US Recession 2023 Already Happened in 2022! Stealth Stocks Bull Market

Stock-Markets / Stock Market 2022 Dec 01, 2022 - 12:45 PM GMTBy: Nadeem_Walayat

Dear Reader

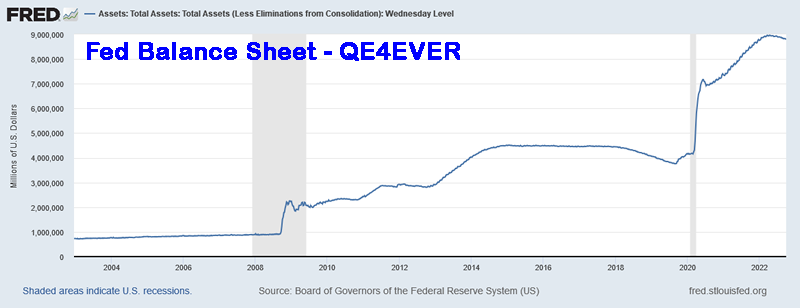

FED Balance Sheet

Not to forget the inflation mega-trend courtesy of rampant central bank money printing to monetize government debt coupled with the fake inflation indices where up until recently the Fed had succeeded in hoodwinking the masses that US inflation was just 1%. Instead at that time I warned it was more like 6%! Now it's more like 14%. Anyway the money printing binge now totals $8.8 trillion, up from $4 trillion at the start of 2020 and down from a a peak of $9.62 trillion in the so called Taper. We saw how the taper of 2019 went which at the time I warned would eventually resolve in the Fed Balance sheet DOUBLING. of course I was not expecting it to happen the very NEXT YEAR in 2020!

The bottom line is tapering is a temporary smoke and mirrors exercise that ultimately will resolve in a DOUBLING of the Fed balance sheet, that's right in the not too distant future I will be posting a chart of the Fed Balance sheet north of $16 trillion! CRACKUP BOOM HERE WE COME!

SMASHED Bond Market Brewing Opportunity

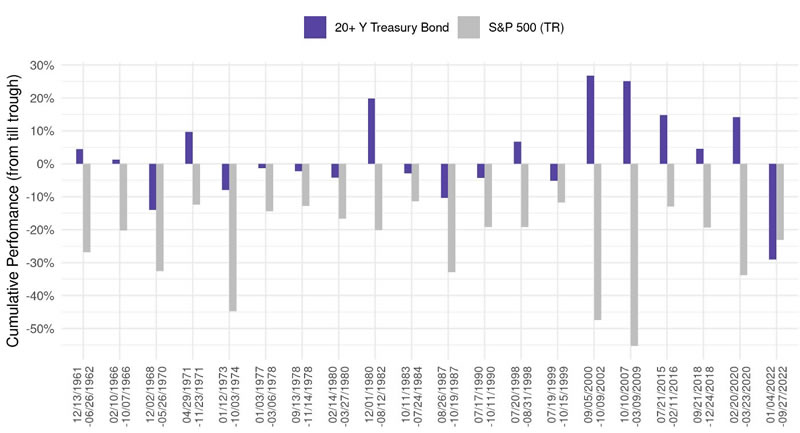

The consensus script is that when stocks fall bonds go up, instead 2022 saw that consensus view blown apart as the below chart illustrates. In fact bonds have NEVER under performed stocks during a downturn, not even during the raging inflation of the 1970's!

US bonds are down 50% form their all time, 15% year to date! Of course now with the benefit of hindsight all are pointing the finger at INFLATION which apparently turned out NOT to be transitory, much as I was warning a year ago when bonds were trading 50% higher in price (Protect Your Wealth From PERMANENT Transitory Inflation ).

I have never been much of an investor in bonds i.e. the only bond I hold is the UK 2030 4 1/4 index linked gilt, but I am definitely perking up to the prospects of deploying at least some of my cash into the decimated US and UK bond markets at some point. In terms of target exposure I doubt it will exceed 5% from the current 1% of portfolio, I am just not that much of a bond investor, not enough upside but do recognise there is an opportunity brewing in the not too distant future when bonds trade to new bear market lows.

