Why I’m buying the “new” value stocks…

Companies / Investing 2022 Jun 17, 2022 - 03:45 PM GMTBy: Stephen_McBride

It’s been a rough six months for tech stocks…

Amazon, Google, and Facebook are suffering their worst stock performance in years…

Some of these names have sold off so hard they’re now among the cheapest stocks on the market.

And that’s presenting a HUGE buying opportunity for you and me.

More on that in a moment…

- But first, do you know the two words that made superinvestor Warren Buffett rich?…

Value investing.

Buffett became the world’s wealthiest investor by hunting for bargains in the stock market.

He buys businesses trading for less than what he believes they’re really worth. Then he often holds them for decades… watching cashflow grow and the stock price appreciate.

This is classic value investing.

Buying undervalued businesses seems like a can’t-lose strategy…

However, value investing has been the laughingstock of the investing world over the past decade.

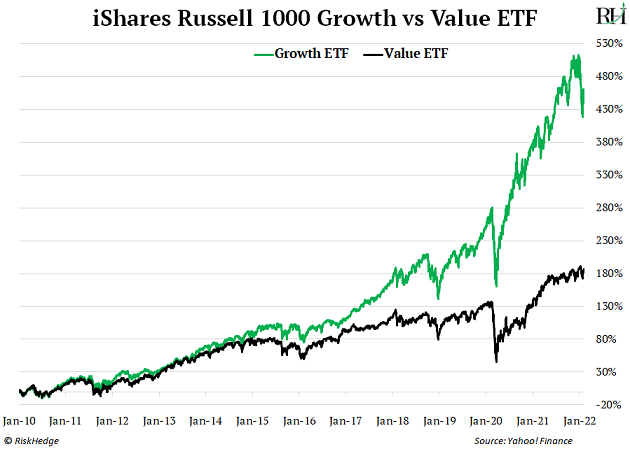

You can split the stock market in two.

On one side you have “value” stocks—cheap, undervalued companies.

“Growth” stocks are the other half of this equation. Think fast-growing tech companies that are usually expensive based on earnings. Often, they don’t have earnings at all.

You can see growth stocks (green line) have pummeled value stocks over the past decade:

But zoom in on this year…

- Value stocks are having a renaissance in 2022.

According to Wall Street Journal, value stocks are beating growth stocks by the most since 2000.

One of my favorite “screens” is the best-performing stocks, year-to-date. While these recent winners aren’t necessarily good investments… it’s useful to know which stocks are hot and which ones are aren’t.

I ran the screen recently… and value stocks are dominating the list.

Specifically, companies that produce oil are some of the cheapest stocks on the market. The 40 best-performing stocks since January include: 38 oil and gas producers, a lithium miner, and a company making fertilizer.

Why are we seeing a huge shift away from tech stocks, toward “old economy” companies?

One word: inflation.

Inflation recently hit 40-year highs. Everywhere you look, prices are shooting up. Our hard-earned dollars don’t go as far as they did five years ago.

Without getting too into the weeds, cheap value stocks typically perform better during periods of rising prices.

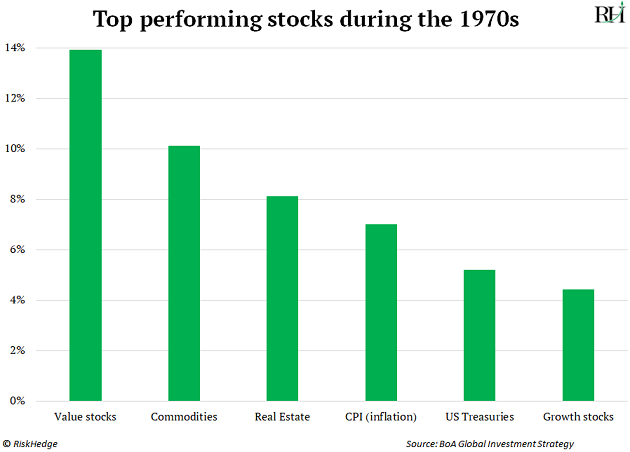

Take the inflationary 1970s for example. Value stocks beat growth stocks by 10% per year for an entire decade. As you can see below, value stocks were the best performing major investment class of the 1970s. And growth stocks were the worst.

After a decade out in the cold, value stocks are back on top.

Have you looked at oil giant Exxon Mobil’s chart lately? It’s surged 50% since January.

Source: StockCharts

- Let me introduce you to the new value stocks.

Value investors love a good deal.

They’re always hunting for cheap, undervalued businesses.

Every value index and fund are jammed with oil producers, banks, insurance companies, and consumer staples stocks like Walmart.

But a real value investor wouldn’t touch these names today…

Instead, they’re buying the “new” value stocks: big tech firms.

Remember, Amazon, Google, and Facebook are down 39%, 26%, and 50%. These stocks are usually lumped into the “growth” bucket.

But these fast-growing tech stocks are now cheaper than many value-investing darlings.

Facebook and Google are selling for their lowest valuations in history. As of last week, when measured by free cash flow, they’re now trading at a lower valuation than Coca-Cola, a 120-year-old soda maker that barely grows.

Same goes for ASML too. Longtime readers know ASML is the world’s most-important company. It’s the only company on the planet that makes the machine capable of producing the world’s fastest computer chips.

ASML grew sales 33% last year and produced record amounts of profits. Yet when measured by free cash flow, its stock is now cheaper than Johnson & Johnson… a company making Tylenol, shampoo, and band aids!

Big tech stocks have become the new value stocks.

Not only are these fast-growing businesses trading near their lowest valuations ever… they’re now cheaper than century-old companies that barely grow!

Some of these names have gotten so cheap we’ll likely see them move from a growth index to a value index later this month.

- Fast-growing tech stocks rarely get this cheap.

You don’t get an opportunity like this often. It’s only happened a few times in history, and it’s usually a great time to put money to work.

Don’t get me wrong… not all tech stocks are cheap. There was a lot of froth in the market that needed to be washed out. In November, Rivian, an electric truck maker with only $1 million in sales, was valued at $150 billion. That’s crazy.

But that was then. Now, we’ve swung from one extreme to the other. Many of the world’s best businesses got clobbered and are now cheaper than they’ve ever been.

Armed with this knowledge, ask yourself: Is this the time to buy or sell?

History shows us it pays to buy great businesses when they’re cheap. We have one of those opportunities again today.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.