AI Tech Stocks State Going into the CRASH and Capitalising on the Metaverse

Stock-Markets / Metaverse Jan 25, 2022 - 11:14 AM GMTBy: Nadeem_Walayat

Dear Reader

Caught off guard by the Stock Market Panic underway?

We'll you cannot say you weren't warned!

AI Stocks Portfolio Buying and Selling Levels, Bubble Valuations 2000 vs 2021

Amazon to the MOON 2021! Then what?

And more recently this - STOCK MARKET CRASH / BEAR INDICATOR TRIGGERED - 103.4% vs 100% = Switched ON!

Four bucks per month still too much for AHEAD of the curve analysis?, not like all the lemmings on youtube and across the blogosFear expecting that final blow off top all the way to their portfolios leaping off the CRASH cliff!

My latest timely analysis lays out how to invest in during the panic of 2022, to be soon followed by my next analysis that continues the above trend forecast into the end of 2022.HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Also access to my recent analysis that updates the current status of my High Risk Bio and Tech Stocks portfolio.

High Risk Bio and Tech Stocks Portfolio Q4 2021 Update

Contents:

Exponential AI Mega-trend

INVESTING PRIORITY

Why Most Investors LOST Money by Investing in ARK FUNDS

ETF BUBBLE Primed to EXPLODE!

INVEST AND FORGET

BREWING FINANCIAL CRISIS 2.0 - RECESSION 2022

FED TAPER CON TRICK

CP LIE - INFLATION vs DEFLATION

UK Inflation Fraud - Real Inflation is 15%+

The 2% Inflation SCAM, Millions of Workers take the Red Pill

Why Inflation is Soaring

Flip Side High Inflation Winners

Warren Buffetts $130 billion Master Plan

STOCK MARKET CRASH INDICATOR

The Quantum Entangled Stock Market

Unloved Biotech Sector

High Risk Stocks Portfolio

COINBASE $247, Risk 1, P/E 19, +0%

TAKEDA $13.7 - Risk 1, PE 10, -19%

Western Digital $56.7, Risk 2, PE 13, -2%

ABBV $132, Risk 2, PE Ratio 11, 4% Dividend, +24%

CORSAIR $21.7 - Risk 3, PE 11, -26%

Neurocrine Bioscience (NBIX) $84, PE 18, Risk 3

ALI BLAH BLAH BABA (9988) $120, PE 17.2, Risk 3

TENCENT TCEHY (0700) $57, PE 19, Risk 4, -9%

RBLX $95. Risk 6, +7%

CRISPR $74, PE 15.3, RIsk 6, -39%

AVIR P/E 30.5 , Risk 9, -71%

APM $1.88, -37%

ACCUMULATING

AI Stocks Portfolio

Limit Orders

Best Stock Investing Platforms

CRYPTO BRIEF

OMICRON a Fuss About NOTHING

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

This is part 3 of 3 of my truly extensive analysis on how to profit form the emerging metaverse.

Part 1 - Investing in the METAVERSE Stocks Universe

Part 2 - Best Metaverse Tech Stocks Investing for 2022 and Beyond

The whole of which was first made available to Patrons who support my work.Best Stocks To Profit From the $1+ Trillion Emerging Metaverse Mega-trend

Contents:

VR and Gaming Becomes the Metaverse

A Video Message from Your Metaverse Analyst

PRIMARY META-VERSE STOCKS

QUANTUM AI METAVERSE STOCKS

METAVERSE STOCKS UNIVERSE

Google Glass a Big Fat FAIL

META (Facebook) Dominating VR

APPLE AR Headset Coming 2022

ROBLOX - High Risk

TENCENT- Chinese High Risk GAMING

AUTODESK (ADSK) - CAD - $254 RISK - 3 OUT OF 10

UNITY (U) - RISK 3 OUT OF 10.

SONY - NEW LIFE FOR AGEING GAMING GIANT? RISK 2 OUT OF 10

MATTERPORT (MTTR) - DIGITIZING THE REAL WORLD - RISK 8 OUT OF 10

INTEL Black Friday Sale!

IBM The REAL Quantum Metaverse STOCK!

NVIDIA THE KING OF THE METAVERSE!

CISCO

AI Stocks Portfolio Current State

AI Stocks - What's Cheap

AI Stocks - What's far value

AI Stocks - What's expensive?

Stock Market Trend Forecast Current State

Current State of Cathy Wood ARKK Garbage

RIVIAN IPO Illustrates We are in the Mother of all Stock Bubbles

DECENTRALAND

SANDBOX

How to Get Rich in the MetaVerse

Bitcoin Trend Analysis

Crypto Current Portfolio

Covid19 Winter Storm Fuel for Financial Crisis 2.0

OMICRON - The 'Oh Dear' Worst Ever Covid Strain?

Consequences for the Stock Markets?

Financial Crisis 2.0 Current State - TAPERING

Financial Crisis 2.0 Stock Market Bubble Investing Strategy

Why You Should Not Fear a 50% Draw down in Your Stocks Portfolio

What's driving asset price inflation?

Inflation Forecasting a Recession In 2022

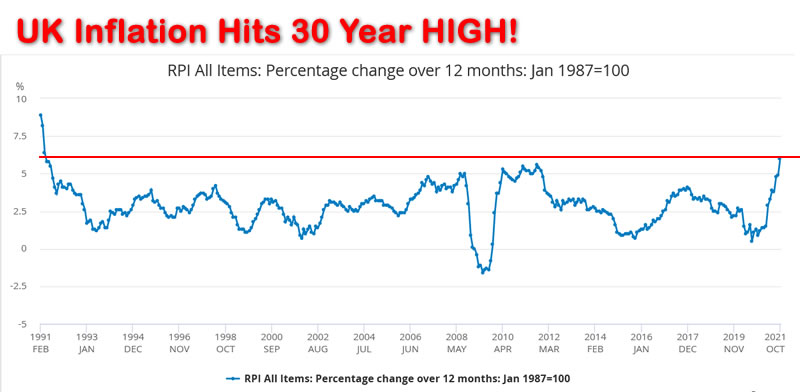

UK Inflation Hits 30 year High of 6%

UK Energy Customers Falling into Energy Firms Fixed Rate Tariffs Trap

Fin tech Stock - Global Payments Inc.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

