AI Tech Stocks Name of the Game

Companies / Tech Stocks Jul 08, 2022 - 02:08 PM GMTBy: Nadeem_Walayat

Dear Reader

Before I get started with my stock market analysis, here is my take on the political assasination of Boris Johnson, who was stabbed in the back yesterday by so called collegues Julius Caesar style by a Tory party that effectively committed electoral suicide.

This analysis AI Tech Stocks Name of the Game, Climate Change Housing Market Impact and the Next Empires was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent analysis -

- The REAL Stocks Bear Market of 2022

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

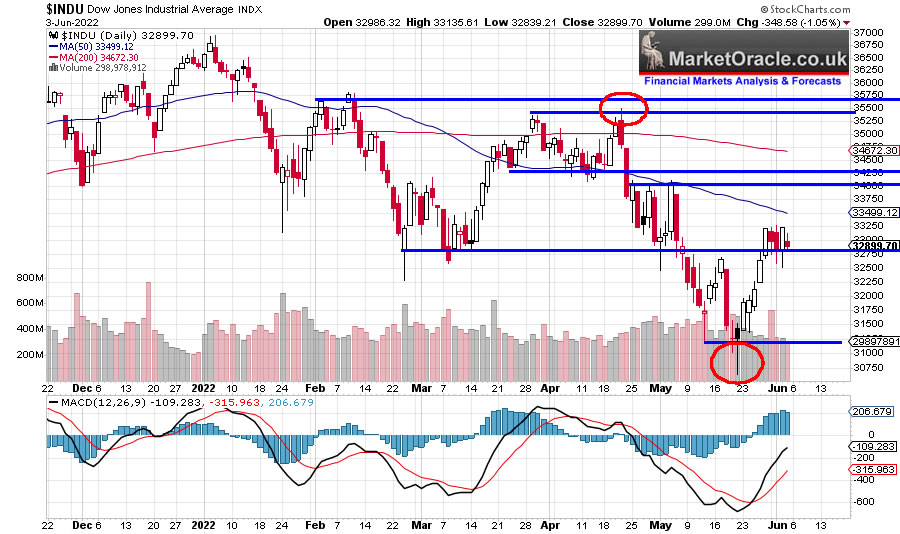

Following a false break lower on 20th of May the stock market has managed to unwind some of what was an extremely oversold state. In fact that is 2 false breaks in a row on the Dow chart (red circles). Still the rally is galvanising many to start fantasising that the bottom is in when at the end of the day it is what it is a bounce from a very over sold state and thus a bear market rally that faces a lot of head winds when one considers all those who were buying stocks for a good month between Dow 34,250 and 35,250, who will mow be eager for a chance to lighten their load on a rally back into their break even price zone which suggests that this bear market rally will terminate long before prices get anywhere near 34,250 so I don't see much upside both in terms of price and time for this rally.

My bear market expectations remain for the Dow to target a trend to 29,600 by Mid August / Early September for an approx 20% top to bottom bear market, whether that will mark the final bottom is pending in-depth analysis. But for mow I continue to see the current bounce soon resolving to new lows.

(Charts courtesy of stockcharts.com)

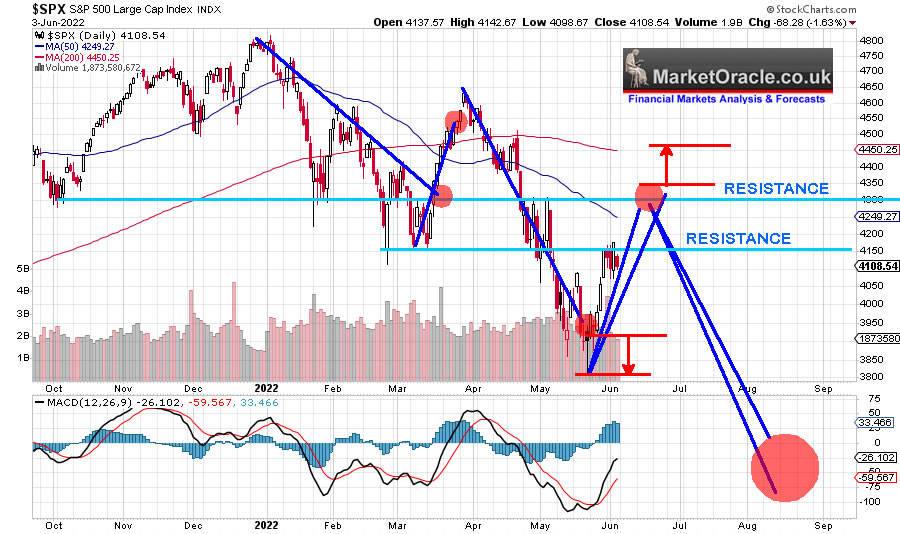

A closer look at the S&P that most focus upon shows that the S&P on a pending break above 4200 will target a trend to 4290 by between 9th and 20th of June to be followed by what could turn out to be a trend to THE or very close to the final stocks bear market low at approx S&P 3,500. Though note that the bear market is more volatile then I am able to model for as indicated by red circles which implies higher volatility could propel the rally to as high as 4450 as a volatility error risk.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

