UK Housing Market Analysis, Trend Forecast 2022 to 2025 - Part 2

Housing-Market / UK Housing Jun 30, 2022 - 09:39 PM GMTBy: Nadeem_Walayat

Dear Reader

This article is part 2 of 3 of my extensive analysis of the UK housing market that concludes in a detailed 3 year trend forecast for UK house prices (Part 1).

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent analysis -

- The REAL Stocks Bear Market of 2022

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

- AI Tech Stocks Name of the Game, Climate Change Housing Market Impact and the Next Empires

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

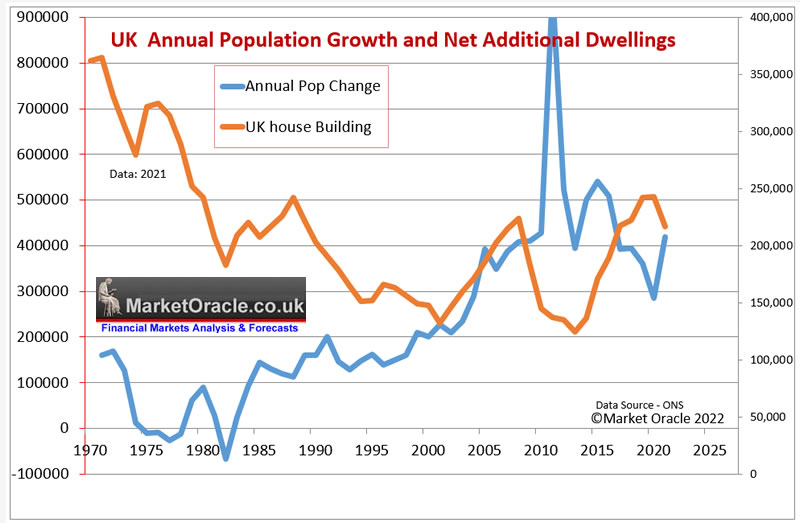

UK House Building and Population Growth Analysis

The below graph shows the UK annual population change against annual net additional dwellings which includes completed new builds.

The graph illustrates a major long-term shift took place in UK housing market dynamics by 2000 as the annual increase in the UK population started to surge higher well beyond the normal dynamics of the system that had typically seen average population growth of about 100k per annum, capped at 200k per annum. Instead population growth soared far beyond the number of new house builds that ended the preceding trend for home construction to exceed population growth demands as the rate if house building fell from 364k per annum in 1970 to just 132k by 2000. Whilst at the same time the average size of the UK household had continued to shrink by falling from 3.1 in 1960 to just 2.2 in 2020 (one of the lowest in the world) as a consequence of the increase in single person households and single parent families. This ratio is only trending in one direction i.e. lower which means that even if the UK population suddenly stopped increasing then the falling ratio towards 2.15 by 2030 would imply demand for at least an EXTRA 1 million properties!

So by 2000 Britain was primed for the catastrophic consequences of a. under construction of new homes and b. a population explosion as a consequence of Tony Blair's Labour government opening the flood gates to allow millions of eastern European economic migrants (new Labour voters) to enter without regard to the impact on the infrastructure which resulted in net migration soaring from 50k per annum of the 1990's to a peak of 336k just prior to the 2016 EU referendum totaling some 5 million extra people to house.

And thus the twin forces of out of control immigration and under construction of new homes resulted in a worsening housing crisis that prompted the people of Britain to vote to LEAVE the European Union as Britain had gone from building over 200,000 homes per annum with net migration of less than 50k, a population increase of 100k per annum to building as few as 130,000 homes, with net migration of 250k+ with population growth of over 500,000 per annum and this IS why Britain voted to LEAVE the EU, a housing crisis some 16 years in the making for which blame squarely lies with Tony Blair's government.

Even the great pandemic failed to put much of a dent into migration flows, which still saw net migration of over 100,000, that post pandemic is likely to see a huge surge higher for evidence of which we only need look at Ukraine. Whilst net new dwellings have peaked and appear to be trending lower likely in response to government cutting incentives to build homes in attempts to cut back on spending post pandemic.

