Bitcoin FTX Crime Scene CAPITULATION!

Currencies / Bitcoin Jan 21, 2023 - 12:11 AM GMTBy: Nadeem_Walayat

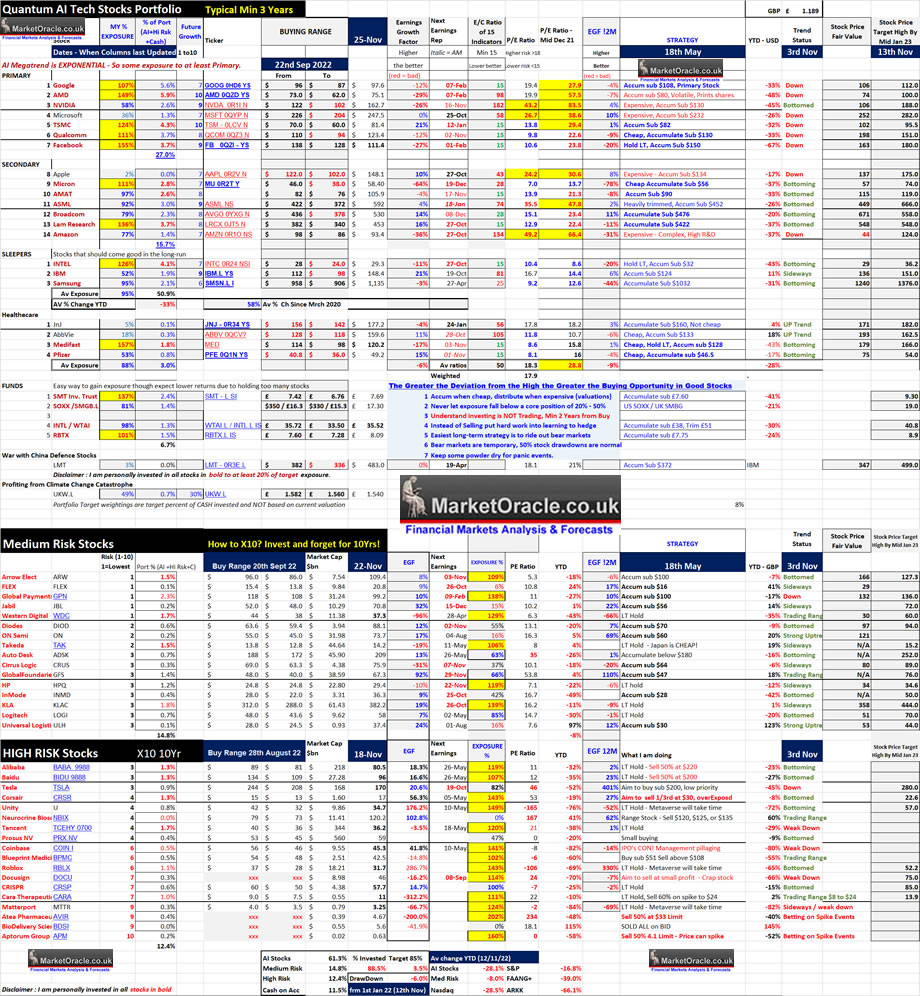

Ai Stocks Portfolio

A quick look at the current state of my portfolio which is now 88.5% invested after arrival of approx 5% of fresh cash and after I sold all of my NBIX holding given that it earlier retreated from a multi year high, and that it tends to trade within a range of $125 to $76. I have update the table to indicate when columns were last updated. I have also replaced the beta column with something more useful called Future Growth (1-10), which is basically how I see the COMPANY doing in terms of future growth potential where 10 is the highest and 1 is the lowest, note this does not mean that the stock prices will match growth potential due to a myriad of factors such as sentiment, valuation and politics, but it gives insight into the underlying prospects for the businesses where the two stocks that score 10 are AMD and TSMC which is why I am heavily invested in both and don't fret about stock price drops in either as recently experienced because the underlying businesses have huge long-term future growth potential. Stocks that score 9 are Nvidia, Facebook, ASML and IBM, which again means I am not too phased by what we recently witnessed with the likes of META and and Nvidia, stock prices rarely reflect the actual state of the underlying business as they oscillate between extreme fear and extreme FOMO as illustrated when one watches the Cartoon Network (CNBC).

Table Big Image - https://www.marketoracle.co.uk/images/2022/Nov/AI-stocks-portfolio-25th.jpg

Bitcoin FTX Crime Scene CAPITULATION!