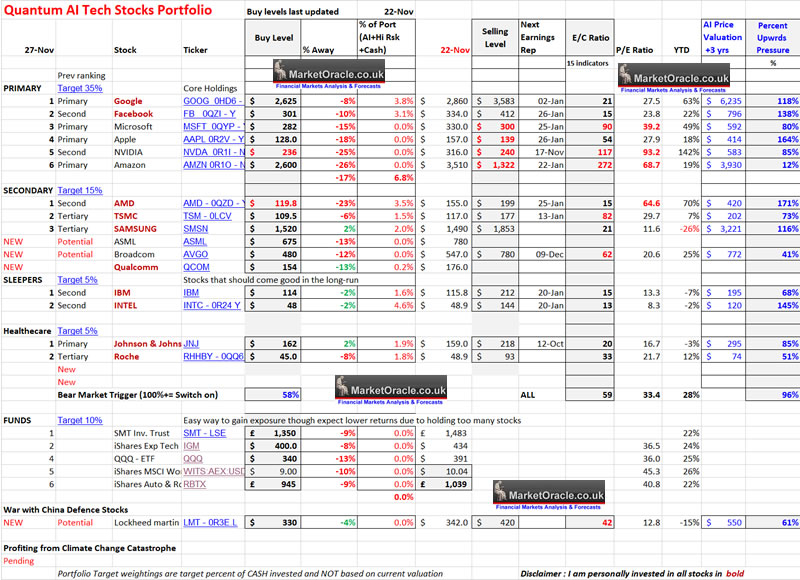

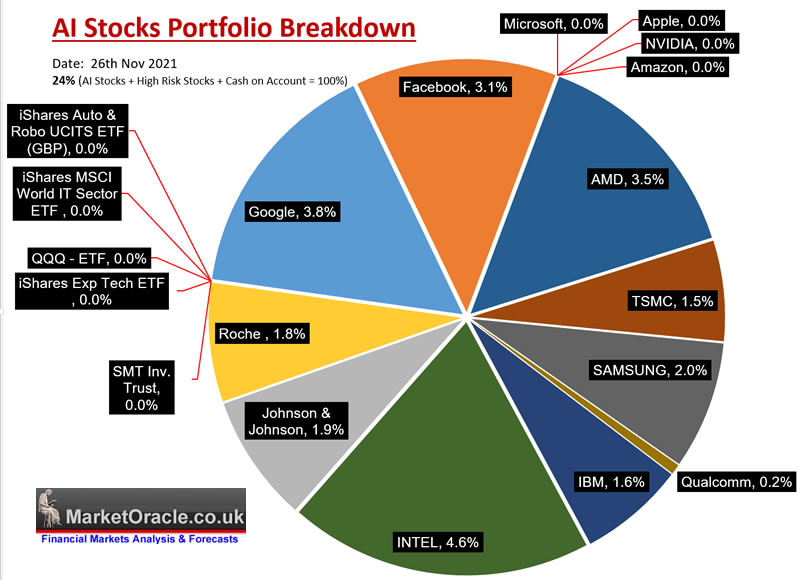

AI Stocks Portfolio Current State

What's cheap and what's expensive right now based on my EC ratio that takes the PE ratio to a whole new level to give insight into valuations, for instance AMD on a PE ratio of 56.7 appears expensive but on the EC ratio is dirt cheap. Whilst TSMC appears fairly valued on a PE of 29.9 however is expensive on the EC ratio and explains why the stock has gone nowhere for over a year. Of course there are anomalies such as Nvidia, which whilst remaining expensive has enjoyed a FOMO parabolic bull run, but that is the nature of our bubble stock market.

Table large image - https://www.marketoracle.co.uk/images/2021/Nov/AI-Stocks-NW-Portfolio-27th-Nov-big.jpg

What's Cheap

Three stocks clearly leap out, Intel, Facebook and AMD. I hold a lot of Intel and I want to buy more AMD and Facebook, I may drip drip buy AMD and Facebook when my ISA transfer to FREETRADE is complete. Whilst IBM is technically cheap however it is in a state of flux following the departure of 20% of it's assets.

I also recently bought a tiny stake in Qualcom that was trading on a PE of 20, and will seek to add more as I expect this to eventually do an AMD.

Big Pharma J&J ($160) trading on a PE of 16.7 appears cheap though it did announce that it would eventually split into 2 so maybe needs some uncertainty pricing in, but there's not much more downside as the stock has a lot of support between $156 to $148 coming down form a high of $232. I can not see the stock getting much cheaper than a PE of 16 so not much downside.

What's far value

Google, Samsung and IBM. Samsung is a poor performer, so I am aiming to buy a little more IBM and increase my bet on this stocks prospects to profit from Quantum AI.

What's expensive?

Microsoft, Nvidia, TSMC. Both Nvidia and Microsoft have been on stellar bull runs, I am aiming to buy some Microsoft but I cannot bring myself to over pay for Nvidia, in fact I have a small short position on Nvidia with a stop at $356. As for Amazon, there are some stocks I don't get and clearly right now I am not getting Amazon, the stock has all the whole marks of consolidating before a breakout higher BUT on a fundamental basis it is not worth the price! Not worth HALF where it is currently trading, hence why I don't get it. Amazon would need to trade to about $1000 dollars lower to around $2600 before I would contemplate buying.

Stock Market Trend Forecast Current State

A reminder of my expectations for the stock market from Mid September into Mid 2022.

Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

The Dow is currently trading at 34,900 which is set against a forecast price of where it should be trading at of 35,000, so on face value is not showing much deviation. However clearly there is a huge deviation in TREND for the Dow is coming off a FOMO SPIKE high of 36,500 which had it parked at support of 35,500 before Fridays mini covid PANIC event, before settling at the next level of support at 34,900.

So yes, technically the stock market 'should' STILL trade higher into the end of this year towards my target of Dow trading at $37k+, but as you just experienced there are SO MANY FLASHING RED lights on my Chernobyl style stock market instrument panel where for me a few more percent of upside does not justify the growing downside risks especially in the over valued stocks.

Current State of Cathy Wood ARKK Garbage

Remember folks, I warned you way back in late February 2021, that the ARKK funds were garbage in response to Patron requests to take a look as up until that point I did not even know who Cathy Wood was. So where does the ARKK garbage currently stand? In a trading range that has a high probability of breaking LOWER.

And What's Cathy Wood currently stating?

According to CNBC - "Cathie Wood says her funds should quadruple over the next 5 years"

She definitely doesn't tend to deviate much from her to the moon sales pitch, 80% per year! CRAZY! If she had said 20% then that could be reasonably possible, but 80% per annum? She will be lucky if her funds double form where they trade today.

The bull run of the past 18 months is ABNORMAL! Her funds are NOT going to quadruple!

RIVIAN IPO Illustrates We are in the Mother of all Stock Bubbles

Just over a week ago EV stock Rivian IPO' d, a stock that virtually delivers nothing in terms of revenues is now valued at $110 billion! The company so far has delivered about 200 cars and their expectations are to deliver about 55,000 cars by the end of 2023.

"Based on our current production forecast, we expect to fill our preorder backlog of approx 55,000 R1 vehicles by the end of 2023"

That's their best case scenario of future revenues of $4.4 billion for a market cap of $110 billion ??? Folks this stock is on another planet! With investors FOMO-ing into a dead parrot at a ridiculous valuation all because they think it will be the next Tesla, forgetting it took Tesla a decade and a lot of pain to get to where it is today. At this stage I put this stock at a 99% probability of FAILING to maintain it's current valuation and in the not to distant future to likely be trading at less than 1/10th of it's current stock price of $130.

