Chinese Manufacturing Contracts as the Tail Fails to Wag the Dog

Economics / China Economy Nov 01, 2008 - 04:56 PM GMTBy: Mike_Shedlock

For the third month in four, China's manufacturing is in contraction. July and August were in contraction as discussed in China's Manufacturing Contracts for Second Month .

For the third month in four, China's manufacturing is in contraction. July and August were in contraction as discussed in China's Manufacturing Contracts for Second Month .

Manufacturing in China expanded in September but has reversed to the downside once again. Amidst weak global demand China Manufacturing Contracts as Crisis Trims Exports .

The Purchasing Managers' Index fell to a seasonally adjusted 44.6 last month from 51.2 in September, the China Federation of Logistics and Purchasing said today in an e-mailed statement. That was the lowest since the gauge was launched in July 2005. A reading below 50 reflects a contraction, above 50 an expansion.

China's cabinet has pledged extra infrastructure spending to stimulate the world's fourth-biggest economy amid the global slowdown. The government has already lowered rates three times in the past two months, increased export rebates and cut property transaction taxes.

The output index fell to 44.3 in October from 54.6 in September, while the index of new orders dropped to 41.7 percent from 51.3. The index of export orders declined to 41.4 percent from 48.8, the statement said. The inventory index climbed to 51.4 from 50.5, it said.

Tail Wags Dog Theory Blows Up

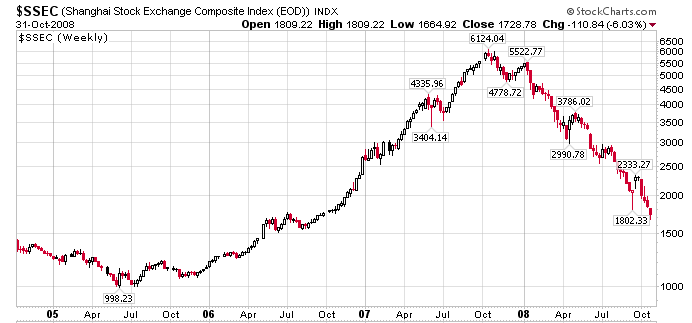

At every peak there are always ridiculous predictions. In the dotcom bust it was all about the "gorilla game", the "new economy" and "click counts". When the Shanghai Stock Index rose from 998 to 6124 in about two years we heard the same sort of thing about growth in China. Instead of click counts, the theory in vogue was called decoupling. China was supposed to be the 800 lb gorilla with insatiable demand for commodities and perpetual growth for the next decade.

That decoupling theory was based on the belief that the US no longer mattered, that China demand was self sustaining, that China could grow forever with no problems, etc. Such beliefs eventually became a religion.

$SSEC Shanghai Stock Index Weekly

The Chinese stock market peaked right along with many stock equity indices across the globe. It was a simple case of global Peak Credit gone bust. I do not know if the Shanghai Index has bottomed or not, but it is clearly at a more realistic valuation than any time in the last two years.

Now, like everyone else, China is attempting to stimulate demand. With new orders dropping to 41.7 percent from 51.3 and the US, EU, Canada, UK, and most of the rest of the world in the worst consumer led recession since the great depression, one thing should finally be clear:

The tail does not wag the dog no matter how many people think otherwise.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.