More Headwinds for Commodity Market Bulls

Commodities / Commodities Trading Feb 20, 2023 - 09:07 PM GMTBy: Donald_W_Dony

Commodity bulls are facing a challenging year ahead.

Some natural resources were benefiting and riding on the coattails of mounting inflationary pressure in 2020 through to mid-2022, such as oil and Natural gas, while others (gold and silver) were still prospering from the low US dollar and near zero Fed interest rates in 2019.

However, conditions started to change for most commodities in mid-2022 (Chart 1).

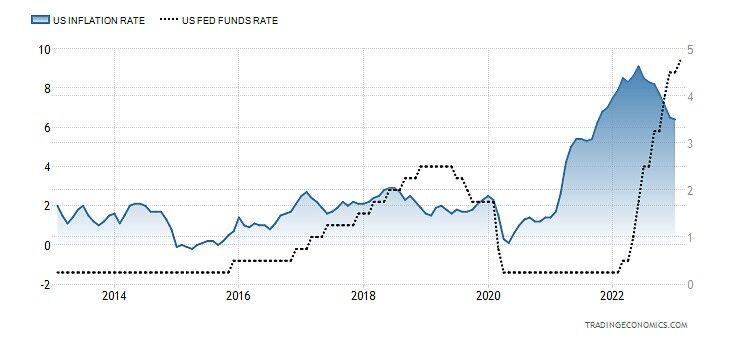

The Fed, in an effort to quell the rapid increase in inflation, began aggressively raising interest rates starting in Q1, 2022, and continuing to date (Chart 2). The rate went from 0.05% to the current 4.58% in 12 short months.

The rapid increase in the Fed funds rate caused several events to occur. First, it helped to slow the rate of inflation (cresting in early 2022) and second, it drove the US dollar upward from a low of 89.51 in mid-2021 to a high of 114.75 in October 2022.

Both of these actions proved challenging for commodity prices.

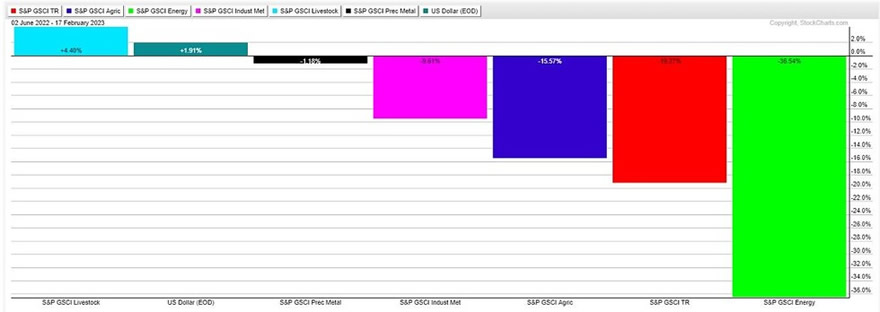

Over the last six months, the S&P Energy sector declined by over 36%, the S&P Commodity Index fell 19.27%, the S&P Agriculture Index descended 15.57%, the S&P Industrial Metals Index dropped almost 10%, and the S&P Precious Metals Index failed to post a positive reading, closing down at 1.18%.

The only commodity index to achieve a positive mark was the Livestock Index with a 4.40% gain (Chart 3).

Moving forward, we know the Fed is still engaged to bring down inflation. This means more interest rate increases and as the S&P Commodity Index is following the US Inflation Rate, a decrease in overall commodity prices. It also means a rebound in the $USD. More interest rate increases are supportive of the Big dollar.

Bottom line: The outlook for natural resource prices going into Q2 is largely flat to negative. Models suggest that WTI will trade at $82 in late Q2, Natural gas will be at $2.90, Copper prices should reach $3.90, Gold is expected to hit $1800, and silver is anticipated to reach $21.20. Models for the S&P Commodity Index are expected to be at a similar price level as it is now, hitting 3440.

The US dollar currently has tailwinds in its favour. The target is 105.40 by late Q2.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2023 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.