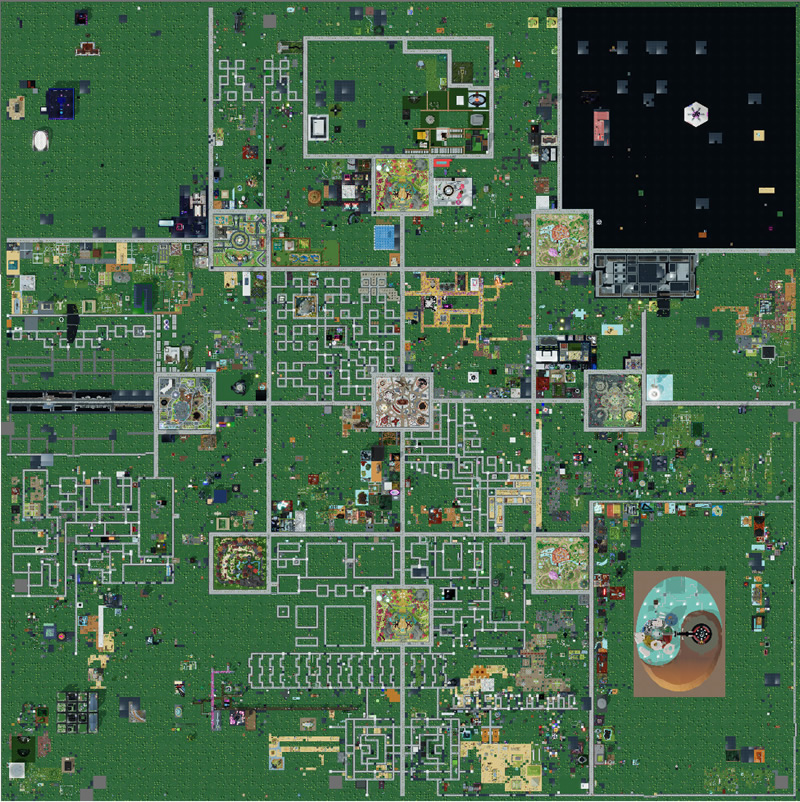

DECENTRALAND

Want to know what Decentraland is all about well the easiest way to find out is to go and play it for a few minutes, nothing to download or signup to, don't even need to give them your email address just play in the browser as a GUEST . https://play.decentraland.org/

Decentraland is a game that promises to become a fully fledged online community and for what little I have seen it is well on the path towards becoming that along with it's very own currency MANA.

SANDBOX

A new meta-verse platform is launching on the 29th of November after 4 years in development where players can earning SAND tokens by completing various quests, very similar to Roblox, with eventually thousands of user generates games on the platform. The current price of SAND is $4.26, up from 75 cents barely a month ago! Given the amount of interest / hype surrounding Sandbox I expect a great deal of volatility when the world goes live in response to potential 'technical issues' especially as the Sandbox world runs on a single server hosted by AWS unlike Decentraland which is hosted across community servers.

SANDBOX IS LIVE - Though one needs to signup to play and connect a crypto wallet!

How to Get Rich in the MetaVerse

Whilst my forthcoming in-depth analysis will point out the primary mechanisms and strategies for becoming wealthy, however here is what one needs to do to fully capitalise on the metaverse where basically you get out what you put in in terms of effort.

So here are what I consider to be what one needs to do to fully capitalise on the metaverse far beyond mere investing in a few stocks, listed in order of effort involved. And in order to keep this concise I will focus on Decentraland and SANDBOX.

1. INVEST IN CRYPTO CURRENCIES

What do you think is the currency of the virtual worlds? Crypto's. where each meta world will favour it's own crypto. For decentralised land that crypto is MANA and SAND for the soon to be released SANDBOX.

As you can see from the following charts that both metaverse crypto's have bolted higher following Facebook's announcement. Still I consider this to be early days so I will be accumulating limited exposure to both virtual world crypto's, a case of invest and forget to wake up perhaps in a few years time to many multiples of where the crypto's are trading today, a bit like buying bitcoin 10 years ago.

Before you all rush out to buy SAND, understand that about 300 million is going to be unlocked on 1st of December (current 900 mill) which 'should' suppress the price for a month or so, with a decreasing amount released every 3 months until the maximum supply of 3 billion is achieved by the end of 2024. Nevertheless SANDBOX release is going to be accompanied by a lot of FOMO.

MANA total supply is 2.8 billion of which 1.8 billion is in circulating. However 400 million was been burned in transactions which means the effective maximum supply is now 2.2 billion (they no longer burn MANA).

2. INVEST IN VIRTUAL LAND

The next easiest step would be to buy a parcel of land in the virtual world. Either to sell on or to build something on at a later date. I'll do a video when I have done it myself to illustrate the process.

3. EARNING POINTS BY PLAYING GAMES

Perform activities that earn points , given that the virtual worlds are actually gaming environments then you can earn some points / tokens by playing the various games they include. Personally I would not recommend going down this route other than to the extent to understand the capabilities of the platform in terms of future prospects as playing games is a consumer activity whereas my focus is in terms of investing capital and creating content, perhaps creating GAMES rather than playing them. You don't want to be sitting there for hours a day clicking a mouse just to earn a few points!

4. Working in the Virtual World

There are thousands of job openings already in the meta-verse! Where? in the META CASINO"s where players come to gamble their SAND or MANA and are greeted and catered to by HOSTS, and that's your first entry level job as a HOST! To populate the meta casinos and keep the gamblers engaged where for about 20 hours of work per week one earns $200 per month. Not much but we are at the very beginnings of the META economy and there are higher better paid positions in the Casinos as well.

Decentraland also has job fairs from time to time where various companies seek to recruit. So one can get a job right now in the metaverse, just don't expect to get paid much by western standards.

If you really want to capitalise on the metaverse?

You have to become a creator!

LEARN to create objects in Decentralised land and Roblox etc , which in fact are NFT's! Even if they may not yet trade as such as given that they predate the crypto NFT craze. This is what I tell my kids to do as I personally don't have the time to go down this route i.e. at this point in time my plates full with machine learning.

- CREATE Wearable's

- CREATE NFT's

- CREATE Games

- HOST Virtual Events

- FREELANCE Your Services

What I am doing

My initial focus will be on buying LAND in the virtual worlds with a view to resale at a later date or given further knowledge perhaps build something on them that generates revenues of sorts.

Bitcoin Trend Analysis

Bitcoin continues to target towards my correction support target zone of $52,000, which I would now revise a little lower to $50k.

So there should be further opportunities to capitalise in Alt coin over the coming week. For instance ADA appears to be trending towards about $1.5 (another 25% drop) and could spike lower still.

