AI Tech Stocks Earnings BloodBath Buying Opportunity

Companies / Tech Stocks May 14, 2022 - 06:35 PM GMTBy: Nadeem_Walayat

Dear Reader

In advance of my US housing market trend forecast to be posted before the end of this month here is a timely look at the big AI tech stocks that are reporting earnings next week, where the dominos could finally start falling as they continue Friday's plunge on break of key support levels for the likes of Nvidia and Google, where after a long wait big buying levels are finally starting to get triggered in the latest phase of the stealth stocks bear market that is cycling through target stocks like the tasmanian devil as we saw during the past week, with Friday's plunge ending what had been an developing stocks bounce, where my focus was on Google as it finally broke below $2400, a level that I had long flagged to patrons of where I would be buying big and in advance of warned Patrons for several weeks not to jump the gun regardless of what the indices were doing.

Stock Market Big Picture

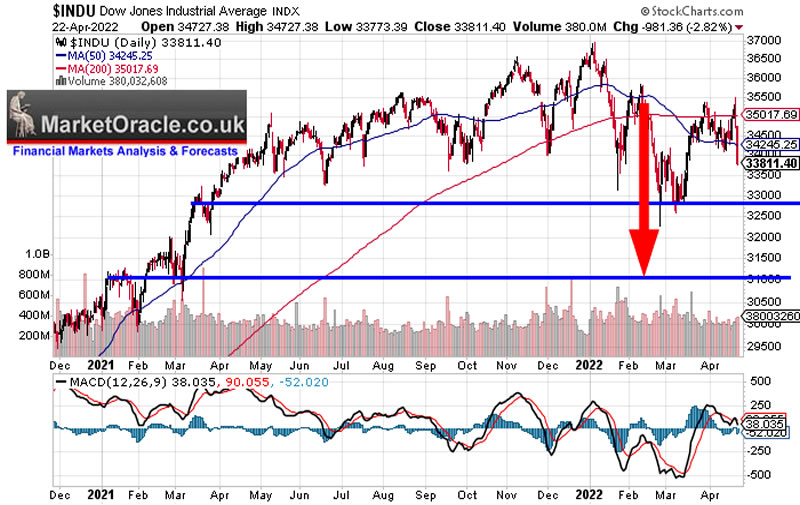

My big picture remains as I have been iterating for the past 3 months in that I expect the Dow to target a volatile trend to below 31k.

5th Feb 2022 - We are in for a volatile trend with a downwards bias for much of 2022, as I wrote to expect on the 5th of Dec 2021 accompanied by revised trend forecast graph.

Following which my expectations were for the Dow to target a trend to $31k as illustrated below -

As things stand an interim corrective rally into Mid May has been delayed for at least a few days as the March lows look set to be breached during the coming week. Especially if the Apple and Microsoft nuts also finally crack, unless they post near perfect results, and the same is true for Google. The Dow is currently targeting a trend to $32k, looking further out I see the final low during late summer a probably between 31k and 29k during August before the Dow resolves in a trend towards new all time highs during Q4, expectations which are subject to my forthcoming in-depth analysis.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

This analysis (AI Tech Stocks Earnings BloodBath Buying Opportunity) was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Latest analysis include -

- The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential

- Why APPLE Could CRASH the Stock Market!

