENTIAL PARTNER SERVING AS A BAD BANK, NAMELY THE UNITED ARAB EMIRATES. The UAE has offered to serve as the BRICS Union sales office (aka dumping ground) for USTBonds. It is unclear as yet how this role will function. The UAE central bank will accept USTBonds for sale. They must provide funds in high volume as proceeds for the sales. It is not clear whether the UAE will be making redemptions with a discount (haircut) like 30 to 60 cents per face value dollar. It is also not clear in what form the UAE will make payouts, like in a particular currency. One can speculate that they might offer AEDirham, except that tremendous dilution would occur upon a grand sudden expansion of their native currency. They might offer Chinese Yuan upon certain conditions for Gold purchase, such as requisite usage of the CHY to buy the Gold. The Gold providers as source might be content with holding CHY. It is believed that Dollar Swaps upon USTBond sales of large size might require the seller to accept a haircut on the bond sale payout. That would constitute a bond default, and would eventually lead to the adverse publicity. When the USGovt debt default arrives, nobody really knows. But the consequences would be both dire and very unexpected, like a total flattening of the Treasury Yield Curve.

Another development might be very possible. The UAE central bank might act as large scale conduit for passing the impaired dumped USTBonds to the USGovt for home storage in the Fed Bad Bank, their bloated Balance Sheet. It will become the new home for broken bonds and misfit securities. What comes is to be the Lehman crisis times five, maybe times ten. Reports were made that the USGovt was angry at the UAEmirates for offering to serve as the BRICS window for USTBond sales. To enable the emirate function, they must have a facility to pay out for bond sellers. They might require a deal worked out where Dollar Swaps are enabled. They must surely have a plan for CHY payouts, or maybe XRP payouts with a gold backing. They might pay out in AEDirham which is pegged directly to the USDollar, thus forcing the USDept Treasury to back their efforts. This could get complicated. Their gold window deserves a close watch for how it will function. Any delays in the SCO-EX might be due to challenges on the USTBond payouts to the many large sellers.

GOLD PRICE IN SHACKLES

THE GOLD PRICE CANNOT ESCAPE THE CHAINS FROM COMEX AND THE LBMA WITHOUT SIGNIFICANT EXTERNAL FORCES. THEIR COMMON NAKED SHORTING COSTS NOTHING AND CONTINUES UNABATED WITH FULL IMPUNITY. People innocently look to the COMEX price as though it might someday show a much higher proper price. It is difficult to say how this might happen under the current structure. Instead, it will go dark from irrelevance amidst a crime scene with yellow cordon tape. The competition by Eastern nations to set a fair just price based upon equilibrium is loudly demanded, and it will come, possibly very soon. The BRICS Union with their SCO-EX exchange will show the way out of the criminal darkness. The Gold price is stuck in the $1950 to $2050 per oz range, smothered by a corrupt 2-ton wet blanket with a stench of propaganda in the air, even the rot within platforms certain to result in collapse. Amidst the recent bank crisis, bond crisis, and USGovt debt dilemma, Gold should have risen by 50% in price. It did not because it cannot. The Eastern trade union will show the way in price reform.

THE GOLD PRICE DOES NOT RESPOND TO ANY PROPER FACTOR AS STIMULUS. THE GOLD PRICE WILL ONLY REACT TO THE USGOVT DEBT DEFAULT AND THE SALVAGE OPERATIONS OF THE USTREASURY BOND. It does not react to expanded money supply like it once did for half a century. It does not rise with higher price inflation either. It does not respond to greater official deficits. It cares little of the endless writhing of USGovt debt limits. It does not even pay note to metal deficits or shortages in market vaults. Gold is the ostracized sanctified metal of the West, called the dead barbaric metal that earns no yield. However, Gold will be elevated as the primary monetary metal of the Eastern nations in the grandest revolt in modern history. Even in the hidebound West, investors in Gold will benefit from the banking and bond crisis which has begun to show its horrific face. The rise of the Eastern BRICS Union will make for a fine chapter in the annals of history. They will set the price, using something akin to the Global Gold Price Fix, an average from the decentralized SCO-EX nodes.