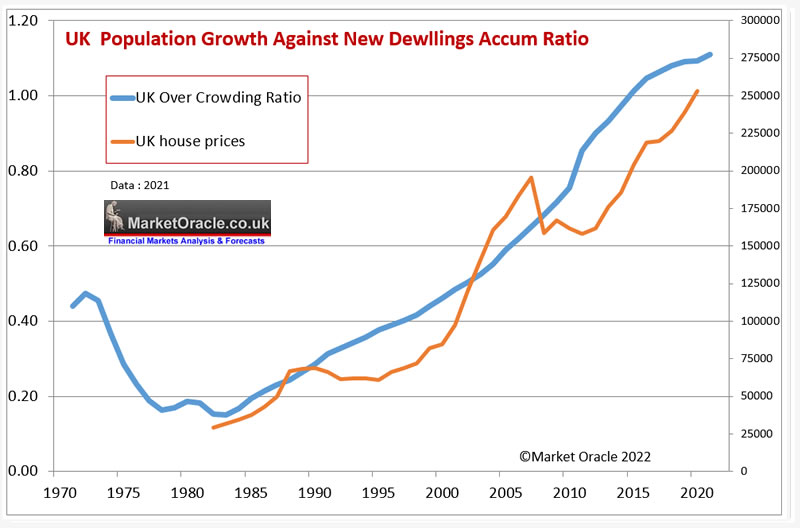

UK Over Crowding Ratio

The following is one of my custom UK housing market indicators that more clearly illustrates the degree of housing market crisis that Britain finds itself in as a ratio between the accumulative change in population since 1970 against the accumulative number of new completed house builds also since 1970 which shows the magnitude of the trend in over crowding of Britain's housing market that given recent mainstream press headlines based on academic studies clearly remain largely blind to the consequences of, because they still are unable to visualise the magnitude of Britain's housing crisis that has WORSENED since Britain voted to LEAVE the EU which should act as a warning to those who contemplate ever holding a second EU referendum, as it implies LEAVE would win by an even bigger margin next time!

The ratio illustrates the change in trend that started to take place during the mid 1980's that coincided with the Thatcher governments reversal of the policy for the construction of social housing and implementation of the right to buy scheme that resulted in the sale of millions of socially owned local council housing whilst at the same time putting restrictions on the the construction of new social housing. The Thatcherite measures were not just adopted out of spite for socialism, but instead was clearly as a result of academic government advisors looking in the rear view mirror at what had happened during the 1970's, namely the mass exodus of millions of Brit's who become economic migrants populating mainly North America and Australia and thus resulted in the over supply of UK housing.

This lack of insight of what was going to happen next laid the seeds for the property boom that began in the mid nineties as house prices responded to the lack of supply to meet new demand that has persisted since the mid 1980's. With Tony Blair's Labour government exacerbating the trend for the inability of supply to keep pace with population growth which ensured continuously persistent upward pressure on UK house prices that despite the great recession of 2008-2009 still showed an accelerating trend as new build supply that currently stands at 220k per year is set against government estimates for a requirement of at 300k per year, with 350k being a more realistic estimate to meet demand given the trend for falling household size, which thus ensures that the UK's over crowding crisis just keeps worsening with each passing year just as it has done or the past 20 years!

Remember the graph is a ratio of how over crowded Britain is, having gone from a ratio of 0.46 in 2000, when perhaps housing was largely affordable for Britain's hard working families with average house prices at £80k. To today's ratio of 1.11 (2021) that is worse than the previous years and thus average house prices are now £278k!

So I hope you now fully understand the true nature of Britains housing crisis and what the journalists and academics fail to see, hence their doom and gloom housing market crash is always coming headline stories in the mainstream press.

And this analysis does not even consider the fact that each year the total number of properties remaining empty continues to rise either as a consequence of being up for sale, let, legal issues or falling derelict. This total is now more than 1 million empty properties at any one time, a number which despite demand looks set to continue to rise as many of the derelict buildings will only come back on the market when they have been demolished and rebuilt, so erroneously counted as new builds when they should be classed as rebuilds.

