Dow Max Drawdown Bear Stock Market 2022 - Accumulating Deviations from the Highs

Stock-Markets / Stock Market 2022 Feb 21, 2022 - 04:14 PM GMTBy: Nadeem_Walayat

Dear Reader

Did you get a good heads up warning of the BEAR MARKETS current down phase BEFORE it began?

We'll my Patrons did with ahead of the curve analysis in my extensive analysis of 7th Feb warning that Stocks were in the eye of the storm before embarking on their next leg lower with forward guidance of what to expect in the lead up the 1st Fed rate hike Mid March 2022.

Stock Market in the Eye of the Storm, Visualising AI Tech Stocks Buying Levels

Content:

m = f - Everything is Waving!

How to Invest in Stocks 20202 and Beyond

Stock Market Calm In the Eye of the Storm

Stock Market Forward Guidance

50% DRAWDOWNS ARE THE NORM!

Current State of Draw downs

Quantum AI Stocks Portfolio Current

AI Tech Stocks Buying Levels

Earnings Growth Factor

GOOGLE TO BE SLICIED INTO 20 PIECES!

FACBOOK MISSION ACCOMPLISHED Whilst CNBC Clowns Buy the TOP and SELL the BOTTOM!

MICROSOFT Short and Sharp

Still Waiting to Take a BITE out of APPLE

NVIDIA is ARMless - To Buy or Not to Buy, that is the question.

AMD - The Chip Master

TSMC - The World's Supreme Chip Fabricator

AMAZON the Dark Horse!

ARKK SARK SHORT FUND

Ahead of the curve analysis for just $4 per month.

Whilst my latest analysis to be posted within 24 hours, likely to have gone live as you read this article is an extensive look at the CRASHED Growth stocks for any opportunties to accumulate at DEEP discounts of as much as 80%, a filtering down from a screening of over 200 stocks down to a shortlist of 45 further refined to just 5 stocks to be added to my High Risk stocks portoflio.

And access to my recent timely analysis lays out how to invest in during the panic of 2022,

HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

The whole of which was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Meanwhile all eyes are on Russia and what it plans for Ukraine, which my video based on my analysis of a several weeks ago maps out what I expect to transpire and how I intend to capitalise on it.

This article is part 2 of my recent extensive analysis (Part 1 INVESTORS SEDUCED by CNBC and the STOCK CHARTS COMPLETELY MISS the BIG PICTURE!) on BUYING the PANIC in TECH STOCKS, that seeks to give investors a cold shower, so that they understand of what is bubbling under the markets surface.

AI Stocks Multi Buying Levels to Capitalise on the Stock Market Panic of 2022

THE VALUATION RESET

INVESTORS SEDUCED BY STOCK CHARTS COMPLETELY MISS THE THE BIG PICTURE!

QUANTUM COMPUTERS

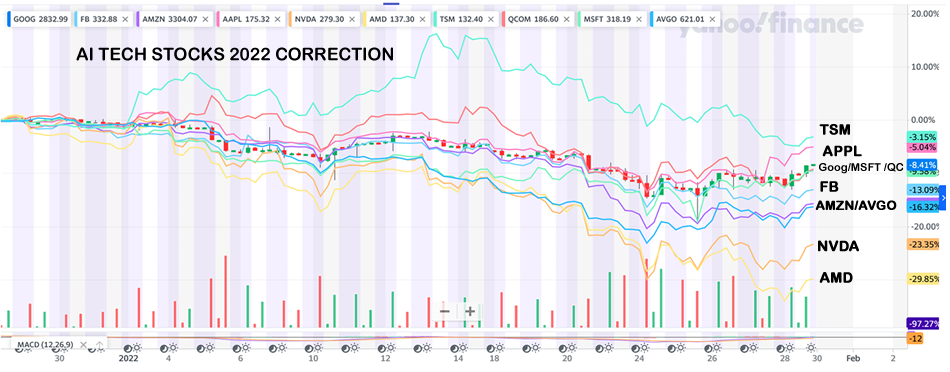

AI Tech Stocks 2022 Correction

Stock Market Trend Forecast Current State

Dow Max Draw Down 2022

ACCUMULATE DEVIATIONS FROM THE HIGHS IN GOOD STOCKS!

NEW STOCKS

The Fishes that Have So Far Gotten Away

AI Tech Stocks Funds Revision

QUANTUM AI STOCKS MULTI BUYING LEVELS

NEW Investors

NETFLIX - You Cannot Say You Weren't Warned!

ARKK MATHS

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Pandemic Rear View Mirror - Next Potential Catastrophe?

