Quantum AI Tech Stocks Portfolio Investing At Bear Market Lows

Commodities / Investing 2022 Oct 08, 2022 - 06:27 PM GMTBy: Nadeem_Walayat

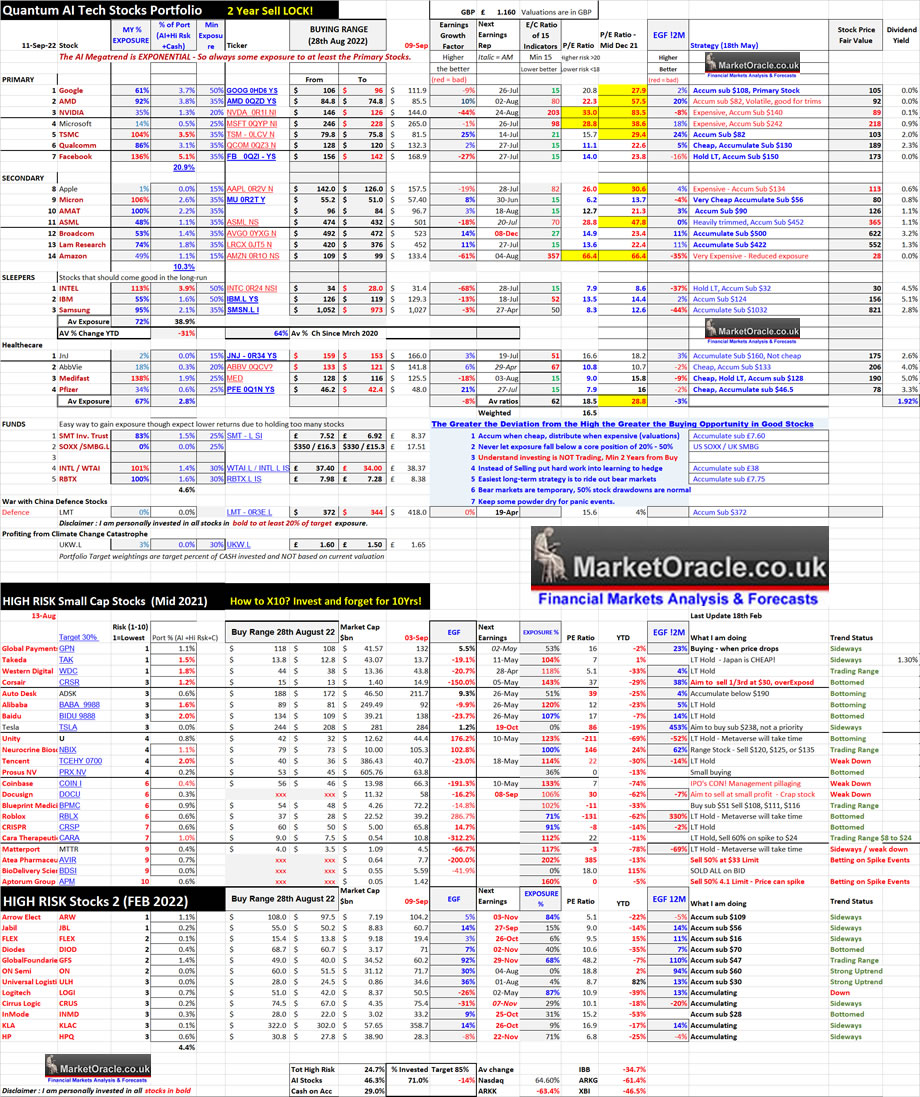

I made lots of small across the board buys earlier in the the week with my main focus on Nvidia, HPQ, Logitec and Arrow, and 1 big buy - Samsung. Current state of my portfolio is 71% invested, 29% cash. Remember as stock prices go up so does the percent invested, similarly when stock prices fall the percent invested naturally drops.

