Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

Stock-Markets / Stock Market 2022 Sep 01, 2022 - 02:36 PM GMTBy: Nadeem_Walayat

QCOM illustrates how the bottoms will tend to play out for most of the AI tech stocks, for if you are not already invested then you will likely end up waiting for the second chance to buy near the bottom all the way towards new all time highs. For instance I would be surprised if we see anywhere near $118 on Qualcom again, I may be wrong but I am assuming there are a lot of investors now wishing they had bought near $120 and are thus eager for another bite at the cherry.

The higher the current Qualcom price swing travels then the higher will be Qualcom's next swing low. Of course there is the chance of a lemmings induced panic event that results in the so called CAPITULATION, as if CAPITULATION is a magic word! Abracadabra the bottom is in! Yes, maybe in hindsight after stocks have bottomed and rocketed higher, which is the problem with technical analysis in that it tends to be EXCELLANT when used in hindsight, but the present is always deemed to be a near coin flip, i.e. so called analysts nearly always resolve in that the market form where could go either higher or lower. That's what TA delivers, a COIN FLIP going forward but which is crystal clear in hindsight! Instead there needs to be a road map of sorts against which one can at least have a measure strength or weakness without the benefit of hindsight.

Late last week the S&P briefly managed to nudge above 4000 before closing Friday at 3962, which as of writing is where the S&P futures remain little changed pre open. The bear market rally is now getting a little long in the tooth and so despite setting a new swing high it clearly does not want to go significantly higher ahead of Big Tech earnings, FED Meeting AND Q2 GDP data, so a busy and probable volatile week ahead.

In terms of the impact of earnings (see below) the stock market should see the bear rally continue early week, probably into Wednesday to deliver close to my S&P target of 4080, after which the market is going to be buffeted by earnings and economic data with likely Thursday and Friday being rough days for the market following release of what I expect to be BAD Apple and Amazon results that will act as fuel to deliver the next swing down, unless both stocks deliver positive earnings surprises (which I doubt).

Monday 25th July

Tuesday 26th July

GOOGLE $108, EGF -7%, EGF12M +8%, PE 19.6, EC 15

As I pointed out last week EGF is weak so the stock price should fall on earnings. In fact investors started to sell early ahead of earnings which prompted me to comment that I was eyeing buying Google big on a drop to $92 to $94. At the end of the day this is the No1 stock on my list where my current exposure of 58% / 3.6% of portfolio is light, and I probably would already be 80% invested in Google if it were not for sterling's 15% drop, hence why I require deep draw downs to buy more which Tuesdays earnings report could deliver.

MICROSOFT $260, EGF -1%, EGF12M +17%, PE 28.1, EC 91

EGF is neutral but Microsoft remains over valued on a PE of 28. My exposure is a light 14% as I await the big price drop to below $220 before I hit the big buy button. The High PE and EC is putting me off buying Microsoft.

Wednesday 27th July

QUALCOM $153.7, EGF +11%, EGF12M +17%, PE 14.1, EC 15

Qualcom is firing on all cylinders, the EGF points to strong earnings that will probably beat market expectations. Qualcom that I often refer to as a no brainier buy is up 30% from it's low! So it could be a case of sell on the news which chimes with my trend expectations, so suggests a continuing rally ahead of earnings and then starts to correct on the earnings report.

META $169, EGF -21%, EGF12M -8%, PE 12.8, EC 15

The EGF metrics have long been warning to expect WEAK META earnings. However, the stock is cheap so unless there is something really disastrous in their earnings report, it's basically already all priced in especially as META fell late last week in sympathy with the SNAP bloodbath so the stock price could be primed for a spike higher even on poor earnings.

LAM RESEARCH $464, EGF -9%, EGF12M +7%, PE 14.3, EC 15

EGF suggests weak earnings, but the low PE and EC should offer some price support. Nevertheless expect downwards price bias towards $400.

Thursday 28TH JULY

APPLE $154, EGF -14%, EGF12M 3%, PE 25, EC 71

EGF suggests to expect WEAK earnings so given the rally in the Apple stock price it looks like the market could have got Apples earnings expectations badly wrong and so Apple could be the straw that breaks the bear market rallies back. I only have token exposure of 2.9% to this over valued stock that could be in for a BIG PRICE DROP next week, if so I will start nibbling at BELOW $120 to at least build exposure towards 20% invested.

