BioDelivery Sciences International - BDSI - High RIsk Biotech Stocks Buy, Sell, Hold Investing Analysis for the Long-run

Companies / BioTech Sep 30, 2021 - 08:58 PM GMTBy: Nadeem_Walayat

Five more biotech stocks to add to the strategy of invest and forget for a potential X10 return. a reminder of why I am engaging in this binge on biotech stocks after having been focused on AI stocks for the past 5 years.

1. Biotech stocks are an unloved stocks sector whilst tech stocks over valued, even the ultra safe stocks such as the Top 10, so I am reluctant to add at current valuations hence why I hit the SELL button for the first time in many years and reduced my exposure to AI stocks by about 40%.

2. That biotech is a derivative of AI, we'll most sectors will soon become a derivative of AI because it is the PRIMARY tech megatrend of our age that will continue to broaden its reach to encompass all sectors of the economy.

3. That one of my former biotech 12xers got taken over (GW Pharma) that flooded my account with cash early May and so that focused my attention on repopulating my portfolio with 10 more biotech stocks where I expect at least 3 to 10x, with most of the rest expected to survive to varying extent. Though this is the stock market and so there are never any guarantees especially where such smallish cap stocks are concerned.

4. Our beloved AI stocks have been BID UP to high valuations, yes including Google, so they are not CHEAP, even after a 10% to 15% correction i.e. the likes of Microsoft and Amazon are discounting a lot of future earnings growth! Of course that does not necessarily mean that they are about to fall to what I would consider to be fair value let lone cheap levels as they did during March 2020 because at the end of the day they are GOOD stocks so usually command a healthy premium to invest in unless there is a market panic that marks everything lower regardless.

I had planned to have completed and posted this analysis shortly after my last biotech stocks analysis (Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond!), but focus shifted to crypto's on how to capitalise on the crypto bear market by investing in a select portfolio of crypto's at various buying levels, that and expectation of a correction would lower the price of these biotech stocks, which has happened even if the general market has held steady.

Analysis Contents

- RISK RATINGS

- HIGH RISK STOCK BUYING LEVELS

- Blueprint Medicines - BPMC - $84.5 - Risk 3

- Cara Therapeutics - CARA - $11.94 - Risk 5

- Takeda - TAK - $16.86 - Risk 1

- BioDelivery Sciences International - BDSI - $3.65 - Risk 8

- Axxxxxxxxxxx - Axxx -- Risk 10

- High Risk Stocks Portfolio Buying Levels

- Netflix - FAANG a Buy, Sell or Hold?

- Trending towards Hyperinflation!

- Delta Variant!

- Solar CME MULTIPLE Black Swans

DISCLAIMER - Investing in Smallish cap stocks is VERY HIGH RISK. The analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any investing or trading activities

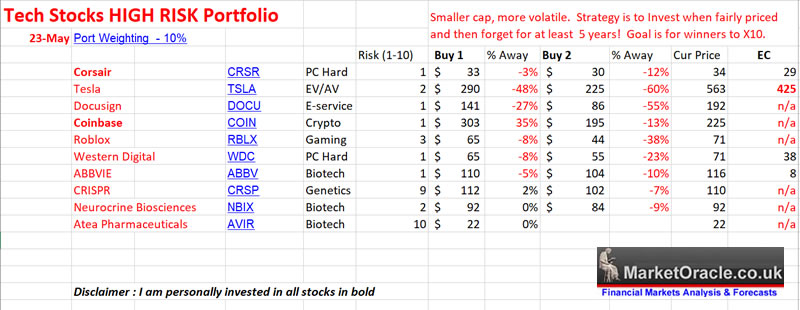

Firstly here's a reminder of the small cap bio-tech stocks state of play as per my last analysis of which I now personally hold positions in ALL 4 of the biotech stocks mentioned i.e. ABBV, CRSP, NBX, AVR, all of which are trending in the right direction. Though of course I am focused on many multiples towards 10x many years down the road.

RISK RATINGS

A rating of 1 is the lowest risk and 10 highest risk in terms of something going wrong and the stock effectively crashes and burns into becoming a penny stock or even going bust within the next 5 years! This is based on the sum of all my analysis of each stock and given my risk averse nature then most of the stocks will tend to have a low probability of actually going bust within the next 5 years. Still this rating gives an extra measure of risk vs reward when entertaining potential position sizes.

