How to Prepare for a Hard-Hitting Stocks Bear Market (Think 1929-1932)

Stock-Markets / Stocks Bear Market Jul 09, 2022 - 10:48 PM GMTBy: EWI

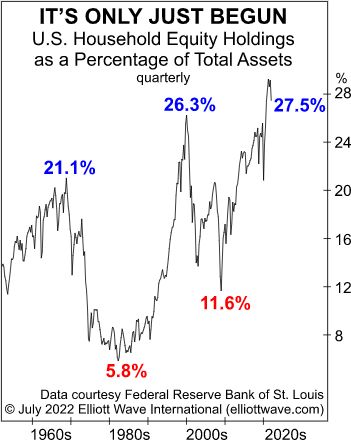

This metric of bullishness is higher than it was at the top of the dot-com mania

An important step in preparing for a historic bear market is to embrace cash or cash equivalents.

This may seem obvious, but even with the stock market in a downtrend, cash is shunned by many an investor -- retail and professional. Many of these investors believe the bull market will resume -- sooner rather than later.

As the May Elliott Wave Theorist, a monthly publication which analyzes financial markets and major cultural trends, noted:

The percentage of assets dedicated to equities in American Association of Individual Investors members' portfolios remains near a bullish extreme. ... They think a "correction" is in force but not a bear market.

So, AAII members have been holding more stocks than cash.

Here in July, investors continue to hold out hope for a resurgence of the bull. This chart and commentary are from the just-published Elliott Wave Financial Forecast:

This chart shows the percentage that U.S. households have in equities relative to their total assets and provides long term context. At 27.5%, the latest reading, from the end of the first quarter, is higher than the peak reading of 26.3% at the top of the dot-com mania in the first quarter of 2000!

Professional market observers likewise dislike cash (Bloomberg, July 27):

S&P Analysts Haven't Been This Bullish In 20 Years

The point is: If you have a portfolio of mainly cash (or equivalents), you'll be in the minority, which history shows is usually the best place to be when a market is transitioning from a bear to bull or bull to bear.

Just make sure your cash is kept in the safest institution possible.

You see, speaking of history, Elliott Wave International President Robert Prechter wrote this in his March Elliott Wave Theorist:

Between 1929 and 1933, 9000 banks in the United States closed their doors. ... Well before a worldwide depression dominates our daily lives, you will need to deposit your capital into safe institutions.

You may say, "My deposits are insured up to $250,000 by the Federal Insurance Deposit Corporation -- why should I worry about my bank's stability?"

The March Elliott Wave Theorist explains why you should not rely on the F.D.I.C. and provides a wealth of other insights into protecting your financial safety -- as well as your physical safety.

If the bear market turns out to be as severe as Elliott Wave International anticipates, social and political turmoil are likely to erupt.

Now is the time to learn the important message of the stock market's Elliott wave pattern.

If you're unfamiliar with Elliott wave analysis, you are encouraged to read Frost & Prechter's Elliott Wave Principle: Key to Market Behavior. Here's a quote from this Wall Street classic:

The practical goal of any analytical method is to identify market lows suitable for buying (or covering shorts) and market highs suitable for selling (or selling short). When developing a system of trading or investing, you should adopt certain patterns of thought that will help you remain both flexible and decisive, both defensive and aggressive, depending upon the demands of the situation. The Elliott Wave Principle is not such a system, but is unparalleled as a basis for creating one.

Despite the fact that many analysts do not treat it as such, the Wave Principle is by all means an objective study, or as [Charles J.] Collins put it, "a disciplined form of technical analysis."

Here's the good news: You can read the entire online version of the book for free once you become a Club EWI member.

Club EWI is the world's largest Elliott wave educational community with approximately 500,000 worldwide members and is free to join. Members enjoy free access to a treasure trove of Elliott wave resources on investing and trading without any obligations.

Interested? If so, just follow the link and you can have the book on your screen in just a few moments: Elliott Wave Principle: Key to Market Behavior (free and unlimited access).

This article was syndicated by Elliott Wave International and was originally published under the headline How to Prepare for a Hard-Hitting Bear Market (Think 1929-1932). EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.