UK House Prices Trend Forecast 2022 to 2025 - Part 1

Housing-Market / UK Housing May 31, 2022 - 03:24 PM GMTBy: Nadeem_Walayat

Dear Reader

This article is part 1 of my extensive analysis of the UK housing market that concludes in a detailed 3 year trend forecast.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My recent analysis also includes -

- Everyone and their Grandma is Expecting a Big Stocks Bear Market Rally

- AI Tech Stocks Current State, Is AMAZON a Dying Tech Giant?

- The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential

- Why APPLE Could CRASH the Stock Market!

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

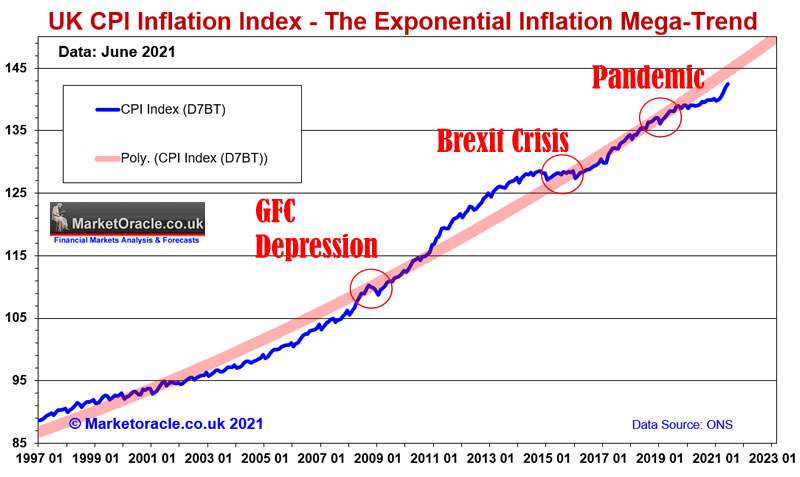

THE INFLATION MEGA-TREND

Inflation has soared to a 30+ year high even on the highly manipulated CPLIE measure resulting in the biggest fall in living standards since records began for the UK and probably similar for US and most western households who are in for a deep real terms drop in disposable income during 2022, with the UK set for an eye watering record plunge of over £2200 per household. Which if you remained focused on the mainstream press then you would not have seen any of it coming having been hoodwinked for the whole of 2021 by the central bank mantra of 'transient inflation' which as I repeatedly warned would turn out to be PERMANENT. However the con merchants are now playing the blame everything on Russia game, as if inflation and all of the West woes were none existant until Putin delusionally marched his amateur army into Ukraine having believed his own lies echoed by his YES Men ensuring him that victory would come within days of invasion.

So firstly understand this what you hear in the mainstream press is ECONOMIC PROPAGANDA, not only that but ECONOMICs is PSUEDO SCIENCE, it's purpose is to fool and keep the masses sedated, a slight of hand to present x to be true when the reality is y. And the underlying reality has remained CONSTANT as I WROTE in my Inflation mega-trend ebook of January 2010! that of an exponential inflation mega-trend courtesy of government and central bank rampant money printing and for the duration since NOTHIING HAS CHANGED! ABSOLUTELY NOTHING!

http://www.marketoracle.co.uk/pdf/The_Inflation_Mega-Trend_Nadeem_Walayat.pdf

WE STILL HAVE THE SAME PERMA DEFLATION CLOWNS WITH THEIR ALWAYS IMMINENT DEFLATION DEPRESSION acting to cloud peoples judgment into continuously making huge blunders due to the fear of falling prices which has NEVER BEEN THE PRIMARY DIRECTION OF TRAVEL! Instead the stealth inflation theft tax has stolen the value of peoples life time savings and purchasing power of earnings.