What's the chance that I am wrong and we have seen the bear market bottom?

At this point in time the market has not done anything to suggest that so I would rate the bottom being in as a 5% probability and so I am focused on preparing to buy new lows with some minor trimming during this rally, though note as stocks rise the percent cash will continue to reduce despite some selling due to the increase in value of invested.

Though as I often voice, don't make the mistake of focusing on the indices as the Quantum AI tech stocks are on an exponential trend trajectory so my PRIMARY objective is to GAIN exposure and NOT to wait to try and buy the bottom which will only be clear in hindsight by which time many of the target stocks will already have blasted off in their bull runs towards new all time highs, hence why I am not trying to buy THE bottom but rather INCREASE exposure whenever opportunities present themselves for I know with the benefit of hindsight I WILL regret not having bought more when I had the opportunity to do so, but that is the nature of bear markets it makes investors reluctant even FEARFUL of buying at prices they could mot dream of attaining barely months ago. So I follow my simple rule of buying the deviations from the highs where the greater the deviation the greater the buying opportunity presented without any regard to THE FINAL BOTTOM.

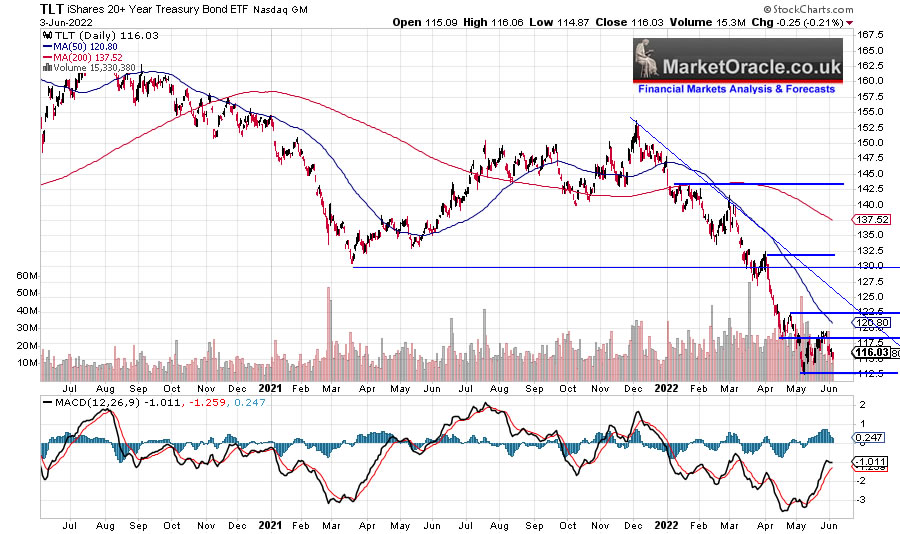

Have US Bonds Bottomed?

A patron asked if US bonds have bottomed / are cheap to buy now that inflation is 'peaking'.

What I see is a severe bear market that had taken US bonds to a very oversold state (MACD) with the recent rally being very feeble and purely acting to unwind from that very oversold state. So I doubt very much that US bonds have bottomed. Though the rate of decent should moderate and become more choppy as the market works it's way through a series of CPI monthly prints so a more gradual trend lower towards the natural support level of $100 is likely. The fact that bonds are rolling over and likely to trend lower once more is another confirming reason for lower stock prices ahead, i.e. falling bond prices equates to rising interest rates, though the relationship between bond prices and stock prices is more complex than that as bonds are usually supposed to be a safe haven for investors during a stocks bear market. Instead bond investors have got hit far worse than stock investors which isn't surprising given out of control inflation. The only reason bonds held up for as long as they did was because of the Fed BUYING US bonds to monetize government debt which apparently the Fed has now stopped doing for the time being hence falling bond prices.

AI STOCKS PORTFOLIO NAME OF THE GAME

What's the name of the game?