The BRICS seek a valid honest legitimate system. They will create a multi-node set of Gold prices, along the decentralized lines. These cities have been cited before as potential nodes for Gold price establishment: Shanghai, Hong Kong, Riyadh, Dubai, Tehran, Mumbai, Moscow, London, Geneva, Istanbul, New York, Sydney, Singapore, Johannesburg. Just a side note, a reflection of sports voting like in gymnastics and diving. Possibly the SCO Global Gold Price Fix might take these 14 Gold prices, for instance, toss out the highest and lowest, and produce the average of the remaining 12 prices for the stated Global Gold price for usage in broadbased contracts. The many diverse BRICS contracts will use their own Gold price for payments, not those of COMEX & LBMA. Where metal does not move, metal cannot be priced.

THE GOLD PRICE CHART IS AN EXERCISE IN SUPPRESSION, FASCISM, CORRUPTION, FRAUD, AND POWER, WITH ZERO REFLECTION TO REALITY. EXPECT A FORCE MAJEURE TO OCCUR, WHICH WILL SET FREE THE BANKERS. Competition in setting the Gold price on the global stage will render the COMEX and LBMA as empty chambers. Use imagination to consider the criminal consequences. The Jackass suspects the banker cabal will receive a pass with Force Majeure on their naked short futures contracts in the high $billions, while they switch lanes and join the global investment parade with amplified Gold purchases. This legal pass will be granted by the bankers themselves, using their stooges in the USGovt. They still might continue to downplay the Gold story, since they are buyers and their corruption will never alter the tiger stripes and corrupt spine. A very favorable upchannel has formed. Any positive upward thrust off the channel base could push the Gold price above the $2100 level easily. There is no shortage of bullish factors. The current Gold price should be over $3000 per ounce, given the crisis in USGovt debt, bonds, and banks. Let the BRICS Union and their new SCO-EX exchange show the way to much higher prices with the power of decentralization.

THE GOLD SOURCE FOR ENTITIES SELLING USTBONDS IS NOT FULLY KNOWN. LARGE POWERFUL ENTITIES WILL SEEK GOLD TO PURCHASE IN VERY LARGE VOLUMES. THE JACKASS HAS BEEN RESEARCHING THIS POINT. The sellers in high volume of USTBonds will be the entire community of nations, friendly allies, enemy states, sovereign wealth funds, pension funds, insurance firms. Dominant will be the central banks and sovereign wealth funds, like with monarchies in the Persian Gulf and in Europe. This will become the biggest bond sale in human history, but will take time to unfold. In fact, the volumes will be kept secret, as part of US national security. The USGovt debt fault and the attendant USTreasury Bond default has probably already begun, well kept from the news. Like with falsified bank statements submitted for quarterly investor submissions, often badly falsified but legal under national security claims, the USTreasury Bond default will be lied about for the same national security claims. The USGovt will wish to prevent a sudden bond collapse and even a sudden global USDollar rejection, even an embargo at the US ports.

Consider some providers of Gold bullion for reserves, as the sources. First, the United States Government itself, by force under threat of international trade boycott, closed ports, and bank sanctions in reverse (other nations against the USA). It is not clear how much Gold the USGovt will relinquish. The next sources will likely be nations with enormous Gold reserves, and motive to make the USTBond-Gold transfers happen smoothly and in large volume. Second, Russia has 100k tonnes of Gold hidden from the Bolsheviks (aka Soviets), fully recovered a decade ago in Russian Military vaults in the Urals. Credit for courage and stealth to the Russian Orthodox Church, a truly Christian institution, unlike the Satanic Vatican in the West. There is also 25 thousand tonnes at Kremlin vaults. They might wish to provide 10 or 20 thousand tonnes for the redemption of USTBonds for Gold. Third, the Chinese elders have at least 100k tonnes, and maybe well over twice that volume, from millenia of accumulation with ancient Chinese Kingdoms. They might wish to provide 10 or 20 thousand tonnes for the redemption of USTBonds for Gold. Fourth, the Persians have somewhere in the neighborhood of 20 to 40 thousand tonnes of Gold, kept from the Rothschild grubby hands for decades. They might wish to provide 10 thousand tonnes for the redemption of USTBonds for Gold. Lastly, the Saudis have offered a significant amount of Gold, unknown the volume, for facilitating the USTBond-Gold transfers. Theirs comes from Saudi Shrine Gold, located in Mecca and Medina. The Saudi source was a surprise to hear for the Jackass, but it seems logical, and an Arab sword to decapitate the King Dollar. The entire BRICS Union will be united to facilitate the biggest transfer of sovereign debt to Gold bullion in human history. The King Dollar Era is over, the requiem not yet conducted, the tumult and shouting having only just begun.