Stocks and Inverted Yield Curve

The yield curve has inverted which initially saw the stock market trade to a new bear market low following which entered into a powerful bull run, as has happened virtually every time that the yield curve has inverted i.e. initial stock market dips followed by a bull run that typically extends to over a year which the current price action looks set to replicate despite the recent double dip.

The yield curve inversion which has accurately called every modern recession signals that a recession is on the horizon within the next 9 to 18 months and that is the trigger for the bull run as the market will assume that the Fed will act looser before the US economy enters recession about 9 months from now, and thus the stock market discounts higher earnings over subsequent quarters in response to an expected looser Fed which remains the trend until the recession actually does start to bite and earnings fall.

What this suggests that stocks should enter a sustained bull run into Mid 2023, however it will be followed by subsequent weakness that depends on the actual severity of the forthcoming recession which is further complicated by the fact that we are already IN a technical recession!

So the yield curve implies stocks should head higher into Mid 2023 and then largely stagnate during the recession.

This article is part 3 of 6 excerpts form my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 which was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month, which is soon set to rise to $5 per month for new signup's so lock in now at $4 per month. https://www.patreon.com/Nadeem_Walayat.

PART ONE: Stock Market Trend Forecast October 2022 to December 2023

Keep Calm and Carry on Buying Quantum AI Tech Stocks

Stock Market AI mega-trend Big Picture

Stock Market 2022 Trend Current Expectations Review

Feeding the Beast

Quantum AI Tech Stocks Portfolio

STOCK MARKET DISCOUNTING EVENTS BIG PICTURE

US Economy and Stock Market Addicted to Deficit Spending

The Inflation Mega-trend

US Economy Has Been in an Economic Depression Since 2008

WHY PEAK INFLATION RED HERRING

US interest Rates and Inflation

Inflation and Interest rates Implications for the Stock Market

TIPS BONDS INFLATION PROTECTION

FED Balance Sheet

SMASHED Bond Market Brewing Opportunity

Stocks and Inverted Yield Curve

US Dollar Big Picture

US Dollar Strength Implications for Global Economies

Financial Crisis 2.0 and Interest Rates

UK Economy and British Pound Trend Forecast

RECESSIONS 2023

The Stock Market Recession Pattern

PART TWO: Stock Market Trend Forecast October 2022 to December 2023

Will there be an Early Fed Pivot?

Why Most Stocks May Go Nowhere for the Next 10 Years!

Valuation Reset and Future EPS

Margin Debt

Answering the Question - Has the Stocks Bear Market Bottomed?

Stock Market Breadth

Stock Market Investor Sentiment

Dow Short-term Trend Analysis

Dow Long-term Trend Analysis

ELLIOTT WAVES

Dow Annual Percent Change

Stock Market Volatility (VIX)

Stocks and 10 Year Bond Yields

SEASONAL ANALYSIS

Correlating Seasonal Swings

Major Market lows by Calendar Month

US Presidential Cycle

Best Time of Year to Invest in Stocks

Formulating a Stock Market Trend Forecast

Dow Stock Market Trend Forecast September 2022 to December 2023

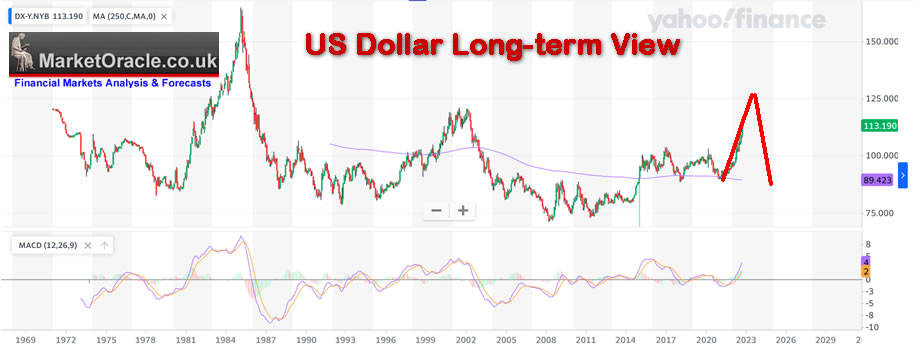

US Dollar Big Picture

Ultimately the fate of the dollar bull market is to spike in a blow off top and then collapse in spectacular style, probably at a faster pace then it is currently going higher.

