The Dark Side of the Internet - Cybersecurity

Companies / Cyber Security May 27, 2022 - 06:30 PM GMTBy: Stephen_McBride

Superinvestor Warren Buffett called it “the number-one problem with mankind.”

JPMorgan CEO Jamie Dimon said, “it may be the biggest threat to the US financial system.”

And Bob Dudley, the former CEO of oil giant BP, told investors it’s what “keeps me awake at night.”

These guys have millions or billions of dollars… so you might assume they’re worried about direct threats to their wealth like inflation, runaway government spending, or the plunge markets have taken lately.

Believe it or not… they’re talking about the grave threat of cyberattacks.

As I’ll show you today, cyberattacks are skyrocketing. And the industry tasked with stopping them is growing faster—and more consistently—than almost any other industry out there.

It’s the perfect industry to bet on now, while stocks are down… knowing it practically must come back stronger than ever when the storm in markets passes.

Today, I’ll share an easy one-click way to play it.

But first, let’s talk about the dark side of the internet…

- Think about how the internet changed our lives over the past 30 years…

In 1990, less than 1% of Americans had browsed the World Wide Web. Online shopping wasn’t a thing. If you wanted a question answered, you opened an encyclopedia. Meeting people online was considered strange and dangerous.

Folks are now buying groceries and selling their homes on their smartphones. And did you know four in 10 Americans met their partner online? Even our homes are plugged into the web through devices like Amazon’s Alexa and Google’s Nest.

The internet is the most transformative tech of the past century.

But the internet isn’t perfect. It created a tradeoff between privacy and convenience.

Need a new coffee maker? Press a few buttons, and it’ll show up in a brown box on your front porch tomorrow morning.

But we forfeit a little privacy for this convenience. Now your name, address, and credit card details are in some company’s database.

And the problem is… bad guys regularly break into databases and steal your info. In fact, everyone from the IRS to the NSA to defense giant Lockheed Martin to Google has been hacked in the past couple years.

By doing virtually anything online, you expose your personal details.

That makes it possible for hackers to steal your money, access your secrets, and, if they’re determined to do so, potentially destroy your reputation.

But hackers aren’t just targeting people…

- Remember the NotPetya ransomware virus a few years ago?

In short, ransomware is a type of cyberattack where hackers freeze a victim’s files, then demand money to unlock them.

NotPetya crippled 30,000 computers and 7,500 servers belonging to drug giant Merck.

It also hit FedEx, shipping giant Maersk, advertising firm WPP, and hundreds of other companies. It was the most destructive cyberattack ever, with damages topping $10 billion.

NotPetya showed a few lines of malicious code can bring multibillion-dollar companies to their knees.

And hackers aren’t just stealing digital data anymore. They’ve gone “big game hunting” by attacking real-world infrastructure.

Last May, hackers shut down the Colonial Pipeline, which supplies 45% of the East Coast’s fuel. For days, two-thirds of gas stations in South Carolina were empty.

A month later, cybercriminals pulled the plug on JBS, the world’s biggest meat processor. JBS, which produces 20% of all US beef, had to pay an $11 million ransom to get their systems back online.

And did you hear about the attack on a water treatment plant near Tampa, Florida? Hackers broke into its systems and altered the levels of lye (sodium hydroxide) in the drinking water. Luckily an operator noticed the chemical levels changing and shut off the pipes.

And the cost of cleaning up a cyberattack is soaring…

Breaches now cost an average of $4.2 million, according to a new IBM report. When you get hacked, you must hire expensive cybersecurity experts to find and fix the problem. And you might need to rip out and replace all your computer systems.

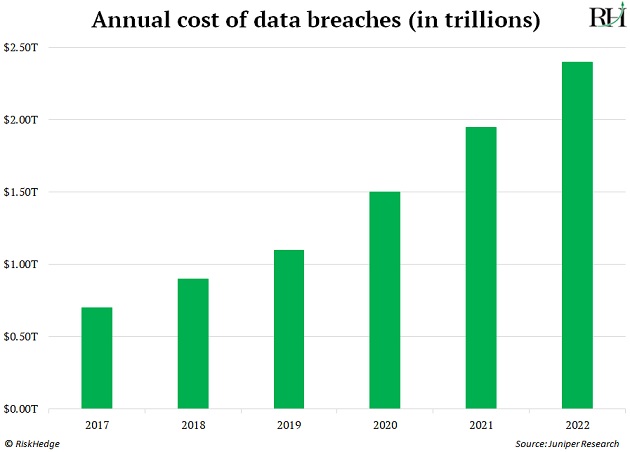

The total cost of cybercrime runs into the trillions.

