How High Could the Impossible Stocks Bull Market Fly

Stock-Markets / Stock Market 2023 Jan 06, 2023 - 11:48 PM GMTBy: Nadeem_Walayat

Dear Reader

Temperate CPI sends stocks soaring to the moon with Fridays close of 3992 literally within touching distance of breaking above 4000. A week ago I wrote - "there may be more sideways to down price action given the drags we have this week with the Mid-terms and the 10th of November CPI release that could hold stocks back until after their conclusion. Nevertheless as long as the 3620 low holds then the pattern remains in tact for an eventual break higher of 3920 to target 4000+ where I would expect the S&P to achieve 4100 by Christmas and by the time this rally is done we may even see a break above 4300."

And so as soon as the CPI dark clouds were lifted the stock market soared, though you would not think it had if you read or watched any of the usual suspects, that's tweeters, youtubers, and the blogosfear. Not a bull in sight! Were they all caught with their short pants down? Glum faces all round! A collective case of WTH is going on! Confounded disbelief which I suspect will only lift towards the end of this rally when the herd FOMO's into the top similar to August.

The trend trajectory is literally as per last weeks swing projections that showed the S&P trending towards a target of 4200 by Christmas.

Big Image - https://www.marketoracle.co.uk/images/2022/Nov/sp-14th-nov-big.JPG

But one step at a time, first 4000 (that looks likely today), then 4100 (which was my base case scenario for Christmas) and then 4200 that could be touched and if touched means probable break of 4200 that would propel stocks in a FOMO driven moon short to beyond 4300! Technically the stock market has moved from the bottom of it's trading range (right chart) to the top, which means we should NOT expect a similar rocket ship move as last week to 4100, This week could prove more choppy which means at best the market could hug the upper trend all the way to 4100, but more likely is a correction down to about 3920 by the end of this month is likely that would set the scene for a 3 week santa rally.

So what am I going to be doing as the S&P eventually homes in on 4100? Trimming and eventually shorting (via options) whilst the crowd FOMO's all the way to above 4300, I'll leave the top pickers to be left staring in the rear view mirror waiting for their perfect sell levels just as as many were left waiting for their perfect buys at between 3200 and 3400 that NEVER materialised.This analysis How High Could the Impossible Stocks Bull Market Fly was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this rises to $5 per month within the next few days.

AI Tech Stocks Portfolio Trimming Strategy

Firstly, I have gone through my portfolio and increased my target exposure for most of the AI stocks typically by about 5% i.e. if a stock is 100% it would now be 95% invested as the amount invested continues to grow with the passage of time as I am nowhere near the stage where I start to draw down on portfolios for consumption until then the traffic of funds remains one way into my portfolios. The current state of my portfolio is 94.6% invested, 5.4% in cash, with approx 5% in transit (ISA transfer) so my effective exposure is about 90% invested. I have also updated target highs to be achieved by Mid Jan 2023 following last weeks explosive bull run.

Table Big Image - https://www.marketoracle.co.uk/images/2022/Nov/AI-tech-stocks-2022-12.jpg

TRIMMING

Many Patrons have asked where I aim to trim my holdings as stocks soar by huge amounts that would have seemed like a pipe dream even a week ago. For instance look at Lam Research, the violent collapse to $300 has now been followed by an explosive rally to $500, Up 67%! And yes I followed my mantra by buying the new lows and so ended up being 133% invested in LRCX with my lowest buy being a mere pin prick of $100 bucks on etorro at $307. A patron in the comments section asked why $100, why not more, We'll at 133% invested it's not easy to keep plowing more into a stock that has fallen to well below bear market expectations that encourages the doom merchants to emerge to proclaim such stocks are dead for a generation. It's not easy to keep buying a falling stock but I did as did many patrons, and thus I stand today at 133%, which gives plenty of scope to trim.

What is trimming?

Trimming is reducing exposure at a profit in those stocks heavily bought into during their descent into the depths of the bear market, sold during a subsequent rally. Profit taking to free up cash in advance of future opportunities when for whatever reason target stocks take a tumble as was the case going into the August peak.