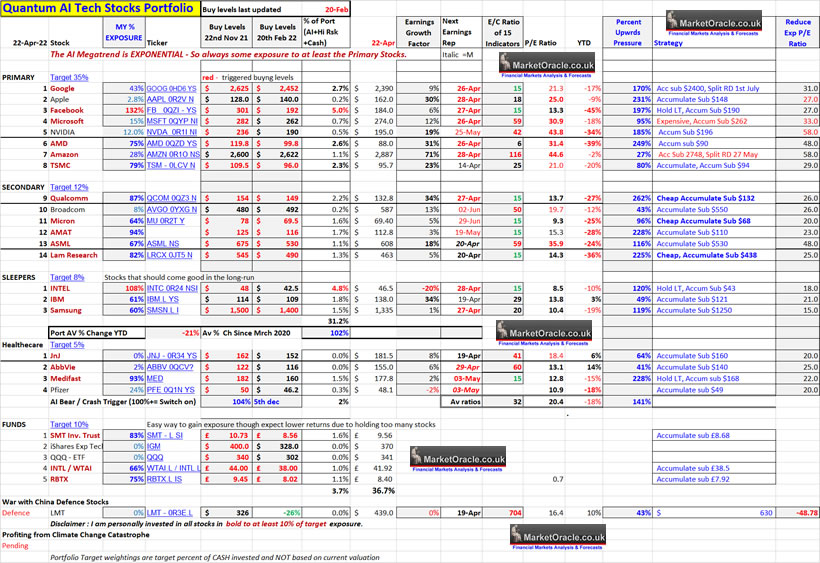

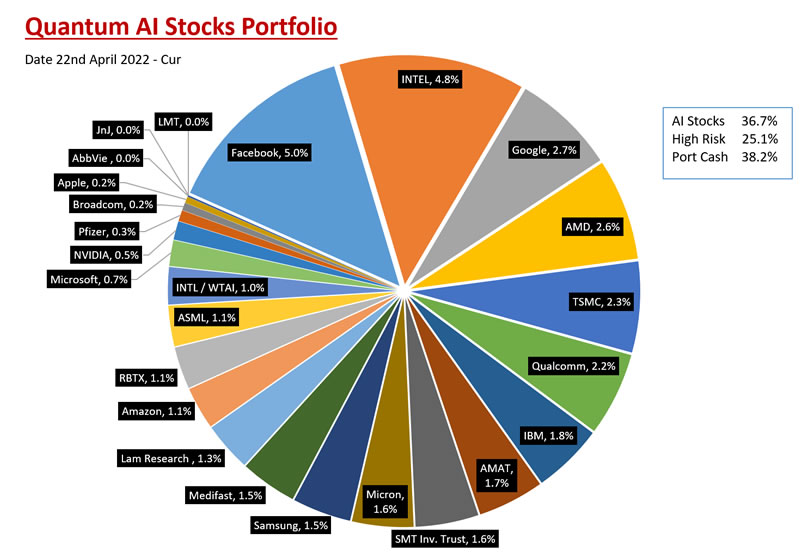

Quantum AI Stocks Bloodbath Potential Opportunities

The once over loved and over hyped tech sector is now HATED! Which is what one wants when accumulating stocks trading at deep discounts to their highs, though once more note that ALL stocks trading above a PE of 20 have a high probability of trading below 20 times earnings given the valuation reset that I warned to prepare for over 9 months ago.

Though understand this everything that happens this year is just a mere inconsequential quantum fluctuation in the Quantum AI mega-trend as the Quantum wave continues vibrate towards quantum supremacy. I often get asked when the sleeping giants such as Intel will come alive and how could the stock price soar. To which my typical response is that it is a sleeping giant and will likely X4 to $200, but the fact is that I am getting asked such questions illustrates that many do not really understand what they are investing in for if you did they would not be asking such questions. And the fact that one does ensures that when the stock price does soar some will likely get out after a 50% or maybe 100% advance and then be forever asking me when will the Intel stock price will drop again so they can buy back in.

REMEMBER WE are NOT investing in normal stocks, these are NOT NETFLIX, ZOOM AND THEIR KIN! THESE ARE QUANTUM AI TECH STOCKS that are riding an EXPONENTIAL TREND.

BUYING LEVELS - Remember folks buying levels are NOT price targets or forecasts, buying levels are so as to be ENABLE one to accumulate a position at DEEP discounts to stocks highs, for instance my buying level for Google of $2625 has been in force since $3000! Which prevented me from buying any significant Google above $2625 which during the bear market was revised down to $2452 and as as I iterated in my recent articles I sought sub $2400 for any big buys. So understand that the whole point of buying levels is that they should eventually be achieved else what is the point of having buying levels that never get triggered. As for how buying levels are derived, the starting point are chart support resistance levels and valuation scenarios that are further refined using spooky maths, such as the Fine Structure Constant i.e. looking at the current AMD chart support is at 81 spooky maths turns this into 82.2, where I have a limit order at, whilst the buying level becomes $84 for a slightly higher probability of being achieved,

See my earlier articles for explanations of EGF, EC etc...HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond and Stock Market in the Eye of the Storm, Visualising AI Tech Stocks Buying Levels

And remember folks one cannot invest with the benefit of hindsight, so it is no good looking at the chart and thinking as if by magic one could have time traveled and bought at the precise lows instead of at x,y,z buying levels, thus buying levels at least prevent one from stupidly FOMO-ing into stocks near their highs, or prevent one from firing all of ones investing ammo early during the bear market. Instead buying levels satisfy the urge to buy new lows by nibbling whilst waiting for the big buys, this way whatever transpires one has at least increased ones exposure to the AI Mega-trend which is the primary name of the game, not picking tops and bottoms but increasing exposure to a mega-trend that most remain largely clueless to the extent that it is already changing all of our lives for better or worse. So in the long run it does not matter that much if one buys Google near $2600 than near $2300, just that it makes one feel like they have put some extra effort into squeezing a few percent extra out of the markets.

Big Image - https://www.marketoracle.co.uk/images/2022/Apr/NW-AI-techstock-APR-22-BIG.jpg

And here's the pie chart breakdown of my holdings in response to last weeks buying.

