Meshing Cryptocurrency Wealth Generation With Global Fiat Money Demise

Currencies / cryptocurrency Nov 17, 2021 - 10:19 AM GMTBy: Raymond_Matison

The promise of electronic currencies

A couple of decades ago the internet started to revolutionize society in ways that could not have been predicted. Email systems developed and evolved to become indispensable and ubiquitous. People could sift and classify business data on spreadsheets in order to make smart business decisions faster. Vast libraries of books, data, news and other information from around the globe became increasingly available to anyone interested to read it. Global maps, archived music, and films could be shared, viewed, and listened to by anyone with a computer and access to the internet. Internet shopping became a reality; and just when it seemed that technological innovation might be slowing, all of these services migrated from desk-top computers to smart telephones. And this technology brought with it incredible amounts of new wealth.

Now continuing technological development is promising additional decades of innovation, that among other things will change ways in which we conduct financial payments, remit money across borders, invest in stocks, bonds and real estate, and control and custody our personal savings. These new technologies can be seen as decentralizing and liberating in the sense that individuals will be their own financial gatekeepers able to function as their own bank, without the need for permission from any trusted third party. This has already, and will continue to create much new wealth over coming years.

Paper currencies will recede in usage, as electronic payments will increasingly dominate. For payment, we may transfer an electronic version of US dollar, a Stablecoin, a Central Bank Digital Currency, or eventually even various cryptocoins. Governments will initially seek to control or otherwise delegitimize cryptocurrencies, but will unlikely be able to extinguish all global electronic coin competitors - meaning that governments will have finally lost their exclusive right to create money, a right that central banks and government usurped from people over a century ago.

Our previous report dated Aug. 10, 2020 stated: “No government will voluntarily give up any control over the issuance of money, but in times of crisis people across the globe from countries around the world will quickly and naturally migrate to assets that may protect them from severe currency implosion loss. People had trusted and believed in government, which they deemed rightfully to have a responsibility to keep their currency valuable. With central bank created money loosing value, individuals will seek alternative systems of value, and assign increased value to gold, validity to Bitcoin and other decentralized and anonymous cryptocurrencies, conferring them money-like attributes. The abuse that holders of devalued currencies will experience in the next two to three years will cause them to assign increasing legitimacy to what they will now see as the more trustworthy digital system - one government or the FED cannot debauch.”

Crypto is not a threat to the dollar or any other country’s currency dominance – government spending above its tax revenues, and increase in national debt and money issuance is the real threat. Existence of cryptos simply provides citizens an alternative to the present system’s inflationary money that is persistently losing its purchasing power. Citizens are running from devaluating currencies to gold, real estate, and cryptos as their preferred refuge.

How could blockchain and e-currencies bring new prosperity?

There are three distinctive ways that blockchain and cryptocurrencies can bring new prosperity to the world. The first is by dramatically reducing present day cost of financial transactions of banks and other fiduciary institutions. Bypassing the cost of a trusted middleman, whether it is it is a bank employee, lawyer, or shipping agent will reduce transaction costs globally benefiting everyday businessmen and consumers alike. The cost of sending remittances globally will also be reduced by new payments systems that will be more immediate, and transfer more or the intended initial transfer sum to its recipient.

Second, prosperity comes from the use of more honest money. For decades, our government-issued fiat currency has suffered from persistent reduction in its purchasing value. Indeed, history proves that every paper currency issued by any country over the last two millennia has eventually collapsed to its intrinsic zero value. Commodity currencies, such as gold or silver coins, have been diluted with substitute metals in the past to eventually be rendered as useless. Thus, history has confirmed that governments cannot be trusted to issue honest, non-inflationary money that does not lose purchasing value over time. As a consequence, people’s savings and value of investments and pensions are slowly confiscated over years by government fiat money. People now are increasingly embracing non-government issued virtual currencies which are specifically programmed not to increase in its emission, thereby maintaining or increasing its value. Indeed, Austrian economist Frederick Hayek observed in 1984 that “I don’t believe we shall ever have a good money again before we take the thing out of the hands of governments”.