Table Big Image - https://www.marketoracle.co.uk/images/2022/Sep/AI-stokcs-9th-Sept-big.jpg

I have reorganised the AI portfolio, relegated Apple to secondary status because it is an over valued giant corporation that I cannot see out performing to the upside, so off it goes to become a secondary stock, cutting my maximum exposure to Apple in half and distributed amongst the likes of AMD, TSMC, Qualcom and others as Apple is no longer a primary AI Tech stock, not because it won't continue to innovate, it's just that its future stock price prospects will likely see it under perform most others. And thus AMD takes second place which has the potential for huge growth over the coming years given that AMD's market cap is just $137 billion, 1/20th that of Apples $2.6 trillion, it is far easier for the AMD stock price to DOUBLE from here than Apples! Thus it is likely that Apple will continue to sink lower in my table over the coming months. Especially given the extent of Apple buy backs, which I would much rather see go to acquisitions as buy backs do not generate future revenues and also what happens when Apple runs into difficulties and needs to raise cash as has happened to Apple several times in it's history, much better to have a huge cash mountain instead of buy backs which makes the corporation less robust.

I have also upped my target exposure to some high risk stocks (Feb 2022), of note is GFS that is on track to join it's brethren in the AI stocks portfolio, this stock is definitely one I would not mind being well over exposed to once more as I was on it's recent dip to below $40 which saw my exposure explode to 150% invested, then heavily trimmed on the subsequent rally to above $62, any dip to below $49 will have me accumulating once more.

I continue to aim to get the job done and get to at least 75% invested in key target stocks that remain pending, that's Google, Broadcom, and ASML In respect of ASML I constantly hear how TSMC rules the world due to it's CPU Fab dominance, completely oblivious to the fact that it is not TSMC that runs the world but actually it is Dutch ASML without which TSMC, Intel, Samsung and Micron would literally be decades behind as there is no competitor to ASML that supplies the EUV machines that etch the circuits onto the silicon wafers at extremely short wave lengths of ultraviolet light, said to be the most complicated machines ever designed by man, each costing over $200mln, which is why despite it's relatively high PE of 28 (down form 48) I have got to get to target exposure in ASML Technology that the US is going to great lengths to block from going to China including the CIA suspected torching of an ASML EUV factory in Germany a few years ago that was said to be linked to Huawei.

So next time you hear someone banging on about how TSMC is at the cutting edge of CPU manufacturing, remind them that the actual machines that etch the circuit patterns onto the wafers are made by ASML. Of course there is a symbiotic relationship as TSMC are by far ASML's largest customer and so exposure to both stocks is warranted.

Funds

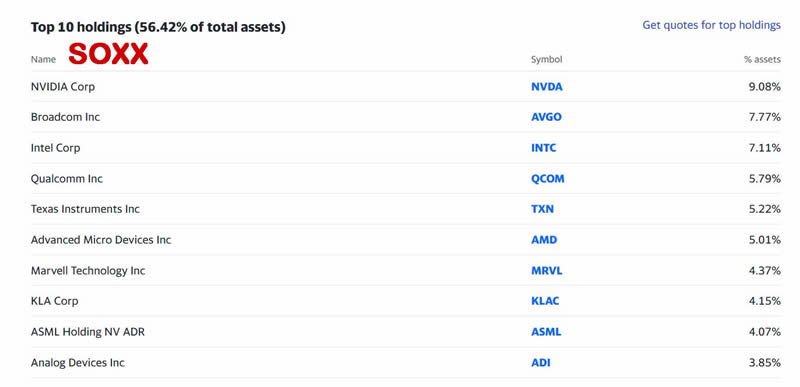

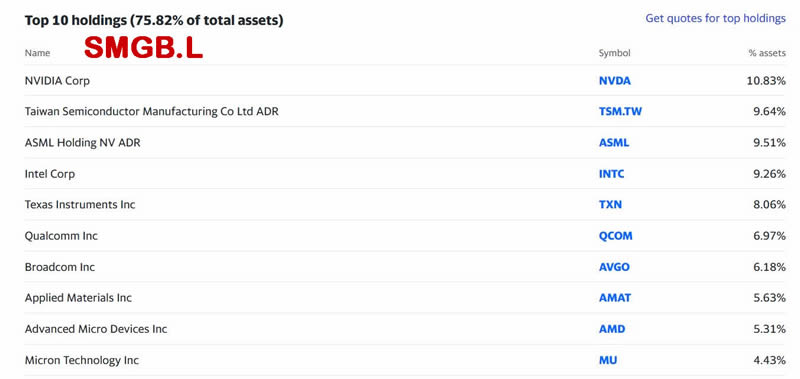

I get often asked in the comments section is SOXX a good ETF to gain exposure to AI tech stocks, yes it is but I have not included in my funds list because one cannot buy it within a UK tax free wrapper. However, SMGB.L appears to be very similar in performance to SOXX, so I have now added SOXX for US and SMGB .L for UK into which I will personally be investing should an opportunity arise, buying levels are given for both funds.

