Quantum AI Stocks Buying Levels to Capitalise on the Stock Market Panic of 2022

Companies / Quantum AI Tech Stocks Mar 18, 2022 - 05:37 PM GMTBy: Nadeem_Walayat

Dear Reader

So have you managed to capitalise on the great tech stocks bear market of 2022?

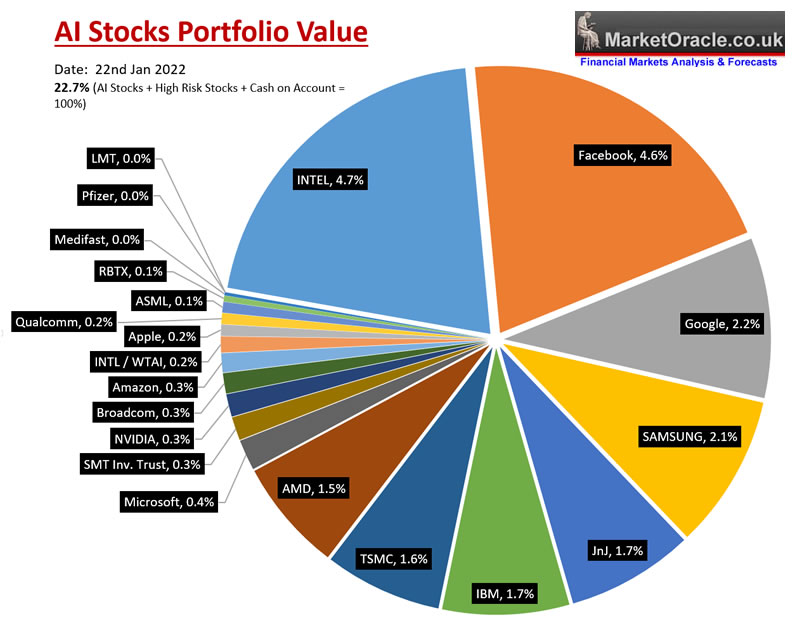

My portfolio and likely similar for many of my patrons has gone from 22.7% invest in late January -

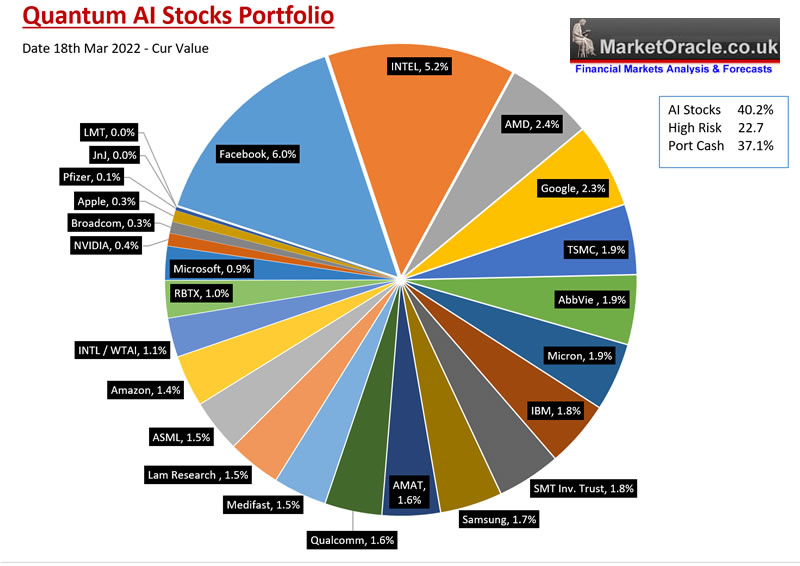

To 40% invested today -

As I BOUGHT the panic drops, caught the falling knives such as Lam Research's dip below $470 of just a few days ago.

This article is part 3 of 3 of my extensive analysis on BUYING the PANIC in TECH STOCKS, that sought to give investors a cold shower, so that they understand of what is bubbling under the markets surface.

