Gold stocks are not yet unique, but that’s coming

Commodities / Gold and Silver Stocks 2023 Jan 20, 2023 - 11:59 PM GMTBy: Gary_Tanashian

Gold stocks have been among the leaders of the Q1 rally, but are not yet unique

It seems that all too often lately the gold mining sector is in tow with commodities in general and broad global stocks in its ups and downs. As a leader, but not THE leader of the rally that is fine for now as long as we’re still on the back end of the originally projected Q4-Q1 rally in broad asset markets.

But if I am correct in the view of a real bull market in gold and especially the miners, at some point this will have to change. Gold miners are counter-cyclical businesses and the fact that their cost inputs like energy, materials and even human resources are rising in cost is not positive. While the fact that gold has been outperforming most of these for the last 3 to 6 months is positive, the real play will begin when investors look at their portfolios, beaten to a pulp, and see only one sector (or one of a very few sectors) rising while a bear market resumes in cyclical, risk ‘on’ assets.

Now, I can freely talk bearish because referring to the second link above, I was talking bullish at the appropriate time. What’s more, I hold not a single short position in anything. Only long (and a boat load of interest paying cash/equivalents). So I am not talking my book when discussing an end to the rally that the FOMOs have been eating in January, as if on cue.

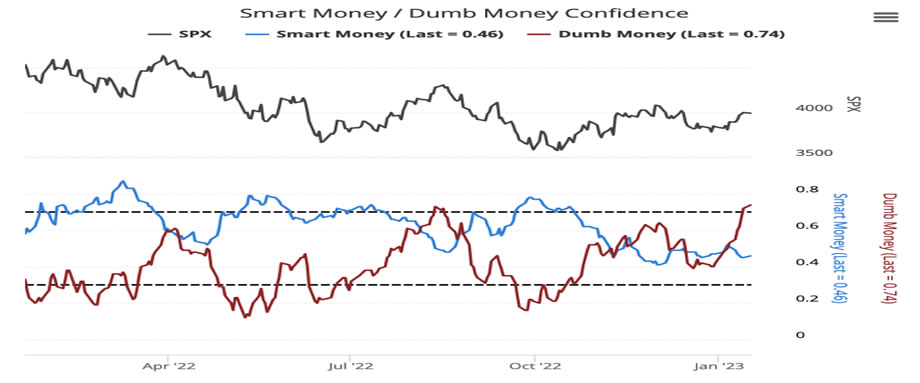

Sentimentrader.com

There must be fundamental reason for a bullish view of the gold stock sector. These ladies need not apply (and they are always out there). The Golden Cheerleaders will be right this time because the squirrel eventually finds his perma-promoted nut.

But the reason will not be inflation. It will not be because China and India want more gold. It will not be because Dorothy is clicking the heels of her ruby slippers. It will be because in a counter-cyclical, post-bubble environment gold is going to retain value in relation to oil, materials, commodities, stocks and all the other beneficiaries of inflation cycles past.

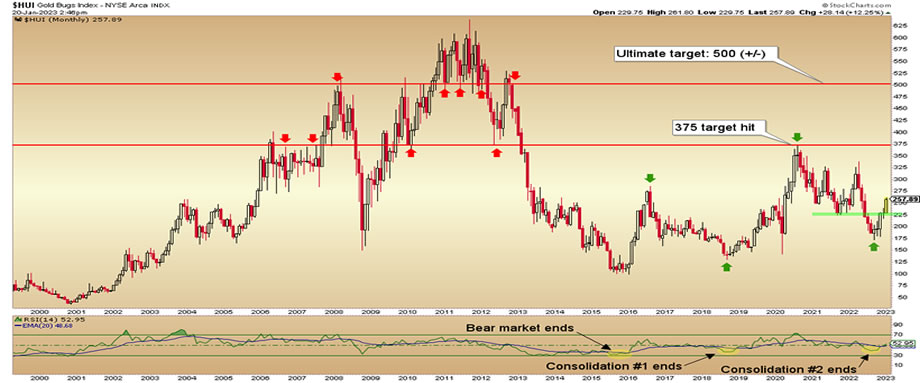

It is beyond the scope of this article to go into the reasons (and indicators), but if you’ve read me with any regularity you already know some of them. I’ll just leave you with the monthly chart of the HUI Gold Bugs index and note a few things…

- The corrections will come (we manage these potentials each week in NFTRH, along with bullish potentials, obviously), but…

- Huey is on the next leg to its target of 500.

- The current plan for the best of the bull market will be when other asset markets flame out (which ironically, could negatively affect the gold miners temporarily). That is not yet happening and oh by the way, the toothless tiger pretending to still be relevant known as the Federal Reserve is meeting on February 1.

As to the monthly chart of HUI, which is the view of the big picture, it is fully on plan after RSI bottomed at a logical point (and since then rising above 50) and Huey took out the 240 area, which was key resistance (now support, which may or may not be tested). Regardless, the implication is a new high over the next year or two in the terribly volatile bull market that began in 2016. If/as it clears our former target of 375, which was registered in 2020, there will be little resistance until 500.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can also keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter ;@NFTRHgt.

By Gary Tanashian

© 2023 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.