Now don't take this chart as a literal trend forecast as I don't have the time to undertake such a study right now but it is a rough picture of what I have in mind of how the dollar trend could play out. There will be plenty of time to define a forecast trend pattern over the coming years.

What does this suggest for US stocks ?

1. A falling dollar is bullish for stocks

2. A rising dollar is bullish for stocks

3. A rapidly changing dollar is bearish for stocks.

Currently we have a rapidly changing dollar, the stock market prefers the dollar to trade within a range which implies the next few years are going to be tough for the indices. So definitely seek to avoid index ETF's and such like. The less volatile the dollar the better for stocks, Which given the fact I expect the dollar to be volatile then that suggests it's going to be tough to see the indices soaring higher. It does look very similar to the dot com bust, of course it's not going to repeat but rhyme in some manner. It all depends on how orderly the decent of the dollar will be, history suggests it is going to be disorderly.

The dollar therefore suggests that the next few years are going to be tough for the general stock market indices to some degree, subdued, it's not going to be business as usual. we are in for something different, maybe somewhere in between that of the 2000's sideways trend and the raging bull market of the 2010's.

US Dollar Strength Implications for Global Economies

A strong dollar is bad for the global economy because for the USD to rise then demand for dollars exceeds supply, and the USD is the lifeblood of the global economy, probably the best measure is reserves as a percentage of GDP. The higher the percentage the more robust the nation is.

Reverses as a percent of GDP of Major Nations, US

- United States: $20.89 trillion - Does not matter because the US can PRINT DOLLARS!

- China: $14.72 trillion - 22.8%

- Japan: $5.06 trillion - 27%

- Germany: $3.85 trillion - 5.6%

- United Kingdom: $2.67 trillion - 7%

- India: $2.66 trillion - 17.5%

- France: $2.63 trillion - 6%

- Italy: $1.89 trillion - 7.9%

- Canada: $1.64 trillion - 5%

- South Korea: $1.63 trillion - 25%

- Russia: $1.48 trillion - 34% - US froze a large chunk of Russia's reserves

- Brazil: $1.44 trillion - 19%

- Australia: $1.32 trillion - 3.3%

- Spain: $1.28 trillion - 5.2%

- Indonesia: $1.05 trillion - 12.6%

Notable mention - Switzerland and Hong Kong 120%, Saudi Arabia 64%.

The lower the reserves the more financial power the US wields over a nation, for instance before Sri Lanka went bankrupt their reserves were 8.5% of GDP, which implies the US holds most western nations literally by the balls with only Switzerland able to chart it's own financial course. And then there is the EURODOLLAR market, which is the beyond the scope of this article to cover.

Financial Crisis 2.0 and Interest Rates

For the whole of the 2nd halve of 2021 I iterated the canary in the coal mines that warned of a brewing financial crisis that would manifest during 2022, foremost of which was the bursting of the chinese bubble, bursting of the valuation bubbles in valuation resets, INFLATION, INFLATION and INFLATION and so on as the following article illiterates, so I won't repeat.

AI Tech Stocks Portfolio Updated Buying Levels and Zones as Financial Crisis 2.0 Continues Brewing

Well that financial crisis is now manifesting itself with a vengeance in first soaring inflation, then soaring US dollar and finally coupled with soaring interest rates that has financial institutions once more teetering on the brink as they face counterparty risks and margin calls on their interest rate bets. In advance of which my patrons got the unequivocal message that IF one was seeking to borrow for Instance for a mortgage then FIX for as LONG as POSSIBLE, the longer the better because the situation with sub inflation interests is NOT NORMAL and NOT sustainable a situation that as far as I can see still persists today, thus for normality to return interest rates need to be ABOVE the inflation rate. Good for savers, bad for borrowers!Though good luck with expecting the banks to pass on the rate hikes to savers!