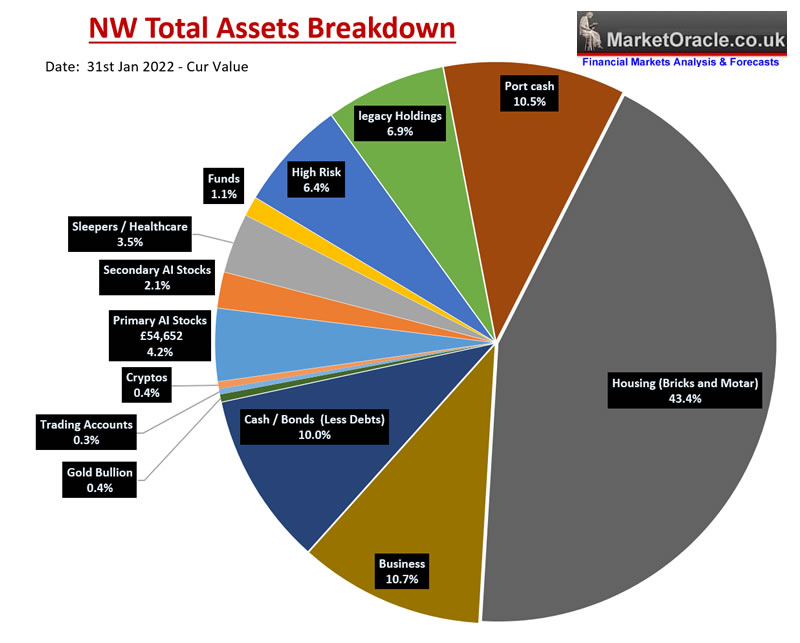

So what does one do when faced with rampant out of control inflation that is fast eroding the purchasing power of earnings and savings, well there has only ever been one answer which is to invest in assets that are leveraged to inflation such as Quantum AI stocks, bricks and mortar properties and commodities, And I am NOT saying this with with the benefit of hindsight for this has been my message right since the last peak of the CLOWNS DEFLATIONARY DEPRESSION IS COMING MANTRA during March 2020 INSTEAD as I VOICED at the the time RAMPANT CENTRAL BANK MONEY PRINTING implies to expect the EXACT OPPOSITE of what the clueless Mainstream press were reporting to expect all on the basis of the PSEUDO SCIENCE OF ECONOMIC PROPAGANDA!

Coronavirus Dow Stocks Bear Market - March and April 2020 Trend Forecast

So instead of a deflationary depression now with the benefit of hindsight some 2 YEARS on most recognise that rampant central bank money printing has resulted in out of control inflation though what have the clowns been focused on since ? WHEN INFLATION WILL PEAK! We'll as I have been stating for a good 6 months now, HIGH INFLATION is probably going to be with us for the REMAINDER OF THIS DECADE! Yes we may get temporary dips, but even on the fake CPLIE inflation measure, average inflation is going to stay persistently high, well above the 2% in 2 years time mantra garbage that the Bank of England STILL iterates to this very day! And worse is the fact that real inflation is at least TWICE CPLIE and probably triple in the UK i.e. real UK inflation has been in the 15% to 20% zone for well over a year as I have been voicing in videos since late 2020 to expect BIG INFLATION. Which is why most ordinary folks are in a state of shock that their earnings cannot cover their expenses as they have been hoodwinked by the central bankster's with their propaganda called economics used to fool the public into believing an economic reality that does not exist.

So again all we can do when faced with rampant central bank money printing QE for EVER! It will never go back to zero and ALL reductions are TEMPORARY! With the next doubling pending the NEXT CRISIS, (War with China?). Tapering of £90 billion per month, how long do you think that will run for? A year maybe? Take the balance sheet down by 10%?

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

This is why one has NO CHOICE but to be invested in price volatile assets such as stocks and housing which whilst yes will move up and down in value from tim to time like a yo yo nevertheless over he long-run will be leveraged to rampant government and central bank money printing inflation so we have NO CHOICE BUT TO BE INVESTED IN SUCH ASSETS! NO CHOICE WHATSOEVER FOR THE ALTERNATIVE IS CERTAIN DESTRUCTION OF ONES HARD EARNED WEALTH which is why the largest asset class I have held for near 10 years now is bricks and mortar UK housing regardless of what the price indices do from month to month, year to year, or the clowns proclaim about imminent deflationary crashes. There is NO CHOICE BUT TO BE HOLD ASSETS THAT ARE LEVERAGED TO INFLATION AS THE ALTERNATIVE IS ONE WILL LOSE THE VALUE OF ALL OF ONES HARD EARNED SAVINGS! Which is why whenever I am asked if now is a good time to buy property I tend to remind those asking that house prices are leveraged to inflation so regardless of the tripe in the clueless mainstream press of how UK housing is unaffordable, however inflation ensures that the overall trend trajectory remains upwards for the fundamental fact that unlike fiat currency houses cannot be printed and thus house prices have confounded the clownomics in the mainstream press by soaring into the stratosphere.