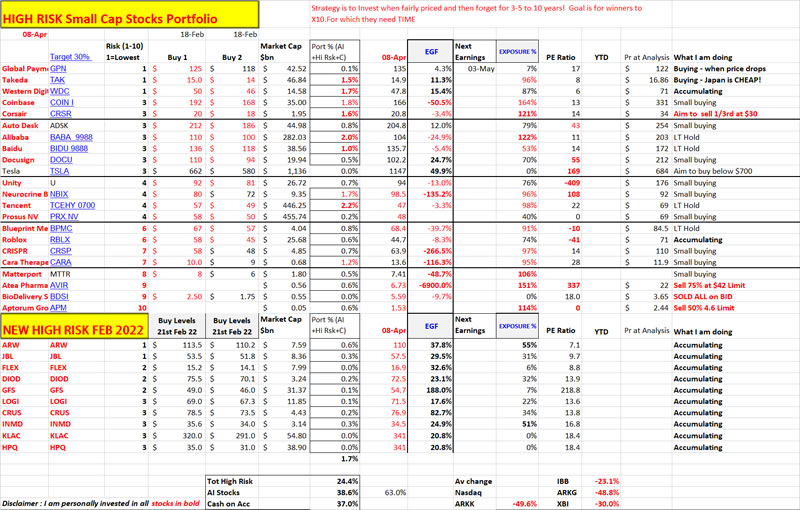

High risk stocks portfolio (8th April).

I continue to accumulate into NEW High Risk stocks each time I see them trade to new lows I buy more, I have reached over 70% invested in INMD and over 60% in ARW..

Big Image - https://www.marketoracle.co.uk/images/2022/Apr/NW-High-Risk-Stocks-APR-8-BIG.jpg

The focus of this article is on 9 major portfolio stocks that are reporting earnings next week. For buying levels for other stock see my previous article - The Stocks Stealth BEAR Market, AI Stocks Buying Levels Going Into Earnings

But briefly, the Nvidia NUT Finally CRACKED on Friday, Small buying levels $192, $182 and then it's a case of jeronimo all the way down to $156 where I will probably buy big, following which is $139. So all those who failed to heed my warnings about Nvidia likely should prepare themselves to experience a draw down as deep as $130, a potential FURTHER 33% PRICE DROP OFF $195! I bought small sub $200, and will continue to buy small until I see something like $158 when I will buy big.

TUESDAY 26th April

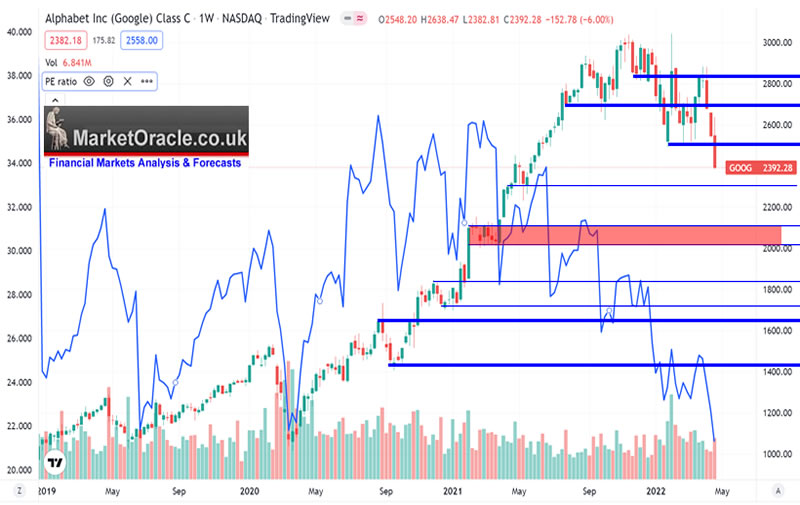

GOOGLE (Alphabet) $2390 : PE 21.3 : EGF 9% : EC 15 - Reports after hours

I FINALLY got to buy Google BIG on Friday at $2382 via a limit order and so my exposure has increased from 29% a week ago to 43% today. As I wrote last week a P/E of 20 translate into Google trading at $2242 which remains the direction of travel where by the end of next week i could easily be over 60% invested.

At $2390 Google's stock price trades on 21.3 X earnings pending it's earnings report. If it is good then the Google stock price should hold steady above $2400, if it is bad then factor in a sub 20 PE, likely X18 i.e. the market will be discounting future poor earnings where X18 would put the Google stock price at about $2020! A 15% drop from the current price which would be a great buying opp par with that of March 2020. representing a 35% drop from it's high. Can history repeat? It's a tough call but but my long standing big buy limit order has been perched at $2282 for some time which is what I still see as being achievable and below that is $2062 both of which I have flagged some time ago as illustrated by my following Google chart from my early February..

In fact Google today is already trading below the March 2020 lows in valuation terms according to Trading View, though my own calc's don't agree with Trading View so take their P/E ratios with a pinch of salt, i.e. the March low was X18 not X22.