Part 1 INVESTORS SEDUCED by CNBC and the STOCK CHARTS COMPLETELY MISS the BIG PICTURE!

Part 2 Dow Max Drawdown Bear Stock Market 2022 - Accumulating Deviations from the Highs

AI Stocks Multi Buying Levels to Capitalise on the Stock Market Panic of 2022

THE VALUATION RESET

INVESTORS SEDUCED BY STOCK CHARTS COMPLETELY MISS THE THE BIG PICTURE!

QUANTUM COMPUTERS

AI Tech Stocks 2022 Correction

Stock Market Trend Forecast Current State

Dow Max Draw Down 2022

ACCUMULATE DEVIATIONS FROM THE HIGHS IN GOOD STOCKS!

NEW STOCKS

The Fishes that Have So Far Gotten Away

AI Tech Stocks Funds Revision

QUANTUM AI STOCKS MULTI BUYING LEVELS

NEW Investors

NETFLIX - You Cannot Say You Weren't Warned!

ARKK MATHS

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Pandemic Rear View Mirror - Next Potential Catastrophe?

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And gain access to my recent in-depth analysis that mapped out how low AI tech stocks could trade down to during the the coming series of stock market panic events of 2022.

Stock Market in the Eye of the Storm, Visualising AI Tech Stocks Buying Levels

m = f - Everything is Waving!

How to Invest in Stocks 20202 and Beyond

Stock Market Calm In the Eye of the Storm

Stock Market Forward Guidance

50% DRAWDOWNS ARE THE NORM!

Current State of Draw downs

Quantum AI Stocks Portfolio Current

AI Tech Stocks Buying Levels

Earnings Growth Factor

GOOGLE TO BE SLICIED INTO 20 PIECES!

FACBOOK MISSION ACCOMPLISHED Whilst CNBC Clowns Buy the TOP and SELL the BOTTOM!

MICROSOFT Short and Sharp

Still Waiting to Take a BITE out of APPLE

NVIDIA is ARMless - To Buy or Not to Buy, that is the question.

AMD - The Chip Master

TSMC - The World's Supreme Chip Fabricator

AMAZON the Dark Horse!

ARKK SARK SHORT FUND

Whilst my most recent article that you all got a taste of in a recent newsletter is focused on capitalising on the downward spiral in stock prices in response to first Inflation Panic and now plus Ukraine War Panic. With the primary focus on identifying 5 small cap tech growth stocks to add to my High Risk stocks portfolio out of a short list of 50 stocks.

World War 3 Phase 1 - Putin WINS Ukraine War!

What Putin Plans for Ukraine

JRS.L Capitalising on Russia's War CRASHED Stocks

THE 2020's INFLATION MONSTER!

Stock Market Trend Forecast Current State

Stock Market FOMO Gives Way to FEAR of Buying the Dip

AI Stocks Portfolio Current State With Updated Buying Levels

FACEBOOK Stock 45% CRASH - Game Over for META?

FACEBOOK RINSE AND REPEAT

INVESTING LESSON - HAVE A PLAN AND THEN EXECUTE IT!

HIGH RISK STOCKS - INVEST AND FORGET

High Risk Stocks Portfolio Revised Buying Levels

GROWTH STOCKS TO CAPITALISE ON THE PANIC OF 2022

1. XXXX - RANK 1 - $121.8, PE 7.8, EGF 38%

2. XXXX - RANK 1 - $58.5, PE 9.9, EGF 30%

3. XXXX- RANK 2 - $16.7, PE 8.7, EGF 33%

4. XXXX - RANK 2 - $89.5, PE 17.2, EGF 23%

5. XXXX - RANK 2 - $49.7 - PE 196, EGF 188%

And gain access to my timely analysis lays out how to invest in during the panic of 2022, to be soon followed by scheduled analysis that continues my trend forecast into the end of 2022.

HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

NEW STOCKS

AMAT $132 - Services the semi-conductor industry, corporations such as TSM and Samsung, PE 20, $117bn market cap, fast growing earnings, 21% off it's high and is prone to buying back it's own stock so upward price pressure. This stock price had been flying too high for a too long at between $145 to $160 for me to buy but I had placed a limit order to buy at $126 which was filled this week. My exposure stands at 1.7% which is on par with that of IBM! Brings home the importance of having large amount of funds on account so one can place distant limit orders in target stocks.

MICRON $79 - along the lines of a AMD, Nvidia, and Broadcom but trades on a much lower valuation of PE 12, obviously there are reasons why it's valuation is a lot lower than it's competitors but I had it penciled in to buy Micron at sub $80. Bought live on Patreon comments at $76.2. Exposure stands at 1.5% on par with that of TSMC.

LRCX $561 - Another semi-conductor supplier trades on a PE of 17.5, good growth, 1% dividend. A patron query in the comment section about 2 weeks ago prompted me to take a look and after doing so I added it to my potential buys watch list, accumulating to 0.6% across a myriad of small buys during the week.

The Fishes that Have So Far Gotten Away

However, there there were a few fishes that still managed to get away, which brings home the importance of having limit orders in place and refining them in the wake of price action and changing exposure.

MICROSOFT - IT FELL to where I would have backed up the truck but in AFTER HOURS TRADING! Still a dozens of small buys at between $298 and $281 lifted my exposure to 1.1%.

GOOGLE - I never made seriously time to buy a chunk of Google as my focus was always elsewhere.

MEDIFAST - It just point blank refused to drop, so drip, drip small buys on sub $192 price action.

NVIDIA - The valuation is still too steep, I need something like $192 for a big buy, still I did accumulate some between $213 and $236, a case of better to hold some rather than none..

QUALCOM - Another great stock that refused to drop at ALL! I was expecting it's chart price GAP between $147 and $160 to be filled, but the stock continues to float in the clouds.

BROADCOM - Same story, another good stock that barely budged lower.

APPLE - Hardly budged, I need sub $140 for serious buying.

So as you can see there is still a lot of buying in the pipeline, so whilst my trend forecast for what to expect beyond Mid Feb 2022 remains pending whilst I buy the panic, nevertheless my expectations are for lower prices for most AI stocks i.e. I would be very surprised if we have seen the bottom,, though some stocks such as Amazon, AVGO and Google are strongly resisting going lower, therefore I will be more inclined to buy their first big buy levels. Whilst others such as Qualcom and Apple have point blank refused to drop hence I have bought nothing.

Nevertheless! I WILL CONTINUE BUYNG THE PANIC, THE DEVIATION FROM THE HIGHS IN GOOD STOCKS TRADING AT REASONABLE VALUATIONS! Remember all of these are GOOD stocks where the name of the game is for earnings playing catchup to valuations, unlike the garbage stocks that have no earnings so instead the fools focus on revenues or worse other even less relevant metrics such as user count that in many cases incur an ongoing cost to retain.

AI Tech Stocks Funds Revision

To make the funds sectional more meaningful I have ditched those funds that I personally would never invest in and focused on 3 AI funds that I would and have now started investing in.

Scottish Mortgage Trust (SMT.L)

