Complete paradigm shift will make Gold the generational trade

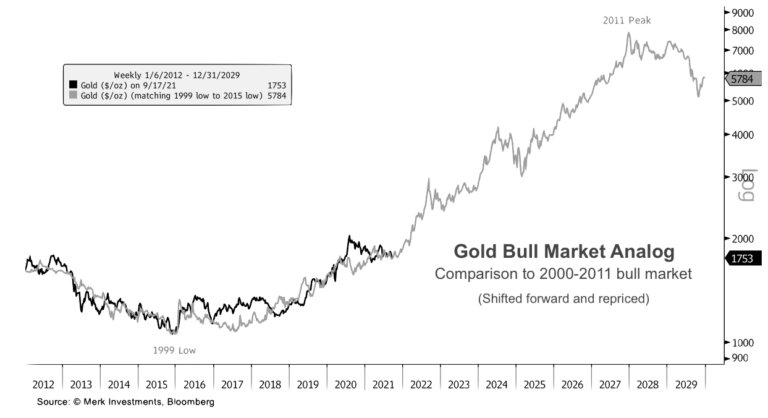

Commodities / Gold and Silver 2022 Jan 04, 2022 - 07:37 PM GMTWall Street billionaire and financier Thomas Kaplan (who once said, “I’m no insect; gold is a great way to make a lot of money.”) is among the group of analysts who believes gold is in the early stages of a new up leg in its long-term secular bull market. Though Kaplan made his fortune in the mining business, he is also an Oxford-trained historian (with a Ph.D.) capable of putting gold’s current price trend in the context of a longer-term cycle – one he believes has not yet reached full maturity. (Please see chart below.)

“Let’s put it this way,” he says in a memorable interview with Stansberry Research’s Daniela Cambone, “gold still remains on Wall Street and in the west probably the most under-owned, least crowded trade in the global financial markets. … The era in which gold was the asset which people loved to hate and hated to love is starting to come to an end. We’re still in the very early innings. It’s still a smart money trade as opposed to a big passive money trade but that’s about to happen.” The next leg up, he believes, will be driven by what he calls “bold-faced” names now involved in the gold business. Kaplan, in that regard, mentions Warren Buffett (who at the time of the interview had just purchased stock in mining giant Barrick Gold), Mohamed El Erian, Mark Mobius, Ray Dalio, Paul Tudor Jones, Jeffrey Gundlach, and Kenneth Rogoff. (Long-time readers of this newsletter will recognize that list of notables as abbreviated.)

“The difference is this,” he concludes. “The market is now ready for the next leg of the gold bull market. The first leg was the one that took us up 12 consecutive years in a row regardless of whether there were inflation fears, deflation fears, whether there was a glut of oil or a shortage of oil, political stability or political instability, dollar weakness, dollar strength. It didn’t matter. Every year for 12 years gold went up. The next move is going to be a third wave, a long wave that lasts for a decade or fifteen years, maybe more … I think that you really are looking at a complete paradigm shift that will make gold the generational trade.” From there, Kaplan goes on to say that gold will reach $3000 to $5000 in the years to come.

Chart courtesy of Merk Investments

Short & Sweet

IF THE FED TIGHTENS TOO HARD, it could launch another 2008-style credit meltdown. If it fails to tighten sufficiently, it could ignite another 1970s-style stagflationary wildfire. It all gets down to a matter of public perception. For the Biden administration and the Fed at this stage, rhetoric might be just as important, if not more important, than the policy itself. As such, the effect is likely to be temporary, or better put, last only as long as the rhetoric holds water. This is where the Fed’s credibility in the wake of its transitory inflation stance becomes an issue. What will investors believe, and how long will they believe it?

“SO DO YOU SEE how everything is completely in flux at present?” asks Craig Hemke in an article posted at the Sprott Money website. “This is madness, and it’s all due to the overwhelming reliance and dependence that ‘the markets’ now have for the Fed. Perhaps this was the Fed’s plan all along? Maybe they have always desired this sort of centralized, market-controlling power? But does having this power make their jobs easier or more difficult?” The questions Hemke raises echo what many of our readers have been thinking for some time now.

CHINA’S PHYSICAL GOLD DEMAND is foundational to the overall market structure, and ramped-up monetary stimulus from the Peoples Bank of China is likely, as Jia suggests, to further stimulate the Chinese people’s already strong interest in the metal. “As 2021 comes to an end and 2022 approaches,” writes the World Gold Council’s Ray Jia, “we are actively searching for clues of possible changes in next year’s global and regional gold markets. Unlike other key markets, China is entering into a different economic cycle and stepping up its easing monetary policy. We believe this could be supportive for local retail and institutional investors’ interest in gold.”

IN LATE DECEMBER, when West Virginia Senator Joe Manchin stuck a fork in Democrat spending plans citing inflation concerns, a progressive Congresswoman was quoted as saying, “The Build Better Act combats inflation and invests in what we need for a strong, stable, globally competitive economy.” The president himself surrendered to full inflation denial the same day, blaming a stock market the previous day on Manchin’s decision to vote against his $1.75 trillion spending program. So, to what degree does pressure from the political sector affect central bank policy? Need we worry about too close a connection between the White House and the Fed? Financial Times recently quoted a former central banker now fund manager as saying, “The idea of independent central banks these days is a fiction.”

