Has Bitcoin Crypto Mania Finally Run Its Course?

Currencies / cryptocurrency Dec 11, 2021 - 06:19 PM GMTBy: EWI

Here's a high-profile parallel between tech- and crypto-mania

When a company that's part of a major financial trend buys the naming rights to a professional sports stadium or arena, watch out!

History suggests that such a prominent move might be a sign that the fortunes of that company are about to dramatically change.

For instance, back in 1999-2000, technology shares were all the rage and one of the "highest of the dot-com high flyers," as the Wall Street Journal put it, was CMGI. It was the best performing U.S. stock from 1995 to 1999.

Well, in 2000, the firm bought the naming rights to the stadium of a major league football team.

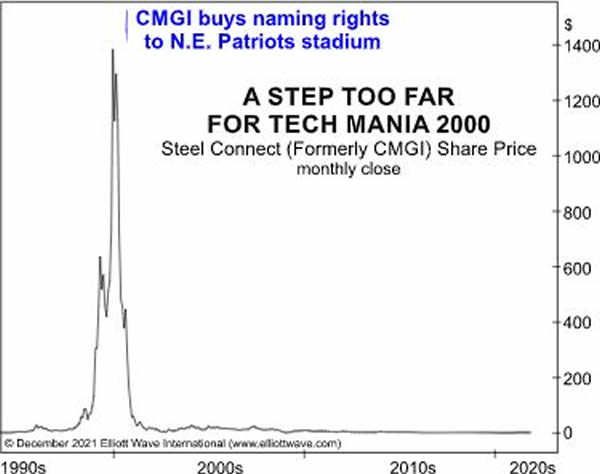

The December 2021 Elliott Wave Financial Forecast, a monthly publication which provides coverage of major U.S. financial markets, showed this chart and elaborated:

The chart shows the stock market performance of CMGI, which is now known as Steel Connect. In August 2000, the company bought the naming rights to the home stadium of the New England Patriots for 15 years. Just two years later, in the wake of the dot.com bust, they were forced to relinquish their agreement.

Relatedly, in 1999, PSINet bought naming rights to the NFL stadium at Camden Yards in Baltimore. But, in 2002, the then internet services provider's name was removed from the stadium as PSINet went bankrupt.

Here in 2021, there appears to be a developing parallel between tech-mania and crypto-mania.

Here's a March 26 headline from the Miami Herald:

FTX, exchange for Bitcoin, wins Miami Heat arena naming deal

And this is another news item from Nov. 17 (fastcompany.com):

Crypto.com pays record price for naming rights to L.A.'s Staples Center

Of course, that's where the L.A. Lakers play and Crypto.com has agreed to fork over $700 million for a 20-year naming rights deal.

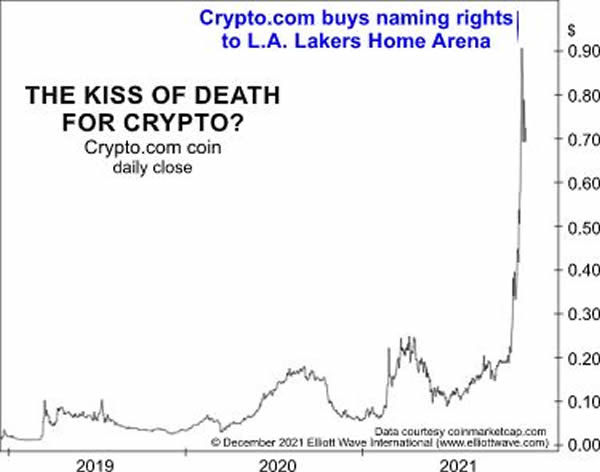

The December Elliott Wave Financial Forecast also showed this chart and said:

This chart shows Crypto.com's recent performance, with an arrow indicating the day they announced their coming stadium debut.

Will Crypto.com's price follow a trajectory similar to that of CMGI?

The Elliott wave method can help you to answer that question.

Frost & Prechter's Wall Street classic, Elliott Wave Principle: Key to Market Behavior, explains why:

The Wave Principle is governed by man's social nature, and since he has such a nature, its expression generates forms. As the forms are repetitive, they have predictive value.

Get detailed insights into the "predictive value" of the Wave Principle by reading the entire online version of the book -- 100% free.

All that's required for free access is a Club EWI membership. Club EWI is the world's largest Elliott wave educational community and is free to join. Members enjoy free access to a wealth of Elliott wave resources on investing and trading without any obligation.

Just follow this link for free and unlimited access to Elliott Wave Principle: Key to Market Behavior.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.