Overcrowding Implications for UK House Prices

New build supply plays an important role in the housing market as it tends to average at approx 10% of the total number of annual transactions, which is more than enough to have a significant impact on the UK housing market especially as supply over recent decades has been consistently below that which is deemed necessary to meet the demands of an relentlessly increasing population which means that the UK housing market was never destined to replicate the housing busts of countries such as the United States or even closer to home of countries such as Spain, where that housing bust prompted many hundreds of thousands of British ex-pats to cut their losses and return to the UK, closely followed by unemployed Spanish and other PIIGS citizens seeking employment in a far more liberal and robust UK jobs market and thus introduce even greater demands on Britain's stressed housing market.

This suggests that the often put forward academic standards in terms of valuing housing market affordability ratios such as X3.5 salary towards the likely path for the UK house prices does not take into account of relentless new demand against lack of new supply to meet new demand that implies affordability ratios look set to continue to be pushed ever higher to new trend extremes, and therefore supports a long-term trend for rising UK house prices in real terms, i.e. expensive UK house prices look set to be here to stay for as long as the lack of new supply exists, especially as the UK population is expected to grow by at least another 5 million over the next 10 years and probably nearer 6 million which demands at least an extra 2.75 million homes to be built which is set against a realistic estimated construction of just 1.9 million new homes, near 1 million short! Which means Britain's over crowding housing crisis is going to get even worse and thus WILL act to drive house prices higher, despite the mainstream press mantra that house prices must fall because they are unaffordable!

The bottom line is Britain's over crowding ratio insures that no matter what arguments are put forward by academics that most people cannot afford to buy anymore so unsustainable house price rises must fall, instead the population growth fundamentals are such that their arguments just do not matter, the only thing that can effect this fundamental trend is if the UK literally doubles the number of houses built each year towards 400k, and even then it would probably not result in falling UK house prices but tend to index house prices to inflation. But of course that is not going to happen, the UK is not going to build anywhere near 300,000 homes per year let alone 400k, as the reality is that for most years UK house building will be short by as much as 100,000 completed new builds which will act to compound housing market demand vs supply pressures and thus exert further upward pressure on house prices with each passing year.

So this analysis continues to confirm that UK house prices on average will continue to rise for many more years. Until we start to see the over crowding ratio decline. Otherwise it acts like a coiled spring always primed to propel house prices into their next strong bull market just as the clueless mainstream media journalists proclaim that house prices are about to crash all because academics say they 'should' be falling. Where negative volatility in house prices in any given year is just going to prove to be temporary as the underlying fundamentals reassert themselves as we witnessed in the aftermath of the 2008-2011 bear market as house prices started to rise a wall of worry of why they would not rise due to a decade of stagnating wages when my housing crisis ratio clearly warned why house prices were about to enter a NEW bull market as my above graph at the time warned to expect.

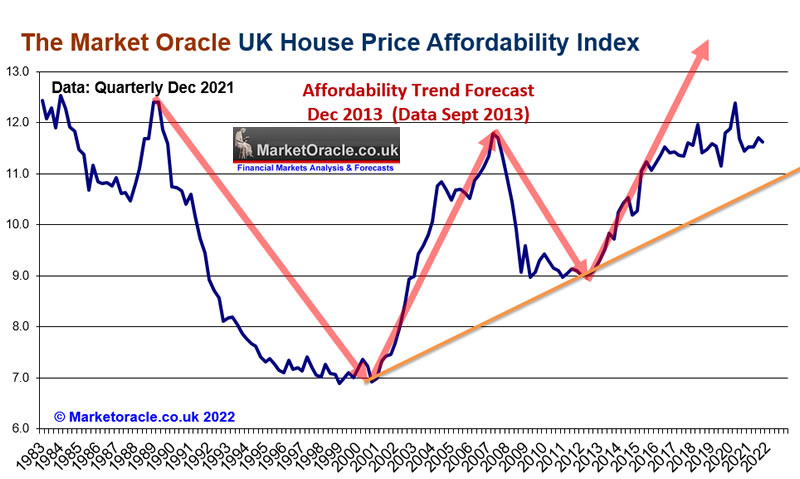

UK Housing Market Affordability

Most academic housing market commentators focus on the various measures of housing market affordability or rather unaffordability as house prices despite the price crash of 2008-2009 never fell to anywhere near the affordability levels of the early 1990's housing bear market lows and therefore ivory tower academics have continued to cling onto expectations that a further house prices crash is inevitable so as to fit in with their theoretical models of where house prices should fall to in terms of affordability that gets liberally regurgitated in the mainstream press, and looking at the graph below it is very easy to be seduced by something that on first glance appears obvious that house prices really did have a long way to fall to reach the affordability levels of the past.