Basically housing is one asset classes not to trade in and out of like one tends to do with stocks but rather to the accumulate whenever one observes deviations from the highs for the greater the deviation from the high the greater the buying opportunity presented. My focus be it in housing or good stocks is ALWAYS to BUY the deviation from the highs, whilst the focus of most would be investors are the possible draw downs as if one can buy the exact bottom, good look with that as you will only ever see the bottom in your rear view mirror, hence why most investors miss the greatest bull markets in history as they miss the bottom and then wait for the last major low to repeat and thus end up buying nothing, or if they do buy soon tend to sell on the few percent blip higher on FEAR that even lower prices are just ahead . which means investing is largely psychological, for some reason most people are wholly focused on DRAWDOWNS hence why they tend to NOT buy when prices are cheap and instead FOMO into assets when expensive, which is the exact opposite of what one should do!

BUY THE DEVIATION FROM THE HIGHS,. DRAWDOWNS ARE NORMAL, YOU WILL NEVER BUY THE BOTTOM OR SELL THE TOP, ATTEMPTING TO DO SO MEANS YOU WILL HOLD NOTHING WORTH HOLDING!

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

UK CP LIE Inflation hits 6.2%, whilst RPI that which most corporations raise their prices to has rocketed higher to 8.2% whilst real UK inflation stands at at least 15%, meanwhile across the atlantic US CPLIE inflation of 7.9 % stands on the brink of breaking to well above 8% with real inflation also at around 15% So much for the Pandemic deflationary depression that the clueless mainstream media had been promoting for much of 2020 and then sleep walked into the mantra of transitory inflation for the whole of 2021, finally awakening during 2022 to what amounts to out control inflation, though like gullible fools swallowing the central bankster's sales pitch of laying the blame on Czar Putin's Afghan War 2.0 in Ukraine which illustrates the extent to which what you read in the mainstream press tends to be garbage written by clueless journalists.

Instead I flagged what was likely to happen not in 2022, not 2021 but right back at the beginning of this accelerated phase of the inflation mega-trend in Mid March 2020 when the current phase of QE4EVER began when governments went on debt fueled spending binge that their central banks dutifully monetized by doubling their balance sheets, printing trillions of dollars of fiat currency without abandon so as avoid that which most were expecting the covid economic black hole! Still despite rampant money printing fools persisted with their imminent deflation mantra!

So what does one do when faced with rampant money printing? To invest in assets that are leveraged to inflation that is Quantum AI tech stocks, housing and commodities, BIG INFLATION is coming was the warning at the end of virtually every video I posted. Which is why I bought everything thing I thought I would need to buy in terms of big ticket items for several years from Mid 2020 to Mid 2021 since which time I have been largely out of the big ticket item consumption loop just as the supply chains closed their death jaws and sending inflation spiraling ever higher all whilst the government and their central bankster's utilised the pseudo science that is economics to pump out transitory inflation propaganda. You don't get transitory inflation when you print trillions of dollars and then get the central bankster's to monetize the debt by doubling their balance sheet! It's a big CON that most fell for, look journalists are good at writing reams and reams of highly polished text but at the end of the day they are what they are journalists who don't have a CLUE of what is actually going on, hence total BS, we have high inflation not because of Russia but because of rampant money printing that RESUMED without abandon in MARCH 2020!

And so far we have not even begun tinkering around the edges of mountain of money printing that STILL continues to this very day, the Fed is still printing more money, there has been no tightening so far, In fact I am pretty sure that today's Fed balance sheet of 9 trillion will be even HIGHER a couple of years from now than where it stands today! In fact we will probably see the Fed's and other central bank balance sheets more than DOUBLE again during this decade i.e. to at LEAST a $20 trillion dollar Fed balance sheet, so much for taper talk!

