Elliott Waves: Your "Rhyme & Reason" to Mainstream Stock Market Opinions

InvestorEducation / Elliott Wave Theory Aug 06, 2022 - 10:54 PM GMTBy: EWI

R.N. Elliott's stock market observations fell together "into a general set of principles"

It's understandable why investors with little experience consult the market opinions of professionals.

But many of these new investors are left scratching their heads. Two headlines from July 29 indicate why:

- [Fundstrat Managing Partner] says the 2022 bear market is over, stocks could hit new highs before year-end (CNBC)

- Stock market's post-Fed bounce is a 'trap,' says Morgan Stanley's [Chief Investment Officer] (Marketwatch]

Yes, two directly opposing opinions that were published on the same day.

The date before those headlines published (July 28), happened to be Ralph Nelson Elliott's 151st birthday.

You may be interested in his discovery about stock market behavior because it offers an alternative to consulting mainstream financial stories.

Here's a brief overview: In the 1930s, Ralph Nelson Elliott (1871-1948) discovered that the stock market moves in recurring patterns that he called waves.

Elliott had led an active life as an accountant and management consultant, working at various times for railroad companies in Mexico, Central America and South America, a business magazine, and for the State Department before becoming seriously ill with pernicious anemia.

In the book, R.N. Elliott's Masterworks, Elliott Wave International President Robert Prechter describes what happened next:

Despite being physically debilitated by his malady, Elliott needed something to occupy his acute mind while recuperating between its worst attacks. ... It was around 1932 that Elliott began turning his full attention to ... finding out whether there was any rhyme or reason to the stock market. ...

Around May 1934 ... his numerous observations of general stock market behavior began falling together into a general set of principles that applied to all degrees of wave movement in the stock price averages.

Elliott's insights continue to be employed by investors today.

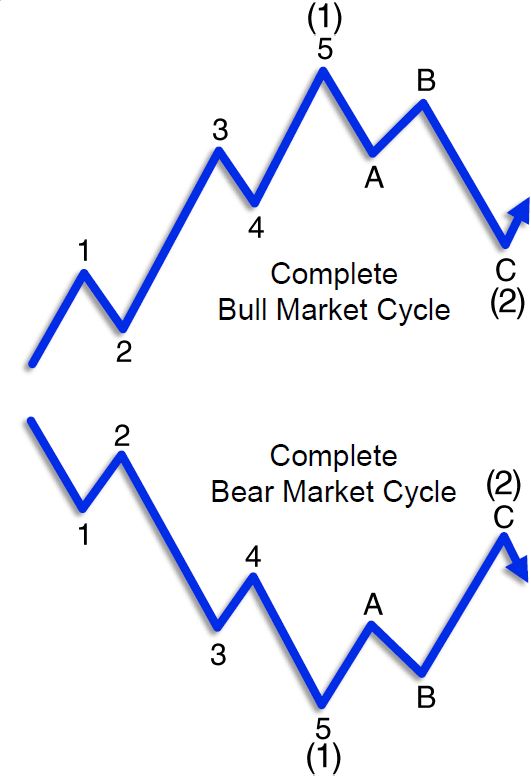

The basic Elliott wave pattern consists of five subwaves (denoted by numbers) which move in the same direction as the trend of the next larger size and three corrective subwaves (denoted by letters) which move against the trend of the next larger size:

When this initial eight-wave cycle such as shown by the illustration ends, a similar cycle begins.

In other words, the basic Elliott wave pattern links to form five- and three-wave structures of increasingly larger size.

An important point is that the Wave Principle helps investors to identify turning points in the trends of financial markets.

Indeed, here's a quote from Frost & Prechter's Wall Street classic, Elliott Wave Principle: Key to Market Behavior:

When after a while the apparent jumble gels into a clear picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%. It is a thrilling experience to pinpoint a turn, and the Wave Principle is the only approach that can occasionally provide the opportunity to do so.

Here's the good news: You can access the entire online version of the book for free once you become a member of Club EWI, the world's largest Elliott wave educational community.

Club EWI is free to join without any obligations and members enjoy free access to Elliott wave resources on financial markets and investing, including exclusive articles and interviews with Elliott Wave International's analysts.

Click on the link to get started right away: Elliott Wave Principle: Key to Market Behavior -- get free and instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline Elliott Waves: Your "Rhyme & Reason" to Mainstream Market Opinions. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.