Who (or What) Is Really in Charge of Bitcoin's Price Swings?

Currencies / Bitcoin Jun 25, 2022 - 10:44 PM GMTBy: EWI

Bitcoin lost three-quarters of its value since November. "Market fundamentals" have lost control of its trend. But something else has been at the wheel the whole time.

I'm not ashamed to admit I have the technological intelligence of an Eggo waffle. So, when my computer bugged out the other day, I called the IT department at work. The tech wizard on the other end showed me to a webpage where I had to click a box that read: "Consent to Control." From that point, the IT guy was able to hack into my laptop, find the source of the glitch, and remedy the problem.

As I sat there watching my cursor move around the monitor on its own, clicking tab after tab as if by some phantomlike force, I thought,

"Holy moly, this is the virtual screenshare of mainstream financial wisdom."

Summarized as such: External forces known as "market fundamentals" operate prices remotely. Positive fundamentals cause the price "cursor" to rise, while negative news and events trigger selloffs. And investors? They have little choice but to "consent" to this outside control.

At least, that's how it's supposed to work.

In reality, however, this news-driven model of market behavior is far from perfect. Markets regularly ignore their "fundamentals" like a Kardashian to the hired help -- and move completely opposite them.

Take, for instance, a little-known (if you were born yesterday) cryptocurrency called Bitcoin. Last October-early November, Bitcoin had clocked a meteoric rise to record highs. And, according to the popular pundits, the "fundamentals" controlling Bitcoin were pointing up, up and away!

Here, these news items from the time recapture the rose-colored Bitcoin glasses:

Safer than the ultimate safe haven, from Republic World on October 12:

"Investors Preferring Bitcoin Over Gold As Better Hedge Against Inflation: JP Morgan Chase."

"Bitcoin's ability to rally despite China's ban on crypto transactions signifies 'one of the most bullish signals ever'

"Nearly 50% of the computing power (called hash rate) of the bitcoin blockchain, pulled the plug, packed up, and relocated to another country in a few months. And no one noticed! It signals an incredibly resilient system."

From MarketWatch on October 18:

"Everything is about to start breaking out now and we've seen it before. We know the pattern...this October, November, December, January, February, March is going to be the point where it's almost impossible to lose money by owning anything."

And, from CNBC on November 1, one crypto expert lists a bevy of bullish forces -- "a super progressive administration," "regularity clarity," "support from Congress," "Bitcoin mining moving to the U.S.," and "passed fears around the China crackdown" -- set to buoy Bitcoin... indefinitely!

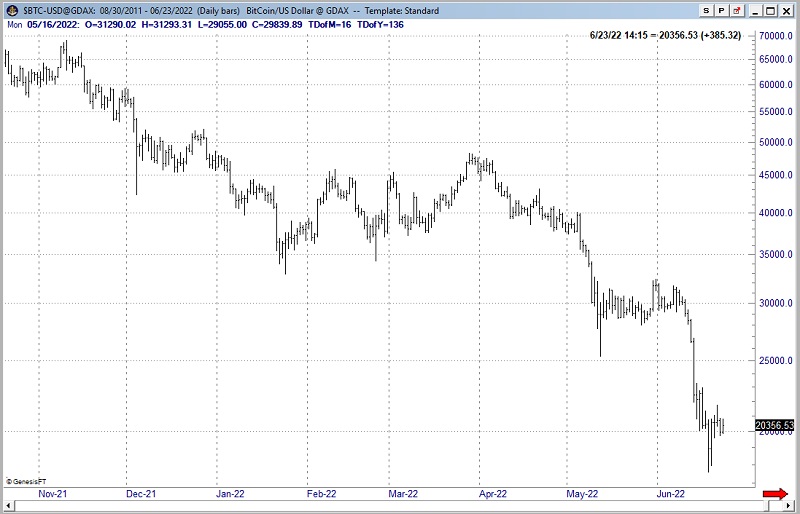

And yet, despite the most bullish fundamental signals in Bitcoin's history and the "impossibility" of loss -- the crypto plummeted 74.5% from its intraday high of 69000 on November 10, to its intraday low of 17,567.45 on June 19.

How come?

Here's the answer: Despite what mainstream experts might say, "fundamentals" did NOT lose control over Bitcoin. They never had that control to begin with.

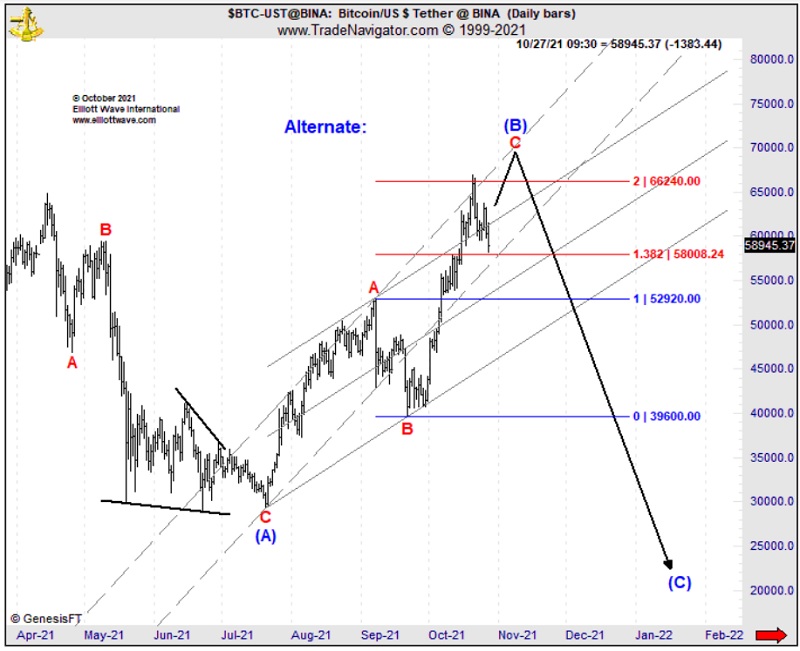

The Elliott Wave Principle offers this answer for what did: investor psychology, which unfolds as Elliott wave patterns directly on market price charts. And, on October 27, 2021, our Trader's Classroom presented a special video episode on Bitcoin. In it, editor Jeffrey Kennedy was able to label price action as a very mature B wave rally of a larger expanded flat.

Meaning, the stage was set for an imminent crash. From Jeffrey's analysis on October 27:

"Under this scenario, we may push a bit higher here and have one more run up to the $70,000 handle. And at that point, going from near $70, we're ready for a $50,000 a dollar drop all the way back to $20,000 a coin."

"This wave count fits and adheres to all the rules and guidelines of the Wave Principle."

This next chart captures what followed: Bitcoin did push up one more time to its November 10 peak, and then proceeded to collapse below $20K area as Jeffrey's bearish analysis anticipated.

Right now, there is no market sector more volatile than cryptocurrencies. In Jeffrey Kennedy's own words: "You're swimming with sharks here and you need to be able to assume and be okay with massive risk when you play the space."

Join two seasoned instructors on June 28 at 11 AM Eastern/NY time for a hands-on 1-hour lesson on how to spot Elliott wave setups in cryptos -- and how to capitalize on them. After just 1 hour, come away equipped to spot and execute crypto wave setups far better than before. Grab your free seat now.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.