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

AI Tech Stocks 2022 Correction

People tend to over complicate investing, looking for that which will give them the exact bottom price to buy at because they cannot cope with draw downs, even though the draw down delivers lower buying prices and thus risk missing out on the golden opportunity of accumulating into some of the best stocks one can ever dream of investing in at deep discounts to their trading highs, virtually all of which traded at least 15% lower during the week with a number such as Nvidia and AMD trading lower by more than 1.3rd of where they were trading barely a month ago!

All one needs is a list of good stocks to own for the long-run. And then wait for opportune moments with list of buying levels to accumulate at the primary purpose of which is so that one does need to THINK in the midst of panic, chaos, NOISE just ACT!

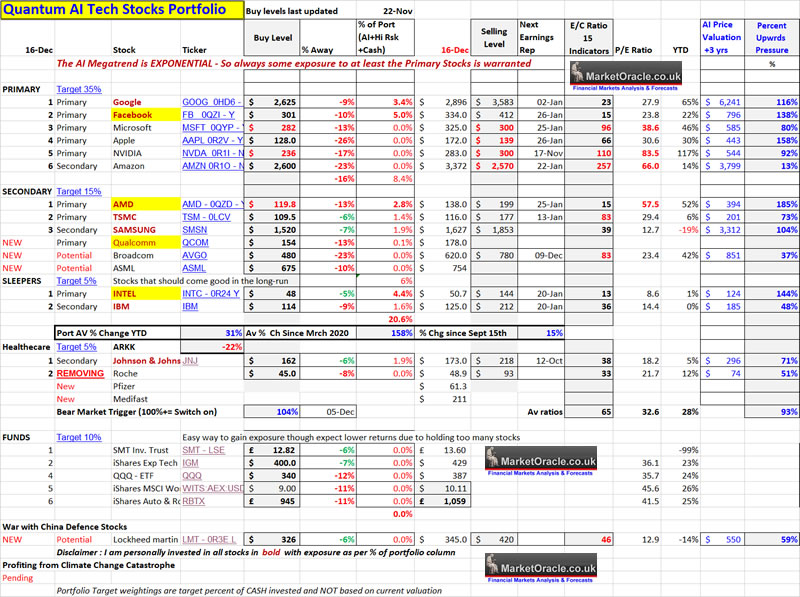

The starting point for investing are my long standing buying levels at valuation levels that no matter what happens should come good in the long-run whilst preventing investors from over paying by FOMO-ing into the highs, i.e. The buying level for Google is $2625 not $3025, Microsoft $282 rather than $342 and Nvidia $236 rather than $336 as some clowns on youtube were publically FOMO-ing into at, as illustrated by my last iteration of the AI stocks table of Mid December.

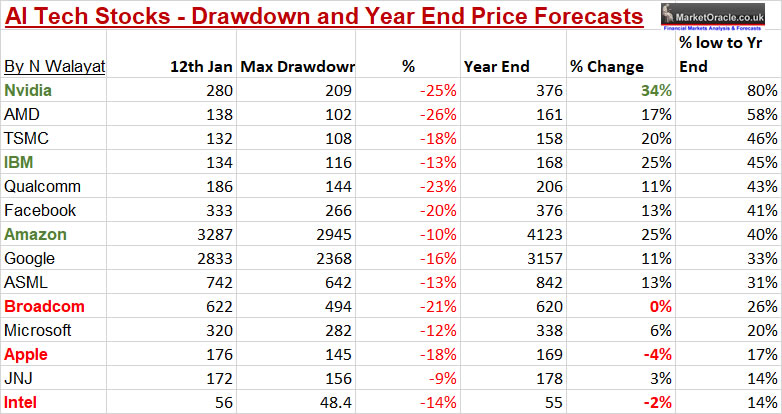

Phase 2 was my timely analysis (HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond) that laid the ground work for how to invest during the anticipated waves of deep deviations from the highs in each of the stocks one by one that concluded in the following table of how low I expected each of the stocks to trade down to as a guide to where to target he bulk of ones planned buying in favour of those stocks that presented the greatest low to high potential price move.

For instance my target low for Nvidia, the stock that I deemed to have the greatest potential was $209, the actual low point of the current sell off is 208.88. And similarly other stocks such as AMD, Amazon, ASML, Microsoft, and Intel have all reached their target lows and so I bought into all of these stocks to varying extent amongst others.

However, I have noticed from Patreon comments that as prices fell sharply, some were finding reasons why stocks could just keep falling much further, which reinforces the importance of having a plan and sticking to it regardless of what happens else one will just find oneself having bought nothing and sat looking in the rear view mirror at the bottom that has come and gone.