Affordability Trend Forecast Feb 2008 - UK House Prices on Target for 15% Fall Despite Interest Rate Cuts

What the academics and mainstream press commentators fail to comprehend is TREND, or more precisely the TREND in AFFORDABILITY. The trend over the past 40 years has been for the proportion of household earnings spent on housing costs to rise from 20% 40 years ago to an average of 35% for Dec 2013, which is trending towards 50% by 2030. This is the big story that academics have missed as over time, decades in fact people are becoming conditioned to spend more and more of their earnings on housing costs as being the norm.

Affordability Forecast - Dec 2013

The reason why I expected affordability to trend ever higher again has its roots in the exponential inflation mega-trend as workers relentlessly face a loss of purchasing power of earnings and savings due to Inflation of the size of the population that is MOSTLY as a result of continuing out of control immigration as evidenced by the baby boom now underway mostly amongst migrant families of the past 15 years that acts to relentlessly put pressure on housing availability where annual construction (new builds) are not able to keep pace with even half of the new demand generated each year. Therefore workers have no choice but to commit an ever larger proportion of their earnings towards housing costs, the effect of which is that housing bear market affordability troughs are being ratcheted ever higher, which has left many academics confused as they remain fixated on their theoretical models that imply house prices must fall so as to return to affordability levels of past troughs as the real world trend passes them and their models by.

The Sept 2015 update showed the underlying relentless trend of affordability being once more ratcheted higher that looked set to soon breach the 2007 peak.

Whilst the current state has prices hitting the affordability buffer which means to expect a moderation in UK house price inflation i.e. I can't see how we are going to get a mania when house prices are this unaffordable, more likely is a measured bull run.

.

In my opinion I think it is inevitable that eventually the government will be forced to build a series of new towns that will grow into major new cities that should be announced over the coming years, which whilst encouraging economic growth will however also encourage further mass immigration, so even a series of new towns and cities may only make a marginal short-term difference to UK housing market affordability ratios.

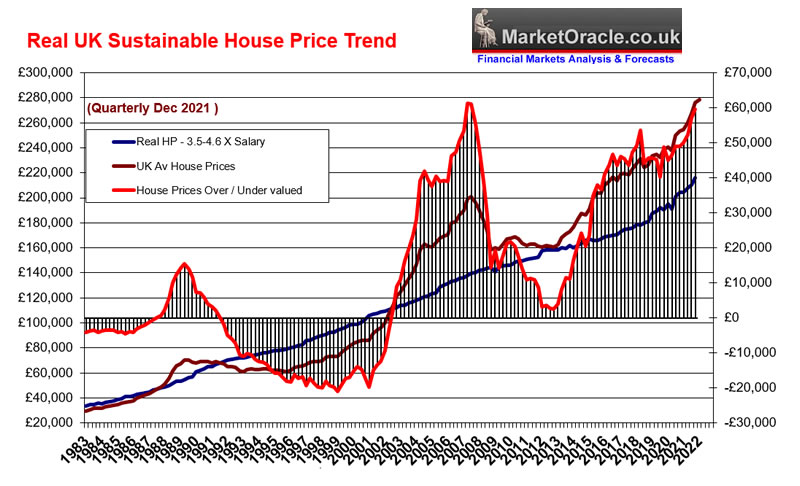

UK House Prices Real Terms Sustainable Trend

Continuing with the affordability theme the real terms sustainable house prices trend metric uses a souped up version of the oft mentioned average earnings X 3.5 ratio, where the X3.5 ratio has been defective since the 1980's instead the relentless trend puts the ratio currently at about 4.5X average earnings which resolves in the following trend graph.