So it's no good asking me now if one should fix for I have been telling all what I would do for well over a year leading UPTO the start of 2022 and continuing during the year which was to FIX FOR AS LONG AS ONE CAN FOR SUB INFLATION INTEREST RATES ARE NOT NORMAL AND NOT SUSTAINABLE as the following excerpt from my early April UK Housing Market Mega-analysis illustrates where I even went as far as giving all a WAKE UP SLAP IN THE FACE TO FIX YOUR BLOOMIN BORROWING RATES BEFORE RATES HIKE!

Lets Get Jiggy With UK INTEREST RATES

There have been so many interest rate hike false dawns over the past decade that one has become skeptical that this time could be different, and YES THIS TIME COULD REALLY BE DIFFERENT DUE TO OUT OF CONTORL INFLATION that worries the CENTRAL BANKS for they understand that it risks igniting the wage price spiral which once it takes hold is not easily brought back under control, hence there is a very high probability of high inflation for a decade because the central banks will not do what needs to be done! FORGET THE NOISE ABOUT Interest rates soaring to ridiculous levels for Central banks know their banking crime syndicate brethren would go BUST! Instead rates will rise but NOT to the level needed i.e. to ABOVE the rate of INFLATION. The UK base Interest rate to control inflation would need to be ABOVE the rate of Inflation i.e. at about 10%! which is clearly not going to happen! Not even to HALF that level, and probably not even to 1/4 of that level, 2% is what the Bank of England is targeting! Whilst INFLATION rages to 10%! That is not going to cool inflation OR the HOUSING MARKET!

The Bank of England is targeting a joke interest rate of just 2%. For UK Interest rates to have any significant impact on the UK housing market the base rate would need to be above 5%, and even then the impact would be relatively mind. People are NOT STUPID! They understand Inflation of 10% vs a Mortgage rate of say 4% is a NO BRAINER i.e. BORROW to the HILT and let inflation do it's MAGIC!

Today's typical UK mortgage rate is 4% which is NEGTAIVE 4.5% against RPI of 8.5%! IT'S A NO BRAINER! Fixed for as long as 10 years! Whilst Americans have it THREE times better for they get to fix their mortgages at even better rates for 30 years! What are you waiting for? The seller to drop his asking price by 10%? Fat chance of that happening! Will Smith needs to give every procrastinating UK and US home buyer a face slap!

You had the whole of 2020, and the whole of 2021 and STILL sat twiddling your thumbs all whilst you have sleep walked into 1970's inflation 2.0! Please note this is not financial advice to buy a house, instead this is Will Smith SLAP IN THE FACE to STOP WASTING TIME THAT YOU CAN NOT GET BACK!

The bottom line is UK interest rates rising to 2% to fight inflation of 8.5% is like a fireman using a water pistol to put out the towering inferno. Still it gives savers who do not understand that inflation is stealing the real terms value of their life time savings to earn 2% pittance interest before TAX! What a CON! People work hard, save some money that gets stolen by the government via the inflation stealth theft tax as they ponder whether they should buy a house or not (shaking my head). Put your savings in the bank for 10 years or burn it all today the net result is near the SAME!

I remember fixing bonds in October 2008 at 7.2% for 3 years when CPLIE was around 5%. The good old days that have yet to return. As once upon a time CASH WAS KING! You could park most of your money in cash in fixed rate bonds safe in the knowledge that the rates would keep pace with the likes of RPI, but then the Bank of England bailed them out, stuffed them full of QE money, and so Banks no longer needed cash from savers, hence the collapse in savings interest rates which since have NEVER kept pace with inflation.

