Stock Market Peculiar Reversal

Stock-Markets / Stock Market 2022 Mar 07, 2022 - 09:11 PM GMTBy: Monica_Kingsley

S&P 500 recovered most of the intraday downside, and in spite of value driving the upswing, there is something odd about it. Tech barely moved higher during the day, and the heavyweights continue being beaten similarly to biotech compared to the rest of healthcare. The key oddity though was in the risk-off posture in bonds, and the Treasuries upswing that Nasdaq failed to get inspired with.

If TLT has a message to drive home after the latest Powell pronouncements, it‘s that the odds of a 50bp rate hike in Mar (virtual certainty less than two weeks ago, went down considerably) – it‘s almost a coin toss now, and as the FOMC time approaches, the Fed would probably grow more cautious (read dovish and not hawkish) in its assessments, no matter the commodities appreciation or supply chains status. Yes, neither of these, nor inflation is going away before the year‘s end – they are here to stay for a long time to come.

Looking at the events of late, I have to dial back the stock market outlook when it comes to the degree of appreciation till 2022 is over – I wouldn‘t be surprised to see the S&P 500 to retreat slightly vs. the Jan 2022 open. Yes, not even the better 2H 2022 prospects would erase the preceding setback.

Which stocks would do best then? Here are my key 4 tips – energy, materials, in general value, and smallcaps. But the true winners of the stagflationary period is of course going to be commodities and precious metals. And that‘s where the bulk of recent gains that I brought you, were concentrated in. More is to come, and it‘s gold and silver that are catching real fire here.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 setback was repelled on Friday, but I‘m looking for the subsequent upswing to fizzle out – we still have to go down in Mar, and that would be the low.

Credit Markets

HYG is clearly on the defensive, and TLT reassessing rate hike prospects. This doesn‘t bode well for the S&P 500 bulls.

Gold, Silver and Miners

Precious metals are doing great, and will likely continue rising no matter what the dollar does – my Friday‘s sentence is still fitting today. I‘m looking for further price gains – the upleg has been measured and orderly so far.

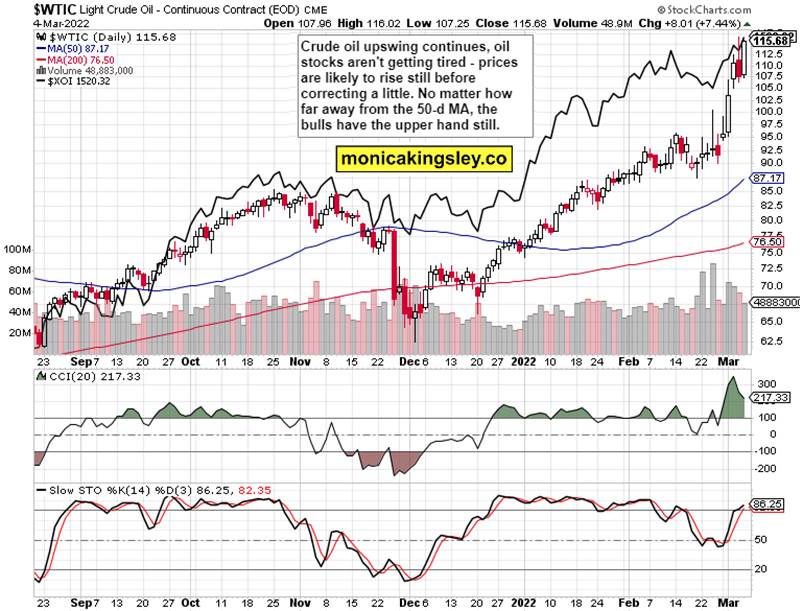

Crude Oil

Crude oil upswing still hasn‘t lost steam, and still can surprise on the upside. Slowdown in the pace of gains, or a sideways consolidation, would be the healthy move next. Jittery nerves can calm down a little today.

Copper

Copper isn‘t rising as fast as other base metals, which are one of the key engines of commodities appreciation. The run is respectable, and happening on quite healthy volume – if we don‘t see its meaningful consolidation soon, the red metal would be finally breaking out of its long range here.

Bitcoin and Ethereum

While I wasn‘t expecting miracles Friday or through the weekend, cryptos are stabilizing, and can extend very modest gains today and tomorrow.

Summary

- S&P 500 is likely to rise next, only to crater lower still this month. It may even undershoot prior Thursday‘s lows, but I‘m not looking for that to happen. The sentiment is very negative already, the yield curve keeps compressing, commodities are rising relentlessly, and all we got is a great inflation excuse / smoke screen. Inflation is always a monetary phenomenon, and supply chain disruptions and other geopolitical events can and do exacerbate that. Just having a look at the rising dollar when rate hike prospects are getting dialed back, tells the full risk-off story of the moment, further highlighted by the powder keg that precious metals are. And silver isn‘t yet outperforming copper, which is something I am looking for to change as we go by.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.