Inflation is Expected to do What?! Implications for Gold.

Commodities / Gold & Silver 2023 Jun 20, 2023 - 09:48 PM GMTBy: P_Radomski_CFA

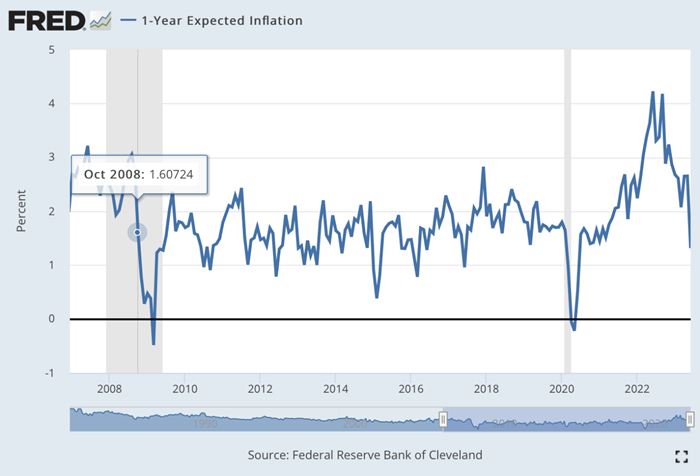

The markets just assumed a dovish U-turn in interest rates, thinking that the inflation problem is handled. The below chart features the inflation that’s expected in one year.

Yes, you see it correctly.

The market expects the inflation to move to about 1.31% in one year.

A bit over 1% in one year… Really?!

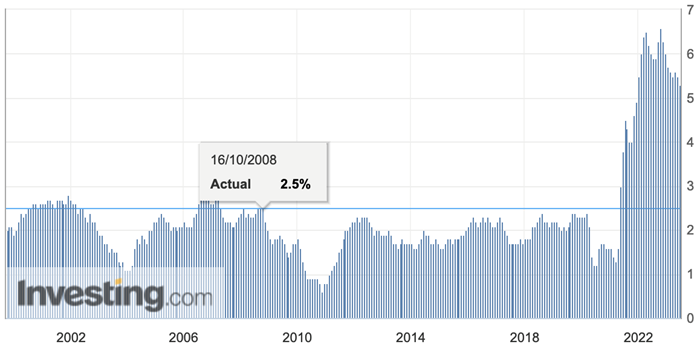

Here’s the recent CPI (YoY) reading:

Long Road Ahead for Inflation Reduction

So, the CPI declined from above 6% to a bit above 5%, given all those rate hikes…

Not below 2%, not below 3%, not below 4%. And not even below 5%.

If the trend persists, then it would take years for the CPI to move below 2%. And let’s keep in mind that the Fed kept hiking interest rates in order to trigger this trend…

And now, at the same time, the market is expecting the rates not to be raised significantly and the inflation to somehow move to 1.31% in a single year. It doesn’t take a PhD in economics to see from just those two charts that this is not just impossible. This expectation is plain ridiculous.

To show you the extent of the current delusion, I marked a somewhat similar situation from the past.

The last time the market’s expectations regarding inflation declined from over 3% to more or less, those levels were in October 2008.

But that was when inflation was just 2.5%! It made sense to expect a ~1% decrease in CPI in a year.

But now? The market expects the Fed to push inflation lower several times more and… without many more rate hikes.

Implications and Warning Signs

The war against inflation is far from being over, and the market’s dovish expectations and overall bullishness are out of touch with reality.

Oh, and by the way, since the analogy is to October 2008, do you remember what happened to the gold price then?

Here’s a reminder:

That was when gold’s rebound and consolidation ended and when the biggest part of the slide started.

That was also the time when stocks declined, and the USD Index rallied.

Why did stocks rally so high, then? Because the investment public entered the market, and it’s the “return to normal” stage of the bear market in stocks, while most investors (primarily the investment public) assume that it’s the return of the bull market.

The wake-up call will not be pleasant for many – but you have been warned.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.