The Definitive Guide to FTX’s Crypto Collapse

Stock-Markets / cryptocurrency Dec 21, 2022 - 10:43 PM GMTBy: Stephen_McBride

Everything you need to know about FTX’s collapse in plain English... What it means for crypto... Is Coinbase next?... And what all crypto investors need to do right now...

Is crypto dead?

That’s the question many folks around the Thanksgiving table were asking following crypto exchange FTX’s collapse.

I’ve been following the fallout from FTX’s collapse closely in my premium RiskHedge Venture service. But this analysis is too important to only share with a fraction of our readers. So today, let’s look at what really caused FTX’s downfall… what it means for crypto prices… and how to position yourself for the rebound.

- How did FTX go from one of the world’s most valuable private companies to bust in a matter of days?

FTX attracted billions of dollars in funding from legendary investors like Sequoia and BlackRock. It bought the naming rights for an NBA stadium, turned NFL legend Tom Brady into an advertising icon, and made a commercial with Comedian Larry David into a Super Bowl hit.

Its former CEO, Sam Bankman-Fried (SBF), appeared on Meet the Press. He was featured on the cover of Forbes and Fortune magazines. And only a couple months ago, SBF shared a stage with former President Bill Clinton.

So, what happened?

Before SBF founded FTX, he ran a crypto fund, Alameda Research.

Turns out Alameda was secretly losing money hand over fist. SBF funneled roughly $10 billion of FTX customers’ deposits into the hedge fund to cover its losses.

Using customers’ money as your piggy bank is obviously wrong, and illegal.

Once details of Alameda’s troubles leaked, users started pulling their money from FTX. But FTX didn’t have money to give out, forcing it to halt withdrawals and file for bankruptcy.

In short, SBF is a crook who defrauded customers of billions of dollars. He reportedly built a “backdoor” into FTX’s accounting system, allowing him to funnel other people’s money into his hedge fund.

- What does this mean for the price of bitcoin, Ethereum, and other cryptos?

The FTX blowup opened up a huge rift in the crypto markets between “strong” and “weak” cryptos.

For example, bitcoin (BTC) slumped to its lowest levels in two years in the wake of FTX’s collapse. As I’ve said before, bitcoin is a weak crypto that can be summed up in two words: digital cash.

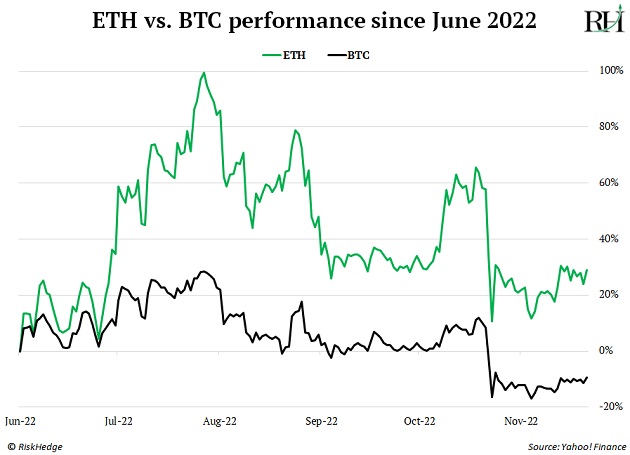

But Ethereum (ETH)—a real businesses making real money... and one of my top cryptos to buy right now—has held strong. Ethereum remains 20% above its June bottom. You can see the performance gap between ETH and BTC over the past six months.

Most cryptos moved in lockstep with each other over the past six months. FTX’s blowup changed everything, and split crypto into two sides.

On the strong side, you have cryptos, like Ethereum, which stayed above their summer lows. On the weak side, there are assets, like bitcoin, that broke their June lows.

Previously, I believed the overall crypto market bottomed in the summer. Now, it’s likely the market has another leg down, led by weak cryptos.

But strong cryptos like Ethereum likely bottomed in June. FTX’s collapse was one of the worst events in crypto history. If it couldn’t drive certain tokens below their June lows, what will?

This suggests anyone who wanted or needed to offload crypto already got out. We’ve run out of sellers, which usually marks a bottom.

- Could exchanges like Coinbase go bust next?

FTX is the latest in a long list of crypto exchanges that went bust, losing users’ deposits.

Now folks are wondering if Coinbase, the most popular place to buy crypto for Americans, is the next domino to fall.

Coinbase is the most reputable crypto exchange. It’s also a US-listed public company, which means it’s heavily regulated with properly audited financials.

This means it’s highly unlikely Coinbase will go bust. But that doesn’t mean you should leave all your assets there.

Buying cryptos on Coinbase is fine. But when you store your assets on Coinbase, you’re essentially handing ownership of your crypto to the exchange. As I’ve stressed from day 1 to my RiskHedge Venture subscribers—NEVER store your crypto on any centralized exchange.

If Coinbase is hacked, your money and crypto on the platform may be gone forever. Think of exchanges like public bathrooms. You get in, do what you have to do, and get out.

- How do you get your assets out? You move them to a “cold wallet.”

Cold wallets are not connected to the internet... giving you total control of your crypto. They keep your private keys offline at all times, ensuring hackers can’t easily steal your crypto.

The two most popular brands of cold wallets are Ledger and Trezor. I prefer Ledger for its ease of setup and use. You can check out Ledger’s full product lineup at ledger.com.

Please don’t take this lightly. Setting up a cold wallet may seem daunting at first because it’s new. But if you’re serious about investing in crypto, you can’t afford not to.

I’ll wrap up with a quick story.

I was talking to a well-known crypto trader last week...

He’s been in this space longer than I have and amassed a multimillion-dollar fortune during the last crypto bull market. This guy even made money “shorting” bitcoin earlier this year. He converted it all to stablecoins and was sitting on the sidelines waiting for lower prices.

His only mistake? He stored the vast majority of his assets on FTX.

Now FTX is bust, and all his money is likely gone. As he told me, “All those hours of work… the sleepless nights staring at a screen, for what? I played the markets perfectly but have little to show for it.”

If you own crypto and don’t already own a cold wallet like a Ledger, buy one immediately and move all your cryptos off centralized exchanges.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.