The third way that blockchain technology have e-currencies bringing prosperity is through the growth in value of crypto platform currencies or tokens. It is not just Bitcoin which is seen to be growing incredibly as a global store of value. Platforms which provide valuable services that can be purchased with their tokens gain value with community adoption and usage. While these platform cryptos and tokens experience spurious price movements, the most useful platform coins and tokens have increased in price by factors of 10-100 times or more in the past few years. As the number of users rises from several hundred million to several billion from continuing global adoption of this technology, prices for blockchain platforms and cryptocurrencies will continue to escalate.

Views on markets, gold, and inflation

If one had invested in the stock market of the early 1920s, and had substantial gains by 1927, but then a market advisor had told that investor to get out of the market because of the risk in a market crash, and he did – how should he feel about the continuing market gains in the 1927-1929 period? Before the October 1929 crash, it would be quite reasonable to say that the market alarmist advisor was wrong. But what should he think of that advice after the October 1929, 90% market crash – considering that it took another twenty five years before the market recovered fully to previous price levels?

Our prior articles have been quite explicit with respect to bloated market valuations and the potential for rapid decline, FED market manipulation, excessive new money creation, inflation, and loss of dollar purchasing value. Investors have roundly neglected these risks, such that no new arguments need to be made; however, for reference, here are some comments from previous articles, which can be found in the author’s archives as dated:

(Nov. 28, 2020) “The global stock and bond markets are at an inflection point. Based on growth of revenues and profits and historic valuation principles, the stock market is grossly overvalued and exposed to significant decline. High tech companies, an important segment of the overall market, are still growing in revenues and earnings – so they may fall less when the general market reverts to sounder valuation principles. But based on Federal Reserve’s actions to print infinitely more currency, and its policy to depress interest rates - the stock market can continue to rise for a time. Such a rise would not represent a bull market, but a market driven by the declining purchasing value of the dollar.”

(Aug. 10, 2020) “As the dollar value decline accelerates, an unexpected intermediate result could boost stock prices as the stock market melts upward. Economic fundamentals don’t matter during this time period. As the dollar loses value the price of goods sold rises, and this inflation is reflected in higher sales, and higher stock prices. Such an event with rising stock market prices took place a century ago as Weimar Germany’s ceaseless printing of the Deutschmark was destroying its currency. The stock market rose before the lack of faith in its currency finally crashed its stock market and the currency. If we experience similar consequences, the stock market can rise more before the final crash.”

(Jun 3, 2021) “Our economy has been increasingly manipulated with drastic actions by the FED ever since the financial crisis of 2008! If over this time period the economy could not normalize – it really means that it is never going to recover fully – and we will first have to experience its actual demise. It is only after a crash, a new monetary system, with diminished military geopolitical goals, and limited social entitlements that the nation’s economy will be able to rise again.”

(Dec. 19, 2019) “Manipulation of our monetary policy has been going on for decades, which has turned increasingly strident in the last twenty years. In the last several years this destruction has been abetted by fiscal policy – that is, running large and increasing budget deficits as a means to manipulate business activity. These budget deficits have and will continue to rapidly increase our national debt, increase its servicing cost, require additional money expansion by the FED, which will more rapidly debauch the currency. Now that monetary and fiscal policies both are firing their heavy artillery, the question of whether we are to expect a recession or a depression is also answered.”

(Jan. 5, 2020) “The stock and bond market are full-blown bubbles. Astute money managers are now forced into purchasing gold or cryptocurrencies to protect their investment portfolios against irresponsible fiscal and monetary policies. Market volatility has raised investment risk as corroborated by the drastic, rapid and record market decline between February and March of 2020, when the DJI dropped 35% in just one month. This is a market to avoid for the foreseeable future. It is a time to own gold and silver bullion or coins.”