I currently have about 70 limit orders in target crypto's at between spot -15% to -30% in attempts to capitalise on more wild swings lower.

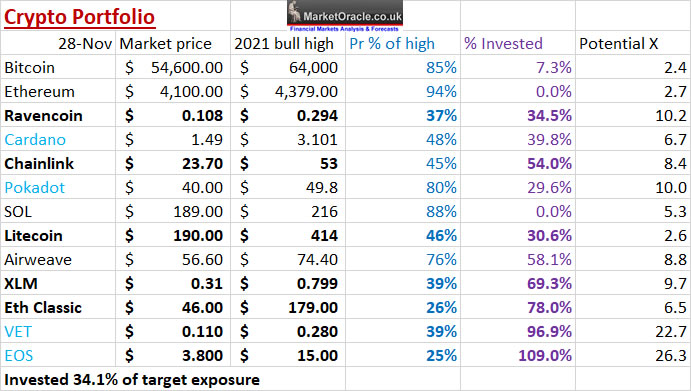

Crypto Current Portfolio

The current state of crypto portfolio stands at 34.1% invested of target exposure courtesy of a series of spikes lower which following the Bitcoin price trading to an all time high in October put me into accumulation mode (art link ), so I have now fulfilled my minimum target to reach at least 1/3rd exposure. Where each spike lower has triggered limit orders in the Spot minus 15% to 30% range for many crypto's. And I expect the current Bitcoin corrective trend to continue to result in further spikes in the alt coins of as much as 30% from their recent highs. So there is plenty of scope to accumulate before the Alt coin bull market proper begins early next year.

Also note do not use STOPS on any crypto exchange because they WILL RUN you stops, only buy limit orders to accumulate or Sell Limit orders to take profits.

Covid19 Winter Storm Fuel for Financial Crisis 2.0

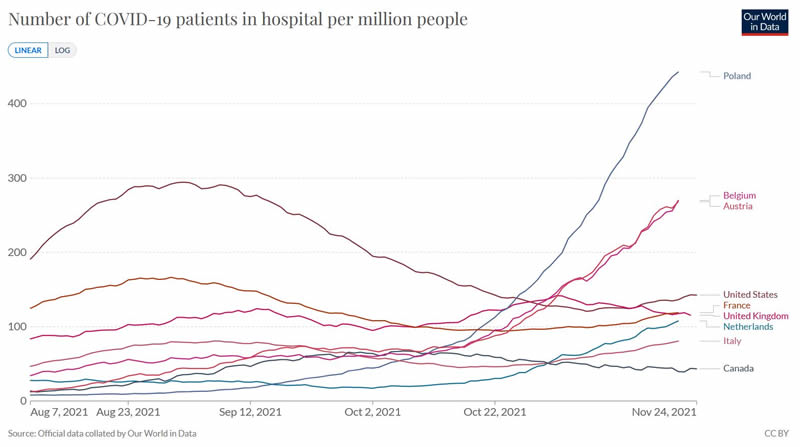

Mainland Europe is going into LOCKDOWN in response to the delta variant as temperatures drop and people spend more time indoors promoting a surge in the spread of the virus putting hospitals under extreme pressure. Austria is leading the way by announcing a national lockdown. Many more will follow suit. I played my part on saturday in preventing the UK going down the route of the EU in getting my booster jab (moderna) on saturday which unfortunately put me out of action for a few days with moderna flu., still I suppose it was better that than covid.