EYES WIDE OPEN! Remember that one is NOT investing in crypto's but rather gambling on crypto's that a greater fool will some day come along and pay more for what one paid as crypto's have NO intrinsic value.

SBF Crypto's Bernie Madoff STOLE over $10 BILLION all whilst MSM elevated him to financial markets godhood, cramer called him Crypto's JP Morgan, forgetting that he also was crook like Bernie Madoff! Anyway Cramer allowed SBernieF claim even more innocent victims! Even today MSM coverage makes me want to puke! WSJ reporters asking SBernieF how he is coping and if he is getting enough sleep. The MSM is not just a joke but dangerous because these clowns will ensure you will lose ALL OF YOUR MONEY for the fundamental reason they are CLUELESS! Most journalists rarely understand the topics that they write about, instead all they do is regurgitate that which someone else has told them!

And it's probably a lot worse than that, GPT-3! How many MSM articles are now being written by GPT-3? I'd happen a guess the percentage is growing each day! Articles, Blog posts, tweets and countless corporate chat bot's, GPT-3 probably interacts with most internet users on a daily basis and you have no idea!

FTX the worlds 2nd largest crypto exchange collapses into a theft of customer funds block hole which has many exchanges including numero Uno Binance teetering on the brink regardless of the LIES that spew out from this entity cross MSM, all of the scams are starting to be revealed that even extend to what one would have imagined were safe from fraud such as the Grayscale Bitcoin ETN that I was warning of in the comments section before the FTX scam exploded onto the scene given the 40% plus deviation to the underlying that the ETN was supposed to be tracking, which was a sign of extreme distress, now we understand why! It was because of FTX! And that discount has continued to widen which suggests worse to come, maybe a halt to redemptions or share printing on an epic scale that dilutes holders into oblivion.

This is not the time for crypto investors to make excuses but to face facts that GBTC could disappear in a puff of smoke, either through outright bankruptcy or to dilute investors into oblivion in attempts to cover losses. This is what the crypto markets are experts at, diluting crypto token investors into oblivion, of course I don't know the in's and out's of the games that the likes of FTX and BInance and GBTC and the rest have been playing behind the scenes but I can imagine it involves siphoning off customer fiat funds in exchange for worthless tokens with fake market caps as I been warning since Mid 2021 that market caps are FAKE because most of the tokens are held by a handful of insiders and thus the actual market caps are engineered to entice gullible fools to buy worthless crypto's as the insiders watch on like vampires watching victims buy into their scam coins as my following video from JUNE 2021 illustrates with countless since.

According to coinmarketcap the crypto space's current market cap is $820 billion, down form $3 trillion, yeah, sure it was, reality is probably nearer to 1/10th those numbers i.e. currently about $80 billion. Fake exchanges with fake trading volumes of fake crypto with fake market caps trying to get fools to invest their fiat.

So once more approach crypto's with both eyes WIDE OPEN! There is no point crying afterwards that ones crypto or platform has gone bust because one kept ones eyes closed to the extreme risks but instead blindly focused on the potential for extreme rewards for one does not get one without the other.

I should have better heeded my analysis of June 2021 and held out for Bitcoin of $14k- Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

Bitcoin Bear markets analysis - How low could she blow?

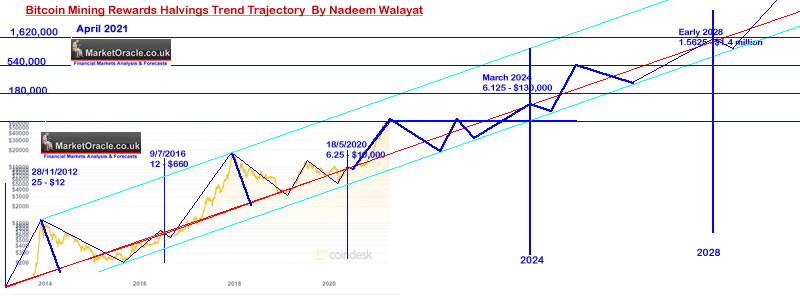

Even I am finding it freaky to go back and read my analysis of 18 months ago! Maps out the Bitcoin trend into 2028! Which suggests Bitcoin is now bottoming for trend to $125k to $135k by roughly March 2024 as per analysis of April 2021!

I even warned to beware of SCAM exchanges.

So the message is clear pick your exchanges carefully, don't get seduced into any of the freebie and special discount offers that the smaller exchanges come out with to entice unsuspecting victims with because it is JUST NOT WORTH THE RISK!