Buying Levels are Small £10.20, Big £9.56 and £8.96

RBTX.L - iShares Automation & Robotics UCITS

Buying Levels - Small from £8.82, Big £8.62, £7.98

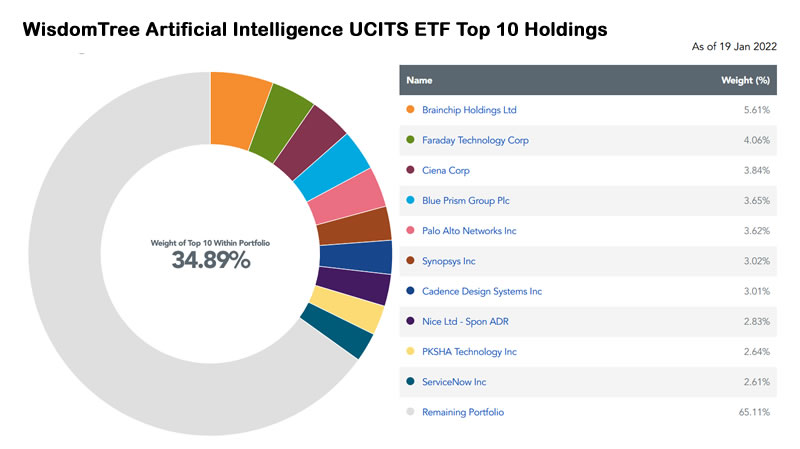

NEW - Wisdom Tree Issuer plc Artificial Intelligence UCITS ETF

USD ticker is WTAI, GBP Ticker is INTL.L

The Wisdom Tree Issuer plc Artificial Intelligence UCITS ETF tracks the NASDAQ CTA Artificial Intelligence Index and invests in large cap AI stocks and thus is far less volatile than SMT.L, so basically one could invest and forget in this fund, or average it with the more volatile SMT.L to smooth out that erratic funds performance. Another benefit of Wisdom Tree is that it is listed both in USD and GBP, so NO FX fees for either US or UK buyers, furthermore NO stamp duty tax unlike SMT.L which does incur 0.5% stamp duty on purchases which is one of the benefits of buying US stocks in the first place over UK stocks i.e. no stamp duty, but there is still an fx fee unless bought on the London Stock Exchange

I can't say I know much about any of the funds holdings, nevertheless the funds chart looks pretty stable, low volatility only down about 10% from it's high despite being populated with growth tech stocks, i.e. no Cathy Wood style collapse given the 50%+ drop in most small cap growth stocks, so they must be doing something right. A steady as she goes AI fund that will help smooth out fund returns.

Buying Levels are £43.29, £41.96, £38.56.

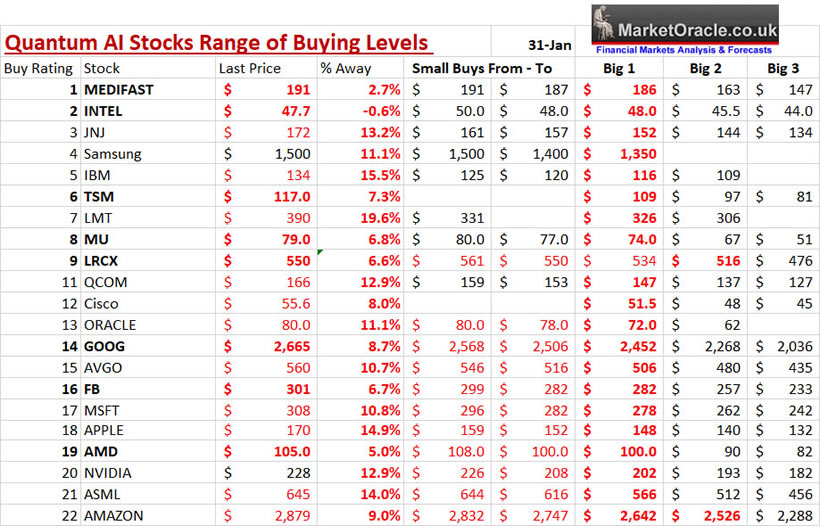

QUANTUM AI STOCKS MULTI BUYING LEVELS

1. GOOGLE - I am slowly ramping up exposure towards at least 50% (36%) via small buys at between $2562 to $2506, large buys are under $2500 at $2452 and $2268.

2. FACEBOOK - I want to ramp up my exposure to at least 90% (75%), aiming to buy at below $292 though given my holding may not buy big at $282..

3. MiCROSOFT - I am continuing with a series of small buys at between $280 and $296 aimed at lifting exposure to 25% (20%), Large buys at $278 and $262.

4. APPLE - It does not look like I am going to be buying any Apple stock any time soon, small buys start at $159, big buys at $148, though I doubt I will buy much above $140.