So trimming is highly variable as it depends on ones position size and where ones holdings are i.e. Etorro and IKBR are far better suited for trimming than other accounts. Also I want to reduce the size of my Etorro account as it is not tax free, thus not suitable for long-term investing.

So here are my trimming ranges for most AI tech stocks.

Google $112 to $122

AMD $85 to $110.

Nvidia $169 to $199

MSFT $276 to $300

TSMC $90 to $110

Qualcom $146 to $155

META $168 to $199 - Unlikely to trim any META.

Micron $69 to $75

AMAT $116 to $131

ASML $586 to $666

AVGO $553 to $600

LRCX $516 to $566

Amazon $120 to $144 - I don't like Amazon, I'm going to sell a lot of what I recently bought if it makes it into the selling range, It could still HALVE to $50.

Intel $36 to $48

IBM $150 to $159

MED $165 to $192

Pfizer $53 to $60

Medium Risk Stocks

Arrow- $123 to $129

GPN - $124 to $135

HPQ $34.6 to $40

KLAC $399 to $436

Logitec $70 to $78

WDC $50 to $63

DIODE $92 to #98

ADSK $248 to #280

CRUS $88 to $95

GFS $76 to $79

INMODE $43 to $50

ULH $44 to $44

High Risk

CRSR $25 to $30

Tesla $252 to $285

Roblox $52 to $72

U $72 to $109

How much will I trim? Not much, somewhere between 4% to 7%. My aim is to get to about 85% invested from current 94.6%, with approx 5% in transit (ISA transfer), so about 5% should do it, enough to buy any further dips during 2023 whilst left with enough exposure to ride the bull market to eventually new highs.

I asked in the comments section of any particular stocks patrons would like me to take a look at from within the existing portfolio and so far the response has been BABA, BIDU, MTTR, COIN, U and RBLX, INMD, MGNI, TESLA, with a lot of requests for Corsair. What I will do is look at one stock in this article and then in a few days time take a look at least 10 stocks as continue to be requested in the comments section over the next couple of days. So if you want me to take a look at a particular stock from within the portfolio then leave a comment and I'll do my best to include the stock in my next article later this week.

CORSAIR $18.2.P/E 57, EGF +56%, +27%

Corsair investors have paid the price due to bad company management, poor quality control of products where what one buys does not match the brand image, unfortunately when customers are once bitten they then tend to avoid that brand. On the plus side Corsair has been around for decades and has always had the potential to become something much bigger as we await the advent of Corsair Motherboards and perhaps eventually GPU board partners with the likes of Nvidia. In terms of earnings outlook then there are signs of life as EGF's suggest to expect earnings surprises ahead for both the next quarter and 2023, which is also evident on the stock price chart with most recent price action rising from a bone crushing low of $11 to approaching a doubling to $22 as the stock attempts to break above $18 resistance which would mark the END of Corsairs bear market.

A break above $18 would target a trend to resistance at $22,5 to $24 that is achievable during the current bull run. Expectations beyond that will either take a bid for the $1,75bn corporation or time for earnings to grow. So first a breakout of $18 to mark the end of the bear market and then target the range of $22.5 to $24, and then earnings to grow. It took Corsair about 1.5 years to fall from $35 to $11, it may take a similar amount of time to regain $35 from it's recent low. Another plus is that unlike most such small caps Corsair actually does usually post earnings in 9 out of 10 quarters, nor is Corsair a rampant share printer, though it does print. So whilst the stock has had a rough year, it's not a dead or dying stock, just that the past year has demonstrated that it's management is mediocre at best, they need a CEO who has a vision of what the company could become rather than the same old same old cases and power supplies, though they have tried with NVME2 drives and water coolers just that their efforts of the past 2 years have proved lacking in reliability.

The bottom line is that I have little doubt that we will see $30+ again when I am sure many will with a sigh of relief offload a large portion of their holdings.