THE BRIICS GOLD TOKEN

THE SOLUTION FOR THE GOLD & SILVER MARKET WILL COME FROM EXTERNAL FACTORS AND FORCES. IN NO WAY WILL THE BANKERS PROVIDE A REFORM THAT RENDERS THEMSELVES RUINED AND BROKEN. Those external forces are gathering like a massive storm system, this time decentralized and with increasing transparency. The BRIICS Union now has a second “I” for Iran, inducted a week ago. They did not reveal their inner workings at St Petersburg in late May, as expected. They should not reveal their inner workings at Durban South Africa in late August, as expected. They surely are putting late connections from the bond, currency, gold, and oil platforms. Their task is complex.

The debate and consternation build. The BRIICS will not be launching a common gold backed currency and using it in mutual trade. A return to a Gold Standard in the traditional sense is not how the Eastern alliance of nations will move next. Expect them to use their Development Bank to issue a Gold Token fully convertible to gold. They will issue no bond, set no rates, observe no mandate. Their local currencies will continue to play a key role, and overshadow the corrupted, impaired, and bloody USDollar as the de-Dollarization reaches a crescendo globally. Irony is thick, as the USD has already become an invoicing unit. See the Russian energy transactions with India, using UAE as payment office. Participating parties will be able to acquire the Gold Token by either depositing gold or via trading goods and services. Many other features will be made known, but this entire concept will be developed in the July Hat Trick Letter by month’s end. A return to medieval times and their effective methods is coming. What comes is a Gold Token used for trade payment, also used as a Reserve Asset for central banks. Expect its growing expansive usage to have a double-edged sword effect. It will lift the Gold price, thus ending the price suppression. It will remove all USTreasury Bond demand, thus forcing a USGovt debt default. A new means of Net Settlement of Trade is soon to make a global splash, and the King Dollar will be removed from its throne by a tsunami.

TIDBITS & TEASES

- Union of South Africa will soon become a toothless player in BRIICS, with ignored voice, maybe expelled eventually. They form a core of African marxist idiots and do not reflect the growing power of African nations.

- Saudi soon formal member included in BRIICS, with the UAE joined at hip.

- The PetroYuan will pave the way quickly to the New Gold Token. The Chinese Yuan defacto Standard for energy is one of the biggest events in half a century, not well recognized.

- Entire nations will remove USTBonds from their banking systems, and no longer invest in USTreasurys. The result will be a USGovt debt default.

- The United States risks being declared a rogue nation, subjected to embargo for predatory war and bond market fraud and gold market fraud. The US ports might not move imported shipments unless and until the USGovt is reformed (removed), and the global trade union is respected.

- The next chapter will feature eye-popping price inflation and acute shortages. Expect the USTBill to be discounted, and the costs passed along for imported products.

- EuroBonds were declared invalid by the USDept Treasury, not for deposit in US banks. They are USTreasurys held in European banks. They have been widely used by European nations to exploit African nations for their assets.

- A war has been in progress for almost a full year, between US-based banks and European banks. One weapon used is interest rates, another crude oil price. BlackRock is a European large element on US soil, dependent upon Ukraine money laundering.

- Amundi has divested all US$-based investments. They are Europe’s largest asset manager.

- No notable purchases of G-7 sovereign bonds have occurred in the last few months, amidst a global strike which recognizes no value in USTBills, as well as astounding fraud in financial markets, even debt default.

HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

by Jim Willie CB

home: www.Golden-Jackass.com (new website)

subscribe: Hat Trick Letter

Jim Willie CB, editor of the “HAT TRICK LETTER”

Use the above link to subscribe to the paid research reports, which include coverage of critically important factors at work during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. The historically unprecedented ongoing collapse has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury Bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 40 years. He aspires to thrive in the financial editor world, free from evil forces, unencumbered by the limitations of economic credentials. Visit his free newly revamped website at www.Golden-Jackass.com. It now has a hyphen in the URL address. For new subscriptions follow the path at http://www.Golden-Jackass.com/subscribe-to-hat-trick-letter. Other services are offered, in addition to accepted sponsors to aid in my noble mission.

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.