And thus what I have been expecting is likely to become manifest in that high inflation is likely to persist for the WHOLE OF THIS DECADE! Which means a lot of persistent pain in the West and if there is pain in the West that will translate into inflation nightmare for the developing world!

Fed Inflation Strategy Revealed

Inflation 4%: It’s a little higher than our target rate, but is definitely transitory.

Inflation 5%: Oh yes, it’s definitely transitory. Just supply chain issues.

Inflation 6%: It is persistently transitory, but it will fall soon all on its own in Q3.

Inflation 7%: Hallelujah Inflation has finally peaked!

Inflation 7.5%: It's the top now, definitely.

Inflation 7.9%: This is really the top for sure. We got this, we pressed the red button on the keyboard..

Inflation 8.5%: This is all Putin's fault! Not Ours.

Inflation 10%: Nothing to worry about. It’s to be expected with the Ukraine war still raging and China lockdown's. Plus the market has already priced it all in.

Inflation 12%: There is no way this is not the TOP now for Sure!

Inflation 15%: OK, you win, Please just make it stop!

Inflation 20%: Don’t make us go all Volcker on you now!!!

Inflation 25%: Where's my index linked retirement package, Time for a new Fed chair to finish the job I started (sort of).

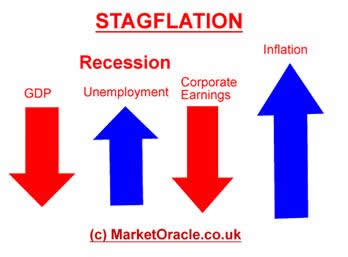

Russian Sanctions Stagflation Driver

Knock out 20% of the world's gas exports and 10% of the worlds exports and how can you not expect even higher inflation. Even worse for Europe where several nations such as Germany rely on Russia for upto 40% of their gas. Whilst for the UK 4% of russian gas may not sound like much but the impact has been on gas prices that had already soared several fold before the Ukraine invasion have now doubled once more. with the risks that the sanctions blitzkrieg prompts Russia to pull the plug on EU gas that will trigger gas rationing among many nations such as Germany and Italy which means INDUSTRY will take a hit thus further disrupting supply chains and hence continuing to put upwards pressure on prices as component and finished goods supply chains are further disrupted which easily translates into EU inflation surging higher by an additional 2% and reduction in GDP of at least 0.5%.

Whilst it is beyond the scope of this article to forecast oil prices, nevertheless if the West sanctions Russian oil and gas then how can that not push oil prices to new highs, maybe not as far as $200 that often gets bandied about but to at least $150 a barrell that would both be highly inflationary and at the same time deflationary in terms of global economic output, RISING PRICES, FALING ECONOMIC OUTPUT = STAGFLATION!

You want to know the playbook for what could transpire, go back to to the mid 1970's with the wars in the middle east for how bad things could get, which also acted to worsening an existing out of control inflation trend as looks likely to rhyme with the Ukraine war in 2022. With full employment how long before workers start demanding real terms pay increases and then we will be off to the inflation races for a whole DECADE! This is what happens when governments and their central banks lose control of inflation, it is not easy to get back under control! Which is all that high interest rates will do is to dampen economic activity to SLOW the rate of INFLATION rather than to bring it down.

Why do you think I am taking the risk of buying AI tech stocks ahead of probable economic contraction? A drop in corporate earnings that will send most stocks sharply lower because at least I have a fair chance of good stocks being indexed to the inflation mega-trend and thus survive the inflation blood bath whilst all those waiting for the bottom will be buying with fiat currency that has lost perhaps 50% of it's value! And thus all that they will be able to buy are the garbage stocks with contracting or even worse no earnings. At these times you want to hold the BEST STOCKS NOT GARBAGE stocks which are for bull market FOMO mania"s and not during times of economic stress!