Views regarding increasing government debt and GDP

With over $28 trillion in present government debt, and an estimated $150-200 trillion in additional unfunded debt, it takes little insight - and no economic training - to realize that the US dollar is following the historical path of other previous country currencies into oblivion. Yes, it may still take a decade or more for it to reach its intrinsic zero value. However, since 1971, when the US closed the gold window and went completely off the gold standard, even according to the questionable compilation of the Consumers Price Index numbers, the purchasing value of our currency has fallen by 85.5%. If we compare the dollar’s value to the market price of gold since 1971, then its value has declined by $35/$1780=.01966, or 98%. Those are very poor performance indicators for our government-led, central bank implemented fiat currency.

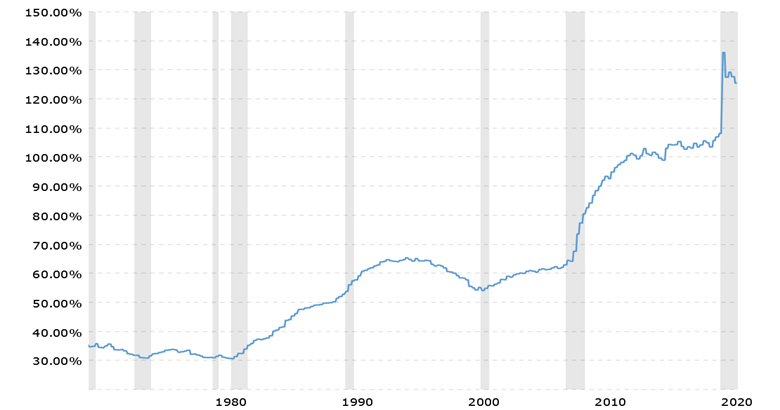

The following chart shows a ratio of debt for every dollar of Gross National Product – the accepted measure for economic health and productivity. That measure shows that the nation’s debt has increased over decades, and now is the highest in its history. It is worthwhile to quote economist/authors Reinhart and Rogoff in their excellent book, published in 2009, “This Time is Different” that: “Ultimately, default often occurs at levels of debt below the 60 percent ratio of debt to GDP enshrined in Europe’s Maastricht Treaty, a clause intended to protect the euro system from government defaults.”

Debt/GDP Ratio – Source: Macrotrends

What this chart shows is that the growth of debt started accelerating with the recession in 1980. More importantly it shows that after the financial debacle related to the 2008 mortgage implosion, national debt started parabolic growth. Not only is this debt at a level that it can never be repaid from government revenues, it excludes the present administration’s multiple trillion dollar announced spending programs – strongly suggesting that debt will grow even more rapidly over coming years.

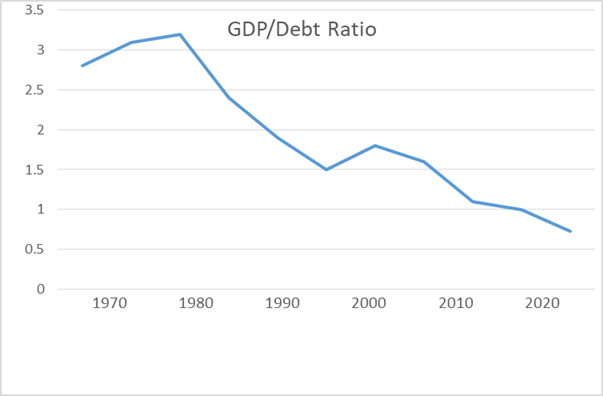

The next chart shows our GDP per dollar of debt. Keynesian economics claims that in order to stimulate an economy, the government must increase its spending, and keep interest rates low. In his book published in 2009, “Where Keynes Went Wrong” author Hunter Lewis writes: “In the United States, we have operated on Keynesian principles since World War II. The government has printed money. Debt levels have grown. We have not only gotten inflation and bubbles. We have also gotten less and less growth for each increment of debt.” Author Lewis’s contention is certainly corroborated by this chart.

Source data: Macrotrends

The chart, which is an inverse of the data of the previous chart, proves why Keynesian economics is highly attractive to politicians as it promotes government spending – but in fact it is also simple economic nonsense. If the chart were to be extended forward in time, GDP relative to debt would continue to decline, debt would increase, and the currency together with people’s savings and pension funds would be destroyed. This chart definitely shows that the nation is getting ever less GDP for rise in national debt.

