UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

Economics / Inflation Nov 13, 2021 - 06:27 PM GMTBy: Nadeem_Walayat

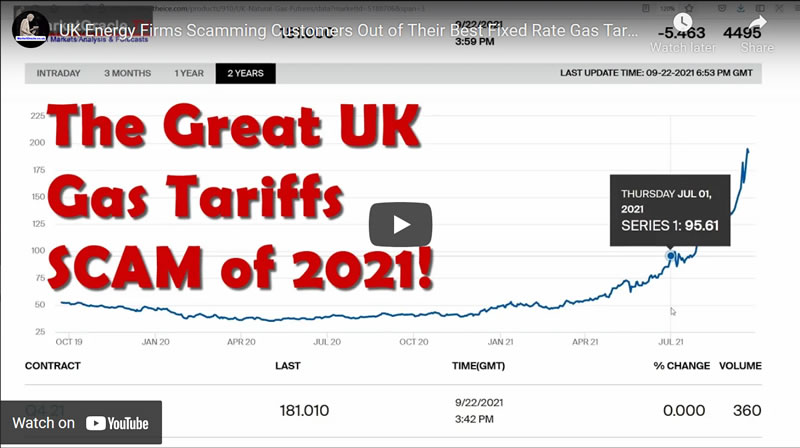

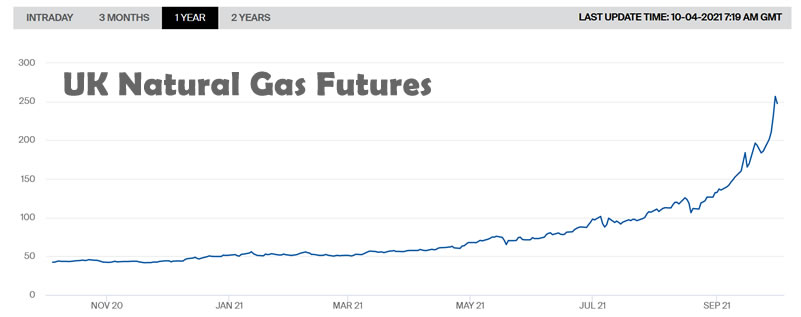

Forget the official UK inflation indices which are just as fake as those in the US and those that spew out of the CCP, a year ago I estimated the REAL rate of UK inflation was 16%, today I estimate it to be near 20%! But that is the average amidst that there will be huge variances with the price of many goods, materials and services more than doubling! Case in point being UK energy / natural gas prices which have doubled and are on their way to tripling as the pieces of turd energy companies FAILED to HEDGE prices as they crept higher during the summer months because they knew at the end of the day they could just walk away from their contracts with customers, shut up shop and reopen under a slightly different name with the same staff and premises, WHAT A SCAM!

Walking away from all of their loyal customers whom they have been ripping off for many years as they are quick to hike prices when the market price goes but slow to give even a fraction of the subsequent price drops whom they now seek to penalise to great extent by not abiding by their contracts with customers who had the commonsense to lock themselves for upto 2 years. So instead of honouring their contracts the scam energy are dumping their customers onto the regulator to then offload onto other energy companies at high variable rates, likely at least double and probably triple the rates that they had fixed as i covered in a recent video where I locked in a 2 year tariff at 2.5p per kwh with Zog Energy that is currently offering the same fix for 5.8p kwh. So there is a high chance that my energy provider will also opt to walk away and dump me onto a rate near triple that I am currently fixed.

For most of 2020 and the whole of 2021 I have been warning that high inflation was on it's way which is why I went on a buying spree during Q3 2020 into Q1 2021 buying everything I could possible need during 2021 and beyond from new computer systems, hardware, components, gadgets, materials, even a new sofa suite, because I knew that high inflation was coming and virtually everything would be marked significantly higher.

For instance I bought a Karcher K7 pressure washer in October 2020 during Amazon's prime day event for £340 which had been discounted from the then normal selling price of £425. Guess how much the current price of the K7 is ?

£690, more than double that which I paid! Real Inflation is HIGH and it is only going to get worse, all whilst the central bankster's fiddle their inflation indices by trying to exclude everything that has gone up so that as if by magic CPI can resolve to 2%, when in reality UK inflation is near 20% and US inflation is at least 10%!

And then to top things off we had the fear mongering mainstream press triggering a Fuel Panic prompting Lemmings motorists to start queuing on mass at the petrol pumps, seeking to fill up their tanks whenever their fuel gauge needles dipped below 99%.

The 2% Inflation SCAM, Millions of Workers take the Red Pill

HIGH INFLATION has been with us for over a year and it is only getting worse! As a rough guide X2 official CPI in the US and X3 official CPI in the UK for a more realistic view of the current real rates of inflation as most people experience. At the end of the day CPI inflation is one of the many propaganda tools that the government uses to keep the public docile. For if people truly understand what the real rate of inflation was they would soon be in revolting against the system of slavery that they are born into. Instead they lap up the persistent insidious brain washing of which CPI inflation is a core part of.

Just ask yourselves how much has your monthly shop gone up over the past year? I would happen to guess it's a lot more than the 5% that official inflation suggests it has gone up! More like 30%! See the smoke and mirrors game that they are playing? If the masses actually understand that inflation over the past 5 years has been over 100% rather than 15% then the whole system would collapse as people would demand that their pay and benefits rose in line with the real rate of inflation i.e. 10% to 20% per annum not the 2% to 3% they have been getting and with it would explode each nations debt mountains even further that would send interest rates soaring as investors would demand higher yields where those nations how borrow heavily in foreign currencies would default on their debts and governments would have no choice but to borrow else would risk a debt deleveraging collapse of the whole system.

In fact the pandemic allowed millions of Britains wage slaves a take the blue pill and realise the extent to which they were slaves with many refusing to return to work as lockdown's end instead requesting that they be allowed to work from home, if not quitting their jobs as I covered in my recent video of why many workers are refusing to go back to work.

The rest of this extensive analysis that maps out a trend of rthe Silver Price into Mid 2022 has first been made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is set to increase to $4 per month this week for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

Also my recent latest extensive analysis on the prospects for the stock market into Mid 2021 see - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

Including access to my recent extensive analysis updating AI stocks buying levels as we head towards the window for a significant correction even a possible stock market crash.

Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 15% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your AI data preprocessing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.