Why Gold’s Latest Rally Is Nothing to Get Excited About

Commodities / Gold and Silver 2022 Jan 25, 2022 - 10:32 AM GMTBy: P_Radomski_CFA

You don't have to be a fortune teller to predict some of the precious metals’ behavior in the market. Any incoming signs take the shape of a bear.

What a signal-rich week that was! At least if you’re interested in forecasting gold and predicting silver prices.

The USD Index rallied, but that was the least interesting of the important developments, as it had already reversed during the preceding week. So, the fact that the USD Index continued its medium-term uptrend last week is not that noteworthy.

It needs to be said, though, as that continues to be an important factor for the future of the precious metals market. To be clear – the implications for the PM sector are bearish.

What about gold, the key precious metal?

Gold is so far almost unchanged this year, despite the initial decline and the subsequent rally. Overall, gold is up by $3.20 so far in 2022, which is next to nothing.

Gold rallied on a supposedly dangerous situation regarding Ukraine, but it failed to rally above the combination of resistance lines and very little changed technically.

On a side note, I would like to remind you that, based on our own reliable source in Ukraine (one of our team members is located there), the risk of military conflict (in particular, a severe one) is low, and it seems that the market’s reaction was greatly exaggerated.

Anyway, moving back to technicals, let’s keep this $3.20-up-this-year statistic in mind while we take a look at what’s going on in silver and mining stocks.

Silver declined on Friday, but it’s still up by $0.97 so far in 2022. This means that on a short-term basis, silver greatly outperformed gold.

What’s up with mining stocks?

The GDX ETF – a proxy for generally senior mining stocks – is down this year by $0.38, which is 1.19%.

At the same time, the GDXJ ETF is down by $0.87, which is 2.07%.

In other words:

- While silver is outperforming gold on a short-term basis, gold mining stocks are underperforming it.

- Junior mining stocks (our short position) are declining more than senior miners, and in fact, they are declining the most out of the entire precious metals sector.

Silver’s outperformance, accompanied by gold miners weakness, is a powerful bearish combination in the case of the entire precious metals sector.

If the general stock market is going to slide, silver and mining stocks (in particular, junior mining stocks) are likely to decline in a rather extreme manner.

The thing is…

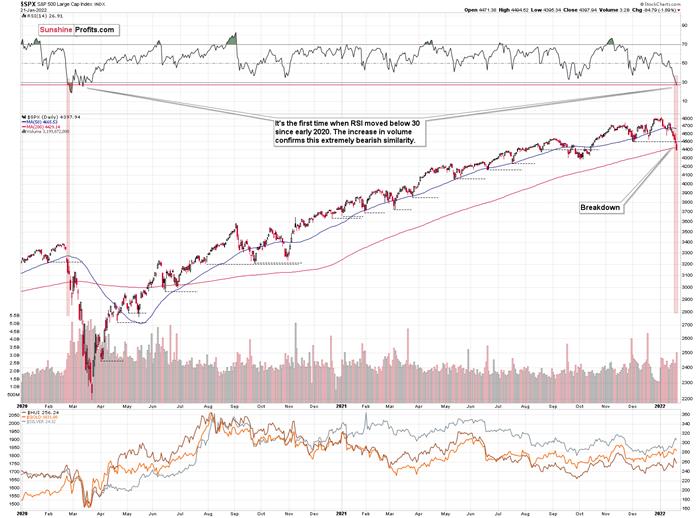

We just saw something in the general stock market that we haven’t seen since early 2020 – right before the massive decline that triggered the huge declines in the precious metals sector.

The RSI Index just moved below 30 for the first time since pre-slide moments. Just like what we saw back then, the S&P 500 is now declining on increasing volume.

Yes, RSI below 30 is generally considered oversold territory, but the direct analogies take precedence over the “usual” way in which things work in markets in general. In this case, the situation could get from oversold to extremely oversold. Let’s keep in mind that stocks declined very sharply in 2020.

One could say that times were different, but were they really? The key difference is that the monetary authorities are now already after the bullish money-printing cycle and are handling inflation by aiming to increase interest rates, while they had been preparing to cut them in 2020.

The situation regarding the pandemic is not that different either. Sure, back in 2020, it was all new, we had massive lockdowns and there was great uncertainty regarding… pretty much everything. Now, the situation is not entirely unexpected, but given the explosive nature of new COVID-19 cases (likely due to the Omicron variant), it’s still quite new and uncertain.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.