Answer - To gain exposure to the Quantum AI tech stocks that are on an exponential trend trajectory. That is the name of the game, where today's 50% deviations form the highs in the likes of Nvidia and AMD will become invisible blips on the long-term charts in a few short years time. Though how many investors will be able to hold on for the big pay off? I suspect not many given that today's platforms induce a trader mindset in investors which is how the platforms have been designed to drum up lots of small commissions be it IKBR's 35 cents per trade or Free Trades 0.45% F/X fee. So I know what's going to happen after stocks have bottomed and start to rocket higher say by 30% to 50% many will start asking is it now time to sell? As they think they will be able to trade in and out of corrections.

Last year I made the mistake of selling too much! Selling 80% of my holdings was too much, yes a bear market was highly probable but one does not know for sure until it actually materialises and to what degree. Back when Nvidia was flying high as a kite above $300, writing that I expected it to fall to below $200 and possibly as low as $140 does not mean it was definitely going to happen until it actually happens!

AND THEN when itt did happen i.e. I saw Nvidia trade down to $154 one starts finding reasons for ever lower price targets to buy at which is the nature of bear markets where the bottom is always perceived as being so many points and months further away. Could Nvidia get to $100 a share? YES I cam make a strong case for that happening however that does not mean it WILL happen which is the risk one carries of failing to gain exposure.

In the midst of a bear market where one to's and fro's between scaling in and out, one is constantly bombarded with ever worsening fundamental data, it's as though the bear market GENERATES bad news and so it can be easy to forget the name of the game which is to ACCUMULATE EXPOSURE at deep discounts to the highs. Instead I see investors exiting their positions at 'break even' with a view to buying at a lower price as though it will be a done deal. That is a recipe for investing disaster!. As the bear market in Quantum AI tech stocks is living on borrowed time and the worst thing one can do is to see the bear market coming and then FAIL to capitalise upon it because one forgot the name of the game!

So whilst we continue to play a cat and mouse game with the stocks bear market do not make the mistake of forgetting the NAME OF THE GAME!