The red line shows current PE relative to where the stock was trading in the past at the same PE ratio, so today's $2400 roughly equates to about $1000 of March 2020. Yes you heard that right $2400 is the SAME as buying Google at $1000 in March 2020 (Actual is $2400 equates to $1200 because Trading View P/E data is not accurate).

Google buying Levels are $2452, $2316, $2262, $2022, $1842, $1462, in fact my previous big buy was in September 2020 at $1412 which I flagged ahead of time, I don't expect Google to come anywhere near revisiting the $1400's., if it did I would probably each 130% invested.

What am I doing? I will continue to do what I started last week which is to accumulate Google where my next big buy is at $2278, ahead of which are a couple of small buys at $2348 and $2312 and should I see $2062 then I will also buy big there, which will probably see my position rise to over 80% invested from current 43%.

The bottom line is my expectations are for $2262 to be achieved, and I see it is very possible that we see Google trade down to as low as $2100. And to think these numbers were unimaginable just a few days ago! Whilst $2282 has always been my ultimate big buying level where I have had an active limit order in place for some 6 months on the off chance of catching a Google crash falling knife.

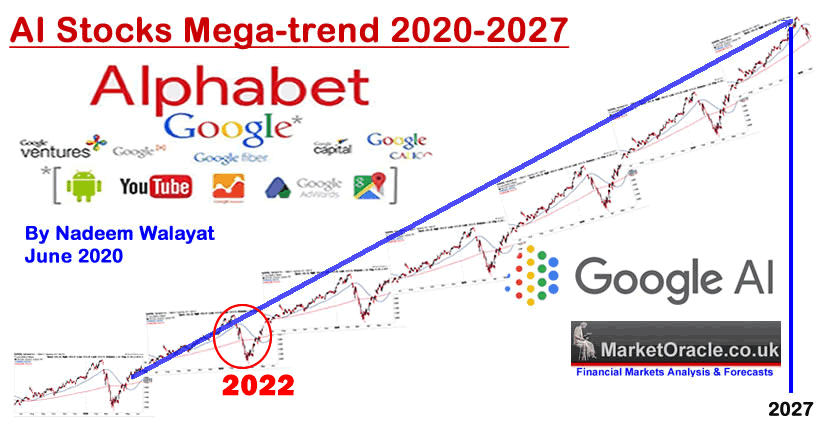

And here's a blast from the past (June 2020 Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!) for all those wavering now that Google is 'cheap'.

However, armed with the knowledge of the magnitude of the exponential AI mega-trend and what it implies for AI stock prices for this decade and beyond than would most still think twice about accumulating the likes of Google today at $1400? Given where I expect Google to trade upto over the coming decade?

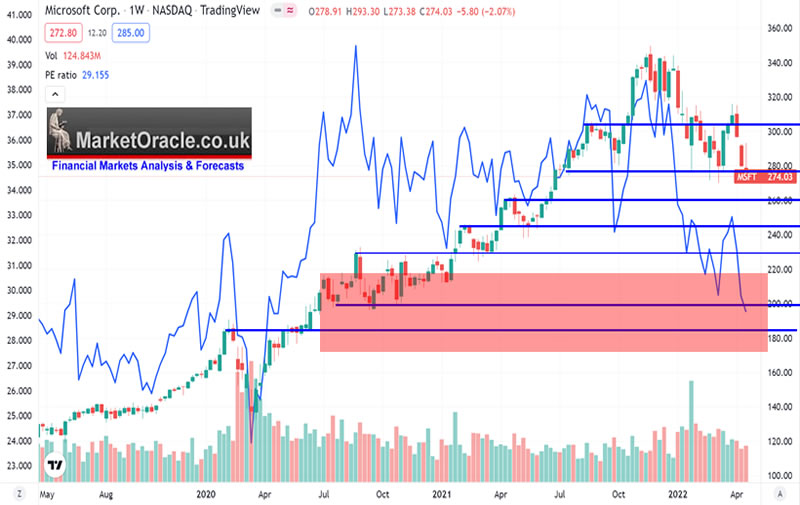

Microsoft $2374 : PE 30.9 : EGF 12% : EC 59 - - Reports after hours

I see Microsoft as a ticking time bomb, 30.9X earnings! If it resets to x20 that would put the stock price at $177 ! That's how LOW Microsoft could fall! Even at my current light exposure of 15% I feel over exposed. The big red price I have flashing in my head which I am sure I have mentioned in past articles is $232! And that is where i intend on buying Microsoft big. whilst I will start to accumulate Microsoft at sub $262, However I need to see sub $242 for any seriously buying and $232 will be my Facebook $236 moment! Of course Microsoft could then do a Facebook and continue sliding all the way down to $170, but without the benefit of hindsight this is my plan to accumulate Microsoft. Small buys sub $262, Big buys around $232 and lower.