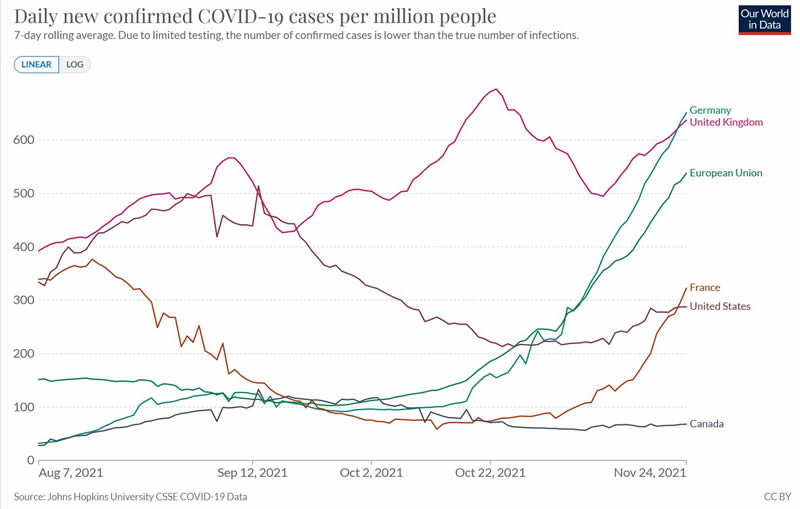

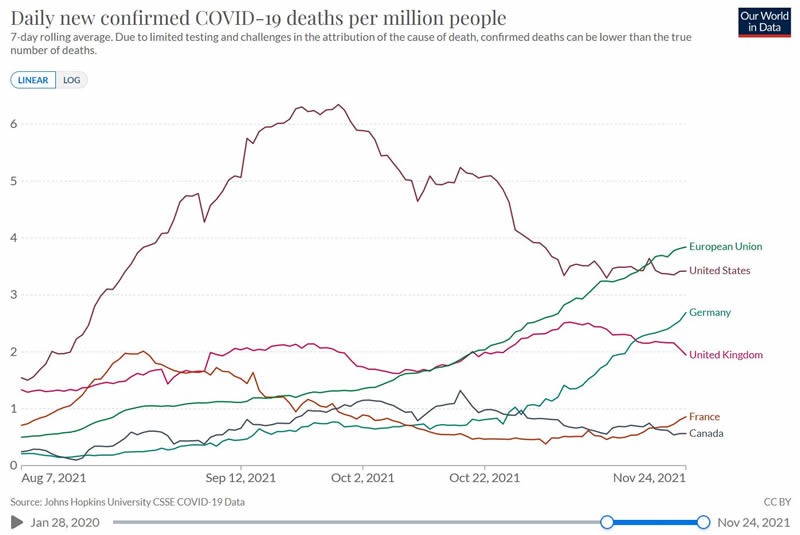

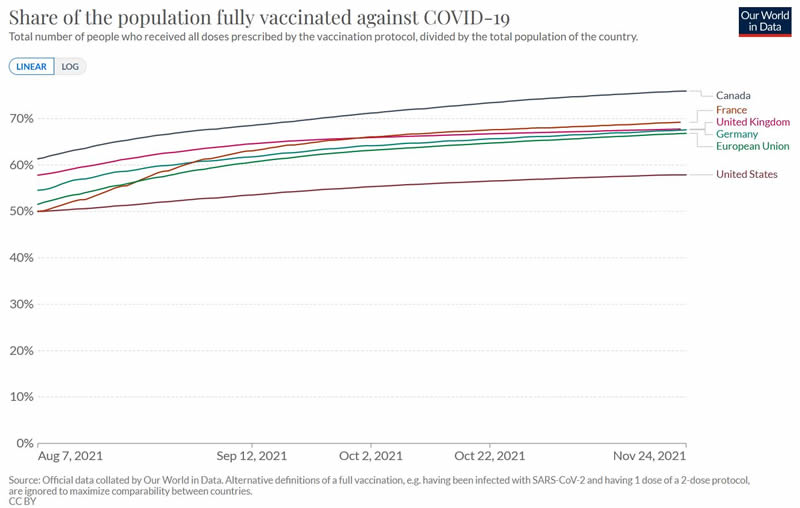

So far the trend trajectories suggest that the UK and US should survive the Covid winter storm, given the high level of vaccinations where in the UK since Mid October have been being supplemented with booster shots. This is reflected in a stable to downwards trend trajectory in the number of new deaths, unlike Europe that appears to be doubling every 3-4 of weeks.

However in terms of what happens next depends degree of vaccinations. Which given a relatively low US vaccination rate could prove to be America's Achilles heel

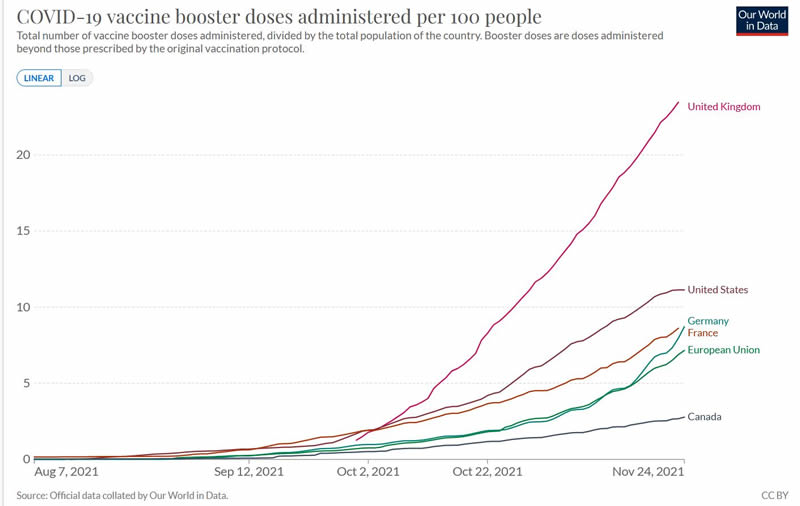

Also given that vaccine protection tends to vane 6 months after the second dose then booster does of especially the most vulnerable could prove to be the deciding factor in preventing winter lockdown's.

Here once more the UK is literally ahead of the curve on a steep upwards trend trajectory that currently stands at 24%. Whilst the US appears to be wavering at just 11% with a drowning Germany desperately trying to play catchup.

The bottom line is that the UK is on course to avoid lockdown's or significant additional restrictions whilst many European nations are increasingly finding themselves in a covid panic as hospital beds fill up. Meanwhile the United States stands at the cross roads of becoming either Europe or the UK depending on what happens over the next few weeks especially in terms of hospitalisations as that is the number that is most likely to trigger lockdown's.

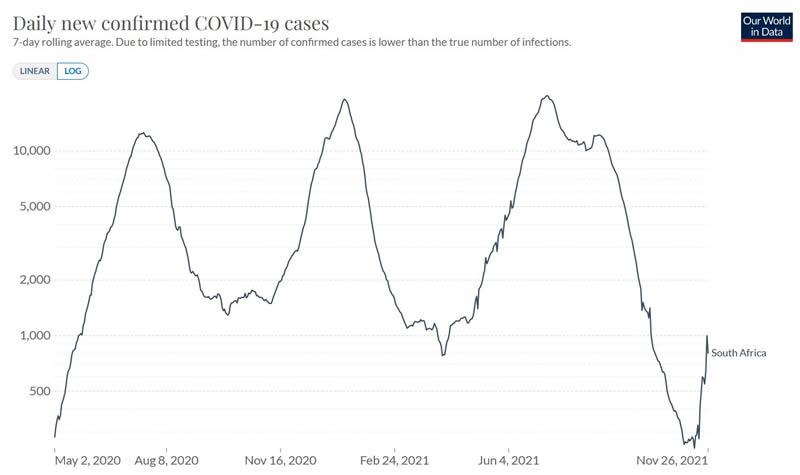

OMICRON - The 'Oh Dear' Worst Ever Covid Strain?

And then along comes a covid black swan, a new variant to supplant the dominant Indian Delta variant. The new Botswana B11529 strain is spreading fast in Southern Africa which has more mutations than any of the other strains to date, 32 that has just been named with the Greek Letter Omicron, could be worse Omega. In response to which the UK has suspended all flights from 6 southern african nations though the cat is already out of the bag with several nations finding carriers of the O strain in mainland Europe so it is probably already within the UK. Whilst the US is adopting a wait and see approach, wait to see the body bags piling up by the thousands before Fauci suggests a new travel ban.

More contagious, high probability of immune escape, makes people more sicker ? pending data. Oh Dear!

If only the scientists would quit playing around with viruses in their labs! The actual source of this new nightmare is ONE person in Botswana, a HIV patient with a compromised immune system that allowed for a hyper evolutionary process to take place.

How bad could things get? We'll that is pretty sharp spike on the end of this graph, the growth appears to be explosive. Still we need at least a couple more weeks of data, but early indications are that it's going to be BAD NEWS! Especially for the northern hemisphere because South Africans are going into their summer whilst the North is in winter.

THE BAD NEWS! 32 mutations, 16 to the spike protein! Delta variant which caused so much havoc last winter had 8 mutations to the Spike protein.

The big question mark is what is going to happen when the virus arrives at a highly vaccinated country such as the UK?

Another big question mark is how sick does it make patients?

Time to restock on vitamin D.

Consequences for the Stock Markets?

Clearly the raging bull markets are not pricing in the economic consequences of new covid lockdown's induced economic stress, which whilst things won't get anywhere near as bad as March 2020, nevertheless something along the lines of March 2021 is possible given that the O variant is more contagious. That and the global economy is not as robust has it was during previous lockdown's as evidenced by the central banks having fired all of their bullets resulting in a surge in inflation with many goods stuck at the ports that is prompting taper talk and rate hikes..

All of which contributes towards Financial Crisis 2.0 which as I said from the outset won't be one thing but knocking away at the pillars that are keeping stock prices elevated. One such pillar is that the pandemic is behind is which clearly for many developed let alone developing nations is NOT TRUE, not for this winter anyway!

Whilst the WHO recommends AGAINST travel restrictions, which says it all of how inept, corrupt, incompetent and irrelevant the WHO is, stop funding the WHO waste of space!.