UK house prices are now just as over extended as they were at the peak of the 2007 housing mania bull market, though this run has been achieved without a mania. The graph also shows why 2012 and 2013 were the best times to buy properties in the UK for decades and hence why during that period I went from zero exposure to about 70% by the end of 2013. The graph also shows the mother of all buying opportunities that persisted for many years during most of the 1990's which WAS THE TIME TO ACCUMULATE PROPERTIES! Where one could literally have picked up a mansion for 1/10th that which they sell for today!

As for today, well the trend on this graph will eventually exceed that of the 2007 high when I presume we will be entering the next mania. So whilst house prices are expensive, however as the 2000's bull run shows, when manias take hold they tend to soar beyond that which anyone can imagine and we have yet to reach that phase of the current housing bull market. For now UK house prices will continue to trundle higher in advance of the next mania.

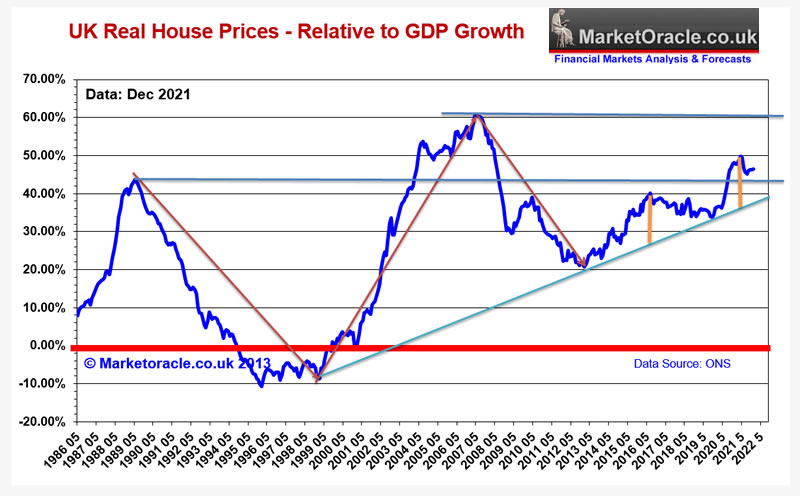

UK House Prices Relative to GDP Growth

This graph shows that following Brexit UK house prices consolidated in GDP terms for a number of years towards trend before the current blast higher driven by the governments maniac pandemic spending binge .However, house prices are NOT that distant from trend so unless there IS a significant recession around the corner, this graph suggests the bull market has plenty of scope to continue trending higher for many years.

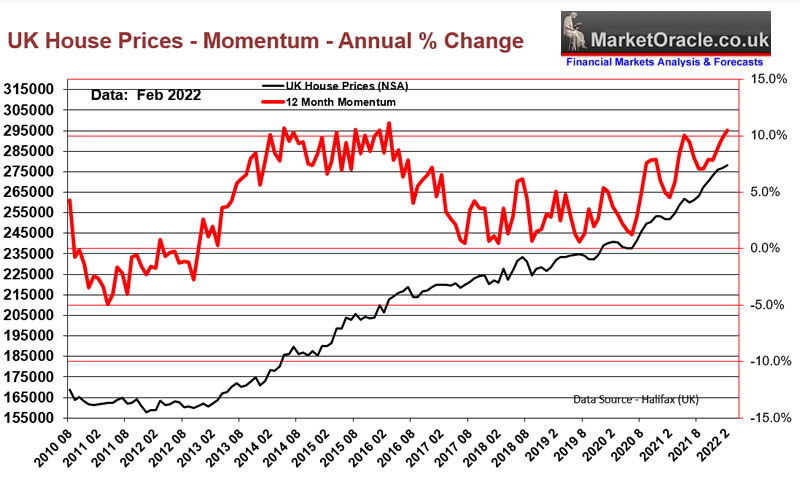

UK House Prices Momentum Forecast

UK house prices momentum soared to over 10% per annum after the bull market broke out of it's 0% to 5% momentum range that it had been in for most of the 2010's. Instead it looks likely the UK is entering into a 10% to 7% momentum range which suggest to continue to expect year on year gains for several more YEARs in the range of 10% to 6%! Yes we will get corrections i.e. 2 or 3 months of mildly falling prices that I am sure will have the perma bears crowing of top being in and a crash just around the corner, but this bull market is far from done and momentum suggests to expect strong house price inflation for at least the next 3 years.

