Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity

Stock-Markets / Stock Market 2022 Oct 20, 2022 - 06:37 PM GMTBy: Nadeem_Walayat

We have a Dogs dinner of a Tory government, waste of space Quasi Modo has gone, next will be Liz Trustless what a pair of idiots, Hunt as Chancellor is only good for reading scripts he gets given! Come on Boris come back, all is forgiven, what was the worst under Johnson? Parties, the media wasted thousands of hours of air time on parties! MSM Is an irrelevance, dumb, blind, completely clueless after all they are Journalists NOT analysts, they don't have a clue! Quasi has gone, so will Trussless and it could even be as soon as today! Definitely before the end of October, she will be GONE! GOOD RIDDANCE to Britain's worst Prime Minister ever! And paving the way for Britain's first brown Prime Minister!

This article was was first made available to patrons who support my work - The Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

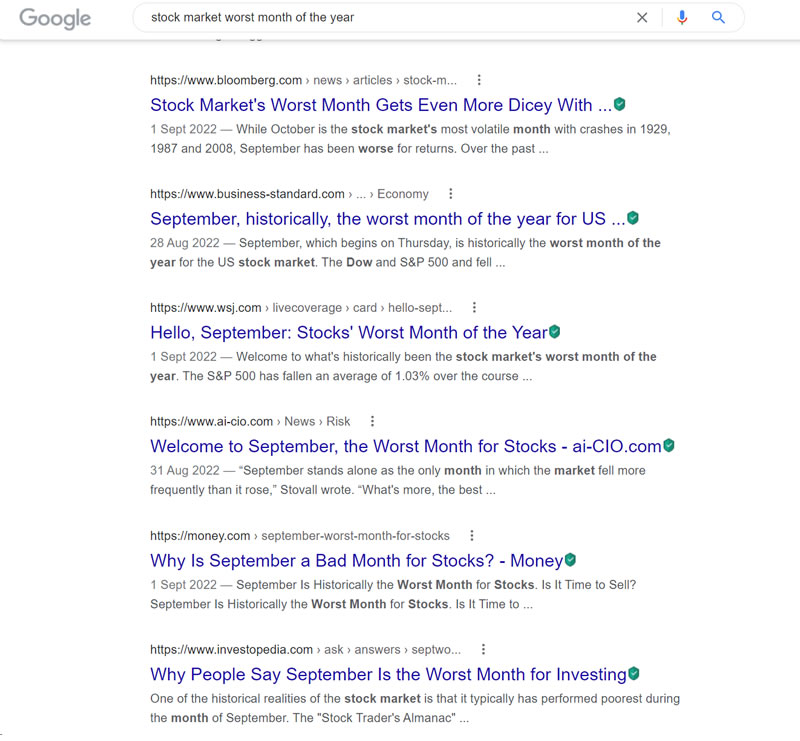

September is the WORST month of the year for stocks, if you have yet to hear the message from MSM and the blogosfear, so it's no wonder that many investors are too frightened to invest as they wait for the big September CRASH to materialise! SHMITA! Don't fight the Fed and so on, though the worst month of the year isn't quite following the script with the S&P Up 3% on the month.

I am currently working on my mega stock market analysis to conclude in a detailed trend forecast well into 2023 which is some days away from being posted, my best guesstimate is it will be posted some time between Thursday to Sunday, hence this update before the markets open Monday, with two excerpts posted to date, Elliott Waves projection on the 15th of August 2022, soon followed on the 19th of August that there was a 80% probability that the bear market had bottomed Mid June.

The fact that the stock market is following the EW trend pattern without the benefit of hindsight increases the probability of what the wave pattern implies for well into 2023, namely that 2023 contrary to the consensus view could turn out to be surprisingly bullish year, all whilst most will be sat on the sidelines fearing recession new bear market lows.

Whilst my working pattern for this bear market continues to come to pass in expectations for an early September low to resolve in a powerful bull run during September to be followed by a very volatile trading range, though now with only a 20% probability of breaking the June low.

My last update of 30th August laid the ground for how the correction into early September could play out to target a higher low at 3860.

Last week saw the S&P bottom at at 3884 before swinging higher. A reminder that I also tend to to give brief updates most days in the comments section of what I expect to happen over the coming day or so some hours before each days open for instance this was Thursday morning's update - S&P 3978 - Broke above 3945, which implies it's going higher even if it corrects lower today back down to the breakout point of 3945 to 3930. Next stop on the upside? 4015 which will probably break to target 4048.