Economics professor Saifedean Ammous, author of the brilliant and highly insightful book on economics and Bitcoin “The Bitcoin Standard”, published in 2018, writes:

“As time passed, governments moved away from sound money ever more as their spending and deficits increased, their currencies continuously devalued, and an ever larger share of national income was controlled by the government. With government meddling in all aspects of life, it increasingly controlled the educational system and used it to imprint in people’s minds the fanciful notion that the rules of economics did not apply to governments, which would prosper the more they spent. The work of monetary cranks like John Maynard Keynes taught in modern universities the notion that government spending only has benefits, never costs.”

Keynesian economics should be seen as a natural on-ramp for socialism, as it promotes government deficit spending, increased taxes and rising debt, and an almost hidden inflation (declining purchasing power) tax. If debt is simply rolled over by issuing new debt, and GDP shown in these charts could not rise without historically large increases in government debt – one must ask the question as to how this is different from a Ponzi scheme?

How will the global legacy financial system die?

The most difficult if not impossible question to answer is how and when the trigger for an accelerated decline will begin. A decline in GDP growth has been persistent in the U.S. for decades – but this decline in the rate of growth has been gradual. For example, the average growth rate of GDP between 1960-1980 was 3.88%; but for the period of 2000-2020 it was only 2.03%. Sadly, the national debt has grown from a miniscule $286 billion in 1960, to a devastating $28.4 trillion presently. Such numbers are the unmistakable precursors of a financial system’s demise.

Since America does not live in an isolated world, but rather in the most financially interconnected world in history, monetary, economic, or military conflict problems in any part of the globe can gain momentum and precipitate rapid decline worldwide. For example, the European Union is experiencing increased dissention among its member countries, as its unelected leadership is trying to impose rules which its member countries do not accept. Britain exited the EU to avoid rules its people could not embrace. In addition, the European Central Bank has not been able to control its Maastricht Treaty limitations for member country deficit limits, economic growth, and indebtedness. Aggressive central bank policies regarding money issue, bond repurchases, negative interest rates, and possible individual country debt default, are catalysts for inflation, credit restrictions, bank implosion, and general economic demise. What could start in Europe would easily expand to the rest of the globe, including America.

China is experiencing a collapse of its largest real estate developer which has defaulted on more than $300 billion in debt. The owners of that debt could easily also experience financial trouble, which cascades from one group of investors to another in an ever expanding circle. With much of the world still locked down, or semi-locked down from the Covid virus epidemic, economic distress can emerge anywhere in the world.

There is, however, one strategy which guarantees economic and monetary failure: the continued adherence to Keynesian economic policies which propose that increased government spending supported by growing government debt and inflationary money issue, together with depressed interest rates will promote continued growth in GDP. This also is the same economic policy which promotes military weapons spending, and their subsequent usage in continuous wars. The consequences of Keynesian economic policies has been disastrous, and its very painful lesson is one that world politicians has yet to learn and accept through actual experience.

People will soon realize that in order protect their money and savings, they will have to take it out of the banking system. They also will soon realize that one will be able to protect their savings only by putting them into a system of non-government controlled money. This will bring them to Bitcoin and the crypto markets. So the present system will die as citizens seek refuge from government devalued money, and vote with their dollars to move them to non-inflationary gold, real estate, or cryptocurrencies.

Meshing of two gigantic intractable forces, and its effect of people

It is quite exciting to look towards the future where greater computer and technological generated efficiencies related to blockchain and cryptocurrencies will reduce the cost of doing business, increase profits, and be more inclusive of all the world’s inhabitants. In that process, it will create an abundance of new technology wealth similar to that created with the development of the internet. The holders of this new wealth predominantly will be members of the younger generation who have embraced and helped develop this new technology. These participants are fiercely independent, and avid promoters of decentralization and privacy. But the meshing of opportunities and improvements from new technologies will have to take into account the demise of the old legacy systems of centralized government and monetary systems. This evolution from our legacy systems will be disruptive and traumatic to everyone on the planet. Excerpts from previous reports, as dated, depict important considerations and observations for this meshing:

(Mar. 28, 2020) “Over the last century, economists and bankers based on actual observation and experience came to the conclusion that the centrally planned and controlled Communist system cannot work – and indeed the world witnessed its collapse. Yet our brightest politicians, policy makers, Keynesian economists and bankers want to maintain the illusion that in a capitalist system of central bank control an economy can work. What is the difference between a centrally planned and managed communist system, and a centrally planned and managed capitalist system – both are centrally planned! We already know that central planning does not work.”