So house prices momentum is expected to moderate down to around +6% to +7% from the current + 10.5%. However at best all we may get in terms of an actual house prices drop is maybe a percent drop from the high. The risk is that UK house prices fall back into the 0% to 5% momentum range which would imply UK house prices basically flat lining for about a year before resuming the uptrend, Nevertheless downside looks very limited with the ultimate direction of travel being higher.

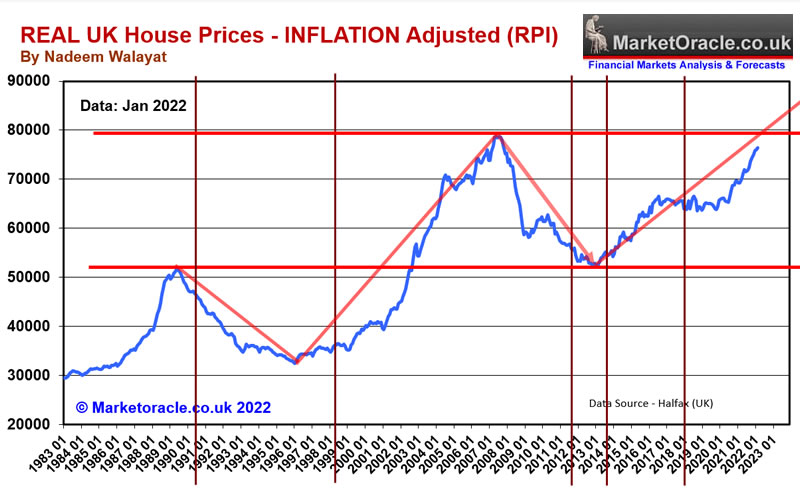

UK House Prices and the Inflation Mega-trend

UK house prices have soared into the stratosphere! Or have they? Not really, not in real terms anyway (RPI). However they are approaching the resistance of 2000's bull market high which could result in a consolidation of sorts. After all if I can see house prices in real terms hitting the buffers then so will be the expedience of most market participants where they are unable to finance property purchases at such extremes.

However, before you all start hoping for a TOP note what happened the last time UK house prices crossed the previous real terms high, Yep they just kept rising. If this bull market followed the script of the last bull market then we have yet to reach the half way mark! We have yet to have the bull market mania. So real terms house prices implies that this bull market is probably only at the half way mark in terns of price and at about the 2/3rds nark in terms of time i.e. the bull market may run for ANOTHER 5 YEARS before we see something akin to a bear market. Now don't take this as a forecast rather an observation as a 5 year forward forecast would be pushing the envelope too far into the mists of time. But those waiting for lower prices to buy should heed the direction of travel of the sum of this analysis which is failing to resolve in anything that suggests lower prices of any significance, If you think UK house prices are expensive today then you are likely going to be pulling your hair out and be found screaming into the mirror during the probable coming mania phase.

Therefore stubbornly high real inflation will continue to put upwards pressure on nominal house prices in line with RPLIE and CPILIE i.e. if CPILIE hits 10% then that is the degree of upwards pressure on house prices. Of course there are also negative drivers such as if unemployment started to rise or the economy started to contract still there is a huge difference between a 10% inflation rate than say a 2% inflation in terms of impact on nominal house prices.

Lets Get Jiggy With UK INTEREST RATES

There have been so many interest rate hike false dawns over the past decade that one has become skeptical that this time could be different, and YES THIS TIME COULD REALLY BE DIFFERENT DUE TO OUT OF CONTORL INFLATION that worries the CENTRAL BANKS for they understand that it risks igniting the wage price spiral which once it takes hold is not easily brought back under control, hence there is a very high probability of high inflation for a decade because the central banks will not do what needs to be done! FORGET THE NOISE ABOUT Interest rates soaring to ridiculous levels for Central banks know their banking crime syndicate brethren would go BUST! Instead rates will rise but NOT to the level needed i.e. to ABOVE the rate of INFLATION. The UK base Interest rate to control inflation would need to be ABOVE the rate of Inflation i.e. at about 10%! which is clearly not going to happen! Not even to HALF that level, and probably not even to 1/4 of that level, 2% is what the Bank of England is targeting! Whilst INFLATION rages to 10%! That is not going to cool inflation OR the HOUSING MARKET!

