Panicking Investors Rush to U.S. Dollar and Yen Bonds

Stock-Markets / Financial Markets Oct 27, 2008 - 02:52 AM GMT

The past week witnessed mounting evidence that the world economy was facing a sharp downturn, causing unrest to engulf financial markets. Stocks and emerging-market currencies and bonds remained under heavy selling pressure as risk-averse investors rushed to liquidate positions, with the US dollar , Japanese yen and developed-market bonds providing perceived safe havens.

The past week witnessed mounting evidence that the world economy was facing a sharp downturn, causing unrest to engulf financial markets. Stocks and emerging-market currencies and bonds remained under heavy selling pressure as risk-averse investors rushed to liquidate positions, with the US dollar , Japanese yen and developed-market bonds providing perceived safe havens.

Improvements in the credit markets provided little encouragement to battle-weary investors in the face of weak US earnings reports and a poor outlook for at least the next few quarters. Forced selling by hedge funds needing to meet margin calls and redemption requests again featured prominently. The S&P 500 Index lost 6.8% on the week (YTD -40.3%), pulling the Index down to levels last seen in 2003.

With financial woes weighing on investor confidence, I couldn't help thinking of what President Thomas Jefferson said in 1802: “I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation and then by deflation, the banks and corporations that will grow up around them will deprive the people of all their property until their children will wake up homeless on the continent their fathers conquered.”

Fast forward to 2008, specifically to former Fed Chairman Alan Greenspan's testimony to a House Oversight Committee hearing on the roles and responsibilities of federal regulators in the current financial crisis.

Greenspan described the financial crisis as a “once-in-a-century credit tsunami”. He acknowledged that the crisis exposed flaws in his thinking and to the working of the free market system, telling the Committee that his belief that the banks would be more prudent in their lending practices because of the need to protect their shareholders had been proven wrong by the crisis. He called this a “mistake” in his views and said he was “in a state of shocked disbelief”.

He furthermore said: “The housing bubble became clear to me sometime in early 2006, in retrospect. I did not forecast a significant decline because we have never had a significant decline in price.” Whew!

“Why did no one on Capitol Hill remind Easy Al that he mocked Americans for not taking adjustable-rate and other low-rate gimmick mortgages – only days before he hiked rates,” commented Bill King ( The King Report ).

And while we are on the topic of the credit debacle, allow me to share with you, courtesy of David Fuller , a little light relief on the bailout workings:

“Young Chuck moved to Texas and bought a donkey from a farmer for $100. The farmer agreed to deliver the donkey the next day. The next day the farmer drove up and said, ‘Sorry son, but I have some bad news, the donkey died.' Chuck replied, ‘Well, then just give me my money back.' The farmer said, ‘Can't do that. I went and spent it already.' Chuck said, ‘Ok, then, just bring me the dead donkey.' The farmer asked, ‘What ya gonna do with him?' Chuck said, ‘I'm going to raffle him off.' The farmer said, ‘You can't raffle off a dead donkey!' Chuck said, ‘Sure I can, watch me. I just won't tell anybody he's dead.' A month later, the farmer met up with Chuck and asked, ‘What happened with that dead donkey?' Chuck said, ‘I raffled him off. I sold 500 tickets at two dollars a piece and made $998.' The farmer said, ‘Didn't anyone complain?' Chuck said, ‘Just the guy who won. So I gave him his two dollars back.' Chuck now leads the US bank bailout team.”

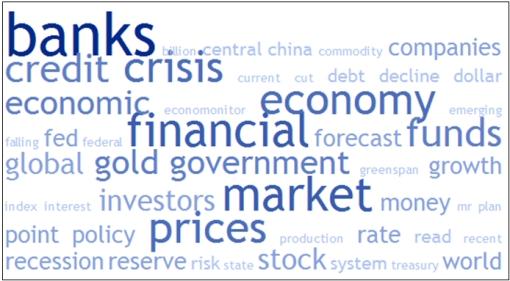

Next, a tag cloud of the text of the plethora of articles I have devoured during the past week. This is a way of visualizing word frequencies at a glance. Not too many surprises here with “banks” still dominating the words.

