Stock Market Trend Pattern 2022

Stock-Markets / Stock Market 2022 Jul 20, 2022 - 12:43 AM GMTBy: Nadeem_Walayat

My stock market big picture remains to expect the Dow to target a trend towards a probable bottom by late August / Early September at approx Dow 29,600 So far the stock market has not done anything to negate this scenario and thus remains the direction of travel ahead of my next stock market in-depth analysis.

With the Dow closing Friday at 29,988 we are within touching distance that I now expect to resolve in an imminent summer rally which some patrons took to imply that the low could come early, no I still expect what ever rally morphs over the coming days to resolve in a LOWER low within the expected time window of Late August to early September.

Looking beyond August as I last wrote I doubt that 29,600 would be THE FINAL low which I expect to emerge from within a volatile bottoming trading range into the end of October as the Dow swings through 29,600 several times ahead of probably strong rally into at least Christmas.

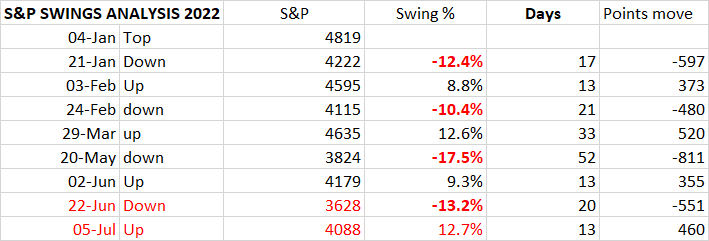

As for what comes next, to elaborate upon what I wrote last week regarding the S&P the S&P is targeting a trend to first support zone of 3875 to 3825 that will likely break given that we are in a bear market to target a trend to a new bear market low of 3730 before embarking on the next bear market rally that will once more resolve in a trend lower to target 3600 by Mid August to early September for the target bear market low." The actual swing down has been deeper to 3628 but nothing out of the ordinary for this bear market that implies to expect a bear market rally to just below 4100, targeting 4088 based on swings analysis.

Thus the S&P either has already bottomed or will imminently do so early next week to target a bear market rally to at least 4088 into early July where the big question mark is can the stock market punch through resistance for a more meaningful rally? So far to date the swings in this bear market have been relatively mild when compared to bear markets of past. Which is either good news or bad news i.e. good in that the declines are orderly, bad in that it could signal the calm before the storm. At this point I still see this as a relatively mild bear market to target a 20% decline on the Dow and so I will use the rally as an opportunity to trim positions. As a rough guide I'll be seeking to trim at between +18% to +25% off the recent lows i.e. trimming AMD on a rally to above $99 whilst I doubt it will punch above resistance at $109. And similar for the other stocks that I have bought heavily into during the past few days.as the AI stocks table illustrates.

This article is an excerpt from my recent this extensive analysis of the state of the stocks bear market and more The Psychology of Investing in a Stocks Bear Market has first been made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis -

- Stock Market Rally Continues Towards Target, Why Peak Inflation is a Red Herring

- Stocks Bear Market Rally Last Gasp Before Earnings Season, US House Prices 3 Year Probability Range

- The REAL Stocks Bear Market of 2022

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

Whilst my recent in-depth analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast, no following of the consensus herd here! Whilst completion of my extensive analysis of the US housing market is imminent.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 85%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the panic selling falling knives.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.