US Economy Has Been in an Economic Depression Since 2008

Economics / Economic Depression Oct 22, 2021 - 03:53 PM GMTBy: Nadeem_Walayat

Wait things are even worse than that! You know the US GDP growth rate we are all bombarded with to illustrate the strength or weakness of the US economy, we'll it is just as FAKE as that which vomits out of the likes of the CCP.

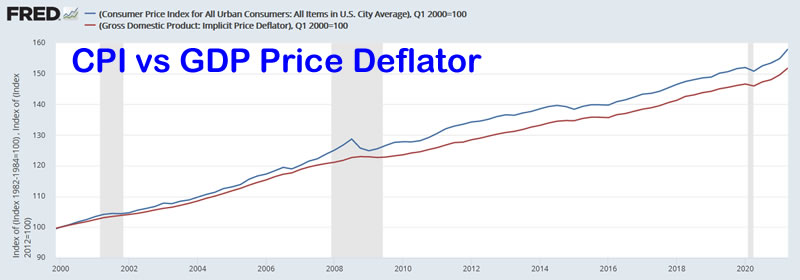

The Fed states US real GDP is currently +12% year on year . Now consider this, what inflation measure do you think the Fed is using to calculate these GDP figures? CPI? WRONG! GDP price deflator which tends to consistently under estimate inflation even against CPI as the following graph illustrates.

What's the difference? 158 divided by 151 which means that US GDP has been over reported by 4.5% since 2000.

What about against real shadow stats inflation? We'll if we used that measure than the US has been in an economic depression for the past 2 decades! What's most probable is that the truth lies somewhere between Shadow stats and CPI, at around the half way mark of US inflation currently being around 9.4%. That would still suggest that overall the US economy has stagnated since the dot com bust, with a growth rate that is about half that which has been posted and even worse performance since the Financial Crisis since which the probable real US growth rate has been ZERO!

So no wonder the Fed has been printing money on an ever escalating scale trying keep a dying economy ticking over, keeps kicking that day or reckoning can down the road for the next Fed President to deal with.