Microsoft and Google are big chunks of the S&P, both of these stocks tumbling should send the S&P well below the March lows.

WEDNESSDAY 27th April

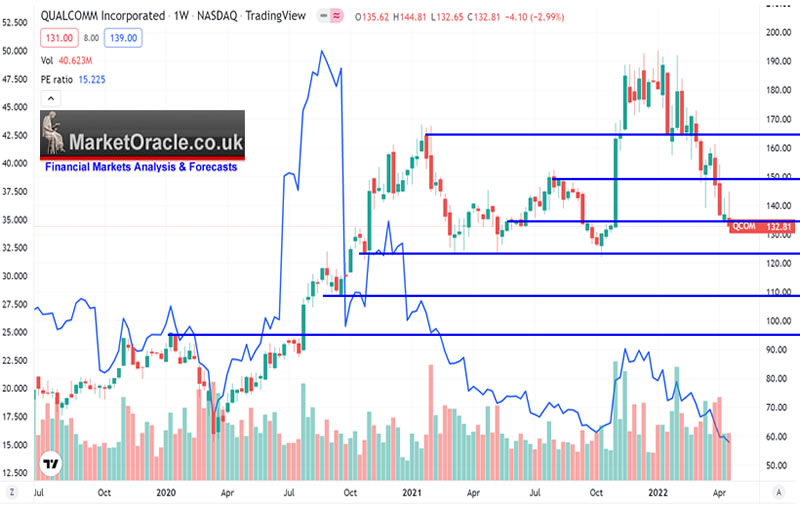

Qualcom $132.8 : PE 13.7 : EGF 34% : EC 15 - Reports after hours

Qualcom continues to fire on all cylinders and is primed for explosive stock price growth. In the meantime the out of favour semiconductors continue to get marked to fresh lows. I am now 87%, but continue to accumulate at fresh lows all the way down to my next big buy ar $125 by which time I will be over 100% invested. One would need to go back, about 6 years to see the stock trading as cheaply as it is today at $132.8 on a PE of 13.7, where in 2016 the stock price was at $44 on a PE of 13.6! How low could the stock go during this bear market? Technically should it break $124 then the stock price could slide all the way down to $110, though should it do so then that would put the stock on a PE of just 11.4. So yes a dirt cheap stock can get even cheaper, but the risk vs reward is infinitely better with a Qualcom than with a Microsoft!

Buying levels $132, $127.5, $125, $116, $110 and $95.

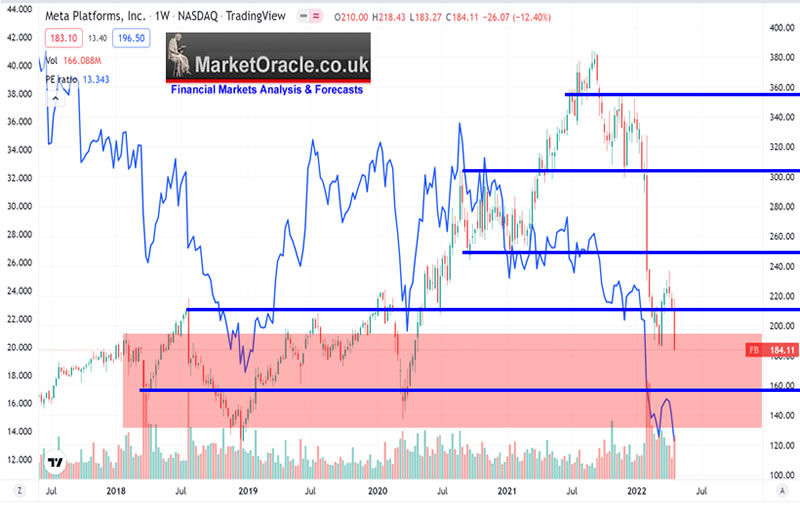

Facebook / Meta $184 : PE 14 : EGF 6% : EC 15% : Upwards Pressure 191% - Reports after hours

A stock that the bear market has shown fit to obliterate down to just X14 earnings. On a fundamental level Facebook has NEVER been cheaper in it's history! Cheaper than the pandemic low of March 2020, cheaper than the taper tantrum low of early 2019 and where investing is concerned that is all one can hope for, to be able to buy ones target stocks when they trade at dirt cheap levels.

Back when Facebook was trading in the $320' the best I could dream that Facebook could trade down to was $236, but here we stand at $184. So what did I do Friday? I bought some more, I now stand at a 132% invested of target. The stock is near 50% off it's highs WITH growing earnings so it's not like it's gong to go bust eventually Facebook WILL trade to new all time highs, this year my expectations are to see Facebook trade to $300, a 65% jump on $184, which is around where I would offload about 30% to get back towards 100% invested. However Facebook is in a very strong downtrend and it could continue trading lower all the way to BELOW $160 and maybe even touch the panic low of $140 of March 2020! See how infectious bearishness is, even I am getting carried away when the reality is that there is no bad news left for the market to price in, perhaps a mass extinction event?

