Stocks Analysis Bonanza Trend Forecasts - GOOG, QCOM, ASML....

Companies / Investing 2023 Jan 18, 2023 - 09:49 PM GMTBy: Nadeem_Walayat

Dear Reader

Analysis of 10 stocks as requested by Patrons to see where they stand in terms of trend and future prospects as many are still trading at deep discounts to their highs. Plus a bonus 11th stock, plus a deep look and trend forecast for the Bitcoin price for 2023 made right at the peak of the crisis of confidence in the crypto markets following the SCAM that is FTX and SBernieF.

First briefly, the S&P spent the last 10 days consolidating it's recent advance taking the S&P down to a low of 3900 as it chopped away at bullish positions and accumulated bearish positions which as I voiced in the comments was sowing the seeds for a break above 4000 to target 4100 which happened Tuesday, Though despite seasonal expectations for a santa rally, this rally is HATED by most for one only needs to go over to twitter to see why where tweeters correctly point out there is a weight of both technical and fundamental evidence against the rally such recession blah blah blah, hawkish Fed blah blah blah, and even if the market does go a little higher there is the impending doom of the 200 day moving average blah blah blah. All of this is PERFECT for the rally to fire it's BOOSTER rockets and propel this market well beyond anyone's expectations as I wrote in my last analysis that I would not be surprise if when the dust settles the S&P is trading north of 4300!

Another MSM mantra that is not standing up to the facts to date is the crescendo of fear mongering that surrounds the impending US recession, We'll the facts are US GDP for Q3 is 2.6^%, with Q4 estimated at 4%, which is not translating into a collapse in corporate earnings which means that it is even possible that the US manages to avoid a recession as I voiced in my in-depth analysis of early October that all this noise surrounding the yield curve predicting a recession with a 100% accuracy appears to have forgotten that the US posted 2 negative quarters of GDP during 2022, so as I stated the recession of 2023 has already happened in 2022!

Though of course this bear market has been driven by rising interest rates which given what is taking place in Europe implies rates could have peaked i.e. Europe IS in recession and thus falling demand should temper inflation that the US will be a beneficiary of and thus it is unlikely the Fed will raise rates to anywhere near what many of the doom merchants have been broadcasting as if the likes of 5% are a done deal. Anyway I have been pursuing fixing my GBP cash reserves before rates respond to a weakening yield curve as the Bank of England is expected to continue to raise rates for a few months more. Thus expectations for the Fed halting rate hikes will continue to feed the rally in stocks all the way to Phase 2! What's Phase 2? EARNINGS CONTRACTION that looks probable during the 2nd half of 2023 whether or not it is accompanied with 2 quarters of negative GDP as per my 2023 trend forecast analysis.

So Fed halting rate hikes will propel stocks to well beyond anything any of the talking heads can imagine today even after a 500 point jump in the S&P, that I expect to resolve in a Phase 2 Stock market decline that should retrace at least half the advance off the October low as earnings contract during Q3 and Q4 2023. Though again stocks will bottom BEFORE earnings start to grow.

This article is part 1 of 2 of as excerpted form my extensive analysis Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION! that was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this is soon set to rise to $5 per month, your very last chance!

Also access to recent analysis including -

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

TRAVELLING THROUGH TIME AT AN EXPONENTIAL RATE!