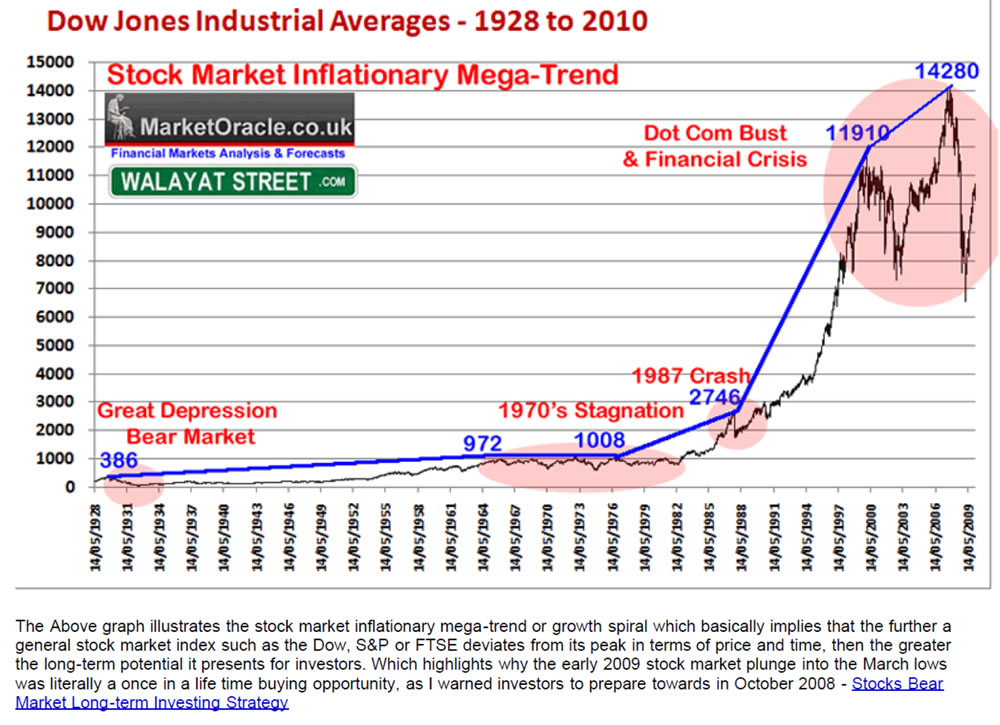

In terms of asset prices such as stocks and housing, the Fed cannot allow for any sustained drop in asset prices for it will literally bring the whole house of cards crashing down to reveal the true extent of the economic stagnation that the Fed has so far successfully masked by means of the inflation stealth tax. It's a case of printing money to infinity and beyond hence remain invested in assets that are LEVERAGED to INFLATION and why this stocks bull market will just keep chugging long until the point when the Fed loses control of the QE monster that it has created. This is why I have been banging the Inflation Mega-trend drum for OVER A DECADE! QE4-EVER, QUANTITATIVE INFLATION, because there IS NO FREE LUNCH! You cannot bail out the banking crime syndicate without paying a price and that is loss of purchasing power by means of REAL INFLATION. as illustrated by my January 2010 Inflation Mega-trend ebook (free download)

And a 12 year long mantra of buying the deviation from the high -

I have been monitoring this Inflation Train wreck for over a decade, and we are definitely heading for high inflation., How high is hard to say because it depends on the magnitude of the policy mistakes the Fed and US government and all of the other governments such as the UK will continue to make going forward as they desperately keep trying to kick the can down the road.

And you know what's funny, there are still the deflation fools out there that populate the mainstream press regurgitating their deflation thesis despite it having been wrong for DECADES! As we have always been on the path towards to real HIGH inflation! You only get deflation right at the very end when everything collapses into a debt deflationary black hole!

Which is why whilst most asset classes are likely to experience some pain over the coming years, as the Fed basically has fired most of it's bullets and so will be forced to adopt painful measures to correct the excesses (if it can), then yes asset prices can fall (temporarily), to what degree and for how long is uncertain but what is certain holding fiat currency is a going to be an even bigger loser than it has been for the past 10 years!

It's a case of trying to limit the damage done so that one can hold onto as much of ones wealth in real terms as possible.

We are in a difficult place right now, for I know stocks are over valued but I also well understand the path we are on requires us to be invested in assets that are leveraged to inflation else one is 100% guaranteed to see ones wealth destroyed as ever more desperate governments in act even more crazy MMT policies in attempts to keep the economies ticking over waiting for the AI God to emerge and save them.

So batten down the hatches folks, watch those multiples for that is where you will likely suffer the greatest investing pain i.e. 50X earnings for a 2 trillion dollar corp, that's asking for Financial PAIN!

Being investing in good stocks at or below a P/E of 20 is required to surf the Inflation mega-trend that we all ride.

At least ISA's and to a lesser extent SIPPs in the UK are tax free, but you never know governments in desperate times can do desperate things such as taxing the fake gains in asset prices courtesy of fake inflation.

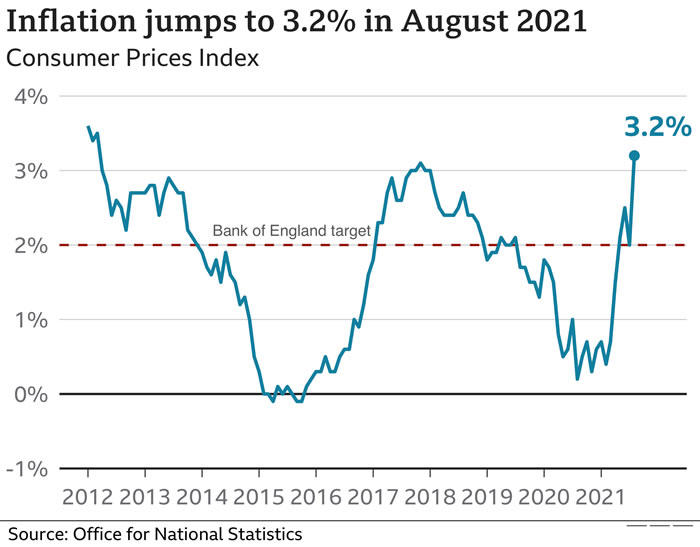

Meanwhile the UK just announced the largest jump in CPI inflation since records began (1998) all in the face of the mantra of temporary inflation that the clueless commentators state will soon fall back. INFLATION RISES ARE NEVER TEMPORARY THEY ARE CUMULATIVE AND EXPONENTIAL, HENCE THE INFLATION MEGA-TREND!

This article was an excerpt from my recent extensive analysis on the prospects for the stock market into Mid 2021 see - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent extensive analysis updating AI stocks buying levels as we head towards the window for a significant correction even a possible stock market crash.

Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

And my latest analysis Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

My analysis schedule includes:

- Silver Price Trend Analysis, AI Stocks Portfolio Update - 50% Done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your AI data preprocessing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.