Current Buying levels - $188, $178, $160,.It will be interesting to see how the stock price reacts to earnings regardless of whether earnings are good or bad! Could Q1 earnings report be the trigger to set Facebook on the path to $300? We shall soon find out!

Samsung $2390 : PE 10.4 : EGF 1%: EC 20 - Reports after hours

One only tends to realise just how stupidly over valued US stocks are when one looks at foreign stocks such as Samsung that trades on just 10 earnings. The S&P trades on 21.6x earnings whilst the KOSPI is on 12.4, UK FTSE on 15, Taiwan 14, Egypt 8.3, China 15.3, so there are a lot of cheap markets out there. Yes Samsung is hardly a fast growing corp but it does pay a healthy dividend and has slow earnings growth, it's just a stock to remember to SELL when you see it trade over X21 earnings, which unfortunately I failed to do, maybe next time....

Buying levels are $1300, $1235 where I have a limit order and $1160. A case of accumulate for the long-run.

So Qualcom and Facebook Thursday (after hours) could give the market some upside.

THURSDAY 28TH APRIL

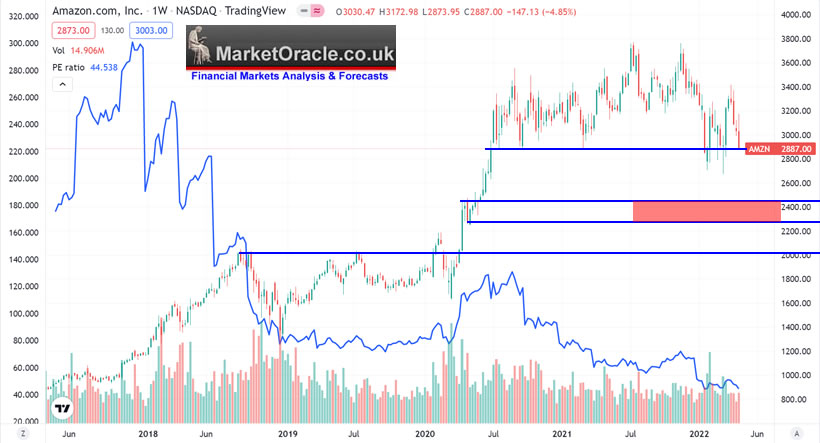

Amazon $2887 : PE 244.6 : EGF 71% : EC 116 - Reports after hours

For decades Amazon has suppressed it's earnings so as to avoid paying taxes (so the P/E and EGF cannot be trusted), that is until the last quarter, so the big question mark is will Amazon continue what it started last quarter as I suspect there is a good chance that it will for at least 1 more quarter as Amazon attempts to massage it's stock price ahead of it's 20 for 1 stock split in early June with the record date of 27th May.

The Amazon stock price is only down 2% on the year, which should not come as much surprise given that it has basically gone sideways for the past 2 years within a wide range of $3800 to $2900 until this years attempted breakdowns. And it looks like overwhelming market doom and gloom may finally deliver a buying opportunity of sorts. where we could see Amazon trade to well under $2500, probably into the $2450 to $2300 support zone, in advance of which I aim to buy big at below $2525 and then maybe again at $2355, where I have a long standing limit order at $2352.

Buying levels are - $2748, $2650, 2525, $2400 and $2320. I will probably buy small sub $2650 and big at below $2525, somewhere between $2500 and $2450. My current exposure is at 28% so I have plenty of scope to accumulate more, though I remain in no rush to do so, unlike for AMD, Google, TSMC, Qualcom etc. So if it does not fall then I am fine to stay put at around 30% invested via a few small buys.