AMAZON $122, EGF -74%, EGF12M -36%, PE 46, EC 367

I don't get why so many people are obsessed with Amazon. EGF suggests to expect very BAD earnings and thus probable sharp drop in the stock price. Amazon bought One Medical for $4 billion as it seeks to branch out into more profitable sectors than consumer retail. I took a look at One Medical's financials and it's basically a no earnings cathy wood turd stock to the extent they printed 43% EXTRA SHARES during 2001 to hand out to themselves! To me it looks like Amazon just paid $4 billion for garbage, though clearly Amazon see's something that they can absorb into their cloud services.

Amazon currently comprises 1.6% of my portfolio which I will seek to further reduce on any rally in the run up to earnings and after earnings if it somehow manages to break higher higher and run to $140. I can live with Amazon comprising about 1.3% of my portfolio on the off chance that I am wrong after all it IS an AI tech stock so whilst it may under perform, the long-term direction of travel should be to new all time highs.

PFIZER $51, EGF 35%, EGF12M +17%, PE 10, EC 15

Pfizer should report strong earnings which unless Apple kills the rally could propel the stock price to break above it's trading range of $54 to $48 to target $60+.

Friday 29TH JULY

ABBV $148, EGF 2%, EGF12M 0%, PE 11.5, EC 76.

ABBV is a tough stock to read as the EGF is neutral. Recent price action off the high is corrective so the stock should resume it's bull run. However, if ABBV does fall then I will be eying any sell off to below $130 to accumulate into..

AI Predicts AI Stock Prices Three Years Ahead

I's been a year since I last ran the ASFV neural net that generates stock price predictions for where the AI tech stocks could be trading at in some three years time. For details of what it is and what it does and what it was predicting a year ago see my article of 19th July 2022 - AI Predicts AI Tech Stock Price Valuations into 2024. And if you do read the article you'll see that I didn't agree with some of it's predictions i.e. I was bearish on a number of stocks that it was bullish on.

Nvidia $820, ASVF $1433, PUP 75%

The AI is effectively saying I was wrong to sell ALL of my holdings at $715 as it prices future prospects for the stock on par with that of Google, which I don't agree with. Anyway I remain uber bearish on Nvidia that I see as floating on thin air, even to the extent of going SHORT on the stock (with a tight stop)! So will ignore the ASVF in this case.

The 3 year forecasts are listed in the tables end column where I would concur with it's current forecasts for Google, Facebook, Microsoft, Nvidia, Qualcom, Micron, AMAT, LRCX, Samsung, Medifast and Pfizer. Whilst I would say that the ASFV is under projecting the prospects for AMD, TSMC, Broadcom, Intel and IBM. Whilst over estimating the prospects for Apple, Anyway it gives a different perspective on future prospects for individual stocks and will be interesting to see how things pan out over the next 3 years, now that it has some bear market data behind it.

In a way the ASFV acts as a reminder that the price action we are seeing this year is basically noise. In the comments section people can tend to make a fuss about nothing. I know, I've been in this game a long time and so I know deep draw downs are normal. It is going to happen to every stock no matter what the stock is! Where the only mechanism one has to mitigate the impact of draw downs are valuations and investing in stocks one actually understands their business and where they are going.

Stock price DEVIATIONS FROM THE HIGHS INCREASE THE PROBABILITY FOR STRONG PRICE APPRECIATION IN THE FUTURE as multiples contract whilst the underlying dynamics remain largely constant i.e. that of the exponential AI mega-trend. Remember folks these aren't just ticker symbols, GOOG,AMD,TSM, these are actual machines that are bringing forth the age of machine intelligence that will expand EXPONENTIALLY! All this whilst we faff about with price charts largely oblivious to the unfolding machine intelligence mega-trend, so perhaps we need to take a cold shower to bring the big picture back into focus so as not to get carried away with the price charts, I mean I see the analysts, with charts full of a gazzilion indicators trying to fine tune minute price action all whilst being completely oblivious to the UNDERLYING MEGA-TREND. It's like only watching the ripples on the ocean whilst being completely oblivious to the OCEAN itself!