Why a Fed Pivot would be BAD for stocks

Fed Pivot, Fed Pivot, everyone obsesses over a FED pivot but has anyone thought what a Fed pivot actually means? What it means is that all of the distressed cathy wood turd stocks get a lifeline when instead they should all go BUST!

ZOMBIE COMPANIES that will never generate profits need to DIE! Because all they do is take up market share for nothing other than fool investors such as Cathy Wood having pumped them full of cash.

THEY NEED TO DIE!

Once they are dead then their market share can go to the better run companies that actually do generate a profit and innovate, instead of investor inflows pumping up loss making hype stocks that take market share from better run companies. Take the example of Cathy Wood turd stock Bed Bath and Beyond, what happens when it dies? It's sales will go to the likes of Target and Amazon and other better managed businesses, these companies are better able to capitalise on those sales and grow and innovate. It is easy to run a company if it never has to make a profit as the likes of Cathy Wood focused on sales and user growth whilst ignoring that which actually counts EARNINGS!.

This is why why a Fed Pivot is bad for the stock market, so becareful what you wish for!

Russia Retreats Across the Dnipro River

Remember that story about a month ago about a mass evacuation of civilians from Kherson? We'll it turns out they were Russian soldiers in civilian clothes. An army in full retreat is never a good sign for those in charge, as markets have reminded us countless times that when a nut crack the moves can be fast and furious. So does this retreat mark the cracking of the Russian military nut, because eventually such events will spell the demise of the Putrid regime. How would it begin? Mutiny in the Russian Army, perhaps even a coup unless those around Putin remove him from power.

Unfortunately Russia's military doing so badly in Ukraine increases the risk of the use of Nuclear weapons as the Putin regime runs out of cards to play.

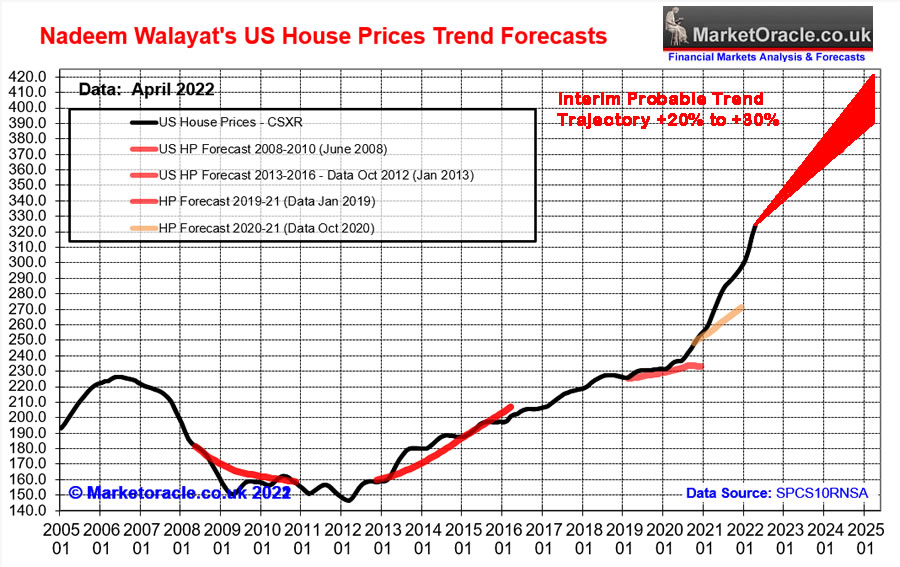

US Housing Market Analysis

I aim to complete and post this extensive analysis during the weekend of 26th to 27th November, existing view is for a 20%+ rise over next 3 years as of April 2022 data.

This analysis How High Could the Impossible Stocks Bull Market Fly was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this rises to $5 per month within the next few days.

My most recent analysis covers what I expect for Gold, Silver, and Crypto markets during 2023, and also includes an S&P500 trend forecast.

Most recent analysis includes -

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

For immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this rises to $5 per month in the new year.

Apart form regular AI Tech stocks and stock market updates, my schedule includes:

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock in now as this soon increases to $5 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your preparing to trim analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.