This table coupled with my existing Dow trend forecast well in advance of the current sell off painted a picture for a significant correction that was expected to run into Mid Feb 2022 with tech stocks expected to fall at twice the pace of that of the general indices.

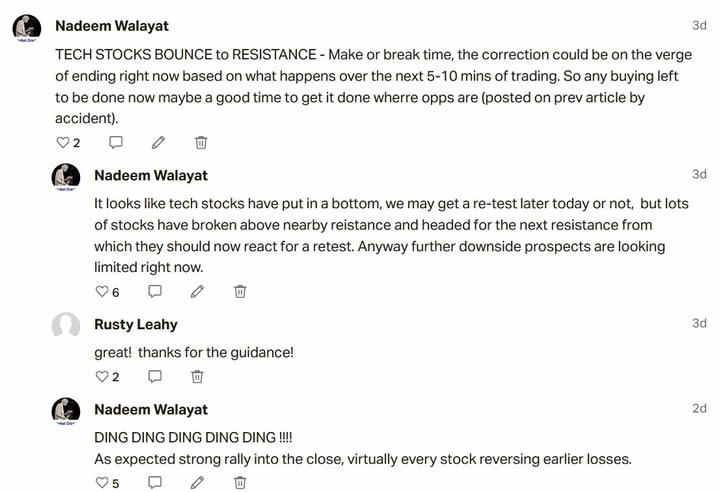

As you can see from the updated chart below that I expect the stock market to continue trending lower for a few more weeks before entering a weak rally. Whilst the immediate future points to a continuation of the rally that began mid-day Friday as I flagged in the comment section at the time, in fact I suggested Patrons thinking of buying should look to get it done asap before the intra day rally solidifies into a trend change..

For how high and how long stocks could bounce is hard to say, after all volatility is high and prices do not move in a straight line. Whilst the Dow closed right at resistance of 34,725. If this is a true panic event then the rally ends here i.e. the underlying panic resumes. So ironically it is harder to call short-term movements right now than the longer term trend but on the balance of probabilities it looks like the Dow is headed higher for at least a couple of days, Monday and Tuesday.

Whilst the Nasdaq at 13,770 has yet to get anywhere near clearing resistance at 14,000 so could turn lower a lot sooner than the Dow, perhaps even as early as during Mondays trading session and thus target fresh lows, a break below 13,000. Okay that's probably more wishful thinking on my part. Stocks are very over sold and who knows the buy the dip brigade may join in on the technical bounce that began Friday to send stocks higher still. This is the volatility that I warned of, sharp moves DOWN AND UP! The nature of the beast!

The bottom line is that there is a very high probability that the downtrend is not over, so despite what may take place over the next few days I ultimately expect fresh lows in especially the tech stocks. However, stocks don't all move in lockstep as we saw last week, Amazon bottomed early in the week, AMD late, and IBM was off doing it's own thing, so I will continue to accumulate as opportunities arise with little regard or interest to what the general indices such as the Dow and Nasdaq are doing as they are not what I am actually investing in.

Dow Max Draw Down 2022

As for how low the Dow could ultimately go during 2022? Without preempting my next analysis I have penciled in a preliminarily 2022 draw down for the Dow of 16% off it's 37k high which would put the Dow low at about 31k that's near 4000 points lower than the last close of 34,725, so about an equivalent points drop from here than we experienced from the 37k high to last weeks 33.1k low and thus this decline may only be half done!

A Dow low of 31k chimes well with both my big buying levels to get triggered AND by giving all the Buy Dippers who I suspect will be piling in this week a very bloody nose! As just after they bought the rally, it's off of the edge of the cliff again!