5. NVIDIA - I am accumulating Nvidia below $220 aimed at gradually building up exposure to at least 25% of target (current 15.1%) with my nearest big buy at $202 and then $193. Though this is a risky stock, i.e it could could go all the way down to something daft like $140! That is the risk I am prepared to take and why I waited till sub $236 before doing any serious buying of Nvidia because I fully understand how low this stock could blow!

6. AMD - Accumulation has gone well with my last big buy at $106, next will be under $100 with exposure standing at 57%. Big buys are $100, $90, $82. I will probably next buy at $92.

7. TSMC - Bought nothing so far, no small buys, big buys start at $109, then $97, $81.

8. Qualcom - So far no significant buys, small buys start at $159, big at $147, $137 and $127.

9. Broadcom - Managed to bump exposure to 22% via a myriad of small buys starting at $546, large buys at $506 and $480, In fact $480 has been my primary buying price for Broadcom for some time.

10. AMAZON - I have been actively buying Amazon given it's huge deviation from it's $3700+ high, bringing my exposure form zero to 1.7%, given that I did previously sell all of my Amazon stock at $3400+, so an average buying price of $2850 feels dirt cheap in relative terms. Small buys are from $2832, big buys at $2642 and $2526, and my most probable next buy will be below $2642, maybe around $2600 as I am not in any rush to add more to amazon right now, after all I do consider Amazon to probably be the worst stock on my list so I definitely don't wan to see it grow to too large a share of my portfolio..

11. ASML - I bought a large chunk of ASML that takes my holding from virtually zero to 81% of target. small buys from $644, large at $566, $512 and $456.

12. INTEL - Plunged on earnings to below $48, so I bought big, Now my largest single holding. Small buys from $50, Big buys at $48, $45.5 and $44. I have no plans to buy anymore.

13 . IBM - Small buys from $125, Big $116, $109. I definitely want to buy more IBM.

My investing plan right now is to continue to increase my exposure to stocks as and when opportunities arise all the way towards being about 78% invested from the current 58%. And it looks like Brit's are very lucky to have SIPP's and ISA"s which means at least capital gains are tax free. Whilst in the US ROTH IRA"s whilst similarly to ISA"s have a lot of rules attached in terms of who can open one and withdrawals from and contributions into in comparison to UK ISA"s. So don't waste your ISA allowances as you don't know when the government will change it's mind and cut the annual allowance back down form £20k to £7k!.

And here are my current multi buying levels for all 22 AI tech stocks ranked in order of what I deem to be in terms of how good of a buy they are right now in valuation terms as well as highlighting those nearest their Big buy levels i.e. AMD may not be one of the best buys in valuation terms but it is in terms of it's deviation from it's high. We are rarely going to get perfect buys i.e. valuation AND deviation from highs, so have to take whatever the market giveths and be thankful for that.

Now understand this, I don't have the benefit of hindsight, so when the dust finally settles in some 6 months time and we all know precisely where all the stocks finally bottomed, don't then have a go at me by for instance saying "Nadeem you said to buy Amazon big at $2642 when the final low was $2136" with similar draw downs for the other stocks such as AMD settling at $76, Nvidia at $150 etc,. Yeah well that's the way the cookie tends to crumble when dealing with an unwritten future, thus one has to allow for the possibility for such draw downs which in relative terms are quite mild i.e. virtually EVERY stock on this list has experienced several draw downs of 50% or more during it's trading history which is par for the course when investing.

NEW Investors

I am regularly asked what I would invest in right now if I was just starting out and held nothing.

In which case I would buy exposure to all of the stocks in bold above i.e. Medifast, Intel, TSM, MU, LRCX, GOOG, FB and AMD at their listed buying levels i.e. AMD at $100.