Fridays update - .S&P 4004 - Set to achieve 4048 target today, rising waters are lifting all boats, what's cheapest right now is Nvidia, Google (bought some pre market), Medifast, WDC, TSMC, HPQ (just bought some pre market), and Arrow. I am toying with buying Samsung, to buy or not to buy..... So far the market is confirming expectations of a. June was the bottom, and b. September contrary to the overwhelming consensus views will be BULLISH!

So if you are interested in my short-term expectations then do check out the comments section of my latest posted article, where I tend to post my thoughts pre open most days.

Which brings us to the present, the S&P closed Friday at 4064 and is following the swing projection quite tightly which extends to 4300 within touching distance of the 4316 high, thus if the swing continues at anywhere near the current pace then there is a good chance that the swing high will break to run the stops before the next swing DOWN to BREAK the September 3884 low by early October which is inline with my Dow Trend Pattern chart above.

So I expect the rally to continue with the swing targeting a break of the 4316 high before reversing sharply lower to target a break of the 3884 low. Whilst where the current rally is concerned the treacle zone between 4120 to 4200 that held the S&P in check for a good two weeks during the previous rally is time that it just does not have this time around, i.e. the upswing is likely to terminate by the end of this week and thus the S&P could run out of steam around 4200 so never make it to 4300 before turning lower, for which the clear warning sign will be if the S&P significantly deviates from the pink swing projection, which would act to strengthen the case for a break of the 3884 low to target 3730. which if it transpires, i.e. 4200 to 3730 would amount to a sizeable potential drop of 12%! So I will do some trimming and short a few stocks as and when opportunities arise we have now entered the time window for highly volatile sharp moves in either direction as I warned to expect some months ago that will likely increase going into October.

So the September Crash is coming crowd may get their big drop after all but it will be after a strong first half of the month which could see the S&P trade down to -5% for the month which would hardly be a CRASH i.e. the June low will still be intact.

STOCK MARKET DISCOUNTING EVENTS BIG PICTURE

As my recent excerpt from my forthcoming mega-piece on the stock market illustrated, there is a 80% probability that the bear market has bottomed and so far it has not done anything to negate this probability. Therefore it looks like we are coming out of our 6th MAJOR discounting event since the BIG Financial Armageddon BAD BEAR MARKET bottomed in March 2009.

Zoom out of hourly and daily charts and see the true magnitude of the 2022 bear market that has so many worried of much worse to come.MSM coverage of the financial markets is akin to a fly buzzing around that needs swatting!

We have had the good fortune to have SIX DISCOUNTING EVENTS! What more could an investor ask for? If some one offered you Google today for 25% less than it was trading at yesterday would you buy it? YES? Then what are you waiting for? Google is 26% cheaper today than where it was at the start of the year!

Since my HAL9000 in December messaged me to expect a BEAR MARKET during 2022. That's at least a 20% drop from Dow 37,000, 29,600 which has been my price target since. Stocks Many of the target stocks having bid themselves up to loony toon prices during 2021 such as Nvidia, AMD, Amazon and many others have fallen much harder than 20%, many have near HALVED (AMD) and some fallen by 2/3rds (Nvidia)! What more could one ask for from a discounting event when focused on BUYING the DEVATION FROM THE HIGHS because unlike INFLATION this bear market IS TRANSITORY!

That has been my consistent message for the duration of this bear market. For the worst thing one can do is to know a bear market is coming but then FAIL to capitalise upon it because one got side tracked with irrelevance of trying to catch the exact bottom. There is no real benefit from in hindsight seeing that yes, the Dow bottomed near 29,600 that we will only know for sure when looking in the rear view mirror. What does it achieve unless one had managed to do the heavy lifting by actually getting INVESTED in target stocks during DISCOUNTING EVENT.

They call it a bear market, but it's not, it's a discounting event, 2008-2009 was a BEAR MARKET, 2000 to 2002 was a BEAR MARKET, 2022 is DISCOUNTING EVENT! That I eagerly anticipated and aimed to capitalise upon for the Greater the Deviation from the High then the Greater the BUYING Opportunity being Presented! Which in this respect has offered some fantastic opportunities, many of our wishes have come true! For instance back when Nvidia was high on cocaine at over $320, I was stating that I would not be surprised if Nvidia falls to below $140 a share. Hence marking my time until sub $140 materialised to near double my position to 35% invested in this key AI stock.