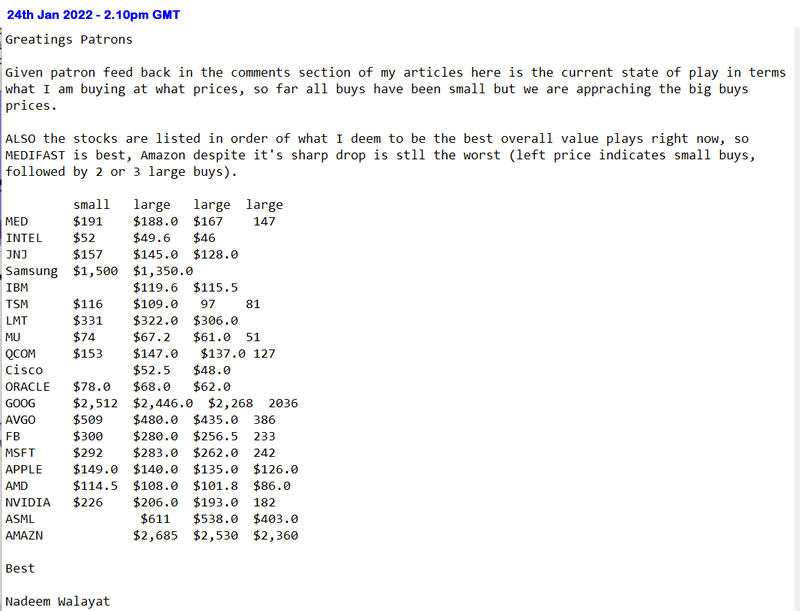

And then there was my CHERRY on top being my multi buying levels that I messaged to all Patrons before last Monday's open following feedback from Patrons in the comments section, of prices where I would be seeking to accumulate each of the primary AI stocks during the coming week that I will update in this article,

Which was supplemented by Patreon comments of my latest posted article of what I was doing each day and answering queries on a ongoing basis, including whenever I made any large live buys such as for AMD and Micron.

ACCUMULATE DEVIATIONS FROM THE HIGHS IN GOOD STOCKS!

HAVE PLAN AND THEN FOLLOW THROUGH ON IT ELSE ONE IS AKIN TO A REED BLOWING IN THE WIND!

YOU ARE NOT TRYING TO CATCH THE BOTTOM, SEEKING THAT IS A RECIPE FOR OWNING LITTLE OR NOTHING AND THEN STUCK LOOKING IN THE REAR VIEW MIRROR AND HOPING STOCKS FALL ONCE MORE AS THEY JUST DID!

A lot of investing is down to psychology, investors are fixated on trying to sell at the top and buy at the bottom instead investing should be about BUYING VALUE AND SELLING WHEN OVER VALUED.

IT DOES NOT MATTER IF A CHEAP STOCK BECOMES CHEAPER! So what if one bought AMD at $100 and it then falls to $80 or even $70! Waiting for the bottom will mean one OWNs NOTHING OF VALUE! for the bottom will ONLY be clear in HINDSIGHT!

THE WHOLE POINT OF INVESTING IS to BUY QUANTUM AI STOCKS WHEN THEY ARE CHEAP!

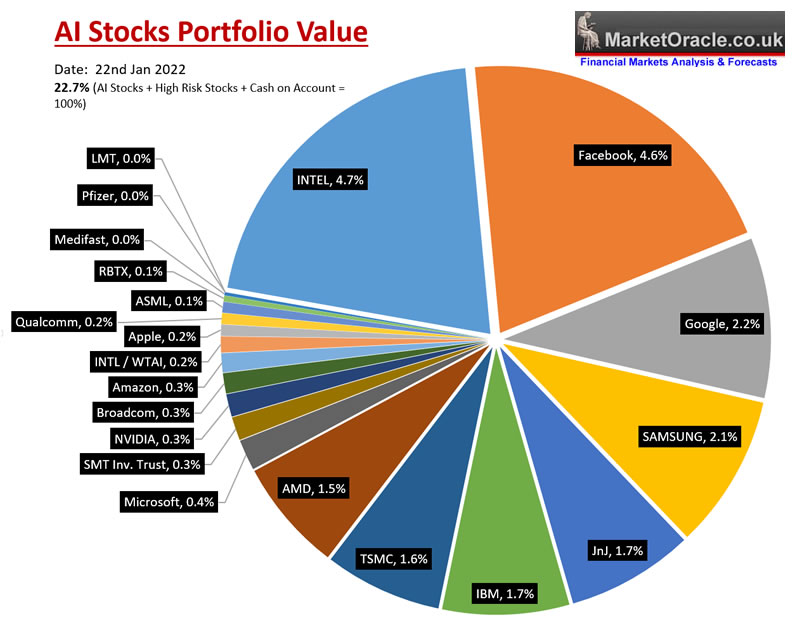

The net result of the panic selling of last week is that I expanded my AI stocks portfolio from 22.7% exposure (AI stocks + High Risk + Cash on account =100%) -