The list of well-known names identifying value on the US stock market at current levels is growing by the day and includes the likes of Jeremy Grantham ( GMO – “ Careful buying is justified ”), Warren Buffett (“ Buy America. I am “), John Hussman ( Hussman Funds – “ Why Warren Buffett is right ”) and Barry Ritholtz ( The Big Picture – “ Another buy in ”). Even perma-bears such as James Montier and Albert Edwards ( Société Générale – “ Turning more bullish ”) are increasing their equity exposure, albeit only for the short term.

“… technical measures of momentum and breadth are at historical lows and valuations have been restored to the point where some notable long-term deep value investors are stepping up their purchases,” said BCA Research .

However, they advised investors to remain cautious. “The risk/reward trade-off does not yet warrant aggressive accumulation of risky assets, given that many investors are looking for a bounce to lighten positions, redemption orders continue to mount, and a prolonged recession lies ahead. Even if equities are nearing a bottom, there should be several good opportunities to add exposure in the months ahead. We recommend … only nibbling on stocks selectively.”

I am still of the viewpoint that stock markets are in a multi-month phase of bottoming out that will see relief, and potentially profitable, rallies from time to time. But stock market valuations, in general, are still stretched when considering an environment of economic and profit recession, arguing that a secular low may not necessarily have been reached.

I am about to hit the road again – traveling to neighboring country Mozambique for a few days – and am therefore only doing a shortened version of “Words from the Wise” this week. Although I am not doing my customary review of the financial markets' movements and economic statistics, I am including a full section of interesting excerpts from news items and quotes from market commentators.

Economic reports

“Business sentiment fell again last week to another new record low. Negative responses to the nine questions posed in the survey measurably out-number the positive ones everywhere but in Asia. But even in Asia confidence has weakened notably,” according to the Survey of Business Confidence of the World conducted by Moody's Economy.com . The financial panic that began in early September has been a body blow to global business confidence and thus the global economy which, according to the survey, is now in recession.

Economic data in the US and throughout the rest of the world showed an acceleration in the weakening of activity.

As far as the US interest rate outlook is concerned, Asha Bangalore ( Northern Trust ) said: “At its meeting of October 28 and 29, we expect the FOMC to reduce its target Federal funds rate by 25 basis points to a level of 1.25%. The Federal funds rate futures market is placing a higher probability on a 50 basis point reduction. The effective Federal funds rate has held below 1.00% every trading day since October 16.” (Also see my recent post “ US rate cut imminent ”.)

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

Date |

Time (ET) |

Statistic |

For |

Actual |

Briefing Forecast |

Market Expects |

Prior |

| Oct 20 | 10:00 AM | Leading Indicators | Sep | - | -0.4% | -0.1% | -0.5% |

| Oct 22 | 10:35 AM | Crude Inventories | 10/18 | - | NA | NA | NA |

| Oct 23 | 8:30 AM | Initial Claims | 10/18 | - | 455K | 465K | 461K |

| Oct 24 | 10:00 AM | Existing Home Sales | Sep | 5.18M | 4.97M | 4.95M | 4.91M |

Source: Yahoo Finance , October 24, 2008.

In addition to the FOMC's interest rate decision on Wednesday, October 29 and the Bank of Japan's monetary policy announcement on Friday, October 31, next week's US economic highlights, courtesy of Northern Trust , include the following:

1. New Home Sales (October 27): The consensus forecast is a drop in sales of new homes to an annual rate of 450,000 during September from 460,000 in August. In August, purchases of new homes dropped 66.9% from their peak in July 2005.

2. Durable Goods Orders (October 29): Durable goods orders (-1.0%) are expected to have fallen in September following a large decline in August. Consensus : -1.1% versus -4.5% in August.

3. Real GDP (October 30): Real GDP is predicted to have dropped 0.6% in the third quarter, which could possibly be the first of a string of declines. The largest negative contribution is most likely from consumer spending, followed be the housing sector and business equipment spending. Consensus : -0.5%.

4. Personal Income and Spending (October 31): The earnings and payroll numbers for September suggest a drop in personal income (-0.1%). Auto sales and non-auto retail sales have been significantly weak, implying a decline in consumer spending in September. Consensus : Personal Income +0.1%, Consumer Spending -0.3%.