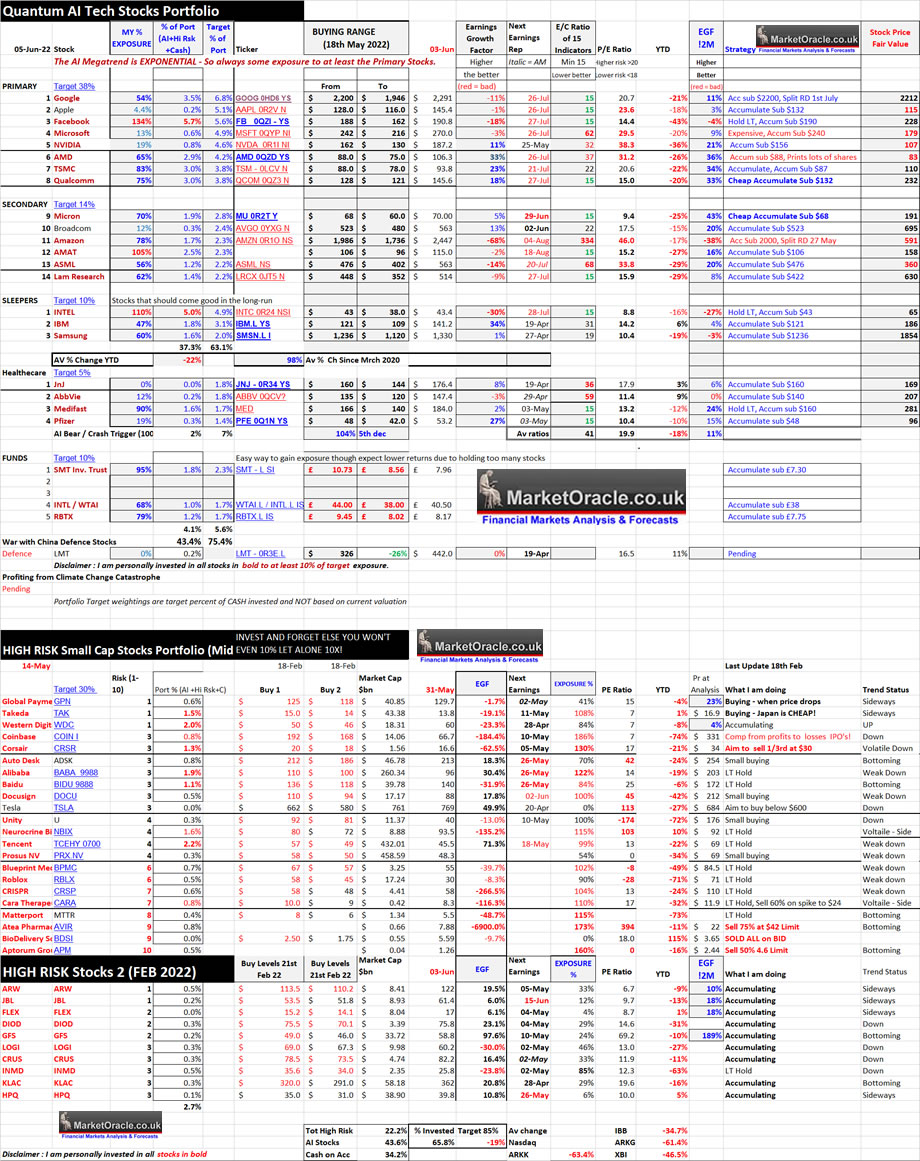

My portfolio currently stands at 65.8% invested. AI stocks 43.6%, high risk 22.2% and cash 34.2% so little changed from my last update. I have increased my max exposure targets for most of the AI tech stocks by about 5% to 10% hence drops in My % Exposure. Primary mechanism for determining accumulating and distributing are valuations. Where the current metrics used to determine valuations are the P/E, EC, EGF, EGF12M, and Fair value within the context of the underlying Quantum AI mega-trend. Supplemented by overall market technical and fundamental studies and several machine learning projects. Coupled with understanding to some degree of the nature of each corporations business activities which resolves in a portfolio with a high probability for exceeding the indices as has been the case since the portfolios public inception some 7 years ago (2016), with the original 6 stocks remaining constant.

Table Big Image - https://www.marketoracle.co.uk/images/2022/Jun/AI-stocks-and-high-riskportfolio-big.jpg

AI stocks Table explained

The fundamentals for stocks CHANGE to varying degree following each earnings report, hence volatile price action around earnings reports. So one needs to keep upto speed on both the direction of travel and changes in the companies fundamentals.

P/E Ratio - The starting point is the the P/E ratio which is calculated by dividing the share price by the sum of the last 4 reported quarterly earnings per share which is readily available, though different sites use GAAP or non GAAP EPS, my preference is for non GAAP. Higher the PE the more expensive a stock, so the simple aim is to buy stocks for as low a PE as possible, but on it's own the PE is very limited.

Buying Range - High probability range for stocks to trade within to accumulate which replaces buying levels as what one buys at what level is determined by ones existing exposure i.e. if one has no exposure then one would accumulate towards the top of the range and then scale in should prices continue to decline down towards the bottom of the range.

Earnings Growth Factor (EGF) - Gives an indication of the direction of travel of earnings where the higher the positive percentage the better. Whilst a negative EGF warns of contracting earnings which should command a LOW P/E ratio to justify accumulation. EGF is calculated by dividing share price by latest EPS X4 then divided by current P/E ratio -1 for example (2X2)=4, 100/4 = 25, Current P/E 30, thus 30/25-1 = EGF +20%.

E/C Ratio - A formulae encompassing 15 inputs such as Price to Book, Price to Sales, P/E etc to better determine which stocks are cheap or expensive in relative terms where 15 is the minimum reading.

EGF12M - Similar to the EGF, however instead of the current quarter EPS X4 I am,using my own estimated EPS for the next 12 months to arrive at the EGF12M percent, as an indication of how strongly a stocks earnings could grow over the next 12 months.

Stock Price Fair Value - Based on the current PE ratio divided by the fair value PE ./ Ratio which is usually 18 for most stocks that is adjusted by the 12M EGF. i.e. Google PE 19.8 divided by (18* EGF12M) = 20 = 1 X share price $2186 = 2212. So one wants to buy a stock for as well below the fair value as possible, whilst buying above the fair value one is over paying to some degree for exposure to a stock. Note it is not a price target but an indicator of how cheap a stock price is compared to future earnings expectations.

MY % Exposure - Is how much I have invested in a stock as percent of the target amount i.e. if my target for a stock is £10k, and I have invested £5k then the exposure is 50%.

Port % (AI +Hi Risk+Cash) - My holding in each stock as a percent of AI stocks + High Risk stocks + Cash on account. So basically my public portfolio

Target % of - Is my target percent of portfolio (AI+ High risk + Cash).

BEST BUYS ( In order)

QAULCOM $145.6 - Stands out head and shoulders above the rest. P/E 15, EGF +18%, EC 15, EGF12M +33%, that resolves to a Fair value price of $232, with the current stock price at just $145.6 and thus remains at the top of my list to accumulate during the bear market.

