MPW - Medical Properties Trust Inc - US Housing Market Stocks Analysis

Companies / US Housing Mar 21, 2023 - 02:38 AM GMTBy: Nadeem_Walayat

US House Prices Current State

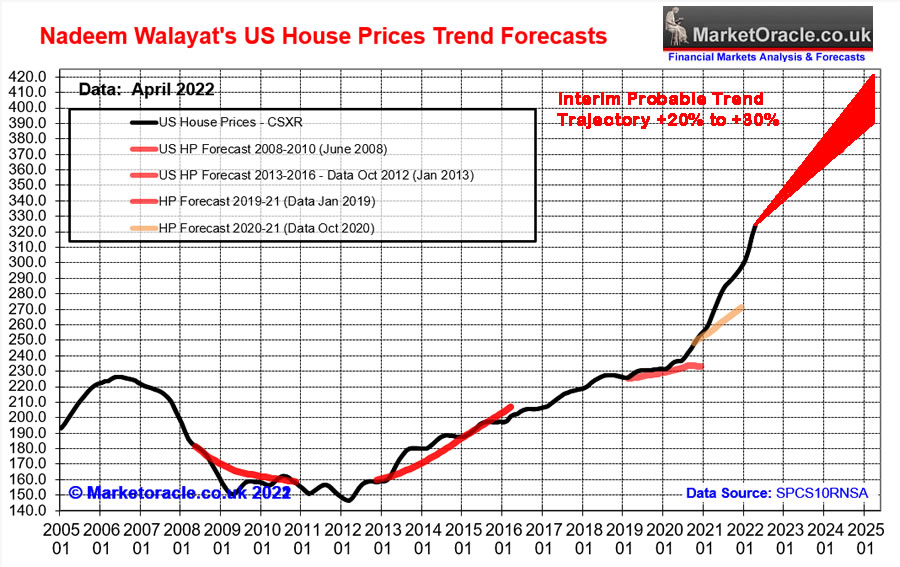

My interim view as of early July 2022 based mainly on my stock market, economy and UK housing market analysis at the time (Stocks Bear Market Rally Last Gasp Before Earnings Season, US House Prices 3 Year Probability Range) concluded in an rough expectation for US house prices to target a gain of between 20% and 30% over the next 3 years that would be punctuated by a correction during 2023.

The latest Case Shiller 10 city index for November 2022 is 313, down form a peak of 330 in June 2022 (remember there is a 2 month lag in reporting of data). Thus US house prices have corrected by 5% from their highs though still positive on an 12 month basis at +6.3% which isn't anywhere near the shrill cries of the doom merchants such as Michael Burry of Mid 2022.

And given the background of soaring mortgage interest rates and contracting corporate earnings coupled with the inflationary cost of living crisis then +6.4% over the past 12 months is a sign of relative strength that suggests that yes US house prices whilst weak during 2023 are not going to fall off a cliff as many prospective buyers hope they will, after all the so called recession saw the US economy add 517,000 jobs last month, more than double market expectations! Thus the correction looks set to mild and prove temporary with prices set to resume their bull and likely to trade at new all time highs during 2024.

US Housing Stocks Mini Portfolio

Where housing stocks are concerned the more bad news the better which is the mistake most investors make when seeking good news to buy, countless times I get asked why am I buying x,y,z, stock when the news is so bad! We'll how else do you think you are going to get the stocks to trade down to a cheap prices? Not when the news is GOOD! You want the news to be BAD, DIRE, disastrous even because that is when one gets the greatest buying opps! It's why during October I looked like a porcupine given all the falling knives that I had tried to catch, which included a few US housing stocks though to very limited extent, pinprick exposures so as to get give me some skin in the game towards focusing on the US housing market.

MPW - Medical Properties Trust Inc

Owns medical properties such as hospitals so exposed to the US housing market and healthcare sector that currently yields 9%!. Like most REITS it's not a capital grower, it's a dividend income stock. However it does range trade between $24 and $10, where most recent price action has seen the stock price bounce off it's low, so another stock trading at an opportune time which has now made a higher low low and higher high and broken it's downtrend line, so as far as I am concerned the bottom is in so all that remains is to climb on board this range trading gravy train before it fully choo choo's out of the station. The stock is currently correcting it's breakout which could end at any time, It is IN it's buying range of $13.1 down to $11.1, I suspect those who get greedy will be left sat on the bench at the station. Yes, for the time being upside IS limited to $24. However add the eye watering 9% dividend to that and well this as good as it gets in terms of risk vs reward, just invest and forget until $24 whilst collecting the 9% annual dividend at it's current price of $12,8.

The bottom line this was already on my buy the falling knives radar as a range trading stock so I am already invested, and will buy more on the dip, that should result in a yield of at least 10% per annum coupled with the potential to X2.

This article is an excerpt from Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1that was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! I am keeping my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, $5 month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile.

And gain access to the following most recent analysis -

- SVB Collapse Buying Opportunity Counting Down to Resumption of Stocks Bull Market

- Stock Market Counting Down to Pump and Dump US CPI LIE Inflation Data Release

- Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- US House Prices Trend Forecast - 50%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 75%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trim FOMO rally buy the DIP analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.