5. Other reports : Consumer Confidence (October 28).

Click here for a summary of Wachovia's weekly economic and financial commentary.

A summary of the release dates of economic reports in the UK, Eurozone, Japan and China is provided here . It is important to keep an eye on growth trends in these economies for clues on, among others, the direction of the US dollar.

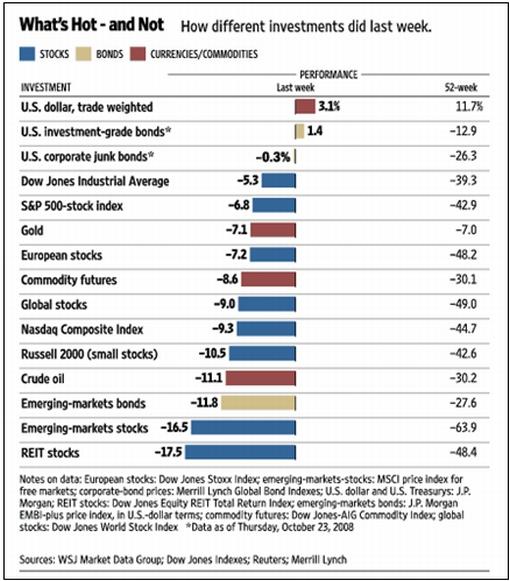

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , October 24, 2008.

Now for a few news items and some words and charts from the investment wise that will hopefully assist in keeping our investment portfolios on a profitable course. But be careful and remember the old Street adage: “In a bear market, money returns to its rightful owners.”

That's the way it looks from Cape Town.

Source: Unknown

CNBC: The unfolding financial crisis, with Roubini and Rifkin

“A look at the unfolding financial crisis, with Nouriel Roubini of RGE Monitor and Jack Rivkin, former CIO of Neuberger Berman.”

Source: CNBC , October 22, 2008.

Bloomberg: Volcker – rebuild US banks from “ground up”

“Former Federal Reserve Chairman Paul Volcker and Nobel economics laureates Robert Mundell and Joseph Stiglitz participate in a Women's Economic Round Table discussion in New York about the global financial crisis, the outlook for the US economy and the government's financial-rescue plan.”

Click here for article.

Source: Bloomberg , October 24, 2008.

Financial Times: World wakes from the wish-dream of decoupling

“The US retains the capacity to disrupt the world economy which it has possessed since at least the 1920s. Accordingly, the struggle between the deleveraging of high-income countries and the growth momentum of emerging economies is ending, alas, in a decisive victory for the former.

“Yet the news is not all bad: inflationary pressures are abating fast. Even so, this hides more bad news. The broken financial system will weaken the transmission from monetary easing to the economy. This will make the coming slowdown last a long time. Even though decisive action has saved the financial system from its recent heart attack, the patient remains enfeebled.

“In 2007, the world economy (measured at market exchange rates) grew by 3.7% in real terms. This year, according to the latest World Economic Outlook from the International Monetary Fund, growth is forecast to be 2.7%. Next year it is expected to be a mere 1.9%. The economies of high-income countries are forecast to stagnate next year.

“Meanwhile, emerging economies are forecast to grow at 6.1%. This seems fast. But it is 0.6 percentage points slower than was forecast in July and is well below the 8% achieved in 2007 and 6.9% still forecast for 2008.

“The pleasant surprise is the forecast growth of 6% in Africa next year. Developing Asia is forecast to remain the world's leader, with growth of 7.7%: China is on 9.3%, while India is down to 6.9%. Meanwhile, central and eastern Europe is forecast to grow only 3.4% next year and the western hemisphere to grow even more slowly, at 3.2%.

“These forecasts were prepared before the worst of the financial shocks of September and October.”

Source: Martin Wolf, Financial Times , October 21, 2008.

Ambrose Evans-Pritchard (Telegraph): Crisis may make 1929 look a “walk in the park”

“As central banks continue to splash their cash over the system, so far to little effect, Ambrose Evans-Pritchard argues that things risk spiralling out of their control

“Twenty billion dollars here, $20 billion there, and a lush half-trillion from the European Central Bank at give-away rates for Christmas. Buckets of liquidity are being splashed over the North Atlantic banking system, so far with meagre or fleeting effects.