A blast from the past - 7th Oct 2008 : UK Interest Rate Forecast 2009

What can Savers and Investors do ?

Savers - To reiterate what I have been saying over the last 6 months, savers still have a a golden opportunity to lock in high fixed savings rates which in the UK are above 7% . These rates won't stay around for much longer, were talking perhaps in the days rather than weeks or months. So the time for action is now ! - Yes, banks can go bankrupt but savings are protected which includes accumulated interest. In the UK the protection is for the first £50k per banking group.

So when you look at the breakdown of my assets and see that I currently hold what looks like a large amount of cash at 30% of my total assets, however just over 10 years ago my total cash holdings were as high as 80%! There was a time when CASH really was KING! Instead since despite volatility and transaction costs HOUSING is KING, and to a lesser degree stocks, CASH IS POOP! Hence why I am seeking to expand my exposure to stocks despite the fact that we are in a bear market and I am likely accumulating some distance from where stocks will finally bottom, at least stocks give me a fighting chance of keeping pace with inflation, whilst holding cash is a guaranteed LOSS. Yes I could buy another property, and probably will do so if an opportunity presents itself, but it truly is a time wasting exercise to do so as every prospective home buyer well understands.

Understand this there is plenty of upside to interest rates for NORMAL RATES equate to rates at WELL ABOVE CPLIE which translates into a UK Base rate that should be rising to about 9%! Of course that is not going to happen! Hence the housing bull market will continue whilst the Banking crime syndicate continues to suckle at the teat of the Bank of England.

As an example in early July a Patron asked what would I do in terms of taking a 10 year fixed rate mortgage if I was buying a house in the UK, my reply was -

>>> I just did a search and 10 year UK mortgages come in at 3.8% to 4%, so yes I would probably go for a 10 year mortgate if I were looking to buy, as inflation will erode the value of the debt, i.e. real inflation is X2 CPI, so debt loses about 16% of its value over just 1 year (currently).

I recently asked the patron if they went ahead with the 10 year fixed rate mortgage and got the reply

>>> Yeah, managed to lock it at 3%. Closed the deal about 2 weeks ago. Talk about timing

We'll that market has now gone kaput! As far as I can see virtually all 10 year fixed rate products have been temporarily withdrawn as the providers await rate hikes.

UK Economy and British Pound Trend Forecast

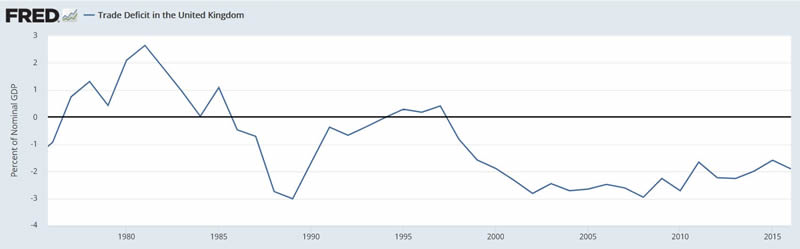

The big problem is this that as the Dollar rises investors SELL their domestic currency for dollar assets which is what all those outside of the US do when they invest in US stocks and other assets which drives down currencies such as sterling in a feedback loop, as a weaker currency tends to be accompanied by weaker economic fundamentals i.e. higher interest rates because there is less demand for domestic bonds and inflation rises because the cost of imports go up which feeds through to more selling of sterling for dollar assets in attempts to escape the falling currency which is where many outside of the US find themselves today, as my earlier example of the US stocks bear market in GBP illustrate. The consequences is that the US can bring inflation umder control whilst there's fat chance of the UK bringing inflation under control with a freefalling currency and given Britains perpetual trade deficit the odds of an significant sterling recovery is pretty slim.

There is only one thing that nations such as Britain can do which is to PRINT MORE MONEY! Which means the value of money FALLS! Brit's should be very wary of being enticed by higher interest rates to invest in UK bonds and saving products because real rates of return are WELL BELOW REAL INFLATION in a perpetual accelerating stealth theft of wealth as I have been voicing all year, get the hell out of sterling! Either into property that cannot be printed or US AI tech stocks as it is never wise to invest in a foreign property market because one does not understand the lay of the land unless one actually lives there and therefore will not make any money by doing so, get ripped off, end up buying garbage properties.

