The Most Exciting Medical Breakthrough Of The Decade?

Companies / BioTech Oct 19, 2021 - 03:12 PM GMTBy: OilPrice_Com

According to Google’s Health boss David Feinberg... over one billion people a day search Google for health concerns.

According to Google’s Health boss David Feinberg... over one billion people a day search Google for health concerns.

But, what if, instead... they could "consult" a phone app with the power of hundreds of doctors?

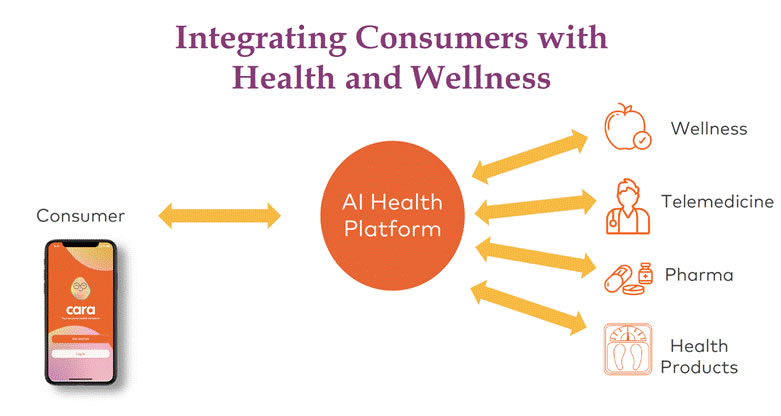

That's exactly what will be available weeks from now when Treatment.com’s (CSE: TRUE; OTC: TREIF) and their big tech platform for healthcare, deliver the breakthrough AI app Cara launches.

After five years in beta, we think that they are about to disrupt the $11.8 trillion healthcare industry.

It will be available to 300million smartphone users in USA

And that’s just for starters. Eventually, it could target the world’s 3.8 billion users.

When this happens, Treatment.com (CSE: TRUE; OTC: TREIF) - the maker of the global library of medicine driving Cara--could see an exponential boost in revenue...

TECH DISRUPTIONS CAN LIFT ALL STOCKS IN THE SECTOR: THE AI HEALTHCARE MARKET WILL SOON GROW 18X TO $120 BILLION

The AI healthcare market is growing at an astonishing rate.

It's growing at a compound annual growth rate of 41% a year, according to GrandView Research.

Some predict it will go from $6.7 billion a year to $120 billion a year in revenue by 2028 That’s 18X growth.

The smart money is moving into this sector now, chasing these potential returns.

So, how does Treatment’s Carabreakthrough AI app work?

Cara was trained by hundreds of doctors to think like a doctor to be your personalized symptom-checker, provide intelligent follow-up, and manage healthcare for your entire family.

Not only was it trained by doctors, but it’s also licensed to train doctors at the University of Minnesota’s medical school.

HOW AI IS CHANGING HEALTHCARE: CHEAPER AND INCORPORATES THE SKILL AND EXPERIENCE OF HUNDREDS OF DOCTORS

Instead of turning to Google…

Tens of millions of people are now turning to the next generation of health apps…

And those apps have been statistically proven at times to be better than actual doctors at performing correct diagnoses and providing the right medical guidance and prescriptions.

Cardiologists are now competing with IBM’s Watson Health, which has a track record of diagnosing heart disease better.

The entire healthcare sector is undergoing digitization, whether it's something as basic as patient records, as convenient as wearables or as complex as AI diagnosis. It’s redefining healthcare monumentally.

According to TechCrunch’ Kai-Fu Lee, diagnostic AI will “surpass all but the best doctors in the next 20 years”.

And studies have already demonstrated that AI trained on big enough data can outperform doctors in various elements of diagnosis--from brain tumors and skin cancer, to eye disease, breast cancer and lung cancer.

And the COVID-19 pandemic is accelerating the disruption . And even then, an April 2020 study found that an AI system managed to detect 17 out of 25 positive COVID-19 cases based on normal CT images, while professionals had failed to detect any .

This could be the biggest disruption the $11.9-trillion global healthcare industry has ever seen. And it’s just getting started.

DOCTORS IN YOUR POCKET: CARA’S BREAKTHROUGH SELF DIAGNOSIS TECHNOLOGY

Like Amazon disrupted retail...