“As the credit paralysis stretches through its fifth month, a chorus of economists has begun to warn that the world's central banks are fighting the wrong war, and perhaps risk a policy error of epochal proportions.

“‘Liquidity doesn't do anything in this situation,' says Anna Schwartz, the doyenne of US monetarism and life-time student (with Milton Friedman) of the Great Depression.

“‘It cannot deal with the underlying fear that lots of firms are going bankrupt. The banks and the hedge funds have not fully acknowledged who is in trouble. That is the critical issue,' she adds.

“York professor Peter Spencer, chief economist for the ITEM Club, says the global authorities have just weeks to get this right, or trigger disaster.

“‘The central banks are rapidly losing control. By not cutting interest rates nearly far enough or fast enough, they are allowing the money markets to dictate policy. We are long past worrying about moral hazard,' he says.

“‘They still have another couple of months before this starts imploding. Things are very unstable and can move incredibly fast. I don't think the central banks are going to make a major policy error, but if they do, this could make 1929 look like a walk in the park,' he adds.”

Source: Ambrose Evans-Pritchard, Telegraph , September 22, 2008.

Financial Times: US to host G20 world summit over crisis

“Global stock markets plunged on Wednesday as the White House said it would invite world leaders to a global financial summit next month, 11 days after the US presidential election.

“The stock-market retreat came as prices for oil and gold fell sharply and European currencies slumped against the dollar and yen as traders bet on interest rates being slashed to offset a looming recession.

“Following calls from European leaders such as Gordon Brown, British prime minister, and Nicolas Sarkozy, France's president, the White House said it was planning a meeting of the heads of state of the G20 group of countries in Washington on November 15.

“The G20 members include some of the countries most affected by the crisis in the developed world as well as emerging markets such as Brazil, China and India.

“‘The leaders will review progress being made to address the current financial crisis, advance a common understanding of its causes, and, in order to avoid a repetition, agree on a common set of principles for reform of the regulatory and institutional regimes for the world's financial sectors,' said the White House.

“It was not clear if the winner of the November 4 presidential election would attend but if either Barack Obama or John McCain were to participate, it would be a remarkably early first appearance on the world stage.”

Source: Chris Giles, George Parker, Ben Hall, James Politi and Daniel Dombey, Financial Times , October 22, 2008.

Charlie Rose: A conversation with Henry Paulson, United States Treasury Secretary

Source: Charlie Rose , October 21, 2008.

Bloomberg: Paulson says US has sufficient funds for bank plan

“Treasury Secretary Henry Paulson said the government has set aside enough money to buy stakes in every financial company that qualifies for the crisis program aimed at halting the credit freeze.

“‘Sufficient capital has been allocated so that all qualifying banks can participate,' Paulson said in Washington, announcing details on how banks can sign up for the funds. ‘This program is designed to attract broad participation by healthy institutions and to do so in a way that attracts private capital to them as well.'

“Today's announcement follows complaints from the banking industry that the rescue effort Paulson unveiled a week ago was short on specifics. Financial institutions such as PNC Financial Services Group and BB&T are considering signing up, and regulators today released details about how to do so.

“After an initial $125 billion was allocated to nine of the largest banks, including Citigroup and Morgan Stanley, the Treasury plans to inject another $125 billion into other lenders.”

Source: Rebecca Christie and Robert Schmidt, Bloomberg , October 20, 2008.

Bloomberg: Bernanke's own words on economy, new fiscal stimulus

“Federal Reserve Chairman Ben Bernanke testified today before the House Budget Committee about the outlook for the US economy, the government's efforts to restore confidence in financial markets and prospects for a new fiscal stimulus package. This report is a compilation of Bernanke's remarks.”

Source: Bloomberg , October 20, 2008.

Greg Ip (The Washington Post): Think the bailout is radical? Just wait.

“In the past month, the unprecedented has become routine. The Treasury Department and the Federal Reserve, headed by Republicans, have intervened in the US economy to an extent that would have shocked liberals a year ago. The Treasury is now a major shareholder of US banks, the Fed is a principal lender to private business, and the American taxpayer stands behind huge swaths of the financial system, from home mortgages to business bank accounts. ‘Socialism has now washed over free-market capitalism,' Sam Donaldson of ABC News recently sighed.

