Gold Market Dis-Information Specialists Ply Their Trade

Commodities / Market Manipulation Oct 23, 2008 - 03:55 PM GMTBy: Rob_Kirby

Tim Gardiner, president and CEO, Mitsui & Co. Precious Metals Inc. appeared on Canada's Business News Network [BNN] and – in a ridiculous attempt to explain the recent demolishing of the gold price - made the claim that demand for gold was down and, “the only reason for physical shortages of gold products at retail was ‘logistical' and due to a shortage of ‘blanks' from which the coins are stamped”.

Tim Gardiner, president and CEO, Mitsui & Co. Precious Metals Inc. appeared on Canada's Business News Network [BNN] and – in a ridiculous attempt to explain the recent demolishing of the gold price - made the claim that demand for gold was down and, “the only reason for physical shortages of gold products at retail was ‘logistical' and due to a shortage of ‘blanks' from which the coins are stamped”.

Shamefully, Canada 's BNN seems to endorse the position taken by Mr. Gardiner – seeing as how they have failed to do basic fact-checking and posted this synopsis of Mr. Gardiner's appearance/analysis on their web site :

Thursday, October 23, 2008 – 8:35 a.m. time slot:

Indian festival and wedding season is just around the corner. But demand for gold is down, as brides are running towards fake gold jewellery instead. BNN talks about this industry angle with Tim Gardiner, president and CEO, Mitsui & Co. Precious Metals Inc.

Guest: Tim Gardiner, president, Mitsui Global Precious Metals

Well, here's a dose of reality folks: In a conversation I had with one of Canada 's largest physical, retail bullion dealers last Friday – here's a summary of what he told me:

- As a long time and valued customer of the Royal Canadian Mint, he has been told that the Mint is not accepting ANY orders for gold or silver coin for at least 3 months – and no guarantees then either.

Gold:

- There are zero one ounce gold bars in North America at wholesale – period.

- Same thing for 10 oz gold bars.

- Some kilo gold bars are available at wholesale but in highly limited supply at prices start at 5 % over spot [COMEX price].

- He is currently receiving a couple of hundred calls per day for small gold [one ounce denominations] and has no product to sell.

Silver:

- He told me there are ZERO one thousand ounce bars available at wholesale in the U.S.A and `supply of the same in Canada is HIGHLY limited.

- He laughed when I mentioned that there was supply at COMEX and he told me COMEX was a JOKE. He told me he doesn't price silver using COMEX [silver futures prices] any more – he looks at prices being paid on E-Bay instead.

- He is currently getting 50 calls a day for silver and has no product to sell.

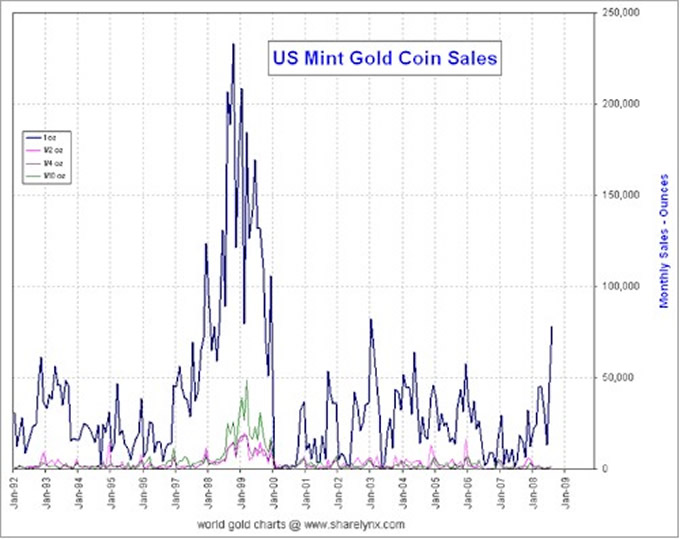

Perhaps Mr. Gardiner, or BNN, could explain to us all just how the U.S. mint was able to ‘source' the blanks required to satisfy investor demand for gold coins back in the pre-millennium days of 1999 but are now un-able to satisfy roughly 1/3 rd of their prior, demonstrable peak output?

The shortages of physical precious metal we are currently experiencing are reflective of a well documented fraud – long maintained by the GOLD ANTI TRUST ACTION COMMITTEE [www.gata.org]. GATA has been documenting this long-in-the-tooth price rigging of precious metals prices – largely through the thoroughly corrupt COMEX futures exchange in N.Y. – for approximately a decade.

As for Mr. Gardiner, he is either naïve, misinformed or talking his book as evidenced by Mitsui's owning one of the largest short gold positions on TOCOM [Tokyo Commodities Exchange] which everyone can see here .

Demand for physical precious metal is welling up, with significant and growing premiums being paid for physical metal, due to smart money migrating into the tangible space before it is widely understood by the general investing public the true extent of mismanagement and malfeasance at the highest levels of our existing monetary order. This is the REAL story that BNN has not reported.

In recent days, anecdotal accounts are beginning to surface that “major off-market transactions” are occurring at much, much higher prices. One such account rumored earlier this week was that a major trade in the physical market occurred between two non-U.S. players at a price equivalent of $ 1,075 per ounce. Perhaps more interestingly, the deal apparently was settled in EUR not DOLLARS .

It is a fact that a great deal of what ails our global economic sense of being is our current “un-backed” fiat monetary system which has been ABUSED by Central Bankers through unbridled credit creation and money printing. In light of what has occurred – precious metals in general and GOLD in particular is now reasserting its historic role as a “go to” wealth preservative.

To counter act and remedy their own largess; it is Central Banks and their proxies that have ruthlessly ENGINEERED the harsh credit crunch we are currently experiencing and merciless, coordinated price-take-downs in strategic commodities, including gold, utilizing futures markets - in vain hopes of re-instilling confidence in their now failing paper money system. For anyone who suggests that these claims are false on the basis that gold is not money; just ask them why it is that EVERY Central Bank on the planet lists gold bullion on their balance sheet as an “ OFFICIAL RESERVE ASSET ”?

Just make sure you remember the long drawn-out blank stare you receive in return.

From where I sit, both Mr. Gardiner and Canada 's BNN might want to “brush up” on the facts or quit talking their books if they want to be accepted as serious purveyors of honest, reliable, relevant business news.

Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2008 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.