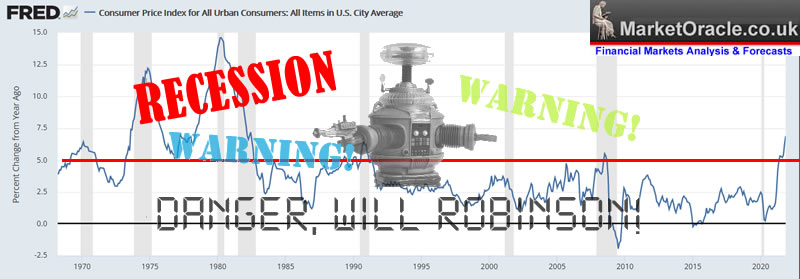

RECESSION RISKS 2023

Firstly it does not actually matter if a recession materialises during 2023 or not all that matters is most people THINK it's going to happen, for asset prices discount the future which is why today stock prices are falling even if that is not being reflected in the stock indices due to the Stocks Bear Market Tornado which I will cover in depth in a forthcoming stocks article. Nevertheless there is a RISK of inflation that I have been flagging a warning of a good 6 months BEFORE the current Yield Curve inversion.

So what do you do?

Hold assets that are LEVERAGED to INFLATION!

- Good Housing

- Good STOCKS

- Good Commodities

Good in the sense you don't just go out and buy any old garbage, for instance an auction property or a high rise flat. Good stocks in that not a Snowflake that's lost half its value but still trades on 1000 earnings!

Understand this, whatever the stock market does over the coming weeks and months it will turn out to be a mere blip on the long-term charts. which is a mantra that I iterate during most market corrections and panic events.

It does not matter where the bottom of any bear market will be, all that matters is gaining exposure to AI mega-trend stocks because they will always tend to surprise to the upside that will leave most puzzled and confused as to how can stocks be trading higher when for instance the pandemic death toll is doubling every week as was the case during April 2020 when many Patrons kept asking me if they should sell now to bank gains of 50% or so, which had me rolling my eyes in their sockets, warning that it would be a BIG MISTAKE to SELL and that the thought of SELLING had not even crossed my mind at that time. Instead it would be well over a year later when I would start to distribute into the FOMO bubble valuations of late last year with the aim of capitalising on THIS SELL OFF, seeking to buy deviations from the highs in GOOD STOCKS which is precisely what I am doing right now just as most are becoming fearful of buying anything.

The key point about investing in stocks is that one is getting out of fiat currency which is 100% guaranteed to go to ZERO and into something that at the every least has a fighting chance of at least maintaining it's real terms value. What the stock price does AFTER one buys it over days, weeks and months is irrelevant, as is the case with properties for one is investing and not trading in and out like a ping pong ball.