MICRON $68.9 - P/E 9.3, EGF +5%, EC 15, EGF12M +43%, Fair value $191! No it's not going to get to $191 over the next 12 months but it does suggest that there is a very high probability of Micron trading to new all time high within the next 12months, that is unless the fundamentals change to a great extent over the coming quarters.

PFIZER - $53.2, fund managers continue to rotate into the healthcare sector. P/E 10.4, EGF +27%, EC 15, EGF12M +15%, Fair value $96! Despite the bear market Pfizer has yet to make a lower low which suggests it could be gearing up for a breakout higher.

MEDIFAST - $184 - P/E 13.2, EGF +2%, EC 15, EGF12M +24%, Fair value $191! No it's not going to get to $281. Whilst the stock has been trending lower since the start of the bear market. however the low PE has prevented any significant decline, hence my exposure stands at 90% as each time the stock dips it soon reverses higher back into the $163 to $196 trading range pending a breakout higher. Still given that we are in a bear market and MED has made new lows then there does remain a chance of a spike lower to under $150 towards $140, though I suspect it would prove to be short lived.

TSMC $93.8 - P/E 20.6, EGF +23%, EC 22, EGF12M +34%, Fair value $110. Trading near 20% below fair value, TSMC is in a downtrend so is tracking the bear market lower, which suggests a break below $86 would target $79. My exposure stands at 83%, where I next eye accumulation below $86, and some trimming at around $107 should the opportunity arise.

Broadcom $563 - P/E 17.5, EGF +5%, EC 22, EGF12M +20%, Fair value $695. AVGO posted good earnings which improved it's E/C rating making the stock more appealing to accumulate in the target buying zone of $526 to $480. So far each spike lower to $513 has been met with heavy buying that usually keeps the stock within a tight range of $554 to $610 as the fundamentals continue to improve with each earnings report. My current exposure is just 12% as I continue to await AVGO's next attempt to break lower into the target buy zone of $523 to $480.

AMAT $115 - P/E 15.2, EGF -2%, EC 15, EGF12M +16%, Fair value $158. A case of mission accomplished, 105% invested. The stock is in a downtrend inline with the bear market, so there is a good chance AMAT could see new lows along with the S&P to below $100 where I would seek to add more. In terms of reducing exposure I would need to see something like $140, though the chances of that happening during a bear market are pretty slim. anyway I will continue to add to AMAT on NEW LOWS for the long-ruin.

TARGET STOCKS

NVIDIA $187 - P/E 38.3, EGF +11%, EC 32 , EGF12M +21%, Fair Value $107. The stock hit a new bear market low on earnings of $154. Whilst the upside looks limited to $226 during this bear market rally/. Ultimately I still see Nvidia heading to below $140 for that big bear market accumulation opportunity with heavy support along $130 which should prove sticky and below that lies $116. Currently I am 19% invested, which is too little so I remain eager to buy a lot more on the next dip.

APPLE $145.4 - P/E 26.6, EGF -1%, EC 15 , EGF12M +3%, Fair Value $115. Apple has had a strong bounce off $133, so it looks like there are a lot of fund managers eager to FOMO into this stock that and it buys back a lot of it's shares. The fundamentals are mot that good so I am not in any rush to over pay and I am prepared to give this stock a miss if it fails to fall to well below $130.

AMD $106.35 - P/E 31.2, EGF 33%, EC 37 , EGF12M +36%, Fair Value $83. AMD has very strong growth fundamentals, the only real problem with this company is that they keep printing a boat load of shares, virtually every quarter they print millions of new shares, Though the big jump for Q1 was down to takeover of Xilinx, though they still printed a good 50 million more shares than was necessary! Which is why the stock is down as much as it is and why it is so volatile because at least 1/4 of the drop in the share price is due to printing of new shares! So for this reason AMD is a stock that I do tend to scale in and out of where I aim to sell more at $110, $116, $123, $132 should the bear rally extend that far and THEN seek to accumulate once more at under $88. This is also why NEW bear market lows are probable, even $75 is achievable. My exposure is at 65% which will probably fall to below 60% if this rally has legs.

BRIEFLY

Amazon Stock has split current price is $122.35 vs $2447. Buying Zone is now $90 to $101. It's fundamentals are poor so upside is going to be limited until the fundamentals improve..

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent analysis -

- The REAL Stocks Bear Market of 2022

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 85%

- Global Housing / Investing Markets - 60%

- Stock Market Trend forecast into End 2022 - 0%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst contemplating a trip down to New Zealand.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.