- This is why money is pouring into cybersecurity…

Cybersecurity companies protect companies, governments, and other organizations from hacks and other forms of cybercrime.

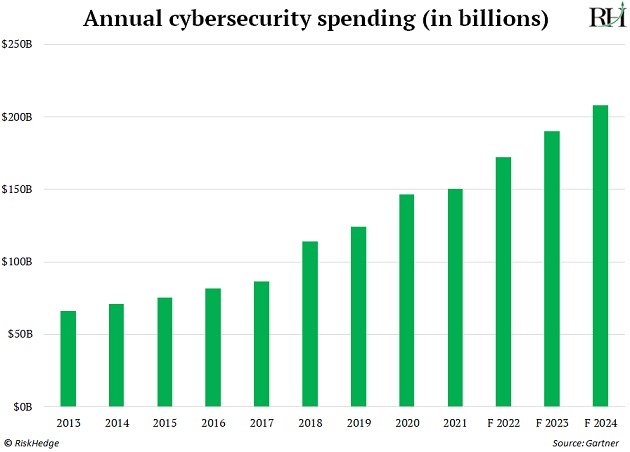

The service they provide is critical to our modern digital world. Top research firm Gartner expects cybersecurity spending will soon hit $200 billion per year.

Cybersecurity spending has grown steadily by 10–15% per year without much notice. When you achieve this year in, year out for two decades running… you soon have a HUGE market.

And we’re only getting started.

Robust cybersecurity used to be a “nice to have.” Now you can’t run a business without it. Every Fortune 500 company employs a chief security officer. No cost is too high when it comes to protecting your computer systems.

CEO Brian Moynihan said Bank of America has an “unlimited” cybersecurity budget. Microsoft is quadrupling its cybersecurity spending to $20 billion over the next five years. Google just announced it will invest $10+ billion to safeguard its networks.

And the US government will plow $19 billion into cybersecurity this year alone.

- Cybersecurity is a never-ending arms race…

Hackers are always inventing new ways to attack. Firms must constantly develop new tools and—spend billions of dollars—to stay a step ahead.

This all but guarantees cybersecurity spending will keep marching higher.

Turmoil in the cyber insurance industry is also adding fuel to the fire…

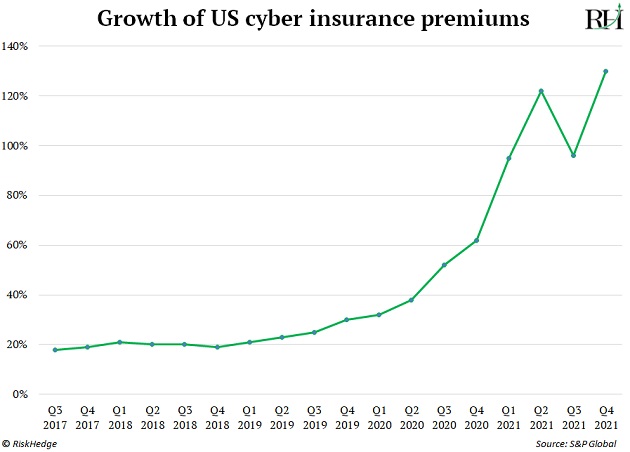

The market for insuring yourself against hacks grew from zilch to $15 billion/year over the past decade. And the cost of cyber insurance is going through the roof.

Research from consulting firm Marsh shows US cyber insurance premiums jumped by 130% in the fourth quarter of 2021.

What’s going on?

Cyber-insurers make money when you take out insurance and avoid getting hacked.

But everyone is getting hacked right now.

Victims are turning to insurers to cover the costs. And insurers are racking up billions of dollars in losses.

Many cyber-insurers have exited the market. Many companies can no longer get cyber coverage. Instead, they’re spending record sums of money on security to avoid getting hacked to begin with.

An easy, one-click way to play this is to invest in an ETF like the First Trust Nasdaq Cybersecurity ETF (CIBR), which invests in a basket of cybersecurity stocks.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.