Addressing the Elephant in the Crypto Room - Regulation

Currencies / cryptocurrency Nov 03, 2021 - 02:24 PM GMTBy: Stephen_McBride

Will the US government regulate crypto… and if they do, what will happen to crypto prices?

This is an extremely important question… and by far the #1 thing readers are asking.

Today, I’ll answer it.

- What happens when the government regulates crypto?

Notice I didn’t say, “if the government regulates crypto.”

I said, “when.”

Regulation is coming to crypto. This is a carved-in-granite, dead certainty. And now’s the time to prepare.

Since bitcoin burst onto the scene 13 years ago, crypto has existed in a regulatory gray area. Regulators didn’t know what to make of it. They still don’t.

Not only is the government unsure how to regulate crypto. It doesn’t even know who should regulate crypto in the first place.

Are cryptos securities, which would fall under the SEC… or are they commodities, which means the CFTC has to get involved?

For a decade, the government mostly dodged these hard questions. Regulators stuck their heads in the sand and hoped crypto was a fad that would go away.

But the total opposite happened. Today, cryptos are a $2.6 trillion asset class. Bitcoin is worth more than Tesla, Facebook, or Berkshire Hathaway.

The crypto industry has grown too big and important for regulators to ignore any longer.

- As you know, the US government lives by extracting money from you through taxes and inflation…

Crypto threatens its ability to do both.

That’s not going to fly with bureaucrats in Washington.

It’s a certainty that crypto will be regulated in a way that prevents it from interfering with the US government’s control of money.

And for us investors, that’s great news.

Because history shows, regulation will most likely be a great thing for the crypto industry.

In fact, I welcome regulation as a huge opportunity that will lead to much higher crypto prices.

- Regulation will provide much-needed clarity to the crypto industry.

This clarity will attract millions of money managers who haven’t put a penny into crypto yet.

Most of the world’s largest investors haven’t touched crypto because of the regulatory uncertainty.

These folks are the financial elite. They have more money than God, controlling trillions of dollars.

And they refuse to invest in crypto before the government sets the rules. Ken Griffin, the billionaire founder of Citadel Securities, recently told Bloomberg:

We don’t trade crypto because of the regulatory uncertainty… if crypto was regulated, I would trade it.

There are hundreds of Ken Griffins out there… biding their time until a regulatory framework comes to crypto.

When regulations come, I expect the floodgates to open. The amount of money that will rush into crypto will dwarf anything we’ve seen so far.

And keep in mind…

Government regulation is usually a good thing for investors in an industry… and sometimes it’s great.

Remember all the uncertainty surrounding Obamacare?

Before Obamacare, health insurance firms were under fire from Washington. Investors worried looming regulations would crush profit margins and put some insurance companies out of business.

When Obamacare was signed into law… the total opposite happened. Obamacare was the best thing ever to happen to healthcare stocks.

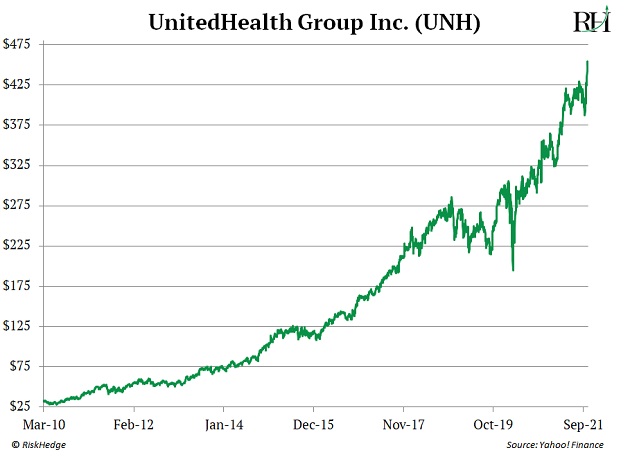

The Affordable Care Act passed in March 2010. Since then, UnitedHealth (UNH), America’s largest health insurer, has soared 1,273%.

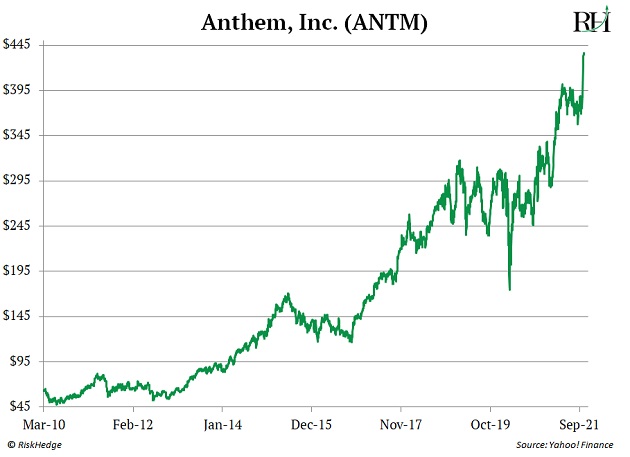

Anthem (ANTM), America’s second-largest health insurer, has soared 585%.

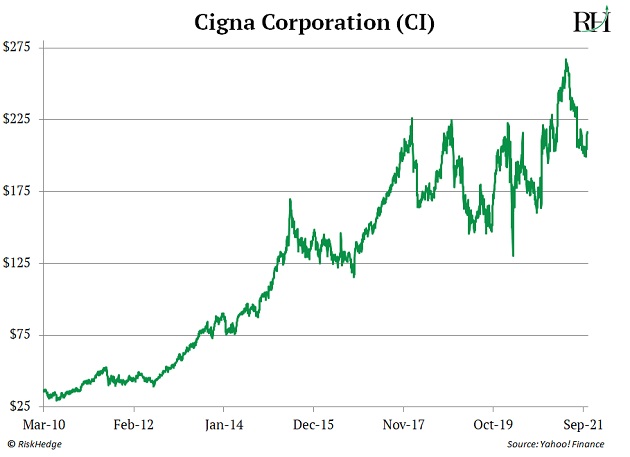

And Cigna (CI), another huge health insurer, has soared 481%.

Why?

Obamacare removed uncertainty. It set the rules. Investors could confidently buy health insurance stocks knowing the rules wouldn’t be changed.

Obamacare sparked a generational boom in healthcare stocks for another reason…

It required Americans to buy health insurance. In other words, Obamacare forced millions of American families to become customers of health insurance companies.

In a similar way… crypto regulation will force more investors to get involved.

For now, billionaires like Ken Griffin have the perfect excuse to not invest in cryptos.

“Why’d you miss out on bitcoin’s 1,000,000% gains?” an investor might ask a highly-paid hedge fund manager.

“Regulatory uncertainty” has been the go-to excuse.

It’s been perfectly acceptable for professional investors to miss out on bitcoin’s 1,000,000% rise.

That won’t be the case once crypto is regulated. The world’s largest money managers will have to consider investing in it… or risk being left behind.

- Regulation is the GREEN LIGHT for Wall Street to finally get into crypto in a big way…

It’ll open the door to crypto for mainstream financial advisors and asset managers.

Banks and other fintech companies should also benefit from more regulatory clarity.

They’ll offer more crypto services… including payments, custody, lending, and settlement.

Are there downsides to regulation? Sure.

The government will likely come down hard on crypto projects that disregard regulations.

The “empty” cryptos that do nothing valuable will have a hard time justifying their existence to regulators.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.