BRIDGEWATER’S RAY DALIO SAYS that people are interested in the news, but they are not interested in history and lessons of the past – two things he has made a fortune by studying. He sticks stubbornly to his formula of the past few years: Stay out of cash, pay attention to the widening political and cultural divide, and get your finances in order by holding “a diversified portfolio of assets,” which includes gold. “As an investor,” comments MarketWatch, “Ray Dailo eyes the rearview mirror to see what’s ahead. If this paradox makes sense, then you likely agree with the view of history that ‘those who cannot remember the past are condemned to repeat it.’ Put another way, it’s hard to know where you’re going if you don’t know where you’ve been.”

“AND WHAT’S HAPPENING NOW,” writes Money Week’s John Stepek, “and in fact has been happening for most of this year – is that the threat both of higher inflation and of higher interest rates is hurting the valuations of the very longest-duration assets. That is, the longest maturity bonds and the most speculative stocks.” Stepek gives gold a mention toward the end of this article, saying that if government borrowing costs spike, “central banks will be called upon to print more money. “Look for inflation hedges,” he says. “Gold is wobbly now but if inflation and financial repression are the end game here then it will pan out.” Meanwhile, the mountain of national debt driven by government spending and subject to potentially higher interest rate charges continues to grow.

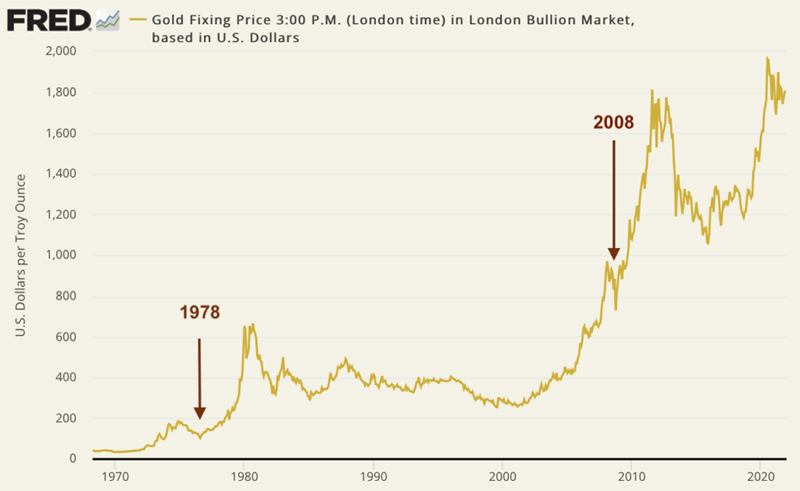

AMIDST THE CONSTERNATION over gold’s under-response to inflation’s sudden entrance, Crescat Capital reminds us that gold does not always enjoy clear sailing during times of economic uncertainty. Crisis troughs after record highs like the one we are in now, though, have at times paved the way for strong, sustained rallies. “It is quite normal for gold to struggle after making new highs,” it finds in a recently released study titled The Macro Case for Precious Metals. “We have seen this price behavior happen twice before. In March 1978, gold briefly reached a record level and then corrected by 15% soon after. Also, January 2008, the metal hit new highs and continued to appreciate for another month until declining by 28% during the Great Financial Crisis. We are probably seeing a similar issue today again. The price is now 14% lower, and the entire financial media already claims that gold is dead. Note, however, how the shiny metal tends to come screaming back after these pullbacks. (Please see chart below.) … Gold and silver cycles are long-term trends that tend to last many years. Our view is that if there was ever a time to go up on the risk curve in exchange for upside return potential, that time is now.”

Gold price

Sources: St. Louis Federal Reserve [FRED], Federal Reserve Board of Governors

“THE MARKET IS DISCONNECTED FROM EVERYTHING,” writes Real Investment Advice’s Lance Roberts. “Throughout history, there are correlations you would expect to hold constant between the market, consumer confidence, and the economy. Currently, after a decade of zero interest rate policy, massive amounts of liquidity, and financial supports, the market has become detached from reality.” That says it about as well as it could be said.

EVY HAMBRO, who heads up sector-based investing at Blackrock, sees “more upside risk than downside risk” for gold in 2022 despite the metal being “relatively out of favor at the moment.” That negative sentiment, he says in an interview posted at The Edge Markets, “typically presents buying opportunities.… It’s real interest rates which are the most important driver for gold, and they’re driven by interest rate and inflation expectations. We see a strong argument for adding to gold for diversification today, given equity markets are around all-time highs and there is still significant pandemic-related risk.”