(Aug. 10, 2020) “Our centralized banking system and purchased government representatives have brought us incrementally and over decades towards economic and financial destruction, and germinated a financial viral infection of socialism and communism in our society, and anarchy to our streets. They are trying and partly succeeding in undermining and sabotaging our cherished form of republican government, and confiscating our freedom of speech, liberty, and right to assembly.”

(Nov. 28, 2020) “Have you noticed yet, that elite politicians of democracies, corporate business leaders around the globe, dictators, socialists and Communists all seek greater centralization – the basis for absolute control over people? As incongruous as it seems, democracies and Communists seem to be embracing the same goals, which time after time have proven not to work! It is only computer geeks, who have escaped the socialist teachings in our higher education system, who quite naturally and farsightedly are programming decentralization, liberty, and privacy in their evolutionary networking projects.”

(Oct. 3, 2020) “A decentralized global system of money issued without Central Bank participation would stop financial oppression, eliminate erosion of the currency’s purchasing value, stop increasing national indebtedness, eliminate costly and unnecessary wars, increase worker savings, provide for adequate pension assets, and liberate people worldwide. For this financial emancipation of mankind to take place, it is sufficient that banks as the present central controllers of credit and currency issue have competition. The marketplace and Gresham’s Law would become the arbiter of real value. Bitcoin and other similar currencies already in existence confirms the challenge to fiat currency issued by central banks, and points to the technological singularity that has the power to free people from the bondage of centralized banks and provide decentralized financial services to those who have never been banked in the past.”

(Aug. 10, 2020) “Our central planners have now created a global financial environment through decades of fiat money expansion from which there is no route to recovery – and no escape. Create the currency and expect unpredictable levels of price inflation collapsing the dollar’s value; or don’t create the currency and expect global loan implosion.”

(Mar. 28, 2020) “However, over the last twenty years the FED itself can be seen as the entity doing the most damage to the dollar through its interest rate policies and money expanding operations. We are not being undermined or subdued by enemies outside our borders. We appear to be self-destructing by forces within our borders, from our central bank, inside our Congress, our academic institutions, and increasingly by false ideologies embraced by our populace.”

(Feb 05, 2021) “It is now clear that the period of “The American Century” is passing, and the torch of the U.S. dollar’s global currency is about to be handed to its next recipient. Over the last seven-hundred years, this global currency torch has been passed from Portugal to Spain, to Netherlands, to France, to Britain, and to the U.S. – so while the passing of this torch to the next recipient may seem traumatizing, it is historically quite common. We hope only that the nation’s leaders superior to our elected politicians can make this transition without resorting to kinetic, destructive war.”

We are to experience the meshing of two titanic forces: a monetary-economic earthquake destroying our old legacy systems, and a tsunami of technology which is submerging the entire world in a new experience. There will be incredible destruction of the old world, and unimaginable building and growth of the new world! Our elite planners and politicians have brought us, because of their misguided policies over decades, to experience what in the future may be called the Greater Depression of 2020 – which will require many years and many sacrifices to overcome. Emergent from the ashes of this destruction will rise a more prosperous and inclusive world, with more liberty and freedom.

Raymond Matison

Mr. Matison was an Institutional Investor magazine top ten financial analyst of the insurance industry, founded Kidder Peabody’s investment banking activities in the insurance industry, and was a Director, Investment Banking in Merrill Lynch Capital Markets. He can be e-mailed at rmatison@msn.com

Copyright © 2021 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.