Like Netflix disrupted everything from cable TV to Hollywood …

Treatment.com’s (CSE: TRUE; OTC: TREIF) Global Library of Medicine (GLM) Powered Cara app is looking to disrupt symptom diagnosis and healthcare management.

How? By empowering consumers to take control of their healthcare in an increasingly dysfunctional system that is impossible to navigate and wildly unaffordable.

For the past 5 years, Cara's tech team has been harnessing the power of AI...

To develop a more accurate smartphone AI engine.

Why?

The biggest opportunity in an AI healthcare sector that hit $120 billion in 2020 and some predict will hit an unbelievable $4 billion by 2025 is going "direct to consumer".

Currently, people try to self-diagnose online… But soon that will change.

Treatment’s Mobile application with Cara Digital Health Assistant provides users with tailored assessments and recommendations from personal medical history, wearable data and individual tracking data.

It also provides intelligent, AI-powered follow-ups--just like a doctor. It integrates intelligent tracking and monitoring into a single app to support health and illness prevention.

And it seeks to become the most accurate health data on the market -- this AI has been trained by a global team of doctors, engineers and mathematicians to continually learn--until all ~10,000 diseases known to man is part of Cara’s intelligence portfolio.

It's been so successful that it's now being licensed by universities to train doctors.

And now, by the end of October, this same technology -- the Cara Health App -- will launch in the public ...

Giving you the power of a huge number of doctors in your smartphone.

A first or second opinion is only a tap away.

And with each tap, Treatment.com (CSE: TRUE; OTC: TREIF) the maker of Cara--could see a boost in revenue.

The market is limitless…

A POTENTIAL AUDIENCE OF 3.8 BILLION SMARTPHONE USERS

The direct-to-consumer phone app model is one of the most profitable in history...

And first-movers in new categories become tomorrow’s big stock winners.

WebMD isn’t a publicly traded company, and it’s valued at $2.8 billion--without any intelligent AI or healthcare management aspect at all.

Babylon Health is valued at $4.2 billion now and is gearing up to go public.

But Cara is a breakthrough.

It's the next gen app and could become worth more than the others in the industry.

Why?

Considering the estimated one billion Google searches a day for health concerns... Cara only needs a 1% market penetration... To gain 10 million new users.

10 million users could turn this small company into a multi-billion-dollar household name.

In time, Treatment.com (CSE: TRUE; OTC: TREIF) could grow much more because it has first-mover advantage with North American Heritage, unlike a number of competitors

It’s already clear that the multi-trillion-dollar healthcare industry is being thoroughly disrupted by AI …

AI in the healthcare industry will grow by multiples more … from $6.7 billion to over $194 billion by 2030...

With a direct-to-consumer model …

That links the consumer up with wellness, telemedicine, pharma and health products for multiple revenue generators, plus collects a goldmine of data that could ping major industry radar …

The Treatment Mobile, Cara app could become as big as any of its 3 competitors... even bigger.

If it does, it could turn this small $371-million market cap company into a multi-billion-dollar household name.

The time to get in is now… before it launches. And we’re just weeks away from that.

By. Joao Piexe

** IMPORTANT NOTICE AND DISCLAIMER -- PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. This article is a paid advertisement. Advanced Media Solutions Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Treatment.com International, Inc. Inc. (“Treatment.com” or “Company”) to conduct investor awareness advertising and marketing. Treatment.com paid the Publisher to produce and disseminate six articles profiling the Company at a rate of seventy-five thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Treatment.com) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares and / or options of the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include, but are not limited to, the size and anticipated growth of the market for the company’s products, the anticipated growth of the market for AI-assisted products generally, the anticipated growth of the market for app-based products generally, the anticipated launch date for the company’s products, the anticipated growth of the market for health care app-based products generally, the anticipated launch date for the company’s products, and the anticipated growth and expansion of the medical library to which the company’s products have access. Factors that could cause results to differ include, but are not limited to, the companies’ ability to fund its capital requirements in the near term and long term, the management team’s ability to effectively execute its strategy, the degree of success of the AI technology used in the company’s products, the company’s ability to effectively market the company’s products to customers within its three anticipated revenue streams, supply chain constraints, pricing pressures, etc. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/Terms-of-Use. If you do not agree to the Terms of Use http://oilprice.com/Terms-of-Use, please contact Advanced Media Solutions Ltd. to discontinue receiving future communications.

INTELLECTUAL PROPERTY. oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.