And so it has been for the duration of this "bear market", where the primary objective was on capitalising on this discounting event, i.e. new lows in target stocks to get invested so as to capitalise upon the next phase of this BULL MARKET that will likely run for another 5 years during which time we will perhaps get a couple more discounting events before we face a the prospects of a BEAR MARKET proper!

One needs to learn to embrace discounting events by understanding what they are and what they mean, instead I get the impression that perhaps as a function of an emotional response on reaction to FALLING prices the exact opposite tends to happen i.e. it appears the more stock prices fall the less inclined investors become to actually invest as the decline generates reasons for why it should continue.

TO GET DISCOUNTS PRICES MUST FALL!

I continue to bite the cherries as they come along whilst adding fresh funds so as to capitalise on the 6th discounting event since this bull market began in March 2009 because I embrace -

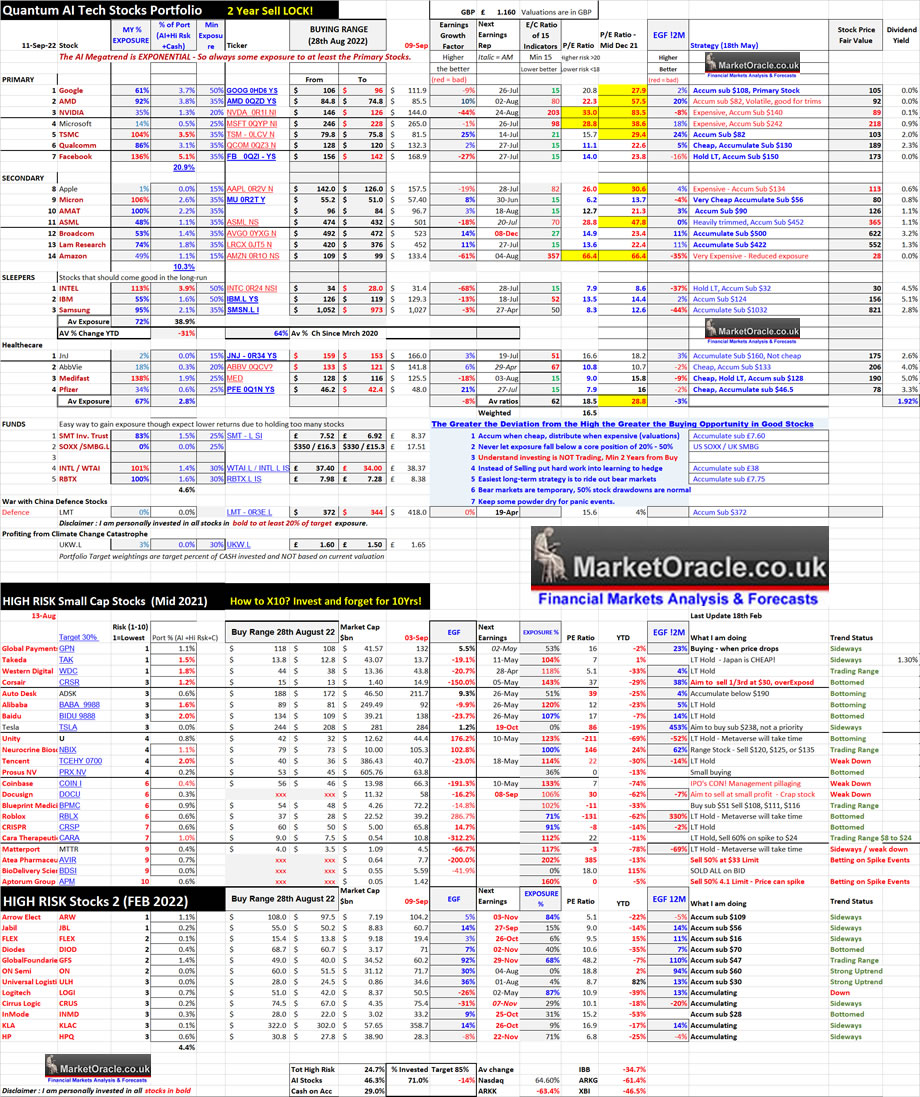

AI Stocks Portfolio

I made lots of small across the board buys earlier in the the week with my main focus on Nvidia, HPQ, Logitec and Arrow, and 1 big buy - Samsung. Current state of my portfolio is 71% invested, 29% cash. Remember as stock prices go up so does the percent invested, similarly when stock prices fall the percent invested naturally drops.