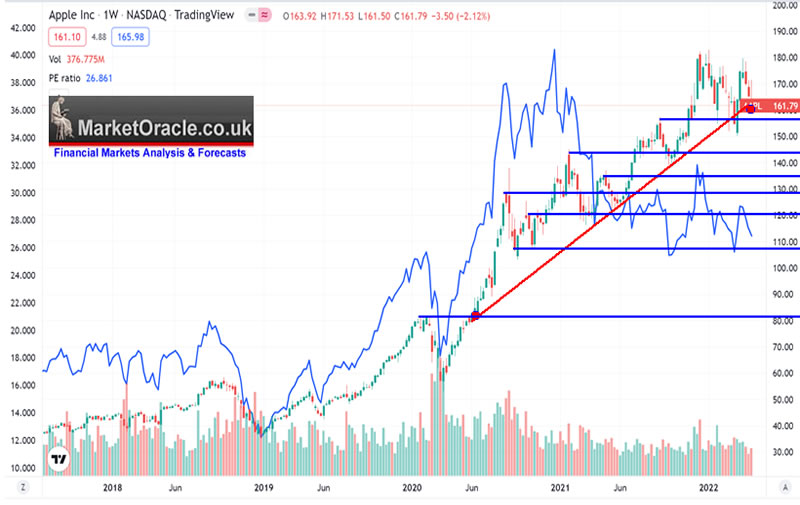

APPLE $162 : PE 25 : EGF 30% : EC 18 : PUP 231% - Reports after hours

Down barely 10% from it's high,. trades on a relatively high multiple of 25. where 20X would put have the stock at $130, So is it finally time for the Apple nut to crack? If it does it will definitely send the major indices sharply lower. The thing is like ALL of the AI tech stocks Apple is a great corporation, where even a tech focused bear market has so far hardly put a scratch on this stock. Apple is definitely a stock to have exposure to hence why it is No 2 on my list, but I want to see a P/E of 20 or lower to do so, especially when one looks at either side of Apple, with Google homing in on X20, and Facebook nudging towards X13. Apple is definitely over valued by a significant margin, all it would take is one poor earnings and this stock could lose as much as 1/3rd of it's value. For such a risk one needs to accumulate at a much fairer multiple, hence I am not buying Apple in any significant amount north of $132 and those only hold a tiny silver of exposure at 2.8%.

Buying Levels $148, $140, $132, $124, $120, Where I seek sub $132 for any significant buying, so about a 20% discount on Apples current stock price.

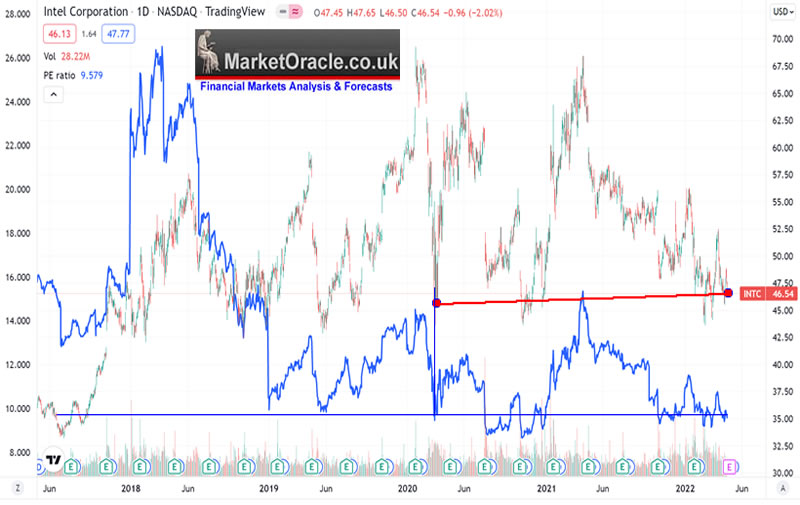

Intel $2390 : PE 8.5: EGF -20% : EC 15

This sleeping giant continues to snore loudly all whilst the exponential mega-trend continues to rumble under the surface. I am 108% invested of target, and don't seek to expand exposure unless I see Intel trade below $40. The stock will remain a slow burner though whilst waiting for the payoff one is in receipt of a 3% dividend.

Buying levels $44, $38, $34 and $28. I would probably buy a little more Intel at around $42 and $39 though I have no limit orders in place given my exposure at 108% of target.

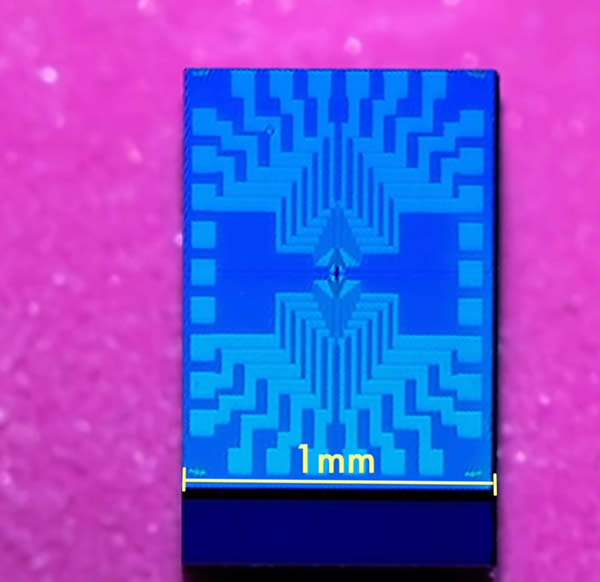

Connecting the Quantum Dot's

What your classical cpu's do with there tens of billions transistors is what Intel's Quantum Dot chips seek to replicate in their tens of millions of error correcting qubits, it's only that the processing power of such chips represents a quantum leap to today;s computers. In fact for want of a better word they will be literally be able to do what we consider as MAGIC today!

