Food Prices & Farm Inputs Getting Hard to Stomach

Commodities / Food Crisis Oct 26, 2021 - 09:13 PM GMTBy: Richard_Mills

Thanksgiving is a time to appreciate the food on our tables, but that probably isn’t stopping a lot of people from grumbling about how expensive the turkey and all the fixings have become.

According to Statistics Canada, food prices are up 2.5% over the past year, but that may be underestimating the impact of inflation. New research from Dalhousie University’s Agri-Food Analytics Lab, quoted by BNN Bloomberg, shows that food inflation in Canada is closer to 5%, well above the normal 1-2%.

Among food categories, meat prices stand out as rising the most, with Stats Canada noting a 10% increase for these products over the past six months. Nearly half of Canadians, 49%, say they have reduced their purchases of Alberta meat, while a majority of consumers acknowledge cutting back on it since the start of the year. The higher number of vegetarians may be due to economic reasons as much as concerns over animal cruelty.

As for what is causing food prices to tick higher, the study by Agri-Food Analytics Lab cites unfavorable weather patterns in the northern hemisphere, i.e., droughts and storms, and logistical challenges owing to the covid-19 pandemic.

Corporate Knights expounds on the covid factor, mentioning several contributors to higher prices on grocery store shelves. These include labor shortages in both Canada and the US, rising freight costs, border waits, last year’s temporary closures of meat processing plants, and higher demand for food, as a revival of home cooking puts pressure on the prices of meat and feed grains such as soybeans and corn.

In fact climate change was affecting food production long before supply-chain problems due to covid.

A 2019 report by Environment Canada showed that Canada is warming at twice the global rate. Wildfires in California and British Columbia have damaged fruit and vegetable harvests. Droughts in the Prairies have led to smaller harvests of feed grains and produce, and water scarcity has forced famers to reduce the size of their herds, causing meat prices to spike. Tornadoes in Ontario and Quebec, and more active than normal hurricane seasons in the Atlantic, have also impacted the food supply chain, writes Corporate Knights.

In Manitoba this past summer, a severe drought drove up the price of feed grain, hay prices and costs for transporting feed, squeezing already tight margins.

“It’s terrible. Our pastures and field are withering. We don’t have enough feed for our cattle so we’re forced to buy it. But as hay and feed grain prices rise, it costs more and more to keep the cattle. It’s devastating,” says Ian Robson, a Manitoba farmer quoted on the National Farmers Union website.

The problem is exacerbated by the fact that cattle prices are falling due to farmers being forced to sell off part of their beef herds, meaning they will have to pay more and more for inputs, to keep cattle that are selling for less and less.

Scientists say that record heat waves lasting longer than a week, such as the “heat dome” that enveloped residents of western Canada and the United States this past summer, will be two to seven times more likely — creating the conditions that spark wildfires, cause water shortages, and increase the frequency of weather events like hurricanes and tornadoes that often ravage farmland and disrupt supply chains around the world, forcing food prices to rise year after year.

By June, drought had already scorched much of the US West, prompting California farmers to leave fields fallow and triggering water and energy rationing in several states.

In mid-September, the Southwestern United States reported precipitation at the lowest 20-month level since 1895. The drought in California and the “Four Corners” states of Arizona, Utah, Colorado and New Mexico started in early 2020 and has led to unprecedented water shortages in reservoirs across the region, while fueling devastating wildfires.

A report by the National Oceanic and Atmospheric Administration (NOAA) found that the unusually high temperatures coinciding with the Southwest’s historic, worst in a century dry spell, are symptomatic of climate change and have intensified the drought.

Quoting from the report, Reuters said, Above-normal heat helps dry up surface and soil moisture and reduces snowfall in winter, which in turn diminishes dry-season surface water storage from snow-melt runoff…

Low snowpack and parched soil can also create a “land-atmosphere feedback” that deepens a drought by helping raise ground temperatures while leaving less moisture available to evaporate for future precipitation…

Extremely high temperatures also sharply boost demand for water, further straining depleted reservoirs and rivers.

According to BNN Bloomberg, heat-related drops in crop yields affecting the supply of food could be with us for decades:

Yields of staple crops could decline by almost a third by 2050 unless emissions are drastically reduced in the next decade, according to a Chatham House report published [in September], while farmers will need to grow nearly 50 per cent more food to meet rising global demand during the same timeline.

It isn’t only retail food shoppers that are feeling the pinch of rising prices. Inflation is just as much a factor at the bottom of the food supply chain, the world of farmers and ranchers, as at the top, the shelves of brand-name grocery stores where most of us peruse items for our weekly shop.

One of the most important inputs that farmers rely on for growing food is fertilizer. Higher fertilizer prices must often be passed onto the end user, the buyer of fruits and vegetables, for the grower to preserve his profit margin. This is precisely what we see happening right now.

Recently the Green Markets North American Fertilizer Index hit a record high, rising 7.9% to US$996.32 per ton, and blasting past its 2008 peak. According to BNN Bloomberg, the fertilizer market has been smoked this year due to extreme weather, plant shutdowns and rising energy costs — in particular natural gas, the main feedstock for nitrogen fertilizer.

Nitrogen, which gets added to the soil to help plants grow, is also on a tear, with some US farmers saying it’s almost doubled in price since last spring. Several farmers are reportedly relying on other crops like winter wheat which consumes less nitrogen.