Meanwhile the vaccine producers have seen their stock prices surge higher, as they prepare to start work on tweaking their vaccines to fit the new strain, though they never did it for the Delta strain.

LATEST - About a dozen cases now in the UK and dozens more across Europe.

Financial Crisis 2.0 Current State - TAPERING

Evergrande defaulted as Chinas government is not going to do a Fed and bail the sector out,. and so literally dozens of large chinese property developers are going under. CCP NO BAILOUT, YOU GO BUST! This illustrates what I wrote a couple of months ago, the CCP see themselves as a separate class of citizenship to the rest of the population, be they common folk or billionaires, the CCP elite are in charge and the rest of you will DO AS YOU ARE TOLD!

Not like the west, cotton wool, kowtowing to billionaires especially those with media interests's, none of that business in China! It's guillotine time folks! We have to remind ourselves investing in China is not the same as investing elsewhere, hence why the Chinese tech titans are considered as HIGH RISK.

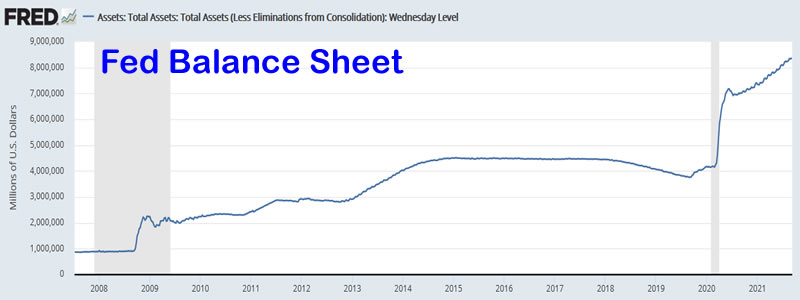

First the current state of the brewing Financial Crisis 2,0 whilst we wait for China's housing collapse to generate hard data to work with. The Fed appears determined to start tapering bond purchases by scaling back on purchases by $10 billion per month, which amounts to a withdrawal of liquidity, On face value this 'should' result in falling bond prices which is what the likes of Michel Burry have been betting on for what seems like the whole of 2021, which has fabled to materialise to date.

The problem is this, Tapering of $10 billion per month is the tip of the bond market ice-berg, it's what it implies that is important where the easy thought process is that the Fed buying less bonds means that bond yields must rise i.e a simple supply and demand equation. However, the whole over valuation house of card has been built on Fed money printing liquidity, start to withdraw that liquidity and what happens to all the over valued assets?

They start to fall in price as investors sell risky assets and buy TREASURY BONDS!

So TAPERING could result in bond prices going UP and not down that given the COT report (commitment of traders) many appear to be betting on.

The bottom line is the Fed appears to be attempting to fight INFLATION that increasingly appears to be a function of supply side issues with MONETARY TOOLS. To fix supply side issues one needs to INCREASE SUPPLY, rather than taper bond buying which is draining asset markets of liquidity and encouraged investors to sell risky asserts and buy bonds.

A lot of market participants have placed their bets on rising interests to fight inflation, unfortunately the inflation that Fed Tapering is likely to reduce is that which it has contributed towards to great extent which is ASSET PRICE INFLATION. that the Fed and Other central banks have levitated the stock and housing markets to. There are a lot of paper profits out there that are seeking a safe home during asset price taper times that could act to support 'safe' stocks trading on modest PE multiples whilst pull the rug on over inflated stocks trading on crazy high PE multiples, many multiples in excess of 20.

As for what I am doing as we hurtle towards Financial Crisis 2.0

In terms of fallout on the west's housing markets such as that of the UK and US, well we have a disconnect of sorts i.e. housing is out of reach for most young adults trying to get onto the housing ladder. So to understand what's going to happen to western housing markets is to ask the question WHO OWNS the PROPERTY! Where for the UK and US at least the answer is the baby boomers! Baby boomers are asset rich, so the fallout from China is unlikely to prompt baby boomers to PANIC SELL. This is not 2008, nowhere near that! HOWEVER, we have a much bigger problem for western housing markets than CHINA! Which is DEMOGRAPHICS!

As Boomers retire they will CONSUME their assets i.e. refinancing for consumption with loans most being interest only mortgages to eventually SELL said properties. So given that the wealth of nations is in large part in the hands of the boomers then that will result in an increase in supply of housing that will drive prices lower because only fellow boomers will be bale to afford most of the properties coming onto the market.

So whilst initial China fallout is limited, however there is a bigger trend in motion that will run for decades that should act to dampen REAL TERMS house price inflation. Of course house prices will still go up in nominal terms due to money printing inflation as houses cannot be printed so will rise in real inflation terms, beyond that I see increasing weakness, especially when we facto in the interest rate hike elephant in the room, but more on that in my NEXT in-depth analysis focused on the housing markets.

Financial Crisis 2.0 Stock Market Bubble Investing Strategy

I have to admit it I SOLD OUT of TOO MUCH stock during the summer months! Where I should had done what I did with Facebook and at least retain 1/3rd of my holdings in the likes of Apple, Microsoft and even Nvidia, anyway selling of over valued AI stocks sent me on a hunt to repopulate my cash rich portfolio with better valued but higher risk stocks to ride out the coming financial storm that unlike the tek giants collectively offered the potential to X5 to X10 return over the next 5 to 10 years and hence was born my high risk stocks portfolio that primarily encompassed the unloved Biotech sector with a few high risk tek stocks such as Corsair, Roblox, Docu and Western Digital added, and then with the icing on the cake being the CRASH in chinese tek giants, where no one knows where the bottom will be but in relative terms appeared to be fairly priced, of course that was all before China's housing market started to implode, that during September saw Evergrande the canary in the coal mine threaten to default on it;'s debts and start to bring the chinese property market house of cards down. Did I say canary in the coal mine, Evergrande Chinas 2nd largest property developer is more like THE COAL MINE than the canary! We'll that coal mine has just EXPLODED by defaulting on it's debts.

Which brought us to the September / October correction that I had flagged expectations of right from the outset in early July, with a penciled in time window of between Mid Sept to Mid October. were whilst I did not expect the indices such as the Dow and S&P to fall by by as much, however, I was expecting the over priced tech giants to trade lower by between 15% and 20% to offer an opportunity of sorts to buy back in to some degree into the likes of Apple and Microsoft and anything else that showed moderation in it's valuation.

Whilst buying opportunities did materialise with the likes of Google falling form $2900 to $2660 unfortunately for most stocks it was just not enough, even Facebook came tantalising close falling to $308 against the buying level of $301 was just not quite enough for me to hit the buy button. The only stocks or rather stock that did give us a great buying opportunity was INTEL, trading to well under $50 for a sustained period of time, dropping it's PE ratio to just 9, and so a portfolio devoid of Apple and Microsoft, Nvidia and Amazon prompted me to triple my stake in Intel to 4.5%.