Here's the basic pattern for the stock market casino (yes it is a casino evident by how eager folks are to gamble on turd stocks) that tends to often repeat for good stocks - Price goes UP X3, Drops 50%, UP X3, Drops 50%., Up X3, Drops 50% and so on....... And which phase are we in right now? Yes, the drop 50% phase where almost everyone fears lower prices, blind to what follows the draw downs as they convince themselves that much lower prices are ahead so SELL on hopes as if by magic they will manage to buy the exact bottom, and so I am not surprised that the ASVF also sees most stocks tripling in 3 years time because that IS the underlying stock price pattern that the AI has been trained to recognise.

Just remember the stock price trend is exponential, that is what X3 UP followed by 50% Down delivers over the long-run, an exponential rise in the stock prices.

The current state of my AI stocks portfolio is 76.2% invested, 23.8% cash, AI stocks 49.4% and High risk stocks 26.9%. So little changed from last week, where trimming so far has been focused on Qualcom, SMT.L, DIODE and Amazon.

Table Big Image - https://www.marketoracle.co.uk/images/2022/Jul/AI-stocks-portfolio-22nd-July-2022.jpg

Financial Crisis 2.0

The brewing multi-headed Financial Crisis 2.0 that I began flagging to expect Mid 2021 that Russia's invasion of Ukraine War has acted to pour petrol on the fires of sending food prices soaring and sparking the collapse of many weak nations as they are no longer able to service their debts as and import critical food and fuel as prices soar, where the most visible tip of the Iceberg is Sri Lanka, and the battered and abused Afghanistan subject to decades of invasions in the name of spreading 'freedom', however soon likely to be joined by many more teetering on the brink states such as neighbouring Pakistan, a nuclear armed state that would result in a several orders of magnitude greater crisis than Sri Lanka.

Nevertheless China collapsing property market, where debts far exceed the real value of properties, especially the largely worthless 'investment' grade properties that many have blindly poured their life savings into are now facing the consequences of the ripple effect of the bursting of the Chinese property bubble which I will cover in part 3 of my extensive analysis of the Housing Markets.

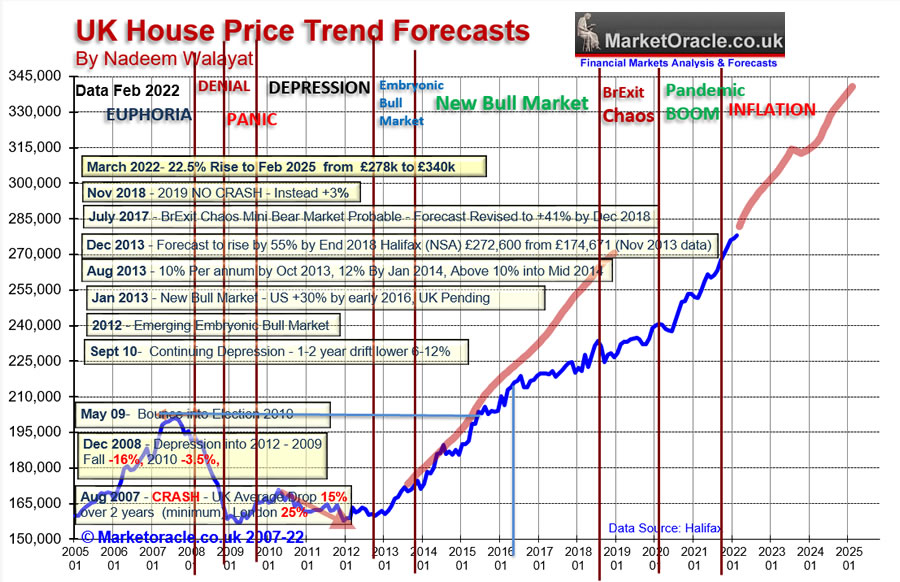

As a reminder Part 1 concluded in a 3 year trend forecast for the UK house prices - .UK House Prices Trend Forecast 2022 to 2025