“Could Bernanke go even further? He has promised to use ‘all of the powers at our disposal' to stop the credit crunch. As of June 30, loans to US households, non-financial companies and state and local governments stood at $27 trillion. In theory, the Fed could supply all of this. But that doesn't mean that it should. At some point, Fed loans would keep alive borrowers that simply ought to fail. And the more credit the Fed extends now, the longer it will take to withdraw once the crisis passes – a process that risks spurring inflation.

“But the Fed could go quite a ways yet: Its $1.8 trillion in assets is equal to just 12% of America's gross domestic product. To battle deflation earlier this decade, the Bank of Japan stuffed Japanese banks with cash, hoping they'd lend it back out. At its peak, the Bank of Japan's balance sheet amounted to 30% of GDP. All this government effort didn't help much: Japan's banks were still so undercapitalized that they were reluctant to lend. But the Bank of Japan's exertions didn't trigger inflation, either.

“Buy other assets. Ask the average congressman why he voted for the $700 billion bailout package, and he'll probably point to the sickening plunge in the Dow Jones Industrial Average. So would it be better for the US government simply to buy stocks?

“The United States once routinely waded into foreign-exchange markets and is now intervening in the mortgage markets through its bailout of Fannie Mae and Freddie Mac. But buying stock is a bigger leap: There's a greater chance of capital loss, and outright purchases enmesh the government in issues of ownership (one reason investing the Social Security Trust Fund in stocks remains controversial). Though US government purchases might drive up stock prices and help banks issue new shares to rebuild capital, they would not address the root of the credit crisis.

“A more elegant way to use Washington's purchasing power would be to buy vacant homes and take them off the market to alleviate the downward pressure on housing prices. Of course, doing so without overpaying would be tricky indeed.

“A future US administration may use its new ownership stakes to press banks to relent on foreclosures or lend more to favored constituencies. But ownership will also make Washington the target of demanding interest groups and disgruntled customers and shareholders if the banks stumble.

“The odds are that once this crisis passes, the United States will return to its free-market roots, albeit with more regulations in place. But until then, things may get even wilder.”

Source: Greg Ip, The Washington Post , October 19, 2008.

Bloomberg: Fed to provide up to $540 billion to aid money funds

“The Federal Reserve will provide up to $540 billion in loans to help relieve pressure on money-market mutual funds beset by redemptions.

“‘Short-term debt markets have been under considerable strain in recent weeks' as it got tougher for funds to meet withdrawal requests, the Fed said today in a statement in Washington. A Fed official said that about $500 billion has flowed since August out of prime money-market funds, which with other money-market mutual funds control $3.45 trillion.

“The initiative is the third government effort to aid the funds, which usually provide a key source of financing for banks and companies. The exodus of investors, sparked by losses following the bankruptcy of Lehman Brothers, contributed to the freezing of credit that threatens to tip the economy into a prolonged recession.

“‘The problem was much worse than we thought,' Jim Bianco, president of Chicago-based Bianco Research LLC, said in a Bloomberg Television interview. Policy makers are trying to prevent ‘Great Depression II' by stemming the financial industry's contraction, he said.”

Source: Craig Torres and Christopher Condon, Bloomberg , October 21, 2008.

BBC News: France unveils bank rescue plan

“The announcement was made by Finance Minister Christine Lagarde and follows similar moves by other governments across Europe.

“Among the beneficiaries, France's largest bank, Credit Agricole, is to get 3 billion euros, while BNP Paribas will receive 2.55 billion euros.

“The move is aimed both at restoring confidence and liquidity to the banks.

“Ms Lagarde said the move was to ensure banks are ‘able to finance the economy correctly'. She added that the banks simply needed to increase their equity capital in order to give more loans to companies and individuals.

“President Nicolas Sarkozy has vowed that no French bank will be allowed to collapse and that savers will not lose ‘a single euro'.”

Source: BBC News , October 20, 2008.

Financial Times: Sarkozy plans new French wealth fund

“President Nicolas Sarkozy on Thursday said France would set up a new ‘strategic investment fund' to stop French companies from falling into the hands of foreign ‘predators'.