British Pound heading towards parity to the dollar but the plunge should prove short lived,

a. The government is gong on a debt fuelled spending spree, whilst bad today in terms of the market discounting huge amounts of additional borrowing to the tune of £200 billion when taking the energy bailout into account.

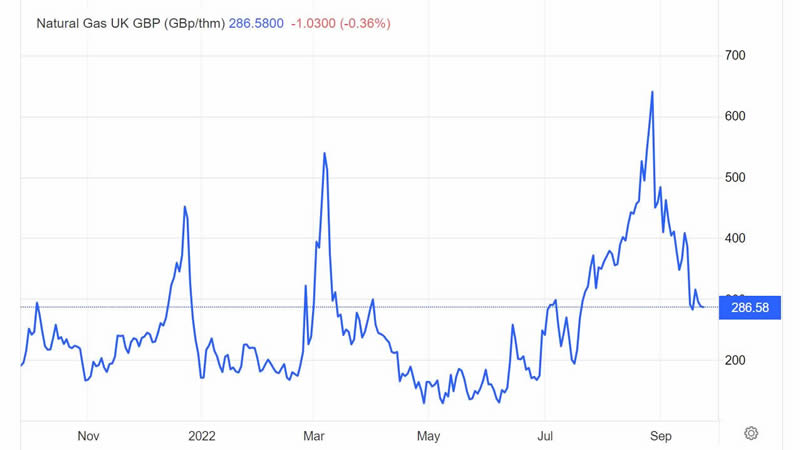

b. The energy crisis is not as extreme as the fear mongering MSM paints it out to be be, I mean this is the chart for UK natural gas prices, down from a peak of 650 to current $286. Yes the whole sale gas price could go up once more but what does one do when the gas price is low (not cheap but low) if one has any brain cells in their head? One stocks up! Replenishes the tanks! YES Winter is arriving but the wholesale price for Natural Gas is £286 and not £650, and remember this is in STERLING! The fall is even more spectacular in dollars.What does this mean well if prices persist at £286, then the panic over the £145 billion energy bailout may turn out to be a fuss about nothing, i.e. the final bill could be LESS than HALF that, more like £70 billion that the market is clearly not discounting given that sterling's drop is in response to the £45 billion give away budget and ensuing crisis of confidence is apparently not discounting economic growth or lower energy prices.

Of course the rip off energy firms are NOT passing on the fall in energy prices to consumers! What a con market! Hell bent on ripping off customers and now tax payers!

Thus whilst it's hard to say where the falling knife will settle especially given that the Dollar is going to be strong and UK rates are lower than US rates, I suspect that the UK drop to parity will prove short lived and a year from now sterling will be a lot higher than where it stands today ($1.11), probably north of 1.25, hence the GBP 1.315 column in my table which shows how the current dollar price of US stocks relates to where it would be at GBP 1.315 so as to better identify true bargains. For instance AMD $65.8 equates to GBP 1.315 of $76.6, therefore AMD is a good buy for US and UK investors, which is similar for most AI tech stocks. Whilst J&J and IBM are definitely not bargains right now, hence why I have added very little IBM or J&J during this bear market.

In terms of timing of sterling spike, we'll it's going to be a panic event. so any time between now and Mid November, and given that sterling already traded down to £/$1.02 it could well have already happened,though the window does not close until Mid November so only time will tell. Following which I expect sterling to enter into an uptrend that will likely take it to above £1.25 by the end of 2023 as my following trend forecast chart illustrates of how I suspect the trend to play out.

Though note the actual trend will be much rougher than this smooth line, i.e. oscillate around the trend forecast by 5 cents above and below the line, which means I would not be surprised if Sterling is above 1.30 by the end of 2023, with my central best guess being around $1.27 by late 2023. So I consider sterling today at $1.11 as being cheap in terms of the longer term outlook i.e. due a cyclical bull run within a secular bear market.