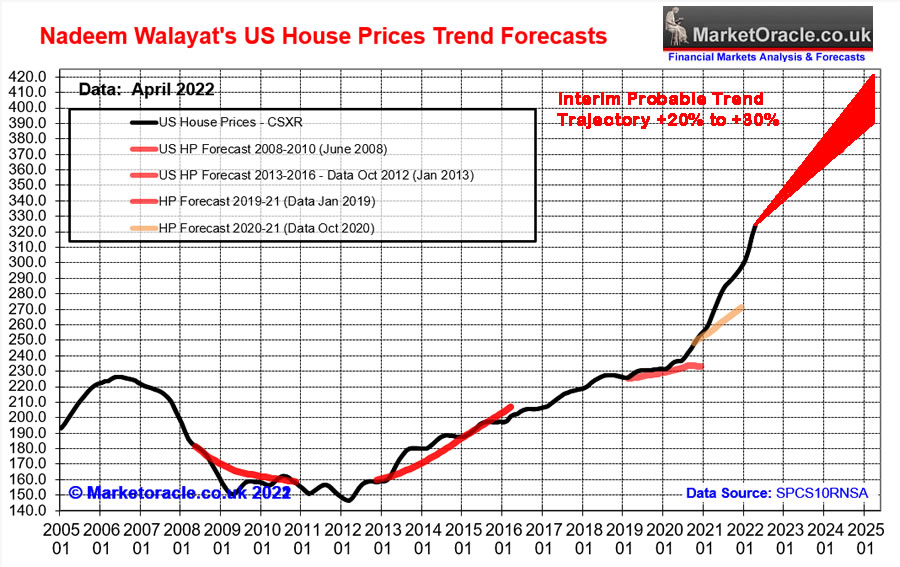

US Housing Market Trend Forecast (Part 2) where my already shared expected trend trajectory of +20% to +30% in 3 years time will be finalised in a high probability trend forecast on release of US Q2 GDP data on the 28th of July and following the probable Fed 0.75%. rate hike.

The above graph is as a result of some 4 months of work.so this weeks Q2 GDP data and Fed 0.75% rate hike probably won't make any difference to my trend forecast, but it will be better to update and post the article AFTER the probable recession has been declared than before.

China Bank Run Protests - Another Potential Tiananmen Square Massacre?

China's property market is collapsing that an inept CCP is attempting to prop up through DICTATS, as if a few words on a scrap of paper can fix the fundamentals. A crisis that has now spilled over into the banking system which has seen many ordinary chinese fall victim the chinese banking triad as their hard earnings savings supposedly in 'safe' regional banks have VANISHED over night after the CCP members had withdrawn their funds or had their funds ring fenced for protection whilst ordinary Chinese folks seeking to withdraw their funds are met by hired goons in the hundreds to beat them away from the bank doors. This is the reality of Ray Dalio's China! A brutal tyrannical state that he some how see's as forging the new world order!

Many thousands of ordinary Chinese had been duped by the chinese banking crime syndicate into depositing their funds through the scam operation where in the first instance the banks apparently broke chinese banking laws by advertising for customers online enticing deposits through the promise of paying a high interest rate, only to do a crypto stable coin style rug pull when customers sought to make withdrawals, resulting in many tens of bullions vanishing from customer bank accounts hence prompting the protests and subsequent crackdowns.

Whilst the banking fraud may have no direct connection to the CCP. however CCP reaction to the protesting customers of the CCP talks volumes of the rights of ordinary Chinese people. Even to the extent of once more sent in the tanks against BANK CUSTOMERS! If they do this to bank customers trying to recover their life savings from thieving banks then what is the CCP prepared to do towards any political dissent!

To further control the BANK protests, the CCP has started to prevent on mass protestors from leaving their states to get to Hunan by changing their covid status to RED forcing bank customers to go into 14 days of quarantine so as to prevent people from protesting! This is what Orwell's 1984 looks like in modern day China! You protest! You go into quarantine for 14 days! This is what it is to live under a totalitarian state where people have NO RIGHTS! This is why Covid will never go away in China because the CCP has a new permanent means of controlling the movement of people! They can instantly flip a switch to shut down the movement of any number of people all the way to shut down whole cities and even provinces! Ultimate CONTROL! Covid is NOT gong to to go away in China!

China is a state within a state, where power resides within the upper echelons of the Chinese Communist Party whilst the rest of the population are mere slaves with NO rights. Contrary to what most imagine that as their nation puts their own citizens first i.e. the US puts American's first, France the French, Britain the Scots, China only puts it's communist party members first, the rest are treated as sheeple that must be controlled so that the CCP can retain complete power. So everything that China does is through the prism of CCP retaining control over the masses so that the slaves do the bidding of the CCP and thus the growing protests in China in response to savings from their bank accounts being erased over night is likely to prompt an equally severe response as the last time the CCP faced a threat to it's supreme power was back in 1989 that resulted in the Tiananmen Square Massacre.