“The new fund will be operated by Caisse des Dépôts et Consignations – the country's existing sovereign wealth fund – but would be ‘more active, more offensive, more mobile' in defence of French industrial assets, Mr Sarkozy said.

“‘I will not be the French president who wakes up in six months time to see that French industrial groups have passed into other hands,' he said in a speech to business leaders near Annecy, eastern France.

“The president's announcement came only two days after he urged other EU member states to set up their own sovereign wealth funds as a means of protecting European industry at a time when share prices of leading companies were heavily depressed. His proposal met a cool response from other governments.

“The new fund will focus on shoring up smaller French companies judged strategically important because of their technology or sector. It could take short-term equity stakes or provide reimbursable loans.”

Source: Ben Hall, Financial Times , October 23, 2008.

Bloomberg: South Korea backs $100 billion in debt to calm markets

“South Korea will guarantee $100 billion in bank debts and supply lenders with $30 billion in dollars to stabilize its financial markets.

“The government will provide tax benefits for long-term equity and bond investors, while the Bank of Korea will buy repurchasing agreements and government bonds to boost won liquidity, the heads of the finance ministry, central bank and financial regulator said in a statement from Seoul. Policy makers held an emergency meeting on October 17 to hammer out the plan.

“South Korea is struggling with Asia's worst-performing currency, a shortage of US dollars and a stock market that has lost 38% this year. The guarantee on bank debts comes after Standard & Poor's said last week it may cut the credit ratings of the nation's largest lenders, which triggered the worst plunge in the won since the International Monetary Fund bailed the nation out in December 1997.”

Source: Kyung Bok Cho and William Sim, Bloomberg , October 19, 2008.

Council on Foreign Relations: Where is my swap line?

“Some emerging market central banks have noticed that they – unlike the Bank of Japan, Bank of England, Swiss National Bank and the European Central Bank – don't have access to unlimited dollar credit through reciprocal swap lines with the Federal Reserve.

“Analysts say the unlimited dollar currency swaps set up between the Federal Reserve and central banks have helped bring stability to currencies through alleviating institutions desire to purchase dollars in the spot market to satisfy overnight funding requirements. ‘In contrast, the lack of currency swaps put into place between the Federal Reserve and emerging market central banks has likely helped to exacerbate the pick up in emerging market currency volatility' says Derek Halpenny, at the Bank of Tokyo Mitsubishi UFJ.

Click here for the full article.

Source: Council on Foreign Relations , October 18, 2008.

BBC News: Further banks may fail, says IMF

“More European banks ‘may fail' as doubts persist about the viability of their business models, the International Monetary Fund has warned. Private funding is ‘virtually unavailable' and banks will have to rely on public intervention, asset sales and consolidation, it said.

“The six-monthly study also warns that eurozone economic growth will almost grind to a halt next year. Growth in the 15 euro countries will fall to just 0.2% in 2009, it forecast. The report argued that disruptions in the US financial system have ‘heightened the risk of a systemic financial crisis in Europe further'. However, it maintained that a full-blown crisis ‘remains improbable'.

“The slowdown has resulted from high oil prices, rising inflation, a strong euro, falling export demand and the financial crisis, the Fund reported.”

Source: BBC News , October 21, 2008.

TimesOnline: Panic over hedge funds “could close markets”

“Regulators could be forced to shut down markets for as long as a fortnight in order to stanch the panic beginning to beset the hedge fund industry, a leading expert predicted yesterday.

“Nouriel Roubini, a professor at New York University, told a London conference that hundreds of hedge funds are poised to fail as frantic investors rush to redeem their assets and force managers into a fire sale of assets. He said: ‘We've reached a situation of sheer panic. Don't be surprised if policymakers need to close down markets for a week or two in coming days.'

“Jon Moulton, the private equity investor behind Alchemy Partners, forecast a tidal wave of hedge fund collapses in the next three months. ‘We estimate 60% of the capacity of UK hedge funds will go this year, through bankruptcies and redemptions,' Mr Moulton told The Times.

“There are widespread predictions of calamity in the hedge fund sector, which has been thrown into crisis by the collapse of Lehman Brothers and the ensuing turmoil in world markets.”