The key point to know is that I expect most of the stocks to trade below their October lows during 2022, so I am in no rush to over pay, yes if I get a fair value I will buy for the long-run but I am in no rush to over pay for the likes of Apple and Microsoft, whilst Nvidia despite all of the promises of an AI future I consider a shorting opportunity, 90X earnings for a 800billion cap! That is a ridiculously high valuation after all they already own 80% of the GPU market, X40 earnings I can stomach but not 90X earnings, hence why in my recent update my buying level remained at $154, HALF where the stock was trading at the time.

So my financial crisis 2.0 investing strategy remains to wait for opportunities to accumulate at much better valuations where I aim to slowly build my portfolio up towards 60%-65% invested from the current 48% as and when the opportunities arise, whilst the big buys will be pending all hell breaking lose during Financial Crisis 2.0 as I always have the option to double even triple my cash on account, so I have plenty of ammo to fire at the stock market should such opportunities become manifest but for the time being I am looking to adding small scale exposure to Apple and Microsoft via the likes of FREETRADE - commission free trading platform that allows me to accumulate 1 share at a time, even fractional shares for the likes of Google and Amazon, rather than my usual big 1%+ buys.

If you have not already done so then do check out their FREE TRADE ISA where they have a promo offering 2 free trades if you sign up before the end of November!

Why You Should Not Fear a 50% Draw down in Your Stocks Portfolio

And finally a dose of stock market reality of why one should not be phased by a 50% draw down in ones portfolio as long as one is invested in good stocks at fair valuations (in relative terms) and why I always seek to be at least 50% invested (AI+High risk+ Cash on Account = 100%)..

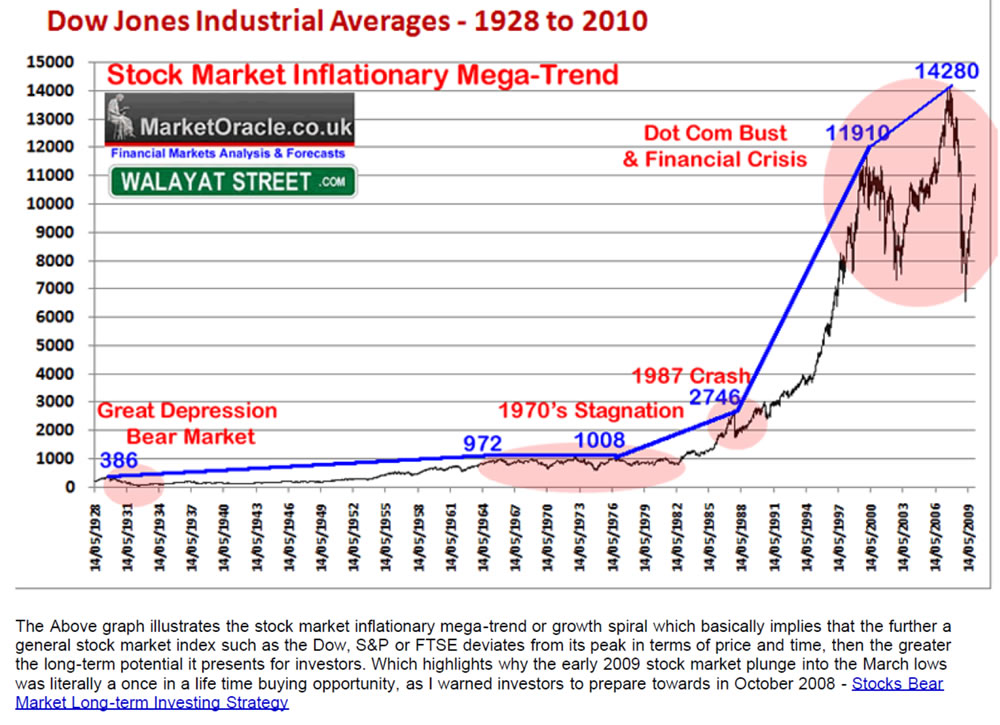

Anyway In terms of asset prices such as stocks and housing, the Fed cannot allow for any sustained drop in prices for it will literally bring the whole house of cards crashing down to reveal the true extent of the economic stagnation that the Fed has so far successfully masked by means of the inflation stealth tax. It's a case of printing money to infinity and beyond hence remain invested in assets that are LEVERAGED to INFLATION and why this stocks bull market will just keep chugging long until the point when the Fed loses control of the QE monster that it has created. This is why I have been banging the Inflation Mega-trend drum for OVER A DECADE! QE4-EVER, QUANTITATIVE INFLATION, because there IS NO FREE LUNCH! You cannot bail out the banking crime syndicate without paying a price and that is loss of purchasing power by means of REAL INFLATION. as illustrated by my January 2010 Inflation Mega-trend ebook (free download)

And a 12 year long mantra of buying the deviation from the high -

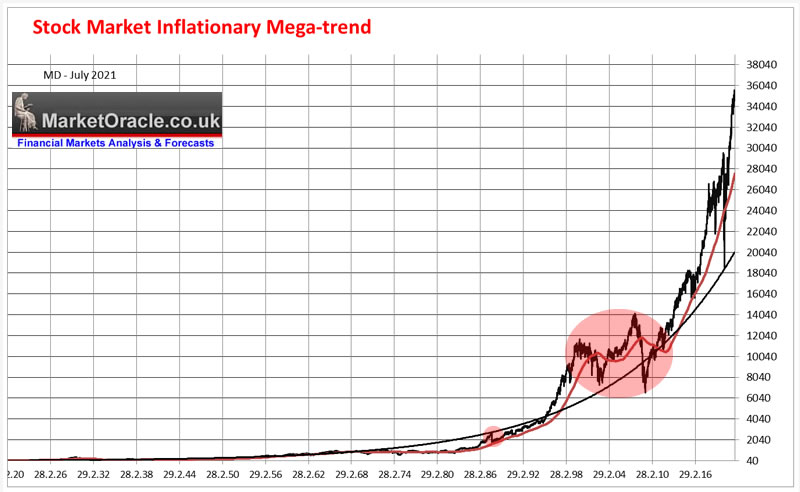

And here's what the chart looks like some 11 years on, the once mighty peaks and troughs of the Dot com and Financial crisis are fast disappearing into becoming inconsequential blips.

What's driving asset price inflation?

SO WHAT DO YOU DO?

YOU HOLD ASSETS THAT CANNOT BE EASILY PRINTIEND SUCH AS HOUSING AND STOCKS THAT DON'T TEND TO PRINT NEW SHARES IN FACT MY PREFERANCE IS FOR STOCKS THAT OVER THE LONG RUN BUY BACK THEIR OWN STOCKS!

Whilst all those WHO DO NOT HOLD ASSETS i.e. workers and savers are systematically being stripped of the purchasing power of their earnings as the real rate of inflation is at least TWICE official inflation which means it's about 13% in the US.