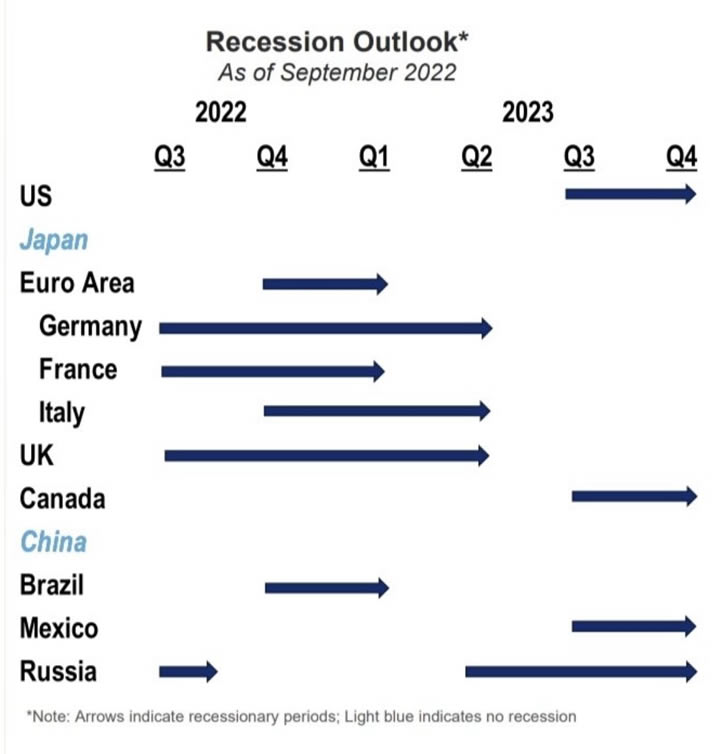

RECESSIONS 2023

In terms of economic activity of all the major economies the US is the most robust so Recession delayed, which may never materialise. Meanwhile the rest of the world, especially Europe is scrambling to counter soaring energy bills and economic stagnation.

Whilst Britain has decided to go for broke with a mega £45 billion shock and awe tax cutting budget with likely more announcements to come in attempts to prevent the UK falling deeper into STAGFLATION by borrowing to spend all whilst the Bank of England RAISES interest rates but to nowhere near the extent necessary to defend Sterling hence GBP has a destiny with parity to the dollar with similar prospects for most currencies against the dollar. Only time will tell if Britain can pull a rabbit out of the hat by means of an INFLATIONARY BOOM! How is the UK going to bring inflation down when they are printing some £200 billion (including the energy bailout) to finance a heron rush? High inflation is not going away anytime soon!

US Recession 2023 Already Happened in 2022!

Yes it is a a big fat con because the US has already posted 2 quarters of negative GDP, what can you do? This is the world we inhabit of fake economic data, the Fed does not like CPI, lets run with the much lower PCE, 5% instead of 8% inflation! What a con!

The facts are the US had a recession in 2022 that everyone is ignoring!