SOXX Top 10 Holdings

SMGB.L Top 10 Holdings

Note for me funds are a side salad, in total probably less than 7% of total portfolio.

This analysis is an excerpt form September the Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity which was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis includes -

- Can the Stock Market Hold June Lows Despite Spiking Yields and Dollar Panic Buying?

- September the Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity

- Jerome Powell's TRANSITORY DIP in INFLATION, AI and High Risk Stocks Updated Buying Levels

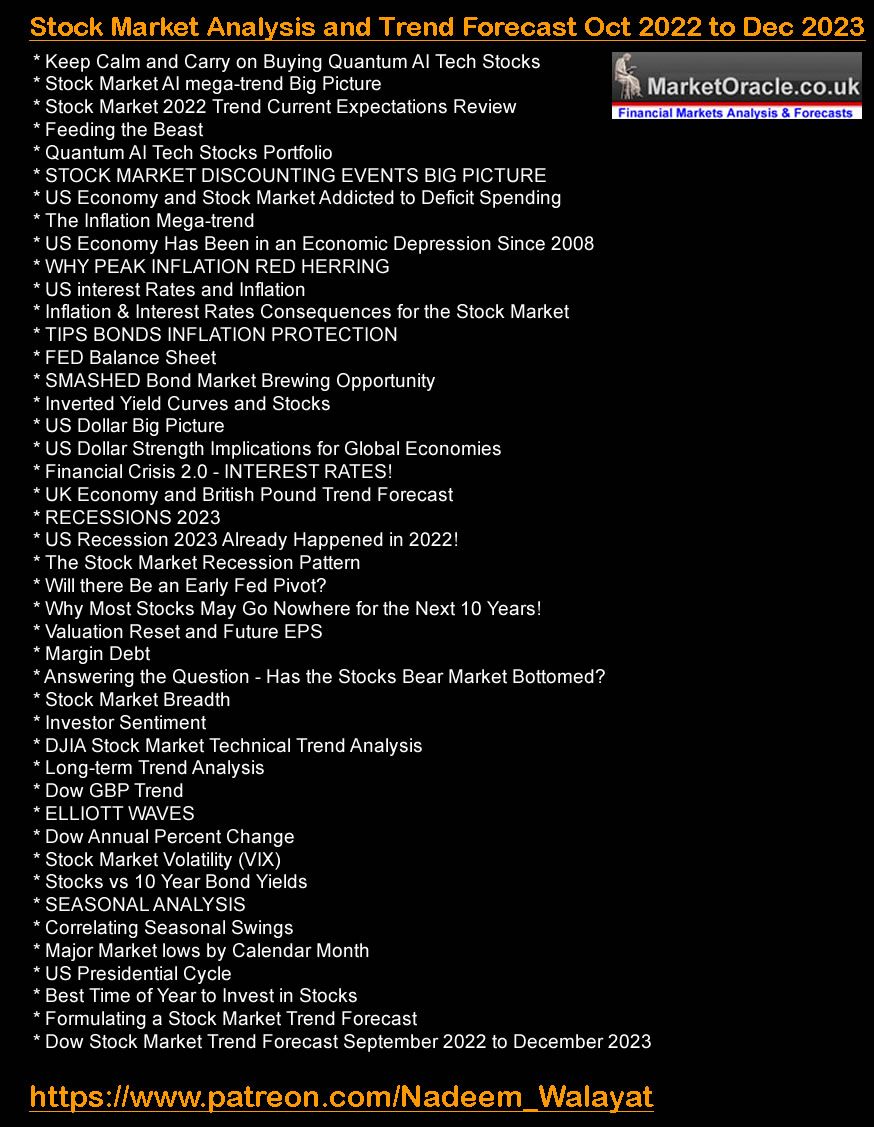

Including access to my just published mega-analysis that concludes in a detailed 1+ year trend forecast into December 2023.

Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your watching the British pound burn at the official rate of 9.4% per annum analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.