And don't worry if there ever comes a day when the music stops then you will all have much bigger things to worry about than the value of your stocks portfolio.

So once more "The greater the deviation from the stock markets high then the greater the buying opportunity that is being presented"

And 2022 remains on track to delivery a series of deep discounting swings lower, I suspect its going to get very messy, and volatile i.e. wilde swings both up and down though with an overall downwards bias.

The only way to play it will be with string of limit orders below the lows so that some get caught on the downswings and perhaps be willing to take some profits with similar limit orders below the highs Whilst generating some return during the great churn of 2022.

My key strategy is to accumulate stocks at or below a PE of 20,

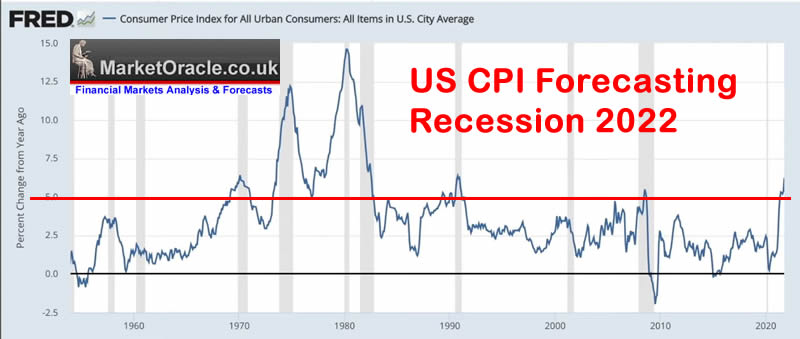

Inflation Forecasting a Recession In 2022

And what happens to the economy when Inflation surges to above 5%? RECESSION!

So it is not just a question of IF there is a recession during 2022 but rather when. So take this as another reminder for all who are FOMING into stocks in their last gasp bull runs that we are very likely to see MOST stocks trade BELOW their October lows during 2022.

Me, I'm being very selective and sticking to my buying levels, even if it means missing out on the next bull run because I intend on my portfolio riding out the recession without seeing the over valued stocks such as Nvidia experience a significant valuation reset.

That and I am going to be doing a lot of short-term shorting of stocks during 2022 because I imagine that the trend is going to be very messy, A lot of sharp swings in both directions, a traders market with a downwards bias so shorts 'should' prove more profitable than 'long' swing trades.

UK Inflation Hits 30 year High of 6%

UK RPI inflation surged higher to 6%, the highest reading in 30 years! Of course the Government and Bank of England wants everyone to ignore RPI and just look at CPI that also surged to 4.2% to it's highest level in 10 years!

So what's next for the Bank of England, how are they going to bring the inflation indices back down to its 2% in 2 years time mantra?

The answer is staring you in the face, they will edit what counts as inflation by ditching all that which tends to rise and keep that which tends to fall, and hey presto Inflation is back to 2%!

Whilst I estimate the real rate of inflation for most folks in Britain to be between 16% to 20%! AND it has been at that level for OVER a year as I have illustrated in videos when comparing the changing prices in our weekly supermarket shops, were pre pandemic used to be about £220-240 per week now tends to average between £320 and £340 per week which converts into an annual inflation rate of 28%! And THIS is even before considering SHRINKFLATION!

All whilst the Bankster of England keeps peddling fake inflation indices that it routinely doctors to UNDER REPORT the REAL RATE OF UK INFLATION that everyone experiences during their weekly shops! No wonder many workers are refusing to return to work given the loss of purchasing power of earnings instead would much rather gamble on meme stocks and crypto's.

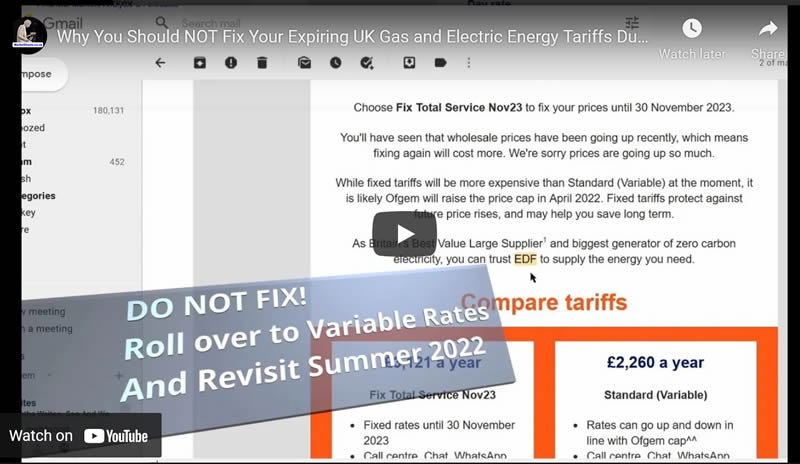

UK Energy Customers Falling into Energy Firms Fixed Rate Tariffs Trap

Gas and electricity prices have surged to extortionate levels and winter has hardly begun to bite sending the fixed rate deals for ALL energy providers soaring in the stratosphere. This prompted me to do a video warning against falling into the Energy providers trap of to fixing maturing contracts now ahead of energy caps being raised in April. The key point is in APRIL! Just as the demand for gas at least slumps ahead of the summer months. Thus one would be making a HUGE mistake fixing NOW on very high fixed rate deals rather than letting exp ring tariffs lapse onto the energy providers standard variable tariffs because the energy cap only applies to the STANDARD VARIABLE TARIFF as my video illustrates.

So if any of my UK patrons have expiring energy tariffs then don't make the mistake of fixing now as the variable tariffs will tend to be far cheaper than the fixed rate tariffs for at least the next 6 months i.e. fixing now means you are going to end up needlessly paying upwards of 25% more for your energy bills over the next 6 months! And of by chance you have recently made the mistake of fixing then you usually have a 14 day cooling off period to change your mind.

Fin tech Stock - Global Payments Inc.

And lastly a Patron recently asked for my opinion on investing in Visa, Mastercard and Paypal given that a big correction is in progress. We'll there is actually a fin tech stock on one of my watch lists that has meandered it's way down to a buying level - Global Payments Inc, GPN. Current price is $123 and the buying level I had penciled in was $122.

GPN trades on a PE of 20 vs PayPal on 60, so much better value for money. All of the usual metrics look fine i.e. no obvious red flags, and with a market cap of $80 billion has room to grow,

So I will be adding some to my legacy stocks portfolio as it does not fit in with either of my public portfolios and I don't really want to create a new Fin Tech subdivision, but just that a Patron asked about fin tech stocks and this one happens to be at the right price / valuation at the right time.

My analysis schedule includes:

- Stock Market Trend Forecast 2022

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst warning Patrons for the nth time to BATTON DOWN THE HATCHES for the coming stock market storm (a couple of weeks ago).

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.