HIGH RISK STOCK BUYING LEVELS

As is the case with the main AI stocks portfolio I will be listing buying levels which are high probability levels that could be achieved during a correction. What I tend to do is put a price alert at the buying level so if triggered I can decide whether to buy, this means I don't need to waste time monitoring any of my stocks for if they fall I will get an alert, and all I need to do is update the buying levels every so often in response to price action. Of course one can also put in selling level alerts if one is looking to cash out or reduce exposure.

However, for high risk stocks I will be listing 2 buying levels, a near buying level and a more distant buying level. The reason being that I may be more inclined to buy some high risk stocks than others, so if I really want to invest in stock x then I would put the price alert at the near buying level, whilst if I am only interested at much lower prices i.e. as the case with Tesla trades, then I would set the alert to act on the more distant price alert level, of course one can set both price alerts and then make up ones mind at the time they are triggered,

Also I will be include the biotech sector IBB ETF to compare each stocks trend against.

BioDelivery Sciences International

- BDSI - $3.65 - Risk 8

BDSI is another hated small cap ($361mln) biotech stock trading on a sub 15 PE (14.86), with forward PE dropping to 12, focused on developing pain management solutions. The company’s portfolio consists of Belbuca and Symproic (opioid induced constipation). Opioid! Hmm, that may explain the suppressed stock price down from a 2014 high of $18. ROIC is a healthy 36% (31st March), and so is the net margin of 16% with both revenue and earnings trending in the right direction for the past 3 years. Financials appear fine, what am I missing? Okay I see a lot of share dilution over the past 3 years of 5% (2020), 35% and 28%. That's a lot of shares being printed, no wonder the stock price is lower! Also the company has a lot of debt but also a lot more cash $116mln to $75mln (debt). Strong earnings growth vs shares dilution vs high debt vs cash surplus makes this a stock that's unlikely to imminently take off.

The stock price had been trending higher, even beating the IBB up until the end of 2020, so what happened in January to send the stock price into a tailspin? A lot of litigation both from and against. Something is weird about this stock it should be trading higher, they even bought back about $6 mln of shares earlier this year. For some reason this stock is very hated! Short interest? It must be uncertainty surrounding it's litigation concerning 3 of it's patents. This is a tough stock, it is cheap for litigation reasons if resolved in the companies favour then surely should send the stock price to new highs. Whilst downside risk appears limited to about $3. Strategy here could be to invest for a year then if it is still dead basically going nowhere then look to exit with a $5 limit order for a small profit. As there is a risk one could be stuck in a stock that for whatever reason fails to budge out of a trading a range. Anyway the price is near the lows, so downside risk is limited, with the price trending higher 1st Buy is now at $3.65, 2nd buy is at $3.35. So this stock is a case of invest when cheap and give it a year or so to prove itself, if it fails to perform then get out with a small profit.

The rest of this extensive analysis focused on finding value in unloved biotech stocks with the potential to X10 over the next 5 years has first been made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Chasing Value with Five More Biotech Stocks for the Long-run

Contents

- RISK RATINGS

- HIGH RISK STOCK BUYING LEVELS\

- Blueprint Medicines - BPMC - $84.5 - Risk 3

- Cara Therapeutics - CARA - $11.94 - Risk 5

- Txxxxxxxxxx - Txx - - Risk 1

- Bxxxxxxxxxxxxx- Bxxx - Risk 8

- Axxxxxxxxxxx - Axxx -- Risk 10

- High Risk Stocks Portfolio Buying Levels

- Netflix - FAANG a Buy, Sell or Hold?

- Trending towards Hyperinflation!

- Delta Variant!

- Solar CME MULTIPLE Black Swans

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent extensive analysis updating AI stocks buying levels as we head towards the window for a significant correction even a possible stock market crash.

Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

My analysis schedule includes:

- Silver Price Trend Analysis, AI Stocks Portfolio Update - 50% Done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your calm as a cumcumber 1/3rd full petrol tank analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.