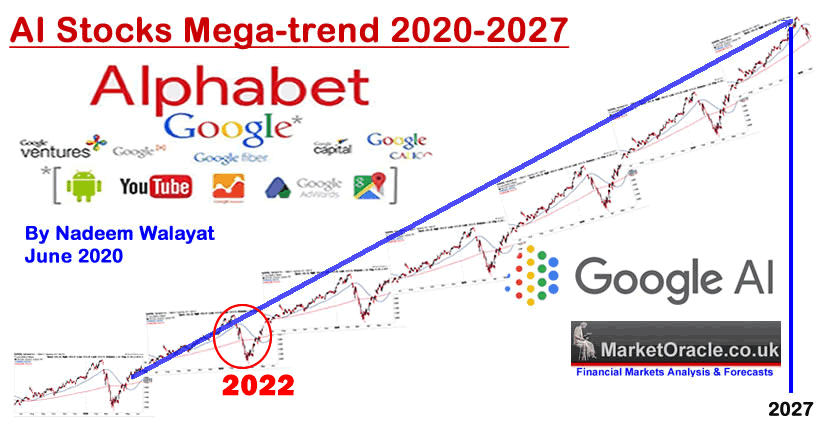

Many analysts refer to what happened decades ago to try and imply to expect similar today, what is it that they are blind to that ensures the past is not a good measure of the future? What they miss is the exponential nature of the trend we are upon! We are RACING THROUGH TIME AT AN ACCLERATING PACE! What not so long ago took decades now has been compressed into years! What not so long ago took years now takes months! That is the exponential AI mega-trend in a nutshell and it is ACCELERATING! Go back a thousand years and nothing much change for most folks for centuries! Go back 100 years and the changes would be measured in terms of decades! Go back 50 years and changes were measured in years! Today the pace of change is in the months! And yes it will become in the weeks! So how are we to capitalise on this exponential trend? By investing in the stocks that are making the trend become manifest, holding on with both hands as they whip through time at an exponential rate, clinging on as we watch those who SELL fall behind waiting for a dip to get back on board.

The bottom line is that we leaving behind the snails pace of biological evolution as the rate of change continues to accelerate which is why we have no real idea of what this will lead to because of the pace of change hence the phrase the Singularity, Everything Everywhere, All at Once!