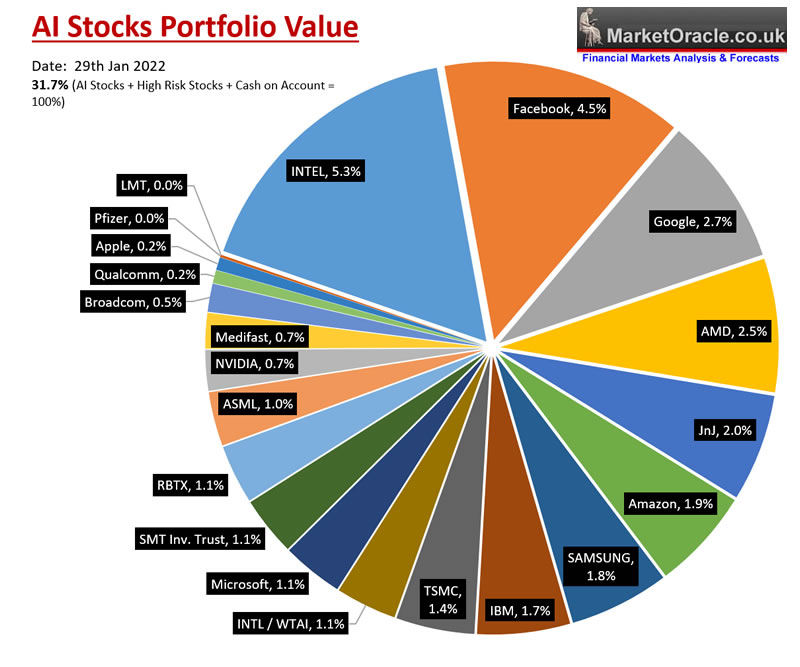

To 31.7% by Fridays close, which is despite many of the stock prices having fallen significantly in price from the week before hence lowered valuations. Where my objective as I laid out many moons ago was is to build my exposure to the stock market back upto around 75% invested which would translate into exposure of about 50% to AI tech stocks so I am about 2/3rds towards achieving my objective.

The only stocks that I bought nothing of were JnJ, Samsung, TSMC and Apple. Whilst the stock that I bought the most of was Amazon, trading a good 1/3rd off it's recent high, with buying continuing in my high risk portfolio and beyond to include stocks from my watch lists that are outside my public portfolios - Micron, AMAT and LRCX (which I will add to either my AI or high risk portfolios in future articles)

Whilst I perhaps went a little overboard with INTEL, which despite the price drop lifted my exposure to 5.3%, I now hold too much Intel so on the next rally to $55 or $56 whenever it maybe I will likely offload 1/4 of my Intel holding.

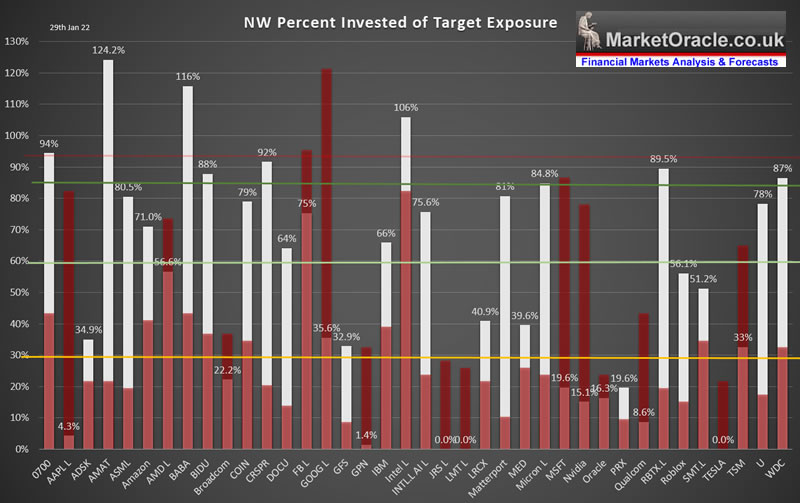

The following table showing stocks that I am currently focused on in terms of percent invested vs target exposure (for detailed explanation see - HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond)

The rest of this extensive analysis has first been made available to Patrons who support my work -

AI Stocks Multi Buying Levels to Capitalise on the Stock Market Panic of 2022

THE VALUATION RESET

INVESTORS SEDUCED BY STOCK CHARTS COMPLETELY MISS THE THE BIG PICTURE!

QUANTUM COMPUTERS

AI Tech Stocks 2022 Correction

Stock Market Trend Forecast Current State

Dow Max Draw Down 2022

ACCUMULATE DEVIATIONS FROM THE HIGHS IN GOOD STOCKS!

NEW STOCKS

The Fishes that Have So Far Gotten Away

AI Tech Stocks Funds Revision

QUANTUM AI STOCKS MULTI BUYING LEVELS

NEW Investors

NETFLIX - You Cannot Say You Weren't Warned!

ARKK MATHS

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Pandemic Rear View Mirror - Next Potential Catastrophe?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Stock Market Trend Forecast Mid Feb to End 2022

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst contemplating his net big buys during the next stretch of panic selling.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.