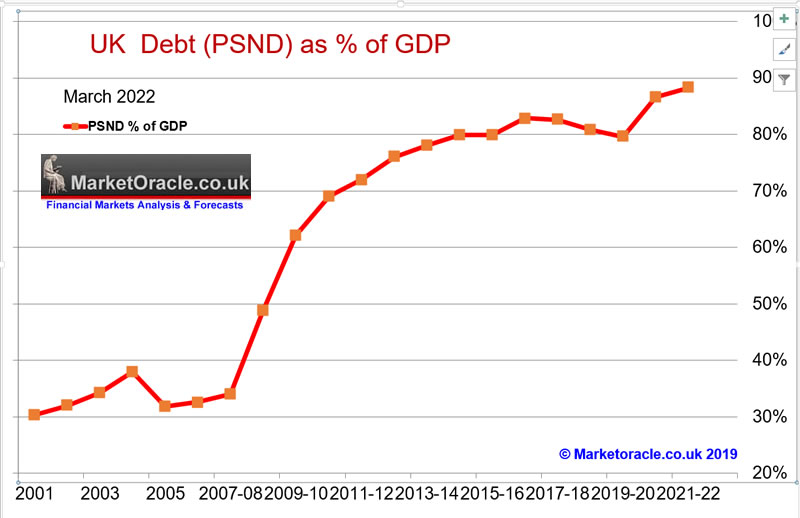

UK Debt Inflation Smoking Gun

Britains debt mountain has long since passed the £2 trillion pound mark, so how come the UK managed to do this without paying the piper? A free lunch given low UK bond interest rates, we'll it's because the Bankster of England has MONETIZED near HALF of Britains DEBT! Now do you understand where the INFLATION is coming from? Yes, as I wrote 12 YEARS AGO in my 100 page Inflation Mega-trend ebook that Inflation is by DESIGN caused by rampant government money printing that the central banks monetize! Which the Bank of England has now done to the tune of near £1 trillion! Which resolves in a fake debt to GDP graph such as the one below that the academic economists get their knickers in a twist over without able to think outside of the box and realise the fundamental fact that actual UK market debt is HALF that which is being reported because the Government is effectively PAYING ITSELF INTEREST on HALF of it's debt! Why don't the clowns in MSM report on any of this? After all It's not rocket science!

And what is the price for this CON JOB? The price paid is HIGH INFLATION! Not because of the smoke and mirrors Russia / Ukraine war that much of the public have swallowed hook line and sinker, THE UK HAS HIGH INFLATION BECAUSE THE GOVENMENT HAS GONE ON A DEBT FUELED SPENDING SPREE THAT THE BANK OF ENGLAND HAS MONETIZED TO THE TUNE OF £1 TRILLION !!! THAT IS THE PRIMARY REASON WHY WE HAVE HIGH INFLATION TODAY!

WHAT A CON THAT THE GENERAL PUBLIC CONTINUE TO FAIL TO GRASP DUE TO PROPAGANDA OF THE PSUEDO SCIENCE CALLED ECONOMICS!

Housing market implications are that house prices MUST rise because unlike fiat currency they cannot be printed!

Britain's Hyper Housing Market

In Britain we have long since known and factored into the equation the China effect on London's property market that has long since sent it soaring into the stratosphere following the stagnation of the Mid 1990's which was probably one of the best times in decades to buy a property in terms of bang for ones buck i.e. it was before immigration soared into the stratosphere courtesy of the open door policy of Tony Blair's Labour government as the socialists enticed millions of eastern european's to come to the UK and become new Labour voters that sent house prices soaring across Britain and eventually putting housing out of the reach of many millions of prospective home buyers who enjoyed a brief respite in the aftermath of the great financial crisis when demand slumped along with the economy.

Then we had BREXIT! Again function of Tony Blair's policy for importing millions of new Labour voters that only briefly acted to dampen the pace of UK house price inflation.

Surely a global pandemic should have finally triggered the perma carrion cry of the CRASH IS COMING MSM?

No, not even a global pandemic could put a dent into RAMPANT money printing on an epic scale that even today few grasp the magnitude of that went to extent of paying millions of workers to stay at home for over a year! THAT IS RAMPANT INFLATIONARY MONEY PRINTING when people are PAID to do NOTHING for over 18 months as Britain only closed it's Jobs Retention Scheme at the end of September 2021! 18 MONTHS of paying people to do nothing, which is on top of the existing 8 million in receipt of benefits for NOT working! All of which is INFLATIONARY on an epic scale

So I think you are getting the picture early on in this analysis that many prospective home buyers and even those looking to move up the ladder are probably not going to like the direction of travel of this analysis, as it is tough to see what is going to crack the UK housing market nut, the relentless dynamics of upwards price pressure all largely courtesy of Tony Blair's government which even BREXIT has FAILED to fix the damage done.

Today we hear a lot in the MSM of how Poland is housing some 2+ million Ukrainians whilst the UK has put many obstacles in the way of Ukrainian migration. Whilst few fail to grasp the point that Poland has plenty of empty apartments left over from when some 4 million Polish economic migrants moved to settle in the UK over a 20 year period thus playing their part in driving Britains perma housing crisis where supply has never been able to keep up with demand for over 2 decades!