Table Big Image - https://www.marketoracle.co.uk/images/2022/Sep/AI-stokcs-9th-Sept-big.jpg

I have reorganised the AI portfolio, relegated Apple to secondary status because it is an over valued giant corporation that I cannot see out performing to the upside, so off it goes to become a secondary stock, cutting my maximum exposure to Apple in half and distributed amongst the likes of AMD, TSMC, Qualcom and others as Apple is no longer a primary AI Tech stock, not because it won't continue to innovate, it's just that its future stock price prospects will likely see it under perform most others. And thus AMD takes second place which has the potential for huge growth over the coming years given that AMD's market cap is just $137 billion, 1/20th that of Apples $2.6 trillion, it is far easier for the AMD stock price to DOUBLE from here than Apples! Thus it is likely that Apple will continue to sink lower in my table over the coming months. Especially given the extent of Apple buy backs, which I would much rather see go to acquisitions as buy backs do not generate future revenues and also what happens when Apple runs into difficulties and needs to raise cash as has happened to Apple several times in it's history, much better to have a huge cash mountain instead of buy backs which makes the corporation less robust.

I have also upped my target exposure to some high risk stocks (Feb 2022), of note is GFS that is on track to join it's brethren in the AI stocks portfolio, this stock is definitely one I would not mind being well over exposed to once more as I was on it's recent dip to below $40 which saw my exposure explode to 150% invested, then heavily trimmed on the subsequent rally to above $62, any dip to below $49 will have me accumulating once more.

I continue to aim to get the job done and get to at least 75% invested in key target stocks that remain pending, that's Google, Broadcom, and ASML In respect of ASML I constantly hear how TSMC rules the world due to it's CPU Fab dominance, completely oblivious to the fact that it is not TSMC that runs the world but actually it is Dutch ASML without which TSMC, Intel, Samsung and Micron would literally be decades behind as there is no competitor to ASML that supplies the EUV machines that etch the circuits onto the silicon wafers at extremely short wave lengths of ultraviolet light, said to be the most complicated machines ever designed by man, each costing over $200mln, which is why despite it's relatively high PE of 28 (down form 48) I have got to get to target exposure in ASML Technology that the US is going to great lengths to block from going to China including the CIA suspected torching of an ASML EUV factory in Germany a few years ago that was said to be linked to Huawei.

So next time you hear someone banging on about how TSMC is at the cutting edge of CPU manufacturing, remind them that the actual machines that etch the circuit patterns onto the wafers are made by ASML. Of course there is a symbiotic relationship as TSMC are by far ASML's largest customer and so exposure to both stocks is warranted.

