Natural Gas: Here's What Happened After a "Double Top"

Commodities / Natural Gas Jan 27, 2023 - 09:06 PM GMTBy: EWI

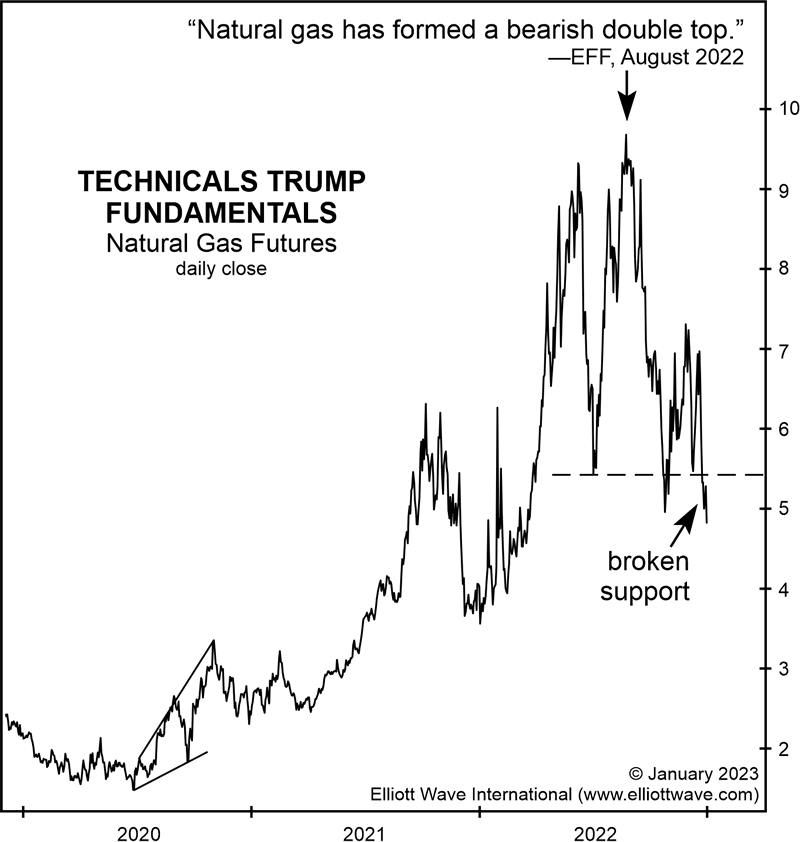

A key technical pattern warns of a reversal

It probably won't be a surprise to you that Elliott Wave International is an advocate of technical analysis. After all, the Elliott wave method is a form of technical analysis.

You probably know that the term "technical analysis" refers to analyzing the behavior of financial markets themselves -- generally by studying charts -- as opposed to "fundamental" analysis, which is based on news and events outside of financial markets.

One of the many classic technical-analysis chart patterns is known as a double top. (Conversely, a double bottom is the same reversal formation after a significant prior down move.) Getting back to the double top, the first price high (or top) is followed by a moderate decline. The price then rises into the same territory as the prior high, which is the second top.

In August, the European Financial Forecast, a monthly Elliott Wave International publication which covers European financial markets and is also part of the monthly Global Market Perspective, said:

Natural gas has formed a bearish double top.

Keep in mind that this analysis was provided even though energy analysts were calling for natural gas prices to remain elevated due to "fundamentals," for example, "supply strains." Here's a July 25 headline (The Financial Times):

Traders expect European gas prices to remain elevated for years to come

Instead of remaining elevated, the price of natural gas fell, which was right in line with our analysis of that double top in the August Global Market Perspective.

The January Global Market Perspective provides a review with this chart and commentary:

The chart illustrates the continuous natural gas futures contract that trades on the New York Mercantile Exchange.

In August, we illustrated this contract along with 15 other key commodities and stated that gas prices had formed a bearish double top. In a matter of weeks, futures collapsed 50% and penetrated a key technical support level at [a key Elliott wave]. The same support level failed again last month.

True, not all analysis based on a market's "technicals" works out as expected, but often, it does -- or at least gets very close.

See how Elliott Wave International's global analysts apply Elliott wave and technical analysis to other financial markets -- free -- for a limited time.

Just follow this link to get the details.

This article was syndicated by Elliott Wave International and was originally published under the headline Natural Gas: Here's What Happened After a "Double Top". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.