Test drive EWI's Financial Forecast Service

Stock-Markets / Financial Markets 2022 Jul 21, 2022 - 09:59 PM GMTBy: EWI

Hi reader,

Market action this year has hurt A LOT of people. Cryptos. Meme stocks. Tech stocks. We've seen some huge percentage declines -- all against a backdrop of historic leaps in interest rates and inflation.

Lifestyles irrevocably changed, not for the better.

Economists missed it. The Fed missed it. Politicians missed it.

But a few folks got it right.

Every month, Elliott Wave International President Robert Prechter and his long-time colleagues Steven Hochberg and Peter Kendall write 20 pages on the markets.

Earlier this year, in his legendary Elliott Wave Theorist, Prechter said:

"2022 through 2024 will witness the biggest bear market ever recorded."

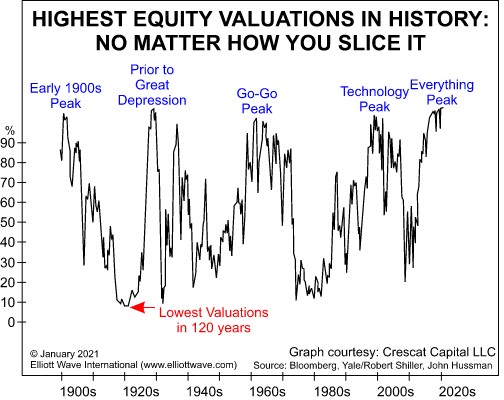

And in early 2021, in reference to headlines about a new "roaring twenties," Hochberg and Kendall included this chart and commentary in their Financial Forecast:

"The great prior valuation extremes arrived amidst relatively robust economic performance. ... Today's weak economy accompanies the overvaluation present during the current fifth and final wave of the Grand Supercycle degree bull market. The anticipation of a roaring new era of stock gains in the face of broad economic deterioration is exactly what we should expect at the top of a major fifth wave."

Many high-flying meme stocks peaked the very next month. Bitcoin and the Nasdaq topped out in November 2021 and the Dow and S&P 500 followed soon after in January 2022.

Are Prechter, Hochberg and Kendall always that right? Of course not.

But: Are they right enough -- and better than the mainstream?

Absolutely.

So here's the deal. For $17, our friends at EWI are offering you 1-week's access to those twenty pages, plus their 3x/week Short Term Update -- and they'll include 3 FREE resources to help you get started. All told, it's nearly $300 worth of material.

Test drive EWI's Financial Forecast Service now for only $17 >>

Join now: The trial offer expires on Thursday, July 28th.

Sincerely,

EWI

P.S. This is an excellent chance to test drive what Financial Forecast Service subscribers pay $97 a month for. For one full week, you get it all -- for just $17. No, that is not a typo.

Who is Elliott Wave International?

EWI is the world's largest independent technical analysis firm. Founded by Robert Prechter in 1979, EWI helps investors and traders to catch market opportunities and avoid potential pitfalls before others even see them coming. Their unique perspective and high-quality analysis have been their calling card for nearly 40 years, featured in financial news outlets such as Fox Business, CNBC, Reuters, MarketWatch and Bloomberg.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.