Funds

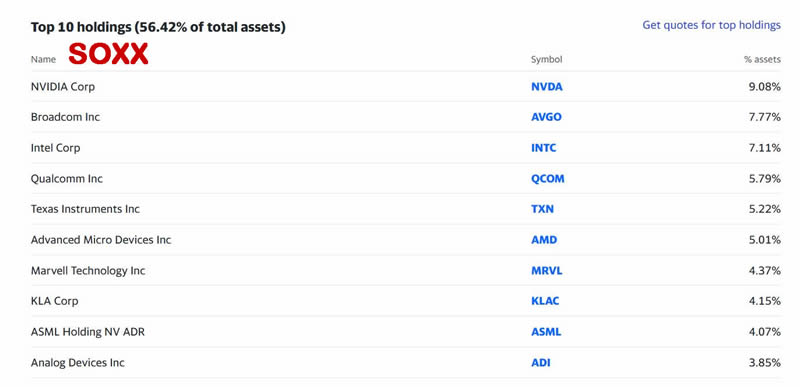

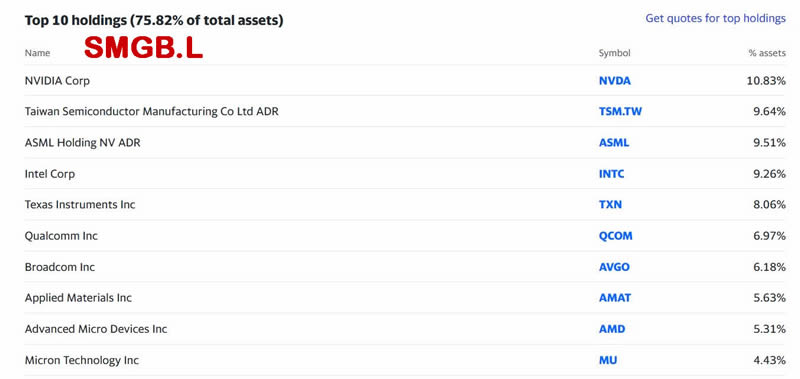

I get often asked in the comments section is SOXX a good ETF to gain exposure to AI tech stocks, yes it is but I have not included in my funds list because one cannot buy it within a UK tax free wrapper. However, SMGB.L appears to be very similar in performance to SOXX, so I have now added SOXX for US and SMGB .L for UK into which I will personally be investing should an opportunity arise, buying levels are given for both funds.

SOXX Top 10 Holdings

SMGB.L Top 10 Holdings

Note for me funds are a side salad, in total probably less than 7% of total portfolio.

Climate Change

Earlier a patron asked if I was going to include climate change stocks, my reply was that I am working on a shortlist, we'll here's one Fund off that shortlist - Greencoat UK WIND UKW. L - Is an Investment trust that invests in UK Wind Farms.

Key metrics - Dividend 4.58%, Market cap £4 bill, PE 4.58, annual fee 1.27%, the trust is not covered by any analysts so not on most radars and public data (yahoo) appears to be very inaccurate. Currently trades at a 6% premium to NAV, range is +18% to -3% so volatile. Stock price is up 20% year to date, though clearly not over valued in PE terms, the board raises the dividend inline with RPI which is currently 14.5%, which means it is a good inflation income stock. Pays dividends 4 times per year, current price 163.

Buying range - 160 to 150, I aim to build up a stake to about 25% of target position in the $163 to $158 range and then aim to scale at lower prices upto about 80% invested. Remember this is NOT a AI tech stock or fund so it's trend pattern will be different.

Some patrons have suggested Carbon Capture ETF's but the performance of the funds suggest they are a dead parrot i.e. they could deliver the exact opposite of that which investors expect them to deliver similar to TIPS falling when inflation is soaring! So again don't fall for the consensus view, always dig deeper before committing ones children's inheritance to any investment, yes I am probably never going to spend a single penny of that which I am busy accumulating like a squirrel burying lots of acorns all over the place, it will all be for my kids to dig them up and blow on useless junk unless I can get uploaded before I kick the bucket.

Making the Invisible Visible

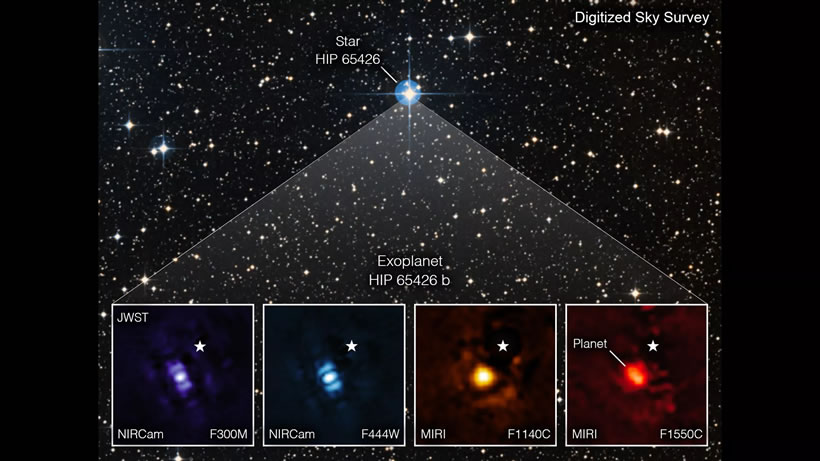

James Webb Space Telescope's first direct image of a planet orbiting a distant star, there's life out there but not as we know it.

The HIP 65426 b gas giant planet photographed by the James Webb Space Telescope on the background of the Digitized Sky Survey (Image credit: NASA/ESA/CSA, A Carter (UCSC), the ERS 1386 team, and A. Pagan (STScI))

This article was was first made available to patrons who support my work - September the Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Also access to my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

Recent analysis includes -

- Stock Market White Swan - Why Fed Could PAUSE Rate Hikes at Nov 2nd Meeting, Q4 Earnings

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

- Can the Stock Market Hold June Lows Despite Spiking Yields and Dollar Panic Buying?

- September the Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.