FORMER FED GOVERNOR KEVIN WARSH says inflation is a choic in a recent hard-hitting Wall Street Journal editorial. and it is the road the Fed has chosen. Disregard the rationalizations offered by the Biden administration and the Fed to explain the sources of the inflation, he adds, and concentrate instead on the main culprit – the Fed itself. In this context, it is important to remember that raising rates will not necessarily slow down rising prices – an outcome that can occur only when interest rates rise above the inflation rate. Beyond inflation, there is the problem of excessive stimulus ending up in financial markets. “The authorities have expressed little concern about financial excesses, bubbles or financial imbalances,” writes Warsh. “Hope they’re right. I expect tension between the Fed’s goals of price stability and financial stability to be in sharper relief in the new year.”

“YET IN A SURPRISE TWIST,” says Elliott Management’s Paul Singer in a Financial Times interview, “a growing number of the largest investors in the world — including socially important institutions such as pension funds, university endowments, charitable foundations and the like — are currently lining up to take on more risk, which could have catastrophic implications for these investors, their clients’ capital and the stability of broader public markets. What is driving this behaviour?” Like former Fed governor Warsh (see above), Singer says easy money is driving the speculative mania. Governments though, says Singer, “have never been more restrained” when it comes to riding to the rescue. Singer goes on to say it could all come to an abrupt halt “when the government orchestrated music finally ends.”

“IT COMES AS NO COMFORT to us to know that the Fed is grappling with policy changes. Its policies have made a colossal mess of the economy and its markets. And it shows no hint of having learned anything,” writes Rogue Economics’ Bill Bonner. He is not convinced that the central bank means business when it comes to tightening. “[T]he Fed,” he says, “would have to put its key lending rate up to nearly 10% (it’s currently less than one-tenth of one percent) in order to achieve the same tightening effect as then-Fed-chair Paul Volcker got in 1980.” In the interim, the real rate of return is likely to slip even more into the negative as inflation advances, and the Fed keeps a lid on rates. Wall Street Bunny, in short, does not take Elmer Fedd seriously.

“THINK OF A VACANT BUILDING that has a gas leak,” [stock trading wizard Mark] Cook once told MarketWatch columnist Michael Sincere. “The gas has been leaking for a long time. The longer the gas leaks, the bigger the explosion. It will take a catalyst to trigger an explosion, but no one knows what is the trigger point. The longer the gas is in there and ignored, and forgotten, the greater the explosion.” There are so many nuggets of wisdom in MarketWatch’s article that it does not do it justice to mention only the one above. This is an interview you do not want to pass up – reflections on the current stock market from veteran trader Mark Cook who passed away in October.

“GOLD IS A DYNAMIC and multi-faceted potential defense against many forms of risk,” says Aberdeen Standard’s Steven Dunn in a recent report. “It has a track record of protecting investors during severe market drawdowns, remaining resilient during spikes in volatility. During negative market events, investors’ fear and uncertainty may spike. As a result, investors seek stable, defensive investments and global equities typically experience large selloffs. Gold has historically performed admirably when global equities have shown negative returns and large drawdowns. For example, during the biggest drawdown in recent history, the Global Financial Crisis, gold managed to deliver significantly higher returns than the broad equity market. Precious metals may serve as such an alternative to equities.”

“ACROSS FOUR DECADES OF WORK in the financial markets, and over a century of historical data, I’ve never observed as many historical indications of a market peak occurring simultaneously..… Emphatically – and this is important – my intent here is not to ‘call the top’ of this bubble. Yes, this is a bubble in my view. Yes, I believe it will end in tears. Yes, the price investors pay for a given stream of future cash flows is inseparable from the long-term returns they can expect. Yes, if this bubble is ever to actually have a top, this would be a perfectly reasonable moment to expect one. Still, my present intent is simply to share what we’re observing.” – John P. Hussman, Hussman Funds

Final Thought

The core problem for the modern portfolio is the debasement of the currency

“The strategies, in which portfolios hold 60% stocks and 40% bonds, have produced just two down years since 2007,” writes Bloomberg’s Michael Mackenzie and Liz McCormick. “… But it posted losses in September and November and is down 0.4% so far in December, just as the Federal Reserve started signaling a hawkish shift.” The bottom line is that both sectors – stocks and bonds – are overvalued, as we are constantly warned in financial reports these days. One analyst said: “In this environment, we think 60/40 is pretty dangerous.” Inflation undermines the value of the very currency in which those assets are denominated. So the problem at its core is the debasement of the currency.

Switzerland-based analyst Claudio Grass, who receives considerable attention among market watchers for his insights on monetary policy, holds what many would consider a controversial view on the Fed’s tapering program. He believes that “most investors can see through the political narrative and the ‘packaging’ of the central bank’s decisions. They realize they can depend on continued support and that there’s no reason to fear that the monetary expansionism of the last decade will be reversed anytime soon. And they are justified in their assumptions.”

“Of course,” he concludes in a short analysis posted at the Gavekal website, “as might have been expected from the track record of central planners this ‘strategy’ is extremely short-sighted. Keeping the money faucets open and persisting in maintaining an environment of extremely low rates is only postponing the inevitable. As conservative, rational investors and precious metals owners clearly understand and have seen coming for a very long time, this myopic approach might put off a recession over the next weeks or months, but it is has created much larger, deeper, systemic risks, ranging all the way from an inflationary crisis to the potential for actual currency collapse.”

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.