UK Population Growth Forecast 2010 to 2030

My long standing forecast is for the UK population to grow from 62.2 million as of Mid 2010 to at least 70.5 million by 2030 as excerpted below:

2nd August 2010 - UK Population Growth and Immigration Trend Forecast 2010 to 2030

The assumptions being factored into the UK population growth forecast are for a natural UK population growth rate of births exceeding deaths of 0.33% per year (current 200k), coupled with net average current immigration trend of 240k per year, supplemented with climate change refugees averaging 50k per year from 2015 onwards extrapolates into the following trend forecast over the next 10 years that targets a rise from 62.2 million as of mid 2010 to 67 million by mid 2020, and should the same trend be maintained beyond 2020 then the UK population could rise to above 72 million by mid 2030. However in all probability the country will not experience the post 2020 trend due to several converging factors including political pressures, capacity constraints and the UK's relegation in the economic prosperity leagues. Which implies a tapering off of net immigration in favour of natural growth which implies a lower total of nearer 70.5 million by 2030 as illustrated by the below graph.

One of the primary drivers for population growth and for triggering the EU Referendum is immigration, specifically EU immigration that many had concluded was out of control as membership of the European Union translates into the free movement of workers which has prevented the UK from controlling its borders for approaching 20 years and has seen the UK buffeted by waves economic migrant flows from mostly Eastern Europe each year. All adding to those that came before with total immigration from the EU since 2000 having passed the 5 million mark by 2016. All whilst both Labour and then the Conservative governments promises to bring immigration under control having amounted to nothing more than empty promises, as parliament clearly had NO control over EU migration, which thus has continued well beyond the targets of the tens of thousands per year.

And thus the people of Britain on the 23rd of June 2016 chose to take back control of Britain's borders by voting to LEAVE the European Union which followed over a decade of EU migration putting added pressure each year on housing, jobs and social services such as schools, NHS and the benefits system, virtually all of which were at critical breaking points by the time of the election and politicians lived in a bubble far removed from the experience of ordinary people..

The updated UK population graph shows UK population has risen to 67.5 million for December 2021, against my trend forecast of 67.58 million. Which implies that the UK population remains on target to increase by an additional 3 million by 2030 as a consequence of what amounts to continuing out of control immigration despite BREXIT that in total translates into a UK population increase equivalent to 6 cities the size of Sheffield by 2030.

In terms of house prices, then the trend trajectory remains the same, where Immigration remains a primary driver for UK population growth adding some 300k per annum amounting to most of the annual population increase which shows no signs of diminishing to a rate anywhere near the level of annual UK house building (140,000 per year). Thus population growth will continue to put upwards pressure on house prices for at least another decade. A metric that most would be housing market analysts fail to grasp. THIS ALONG with INFLATION are your TWO HIGH house prices smoking guns! Which strongly suggests that unless net immigration falls to well below 100k per annum then any UK house price wobbles such as occurred following the Brexit vote will always turn out to be temporary as new building cannot even keep pace with existing pent up demand let alone the added pressure from that of continuing net migration of over 300k per year.

So my long-term message remains EXACTLY the same for now approaching 10 YEARS for all those waiting to get a foot onto the property ladder which is not to pin your hopes on any significant price falls let alone a crash in UK house prices such as what the Bank of England were forecasting a 30% post Brexit house prices crash that FAILED to materialise, which means those waiting to buy should act sooner rather than later, to get a foot onto Britains property ladder else face the consequences of ever rising house prices in the face of one of the primary fundamental drivers of UK annual population growth far outpacing house building courtesy of continuing high immigration, far beyond the 50k annual target that the Conservative government used to trundle out as being imminent but gave up hopes of ever achieving some 6 years ago! Which now the Ukraine crisis will likely worsen still with some 300,000 already on their way to the UK, virtually all of whom will seek permanent settlement, thus a year from now even those offering rooms in their homes to Ukrainians will be moaning about the impact on housing and social services. There is no free lunch, invite upwards of 300,000 excess people into the UK and then be prepared to pay the price in terms of added pressures on housing, health and social services that were already at breaking point.

The rest of this extensive analysis was first made available to patrons who support my work.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Whilst my recent analysis includes -

- Everyone and their Grandma is Expecting a Big Stocks Bear Market Rally

- AI Tech Stocks Current State, Is AMAZON a Dying Tech Giant?

- The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential

- Why APPLE Could CRASH the Stock Market!

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the panic selling falling knives.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.