So it should be much safer to have holdings at the largest exchanges hence why I had high hopes for Coinbase, unfortunately it is a poor trading platform and it's charges are VERY HIGH, so the bulk of my crypto will not be bought through Coinbase but rather Binance, yes it is higher risk than Coinbase, so the strategy will be to buy with Binance and then probably seek to move the bulk off Binance into a hard wallet, probably just most of my Bitcoin and Ethereum holdings only.

It's amazing reading some of the comments at the time, many did did not want to hear that Bitcoin could fall to as low as $14k form the then price of $40,335, crypto's are like a bloody religion for some folks! Get a grip! Most Alt coins are SCAMS!

ARKK TOO - At the time ARK was trading at $113 and I warned that it could fall all the way to the low $40's, well Cathie's ARKK bottomed at $32.5 and it may yet see even lower lows.

it is possible that we could see ARKK trade all the way down to about $60, which is near half it's last close of $113!

I am sure if it happens ARKK's Cathy Wood will pump loads of spin into how great a buying opportunity it is that stocks have fallen so much just as she was seen stating about a week ago that she had expected the drop all along because her just out of University motley crew of pocket geniuses with no real world experience told her so in tweet or whatsapp message that self destructed months ago or maybe it was in a dream via prototype neural link, anyway ARKK at $60 is all good as it's going to X3 from there. In which case lets hope Tesla does not halve in price once more to tale ARKK down to the low 40's! But with Cathy it's always a case of blue sky's overhead no matter that most who have invested in ARKK will done so at over $100 per share as indicated by the volume.

This is the problem with funds and fund managers, all one is doing is paying for a perma sales pitch of blue sky's ahead. It is infinitely better to invest in a few good safe stocks and then forget about them, that is how one actually INVESTs, not like these ARKK clowns trading in and out, in and out, in and out to fund value oblivion.

Back to the present, armed with PAST KNOWLEDGE what's next for Bitcoin? Despite crypto markets being in crisis, BITCOIN and the other more credible crypto such as Ethereum have been holding up well which is a sign of accumulation rather than panic selling. Therefore the relatively transparent bitcoin price could have passed the worst of it's bear market and whilst a FOMO bull run to new all time highs will be more than a year away i.e. during 2024, anyway the downside or draw down from there looks limited. Maximum Fear is not triggering an avalanche of selling or if it is that selling is being soaked up by stronger hands. But one when one plays with Bitcoin one needs to be prepared for the draw down. Anyway this is my best guess of how Bitcoin could play out from now into 2024 where the downside risk is we see a spike to $10k.

I hold hardly any bitcoin (pity I can't say the same for Alt coins) so I have plenty of scope to scale into a position between now and about $12k much as I did for tech stocks during 2022, the point being I am not trying to catch the bottom because THE bottom from here could be anywhere from $16k down to $8k, which we will only know with the benefit of hindsight. However the upside should be north of the previous all time high of $69k, somewhere between $99k and $130k which offers a potential X6 to X8 from here.

Now don't ask me about the Alt coins as one needs to delineate between Bitcoin which was 100% freely mined against crypto tokens 99.9% of which are issued and controlled by insiders, Bitcoin is at the core and the rest are on the periphery where it is literally a case of place ones bets and take ones chances. BICTCOIN WILL HAVE ANOTHER BULL MARKET. However it's a crap shoot to to guess which token will follow Bitcoins lead. Especially given the prospects for regulation, Securitization of tokens which most alt coins won't survive. Though looking at some of the Alt coins I own there are signs of life for instance in Litecoin at $77 after bumping along at $50 for several months.

So if one wants to gamble on the next crypto bull run then ones focus should be on Bitcoin as a far lower risk then any of the tokens out there, yes we all have our favourites, mine is Ravencoin which is similar to Bitcoin in that there is no pre mine unlike Ethereum and 99.9% of other crypto's.To date I have NOT funded any crypto accounts since Mid 2021 when I took advantage of GBP 1.40 and crazy f/x spikes on Binance to as high as 1.50. However since a flurry of activity late 2021 I have hardly touched my crypto accounts though trying to log into Binance during the weekend resulted in this -