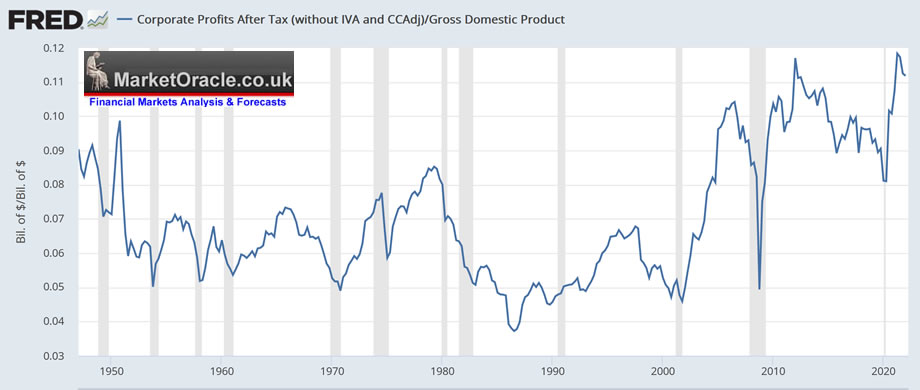

The US posted it's 2nd negative GDP of -0.6%, that's -2.4% year to date, what does that mean for stocks? Corporate profits Dividend by GDP graph clearly shows that we are still near the cycle peak, i.e .unlike Q4 2019 BEFORE the pandemic crash, earnings have not contracted anywhere near to signal an earnings bottom. So this metric suggests new highs in the indices are NOT likely anytime soon, especially given that GDP is FALLING. However against this we have the MAGIC of INFLATION that should support nominal stock prices as Inflation INFLATES GDP and corporate profits, case in point being the 1970's where corporate profits ROSE albeit form a 1970 trough, but the indices ended the decade little changed.

So I think corporate profits relative to GDP are going to fall, not drastically but the decline to date is not enough, we could see weak earnings for another 3 quarters which would take us into Q1 2023 as being THE earnings BOTTOM. Of course stock prices discount the future, and we have an Ace up our sleeve, EGF! Which gives a near 3 months advance warning of what to expect at the next earnings for each stock, as well as the probably less reliable 1 year out EGF12M.

The Stock Market CREATES Recessions and Recoveries! Think about that?

What drops first - STOCK PRICES!

What rallies first - STOCK PRICES!

Falling stocks create the recession

Rising stock prices create the recovery.

Of course it is not black and white but you get the picture of why at bear market bottoms the economic outlook is so bad, it's bad because Stocks have cratered! And why stocks rise on a wall of worry because it is the RISING stock prices that CREATE the RECOVERY!

The Stock Market Recession Pattern

The base pattern is that which we have experienced to date in that stock markets is to FALL BEFORE the recession materialises, the average bear market heading into and during a recession has been -29%, the median has been -24%, the current bear market to date has been -22.4% (Dow 28.7 / 37k = -22.4%). Which thus suggests the bear market could have further to go but not by a huge margin i.e. a couple of percent lower to say down to Dow 28k. What does this imply, that the current rally (should it materialise) will probably resolve in a lower low during the next recession.

So given that the next actual quarterly drop in US GDP may not materialise until Q3 of 2023, then that quarter can expected to be weak, i.e. wherever the stock market is by late Q2 it will start to trend lower going into Q3 and bottom towards the end of Q3 as it discounts an end to the recession following negative Q4. So we may get a double dip in the stock market during Q3 of 2023 that see's a lower low than that which we just made only a few days ago.

Against this is the possibility that the US recession is brought forward 1 quarter to Q2 and Q3,thus stocks peak during Q1, fall during Q2, bottom toward the end of Q2 and then head higher during Q3.

Which pattern is most probable?

At this point in time the former pattern looks more probable than that latter.

At the end of the day the guiding light is the deviation from the highs, for the greater the deviation the more of the recession is being discounted by the price. So, today's -22,4% does not carry much risk as the worst it implies is a double dip during 2023, which thus affords one the opportunity to collect dividends and trim positions ahead of the double dip.

This analysis continues in Part 2 - Stock Market Trend Forecast October 2022 to December 2023

Again this article is part 3 of 6 excerpts form my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month, which is soon set to rise to $5 per month for new signup's so lock in now at $4 per month. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes -

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

- How High Could the Impossible Stocks Bull Market Fly Into Christmas 2022

- Stock Market Cool as a Cucumber Despite Earnings and Fed Noise

- Intel Empire Strikes Back! The IMPOSSIBLE Stocks Bull Market Begins!

- Stock Market White Swan - Why Fed Could PAUSE Rate Hikes at Nov 2nd Meeting, Q4 Earnings

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month, which is soon set to rise to $5 per month for new signup's so lock in now at $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your stocks stealth bull market 90% invested analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.