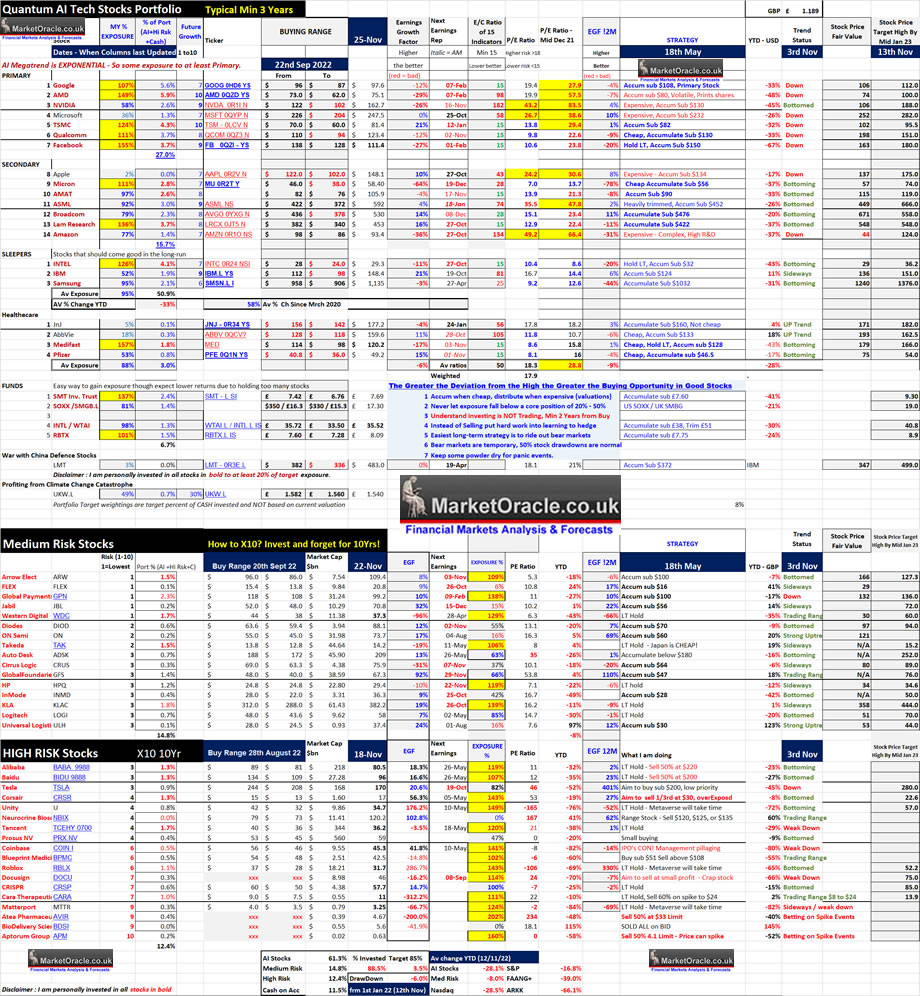

Ai Stocks Portfolio

A quick look at the current state of my portfolio which is now 88.5% invested after arrival of approx 5% of fresh cash and after I sold all of my NBIX holding given that it earlier retreated from a multi year high, and that it tends to trade within a range of $125 to $76. I have update the table to indicate when columns were last updated. I have also replaced the beta column with something more useful called Future Growth (1-10), which is basically how I see the COMPANY doing in terms of future growth potential where 10 is the highest and 1 is the lowest, note this does not mean that the stock prices will match growth potential due to a myriad of factors such as sentiment, valuation and politics, but it gives insight into the underlying prospects for the businesses where the two stocks that score 10 are AMD and TSMC which is why I am heavily invested in both and don't fret about stock price drops in either as recently experienced because the underlying businesses have huge long-term future growth potential. Stocks that score 9 are Nvidia, Facebook, ASML and IBM, which again means I am not too phased by what we recently witnessed with the likes of META and and Nvidia, stock prices rarely reflect the actual state of the underlying business as they oscillate between extreme fear and extreme FOMO as illustrated when one watches the Cartoon Network (CNBC).

Table Big Image - https://www.marketoracle.co.uk/images/2022/Nov/AI-stocks-portfolio-25th.jpg

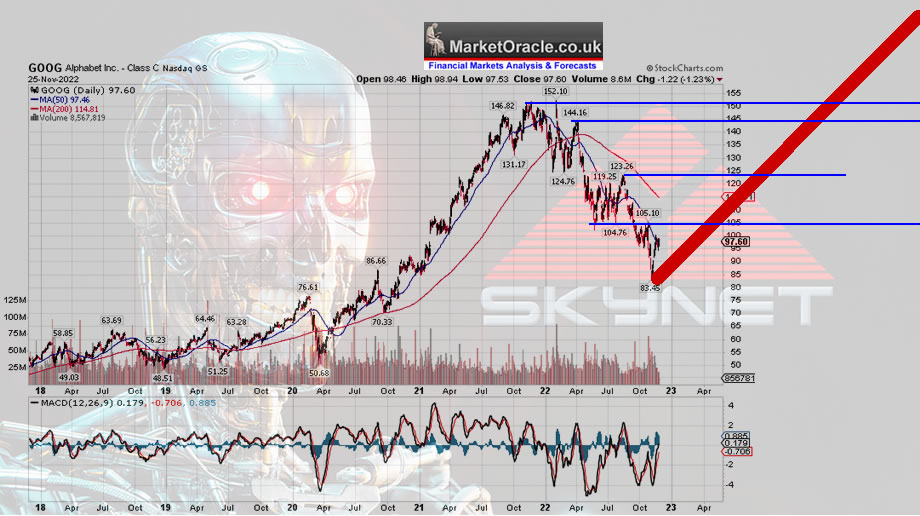

Google - GOOG - $97.6, EGF -12%, -4%, P/E 19.4

The daddy of online search with a 95% market share that has squashed all who tried to compete including Amazon and Microsoft, strong cash flow that in part gets plowed into bets such as Deep Mind and Boston Dynamics. The great soon to be forgotten bear market of 2022 delivered the mother of all buying opps on par with that of March 2020 in the No 1 stock on my list and the further it fell the more bearish the talking heads become, what did I do ? I bought more! And even now at 107% invested some 5.6% of my public portfolio I am NOT DONE! Though the stock at X19.4 is not exactly dirt cheap but a lot better than where I was selling at a year ago. EGF's of -12% and -4% point to more rough quarters ahead so I do not expect any moon shot attempt for the stock price for a several quarters, so there could be scope to accumulate more near the bear market low of $83. However all of this is noise compared to Google's long-term prospects for instance the Algo forecasts $224 in 3 years time which I consider achievable, $224 from $97 is a HUGE 130% Jump even if it may take longer than 3 years with the risks being to the upside. So far Google has actually not done anything that I was not expecting the stock to do as it cycles between FOMO over valuation and PANIC under valuations as my chart form June 2020 illustrates .Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

Thus Google is primed to begin it's next multi-year advance that will likely see Google trade near it's all time high of $152 during 2023. I am glad I am 107% invested.

