Why Gold?

Commodities / Gold & Silver 2023 Apr 03, 2023 - 06:15 PM GMTBy: Gary_Tanashian

If the decades old bubble in paper assets is ending, that’s why gold!

If the decades old bubble in paper assets is ending, that’s why gold!

Various promotions along the way of the Continuum have distilled the case for gold down to handy buzz phrases like “got Gold?” as if it were a carton of milk. Other promotions have presented gold as the go-to asset through all types of macro phases, from “fiat is gonna blow up any day now” to “inflation is gonna eat your future” to “a deflationary Armageddon is on the way”.

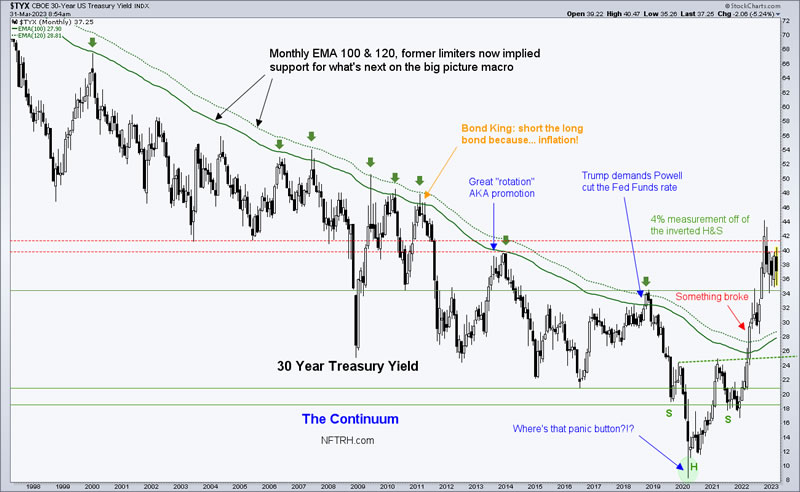

Yet all along the Continuum, policymakers papered it over, inflated the mess at every crisis as long as the Continuum allowed.*

* By “allowed” I mean inflated the system per the license they were given by the deflationary market signaling that lasted decades and the acute deflationary episodes against which they inflated. The last being the most intense, in Q1, 2020.

But in April of 2022 something officially broke. That was the month – 1 year ago – that market players who were on the ball would have realized that everything changed on the macro. The rules of the previous four decades changed because the trend of the 30 year Treasury bond yield Continuum changed. Period. This had been the disinflationary backbone against which policymakers were allowed to chronically inflate almost at will during various crises. But that jig is up.

Now the job is to correctly define what is ahead in this brave new world of macro uncertainty. If for no other reason than this uncertainty, gold is actually a “go-to” asset because it is an anchor to value within a system that is changing, and may well be falling apart. Gold goes nowhere, which means it also does not go down even when its price does. As the old system comes apart gold will also go nowhere even if/as its price goes up. Remember, it is the stuff around gold, cyclical speculations from stocks to commodities to crypto-currencies, that go up and down, affecting the mass perception of gold and hence, the price assigned to it at any given time.

There is a speculation associated with gold and that spec is the gold mining sector. When gold’s value is perceived higher vs. cyclical assets gold stocks leverage that perception to the upside. These rallies have been fleeting, however, because there was always a new policy bailout in the offing as implied by the Continuum above. But if something broke and a real post-bubble environment is engaging might we not say something could be different this time? Yes, we could. The gold mining spec could work very well and NFTRH is managing that weekly.

But today we are also managing a false dawn (bear market rally) to renew the spirits of the dear departed stock market bulls (as illustrated in this brief video) and gold and gold miners are among the leaders. But when this false dawn rally ends and perhaps gold and gold stocks get corrected, we’ll be on watch for the next and likely more enduring phase of gold out-performance on the new macro.

On the short-term, gold is dealing with its “round number” resistance at 2000. It appears only a matter of time.

On the long-term, gold’s massive Cup and volatile Handle imply higher prices to come. If the chart’s measurement holds true (it’s TA, folks, not a guarantee) gold would target 3000+. We have had this prospect loaded since gold made its higher high to form the Cup’s right side rim in 2020.

Bottom Line

Gold is not a price vehicle and as such, it should not be cheered, rooted for or otherwise pumped with stupid buzz sayings like “got Gold?”. It will get where it is going of its own value proposition. It is a rock and an anchor. As the system splits its seams the value of said rock (AKA insurance) gets marked up in the minds of newly, financially sober humans.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can also keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter ;@NFTRHgt.

By Gary Tanashian

© 2022 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.