Source: Miles Costello and Helen Power, TimesOnline , October 24, 2008.

Current: Naked short selling destroying companies

“If you ever wondered how or why a stock price suddenly drops like a rock on incredible volume, or why executives battle damaging reports in the NY financial press and in analyst reports, see this video.”

Source: Current , October 23, 2008.

CNBC: Greenspan's Testimony

“Insight on former Fed chief Alan Greenspan's testimony before Capitol Hill, with Nariman Behravesh, Global Insight; Thomas Higgins, Payden & Rygel; and CNBC's Maria Bartiromo.”

Source: CNBC , October 23, 2008.

Financial Times: “I made a mistake,” admits Greenspan

“Alan Greenspan, the former Federal Reserve chairman, said on Thursday the credit crisis had exceeded anything he had imagined and admitted he was wrong to think that banks would protect themselves from financial market chaos.

“‘I made a mistake in presuming that the self-interest of organisations, specifically banks and others, was such that they were best capable of protecting their own shareholders,' he said.

“In the second of two days of tense hearings on Capitol Hill, Henry Waxman, chairman of the House of Representatives, clashed with current and former regulators and with Republicans on his own committee over blame for the financial crisis.

“Mr Waxman said Mr Greenspan's Federal Reserve – along with the Securities and Exchange Commission and the US Treasury – had propagated ‘the prevailing attitude in Washington … that the market always knows best.'

“Mr Waxman blamed the Fed for failing to curb aggressive lending practices, the SEC for allowing credit rating agencies to operate under lax standards and the Treasury for opposing ‘responsible oversight' of financial derivatives.

“Mr Greenspan accepted that the crisis had ‘found a flaw' in his thinking but said that the kind of heavy regulation that could have prevented the crisis would have damaged US economic growth. He described the past two decades as a ‘period of euphoria' that encouraged participants in the financial markets to misprice securities.

“He had wrongly assumed that lending institutions would carry out proper surveillance of their counterparties, he said. ‘I had been going for 40 years with considerable evidence that it was working very well.'

“Mr Greenspan said that when, as Fed chairman, he declined to advocate regulating credit default swaps – derivatives that have been blamed for worsening the crisis – he had been following the will of Congress.”

Source: Financial Times , October 24, 2008.

YouTube: 40 Years is all it took to figure out the world ain't flat

Source: YouTube , October 23, 2008.

Paul Kedrosky (Infectious Greed): The credit hearings political theatre

“Today's House Oversight hearing into the credit crisis with witnesses Alan Greenspan, Chris Cox, and John Snow is grim and awful political theatre. While not unexpected, it is by the most politicized hearing we have had too date, with members trying to noisily pin subprime on Barrack Obama, entirely on the GSEs, regulators, etc. There are also non-stop attempted gotchas (”Did you know? Huh? Didya?”), plus congress members putting up signs, shouting, and doing everything except throwing spitballs.

“One of the few interesting moments so far has been this one with Alan Greenspan:

“‘THE HOUSING BUBBLE BECAME CLEAR TO MEET SOMETIME IN EARLY 2006, IN RETROSPECT. I DID NOT FORECAST A SIGNIFICANT DECLINE BECAUSE WE HAVE NEVER HAD A SIGNIFICANT DECLINE IN PRICES.'

“Got that? Greenspan only noticed the housing bubble in 2006, as it was bursting, and his main reason for not thinking prices would not decline in the US is because the US has never had a significant decline. Sad stuff.”

Source: Paul Kedrosky, Infectious Greed , October 2008.

Asha Bangalore (Northern Trust): Bair notes more is necessary to stem foreclosures