Perhaps Google will change it's name once more from from Alphabet to DEEPMIND! As Deep Mind is being integrated into the day to day operations of Google's various divisions making the corp run more efficiently, as we await the ultimately name change to SKYNET!

And briefly a history lesson on how Google does it's magic, In 2011 Google bought Motorola (maker of the popular Razr flip phones of the early 2000's) for $12.4 billion. Three years later Google sold Motorola to Lenova for $2.91 billion. A disaster? As MSM were reporting on at the time of the the huge loss that Google had suffered, so if one followed the MSM narrative one would have concluded to steer clear of Google in mid 2014 when the stock price was trading at $26 given how badly Google was apparently being run.

So why did Google buy a dying corporation that they would later sell for pennies on the dollar?

17,500 Patents granted plus 7.500 patents pending in the field of wireless communications. Thus when Google sold Motorola, they kept 80% of the patents that they used in their patents war against Apple and Microsoft to ensure that Android survives to become what it is today, the worlds No 1 smartphone operating system.

Furthermore after taking into account other spin offs from Motorola and use of over $6 billion of tax losses meant that the actual cost to Google for the 24,000 patents was just $650 million.

Qualcom - QCOM $123.4 - EGF -12%, -9%, P/E 9.8

Qualcom managed to hold up well during the bear market right up until October when it broke support at $120 falling to within touching distance of $100. A decline that has greatly weakened the outlook for QCOM during 2023, i.e. one can forget about new all time highs this side of 2024. At best Qualcom could break above the $156 high to target $170. The fundamentals are mixed as Qualcom trades on low P/E of 9.8 against which EGF's are -12% and -9%, so no earnings growth for 2023 thus the stock could remain range bound for most of 2023 within the range of $120 to $155.

(Charts courtesy of stockcharts.com)

I am 111% invested, I will be seeking to trim on a rally to above $150 and accumulate on declines below $120 which is a good 26%+ spread.

ASML - $5924 - EGF +3%, 0%, P/E 35.5

If I had to pick one stock that I thought would bounce back strongly form it's bear market low, that stock would NOT be ASML! Given it's literal rip your bear face off 78% rally which is just as much a surprise to me as to most after all it is trading on a high PE of 35.5 with fairly neutral EGF scores of +4% and +2%. I guess it comes down to RELATIVE performance i.e. whilst most semi stocks have deep in the red EGF's ASML is positive over the short and longer term. That and the corporation makes the machines that makes the chips is clearly being discounted for stronger demand than it's semiconductor brethren as they need to BUY the lithography machines before the likes of TSMC can make the processors for it's chip designer clients, a case of ASML stock is first to drop and first and rise given that the stock peaked several months earlier than the likes of TSMC.

However the current rally has run ahead of itself +78% above it's LOW! There is plenty of scope for a post christmas hangover, but on the flip side there has literally been panic buying of this stock given that it rose at a faster pace then it fell! Given that the stock was so over valued it was one that was never at the top of my to accumulate list, still I did manage to lift my exposure to 92% invested with a large chunk of that buying done during the PANIC sell off into October when it spiked down to $362 as I just kept buying that dip. I think ASML is a prime candidate for testing it's all time high during 2023, though I would be surprised if it actually broke out to new all time highs. Clearly someone big is building a position in this critical one of a kind stock which means personally I am going to be reluctant to trim much of ASML and be even more eager to buy any future dips.

And now for the three nightmare Chinese stocks that Emperor Ping has crushed!

Tencent - TCHEY $36 - EGF -3.5%, +1%, P/E 21

.....

This article is part 1 of 2 of as excerpted form my extensive analysis Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION! that was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this is soon set to rise to $5 per month, your very last chance!

Also access to recent analysis including -

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

Apart form regular AI Tech stocks and stock market updates, my schedule includes:

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock in now as this imminently increases to $5 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trim the rally analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.