The Bank of England is targeting a joke interest rate of just 2%. For UK Interest rates to have any significant impact on the UK housing market the base rate would need to be above 5%, and even then the impact would be relatively mind. People are NOT STUPID! They understand Inflation of 10% vs a Mortgage rate of say 4% is a NO BRAINER i.e. BORROW to the HILT and let inflation do it's MAGIC!

Today's typical UK mortgage rate is 4% which is NEGTAIVE 4.5% against RPI of 8.5%! IT'S A NO BRAINER! Fixed for as long as 10 years! Whilst Americans have it THREE times better for they get to fix their mortgages at even better rates for 30 years! What are you waiting for? The seller to drop his asking price by 10%? Fat chance of that happening! Will Smith needs to give every procrastinating UK home buyer a slap!

You had the whole of 2020, and the whole of 2021 and STILL sat twiddling your thumbs all whilst you have sleep walked into 1970's inflation 2.0! Please note this is not financial advice to buy a house, instead this is Will Smith SLAP IN THE FACE to STOP WASTING TIME THAT YOU CAN NOT GET BACK!

The bottom line is UK interest rates rising to 2% to fight inflation of 8.5% is like a fireman using a water pistol to put out the towering inferno. Still it gives savers who do not understand that inflation is stealing the real terms value of their life time savings to earn 2% pittance interest before TAX! What a CON! People work hard, save some money that gets stolen by the government via the inflation stealth theft tax as they ponder whether they should buy a house or not (shaking my head). Put your savings in the bank for 10 years or burn it all today the net result is near the SAME!

I remember fixing bonds in October 2008 at 7.2% for 3 years when CPLIE was around 5%. The good old days that have yet to return. As once upon a time CASH WAS KING! You could park most of your money in cash in fixed rate bonds safe in the knowledge that the rates would keep pace with the likes of RPI, but then the Bank of England bailed them out, stuffed them full of QE money, and so Banks no longer needed cash from savers, hence the collapse in savings interest rates which since have NEVER kept pace with inflation.

A blast from the past - 7th Oct 2008 : UK Interest Rate Forecast 2009

What can Savers and Investors do ?

Savers - To reiterate what I have been saying over the last 6 months, savers still have a a golden opportunity to lock in high fixed savings rates which in the UK are above 7% . These rates won't stay around for much longer, were talking perhaps in the days rather than weeks or months. So the time for action is now ! - Yes, banks can go bankrupt but savings are protected which includes accumulated interest. In the UK the protection is for the first £50k per banking group.

So when you look at the breakdown of my assets and see that I currently hold what looks like a large amount of cash at 30% of my total assets, however just over 10 years ago my total cash holdings were as high as 80%! There was a time when CASH really was KING! Instead since despite volatility and transaction costs HOUSING is KING, and to a lesser degree stocks, CASH IS POOP! Hence why I am seeking to expand my exposure to stocks despite the fact that we are in a bear market and I am likely accumulating some distance from where stocks will finally bottom, at least stocks give me a fighting chance of keeping pace with inflation, whilst holding cash is a guaranteed LOSS. Yes I could buy another property, and probably will do so if an opportunity presents itself, but it truly is a time wasting exercise to do so as every prospective home buyer well understands.

Understand this there is plenty of upside to interest rates for NORMAL RATES equate to rates at WELL ABOVE CPLIE which translates into a UK Base rate that should be rising to about 9%! Of course that is not going to happen! Hence the housing bull market will continue whilst the Banking crime syndicate continues to suckle at the teat of the Bank of England.

The rest of this extensive analysis was first made available to patrons who support my work.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent analysis -

- The REAL Stocks Bear Market of 2022

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

- AI Tech Stocks Name of the Game, Climate Change Housing Market Impact and the Next Empires

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 85%

- Global Housing / Investing Markets - 60%

- Stock Market Trend forecast into End 2022 - 0%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buy the dips in AI tech stocks analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.