Green Markets says expensive fertilizer could push US corn farmers’ cost of production costs 16% higher.

The higher the cost of farming inputs, the more farmers will have to charge the consumer to make up for those payments. On a personal note, I see this happening on my hay farm. The price of custom fertilizer has doubled from about $500/t to $1,000/t, forcing hay farmers like myself to either absorb the higher cost, or make some tough decisions — like using less fertilizer or none at all, which obviously affects your grass yield. I also raise beef cattle, so the increased cost of fertilizer forces me to consider whether I can afford to carry my full herd. The price of herbicides has also gone up, so now I need to decide whether to spend a lot of money on weed control. When you factor in unpredictable weather conditions during growing season, such as dry spells, extreme wet and forest fires, it seems to be the start of an extremely vicious cycle that threatens to both drive farmers into bankruptcy, and ratchet up the price of food, all the way up the supply chain from farm to table.

Conclusion

According to the Food and Agriculture Organization’s global food index, food prices are already at a decade high, and increased fertilizer costs could lead to persistent food inflation well into 2022.

Beyond the headlines blaming covid, a deeper understanding of food inflation requires an appreciation for how the rising prices of farm inputs like fertilizer, feed grains, hay, etc., get passed on up the food chain and eventually end up as higher grocery bills. Food inflation in Canada is close to 5% and we can see this reflected in the higher costs of a number of grocery items.

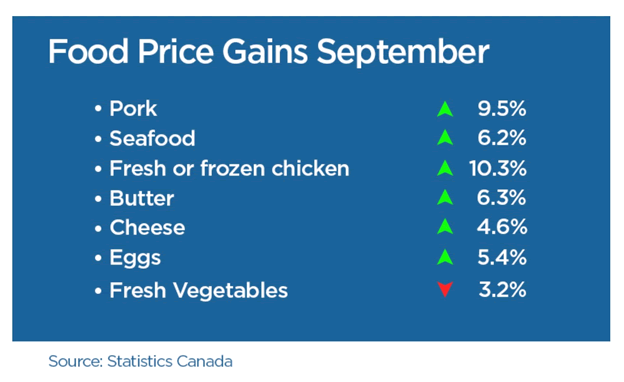

Leading the price increases, in September fresh or frozen chicken gained 10.3%, pork was up 9.5%, seafood was 6.2% more expensive and butter was 6.3% more dear. Surprisingly, the prices of fresh vegetables were down 3.2%.

Statistics Canada says the cost of food rose 3.9% year over year in September compared to 2.7% in August. The agency notes the country’s annual rate of inflation reached its highest level since 2003, with the consumer price index (CPI) up 4.4% in September compared to a 4.1% year over year increase in August.

US inflation is even higher at 5.4%. The CPI increased 0.4% in September, with food and rent accounting for more than half of the rise. Food prices reportedly jumped 0.9% last month after increasing 0.4% in August, with the largest rise in food prices since April driven by a surge in the cost of meat.

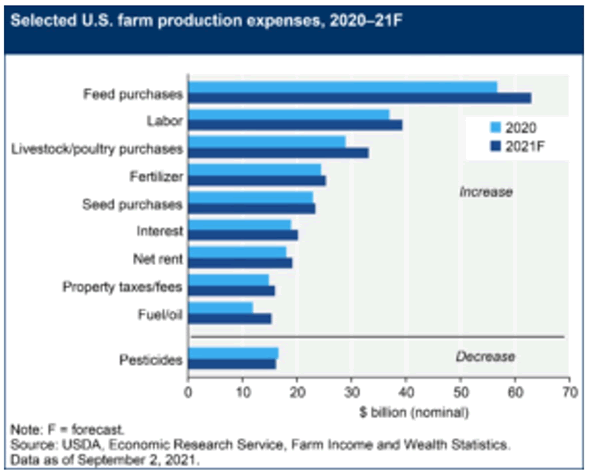

Among US farm inputs, feed purchases, representing the highest percentage of farm production expenses, are this year outpacing 2020’s, according to the US Department of Agriculture graph below.

Source: USDA

As for whether food inflation, and other kinds of inflation, are transitory, there is increasing evidence that rising prices are becoming stickier than previously thought.

Reuters reported on Thursday that industry leaders around the world believe prices are only going higher, with shortages of workers, fuel, container ships, semiconductors and building materials, as examples, keeping companies scrambling to keep a lid on costs.

“We expect inflation to be higher next year than this year,” the article quotes Graeme Pitkethly, finance chief at consumer products giant Unilever.

Some of the problems leading to higher prices are structural, including labor shortages, due to older employees leaving and fewer entering the workforce.

To this I would add climate change, which pre-dates covid-19 supply chain gum-ups. A planet that continues to warm (there is nothing we can do to stop the Earth’s natural climate cycles, the Earth will keep warming until it isn’t) will do more to raise the prices of crucial farm inputs like fertilizer, herbicides, feed grains and diesel fuel, than a bunch of refrigerated containers waiting for a cargo ship berth could ever do.

At minimum supply disruptions are likely to last until 2022 and there is every chance that next year’s growing season will see the same drought conditions as 2021’s, meaning no reprieve on the prices of many grocery items.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2021 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.