At rough guess I am down about 60% on my crypto portfolio. Anyway given FTX I was not going to use Binance to accumulate fresh Bitcoin, and conbase is also a pain in the butt to fund with their pro version that they are changing to Advanced version, as they want to rip people off with a 5% FEE charged on their conbase.com platform, similar rip off fee from paypal of 1.5%-2% plus spread. Neither do I want to get suckered by an ETF trading at a 40%+ discount that could go bust! So what's left? We'll for now the easiest option for me is etorro at a 1% fee to buy bitcoin. There is also the option of GPU mining perhaps in the cold winter months I will get the GPU to heat up my office as I earn bitcoin in the background at a cost of 18.1p per kwh after midnight,

so I will likely accumulate Bitcoin from $16l all the way down to $12k over the coming months as I build a significant position in excess of that which I invested in crypto's during 2021, perhaps equivalent to 2% of my stocks portfolio as there is likely plenty of price volatility ahead before a bull market proper gets going all the way to FOMO new all time highs when a new set of greater fools appear to take bitcoins off our hands. Thus buying Bitcoin at $16k for $100k looks like a a good risk vs reward, Though most will obsess over draw downs as if they imagine they will be able to buy Bitcoin at the exact low that we will only know with the benefit of hindsight, whilst the tortoise investors are already accumulating for a potential X6 return.

The bottom line is that whilst it is bad it could be worse as we await the return of the crypto FOMO lemmings to lift all crypto boats higher.This article is an excerpt form my recent analysis on the current state of the embryonic stocks bull market Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION! that was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this is sooon set to rise to $5 per month.

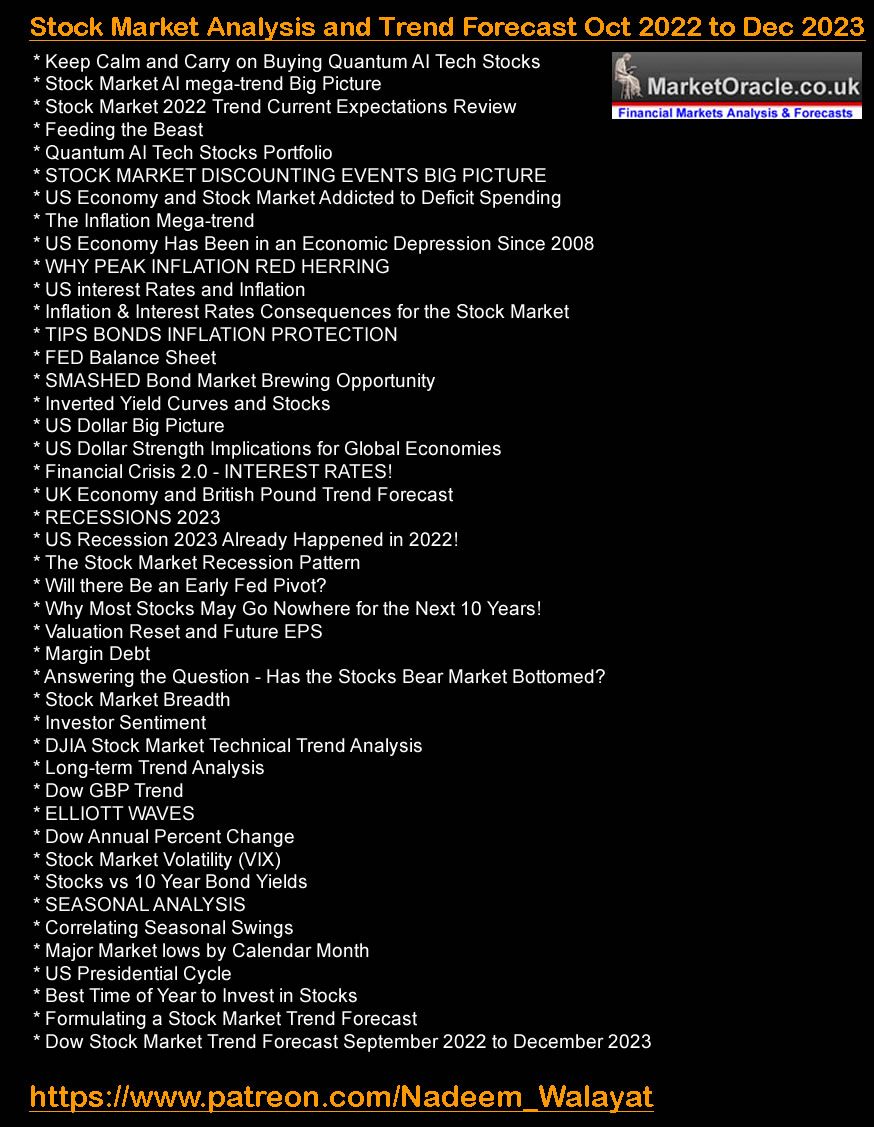

Also access to my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

Most recent analysis includes -

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 90%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock in now as this increases to $5 per month in the new year.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your mega-trend investing analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.