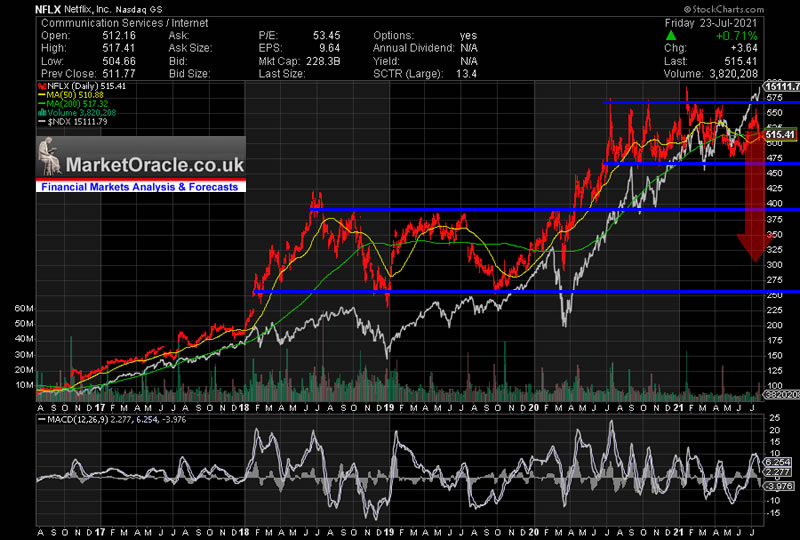

NETFLIX - You Cannot Say You Weren't Warned!

Some six months ago in response to Patron requests for why I do not include Netflix as one of the FANGs in my list, my quick analysis painted a dire picture for the stocks future prospects that I saw as destined to trade down to between $250 and $400 for several years, and thus the price being bid up towards $600 at the time was literally a stock asking for an INVESTOR PANIC to CRASH it at least halve in price.

23rd JUly 2021 - Chasing Value with Five More Biotech Stocks for the Long-run

If you are determined to torture yourself by investing in this stock then perhaps wait for a price near $300, at least then that would carry a probable floor of around $250.

ARKK MATHS

Just remember this, for ARK or any stock to recover from a 60% drop the stock has to go up by 150%!

So given the pace of the decline which suggest an 80% high to low drop is possible then Cathy Wood's ARKK really could X4 in 4 years as Cathy Wood insists, though those who invested at the average price of $119 (based on volume analysis), will be barely breaking even in 4 years time!

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Saber rattling, troop build ups, mis-information, clutching at peace straws, clueless journalist suggesting it's not going to happen because Putin's best buddy in China is in the mood for an omicron spreading sporting event.

Clearing away the fog - The Russians ARE going to invade Ukraine as soon as weather permits! Why? Because Russia is a dictatorship! Dictatorships seek out that which can exaggerate their power and Ukraine in those terms is the only obvious bordering target for Putin.

Russia's pinhead dictator wants the world to perceive RUSSIA in the same terms as they used to perceive and fear the USSR! Instead of a past it's sell by date super power with a midget economy that produces nothing of significance reliant wholly on exporting oil and gas for foreign currency.

The great irony is that UKRAINIANs ARE the REAL russians for that is where Russia began in the UKRAINE! So for many Russians including Putin Ukraine being independent is a bit like London being Independant of England. And that is how Putin perceives Ukraine, and why Putin wants the WHOLE of the Ukraine! Something most in the West fail to grasp, he doesn't want the Donbas, he wants the whole of Ukraine lock stock and smoking barrel!

Meanwhile the West threatens sanctions, but Russia holds many of the trump cards as past sanctions have made the Russian economy more resistant to sanctions, and much of Europe especially Germany relies heavily on Russian Gas so if there was an opportune time for Russia to go to war then that time is now.

And so could begin a chain reaction of actions and reactions that ultimately risks leading to World War 3! As what came to be known as WW2 sprung from the Japanese attack on Pearl Harbour trying to capitalise on Germanys War in Europe, so in 2022 it could be China's attack on Taiwan trying to capitalise on Putin's war in Europe.

The whole of this analysis was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- Stock Market Trend Forecast Mid Feb to End 2022

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst catching the falling knives like a well trained acrobat.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.