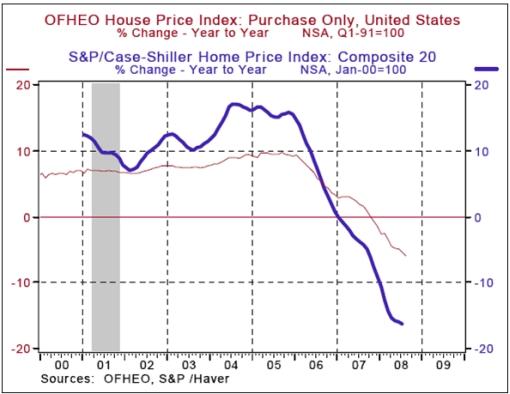

“The OFHEO House Price Index confirms the news from the existing and new home sales reports of August. Home prices maintain a downward trend, with the OFHEO House Price Index declining 5.9% from a year ago in August. Stability of the housing market is one of the important factors that will reduce risk aversion in financial markets in addition to more transparency of balance sheets of financial institutions. Foreclosures in the third quarter, according to Realty Trac, are now up 71% from a year ago. Declining home prices raise the probability of foreclosures as homeowners find their mortgages exceeding the current prices of their homes.

“Today, Shiela Bair, the chairwoman of the FDIC, indicated that more was needed to stem the tide of home foreclosures. She was of the opinion that there has been a ‘failure to effectively deal with' the mortgage foreclosure problem. Bair said ‘new efforts to stem foreclosure are needed, even if it means the Treasury offering to absorb losses on some soured mortgages'.

“She suggested the following: ‘Loan guarantees could be used as an incentive for servicers to modify loans.' Furthermore, Bair noted that ‘the government could establish standards for loan modifications and provide guarantees for loans meeting those standards.' Mortgage servicers are using ad hoc procedures to modify mortgages, implying that guidelines to modify mortgages are necessary.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , October 23, 2008.

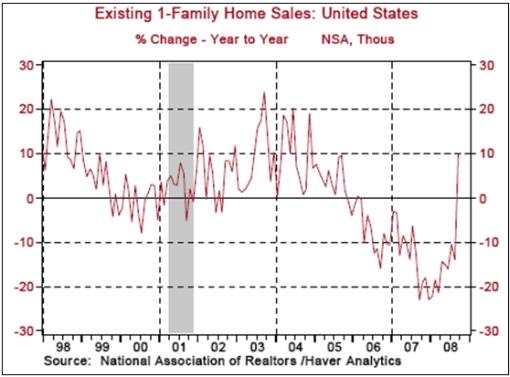

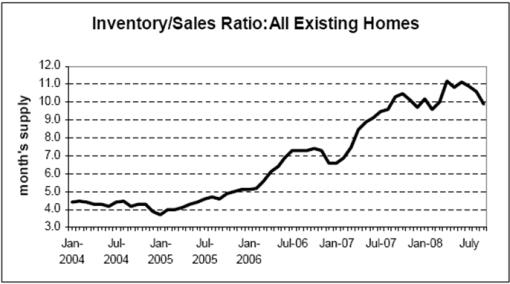

Asha Bangalore (Northern Trust): Rebound of existing home sales suggests beginning of turnaround

“Sales of existing homes rose 5.5% in September to an annual rate of 5.18 million units, putting the year-to-year gain at 7.8%. Sales of existing homes appear to have stabilized … On a year-to-year basis, sales of existing single-family homes moved up 10.1% in September, the first year-to-year increase since October 2005.

“… the drop in inventories of unsold homes is another positive factor pointing to a small improvement in the housing market. There was 9.9-month supply of unsold existing homes in September, down from a 10.6-month supply in August. The inventory-sales ratio of single-family homes was 9.4 months in September versus 10 months in August and that of condos dropped to 14.3 months from 15.7 months in August. These numbers suggest that sales of both single-family homes and condos have improved.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , October 24, 2008.

Reuters: Home prices to fall another 10 percent: Fitch

“US home prices will fall another 10% before they begin to show signs of stabilizing, Fitch Ratings said on Monday.

“National home prices have declined a full 22% from the peak hit in 2006, the agency said in a note. Fitch has a peak to trough forecast for prices to decline 30%.

“The additional 8 percent decline is equal to another 10% decline from current levels, it said. Most of that correction will take place in the next several quarters before prices exhibit stability in 2010, said the agency.

“Fitch's analysis indicates that expected drop will reverse the home price increases seen between 2004 and 2006.

“‘Should economic conditions become much worse than expected, home prices would decline more than Fitch's projection and price stabilization would be delayed,' said Huxley Somerville, group managing director and head of US residential mortgage backed securities.”

Source: Reuters , October 20, 2008

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.