Intel are working on applying their standard CMOS technology to quantum computing, and there aren't many corporations out there that can do this. Maybe IBM and TSMC and a few high risk startups that will likely be gobbled p by the tech giants in due course, but Intel knows what needs to be done for the next major breakthrough in quantum computing to leave behind the entangled qubits in the hundreds chips, by jumping to the tens of million qubit chips and thus unleashing the true potential of POST HUMAN intelligence.

Classical quantum computers that currently have between 100 or so entangled qubits require liquid nitrogen cooling to near absolute zero are all basically research devices, the next generation will leave the development labs and enter industry. Where Intel seeks to replicate what it did with the transistor to the qubit by applying the same scaling technology that Intel has been developing for decades for transistors where the quantum dot qubit starts life at a size of 1mm just as the transistor once did.

Eventually, through many generations of size reduction and stacking and incorporation of classical computing circuits to drive the quantum circuits we will basically arrive where Apple is with it's System On a Chip (SOC's), Intel's Quantum SOC's in the not too distant future will put Intel on all together different level, maybe to become the Apple of it's day.

And similarly all of the tech giants to varying degree have a foot print in both AI and Quantum computing. only that as far as I can see they are all several steps behind Intel where Quantum SOC's are concerned.

And what is Intel trading at ? 8.5X earnings! The media calls Musk the Tony stark of our time, in the not too distant future it will be Gelsinger and Intel and that's why my exposure to Intel is at 108% of target.

Western Digital $49.5 : PE 6 : EGF 15%

Western Digital a rank 1 high risk stock despite having a market cap of $15 billion continues to fly under the radar, a PE of just 6 means even if WDC has a disastrous earnings report resulting in a doubling of the PE that would still put the multiple at 12! I think is the market thinks Western Digital will start to post losses again as in years past hence why the stock continues to trade on such low multiples. In a worst case scenario the stock could fall to as low as $37. Which would require the stock sliding through several support levels at $44, $43 and so on. Instead the stock has been quite stable for the past 6mnths i.e. the stock price today is the SAME as it was on the 1st of November so it has defiantly proven to be a more stable investment then most of the tech giants that are trading at deep discounts to where they were at on the 1st of November.

Buying levels are at $46, $44, $41, $37.5. Whilst I have a large limit order at $38, that would lift my exposure to well beyond 100% from my current exposure of 93%.

Getting the Job Done

Overall I am accumulating to get the job done by buying target stocks at deep deviations form their highs as and when opportunities arise, regardless of what the indices such as the S&P or Dow do, which is the problem with such indices and the tracker funds, for instance last week I was buying AMD at a 47% deviation from it's high, whilst the S&P had only deviated by 12%. So what do you think is going to happen when for instance AMD doubles to $176? The S&P won't be doubling, it will maybe up 15% at best. Of course the indices are the easy way to invest and forget, but you get out what you put in as the problem with the index funds is that not all stocks top or bottom at the same time which gives advantage to stock investors over index fund investors but for that one needs to do the work to reap the rewards. Worse still is that this averaging could result in a lost decade for index fund investors, just something to beware of and why I tend to avoid funds i.e. funds comprise only about 5% of my portfolio and even then none of them are general index trackers but focused on aspects of AI.

PREPARE FOR FEAR INFLATION

And finally folks don't forget that the Inflation Fires are RAGING, CPLIE US 8.5%, UK 7%, REAL DOUBLE - Forget PEAK inflation we are soon going to hit FEAR Inflation - PANIC BUYING of foodstuffs, that's wheat products including flour, pasta and cooking oils to start with. Most people have YET to comprehend what BIG INFLATION ACTUALLY MEANS! Food prices could easily DOUBLE over the next 12 months due to the nut jobs putting sanctions on Russian fertilizer, what are farmers going to grow in 2023? What's going to keep pace with real inflation? Not money sat in a bank account or bonds! We may even get panic buying of inflation proof stocks in attempts to escape cash and bonds! If sterling keeps tumbling all the way to GBP 1.0 (not a forecast) I may find my portfolio is up 30% in sterling by the end of this year even if the Dow fails to budge a point from it's last close!

Using my weekly shops as a gauge then currently UK food inflation appears stable, with only significant distress observed in the pasta and sunflower aisles.

Whilst big ticket items have continued to gallop along at typically over 20% per annum, for instance the K7 pressure washer I bought some 18 months ago for £340 is currently priced at £670.

Latest analysis include -

- The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential

- Why APPLE Could CRASH the Stock Market!

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 70%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Your Analyst

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.