Could one imagine when there was run on Northern Rock Bank in the UK that Gordon Brown would send in the tanks to meet queuing bank customers, and army of thugs to beat the customers away from the banks doors?

As the 2008 Great financial crisis (GFC) illustrated that once bank runs start the panic fast spreads to the extent that soon the whole financial system finds itself teetering on the brink of collapse which is precisely where the US found itself on the 18th September 2008 that was within a couple of hours away from a total collapse of the US financial system and along with it the US and world economy within 24 hours as the first few minutes of my following video illustrates.

So the authoritarian CCP finds itself on the brink of a financial crisis where so far their authoritarian response has been to send in the troops and order the people to not to panic. Will it work? I doubt it, the only solution as was the case for 2008 was to print a load of money to bailout the bankrupt banks and thus inflate the crisis away where the price paid will be in the loss of purchasing power of peoples earnings and savings As was the case with the GFC. However there is always the risk of making a mistake and thus sending the situation spiraling out of control.

Meanwhile in part China is contributing towards the collapse of many nations starting with Sri Lanka due to saddling developing nations with huge debt mountains all in pursuit of creating white elephants that are of little if no practical use to nations such as ports that China then can step forward and buy leases on for 99 years or more just as they did with Sri Lanka, of course China is just taking advantage of weak and corrupt regimes across South Asia and Africa for it's own benefit much as the West were busy doing in the aftermath of independence to ensure that newly liberated nations would soon become saddled with debt that they cannot repay and thus their former colonial masters coupled with Wall Street and the State Department would once pull the strings behind the scene. Borrowing from Wall street or China is a bit like borrowing from the Mafia, yes there is a chance that one can make good with that money but those chances are very slim.

The bottom line is that China is on the march seeking every advantage to displace the US as the world's Imperial power, even if the power battle between the two giants destroys countless nations in their wake all in the name of maintaining and gaining supremacy as China appears to have succeeded in doing in Sri Lanka. though to enable China to do so on needs corrupt blood sucking vampires drinking the life blood of their nations population which is what the Rajapaksa family are. They sucked the blood out of Sri Lanka, saddled the nation with debt that includes billions of dollars they siphoned off into their offshore bank accounts and assets.

Meanwhile Europe's tin pot dictator continues his war in Ukraine that has slowed to a grind as the West funnels heavy arms to the Ukrainians as they increasingly mobilise a million strong army to counter the Russian invasion that is prompting many western politicians and pundits to convince themselves that Russia is destined to lose the war. I don't get it, don't these fools see the huge stock pile of 5000+ Russian nuclear missiles. So exactly how can Russia lose the war where if their backs are against the wall then the Russians WILL USE NUCLEAR WEAPONS! Russia is NOT going to lose the war in the Ukraine and those who think that they could fail to consider the consequences of Russia losing. So Russia will achieve it's goals of carving up half of Ukraine as I pointed out some 8 years ago, even if it takes a lot longer than anyone imagined it would when they first marched their troops across the border in February, which is a harbinger of what to expect when China decides to take Taiwan, it's not going to be over by Christmas as the Lads brigades thought as they marched off to war in 1914.

The flight of capital from Europe to the United States tells you what the smart money thinks is going to happen in Europe, the longer the war goes on the more likely it is to spill out of Ukraine's borders to result in an ever increasing risk of nuclear war. And similar is true with Taiwan where the Chips Act is just the firing of the starting gun in what will become a mad dash to build the chip fab's safe on US soil before the Chinese invasion of Taiwan happens.

The way I see it, Russia Wins the West / Ukraine lose or Russia loses and so does the West and Ukraine, with similar outcomes for Taiwan.

And then there are the unintended consequences of mass starvation soon to be followed by mass migrations, the flight to safety of US assets has only just begun!

This anaysis Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis includes -

- Jerome Powell's TRANSITORY DIP in INFLATION, AI and High Risk Stocks Updated Buying Levels

- Answering the Question - Has the Stocks Bear Market Bottomed? Saudi Black Swan

- Stocks Bear Market Rally End Game

- Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

- Stock Market Rally Continues Towards Target, Why Peak Inflation is a Red Herring

Whilst my recent in-depth analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast, no following of the consensus herd here! Whilst completion of my extensive analysis of the US housing market is imminent.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 85%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your watching the British pound burn at the official rate of 9.4% per annum analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.