Credit Spreads Declined Unprecedentedly. Will Gold Follow?

Commodities / Gold and Silver 2021 Jul 01, 2021 - 07:18 PM GMTBy: Arkadiusz_Sieron

When credit spreads narrow, it’s bad for gold. But this time there is a silver lining we can look for, although it’s quite adverse for the economy.

When credit spreads narrow, it’s bad for gold. But this time there is a silver lining we can look for, although it’s quite adverse for the economy.

There are several important factors affecting gold prices. Many analysts focus mainly on the US dollar and real interest rates . However, what is sometimes even more important is economic confidence. Of course, the level of economic confidence is partially reflected in the strength of the greenback and the bond yields . However, I would like to focus today on credit spreads , an often overlooked indicator of economic confidence.

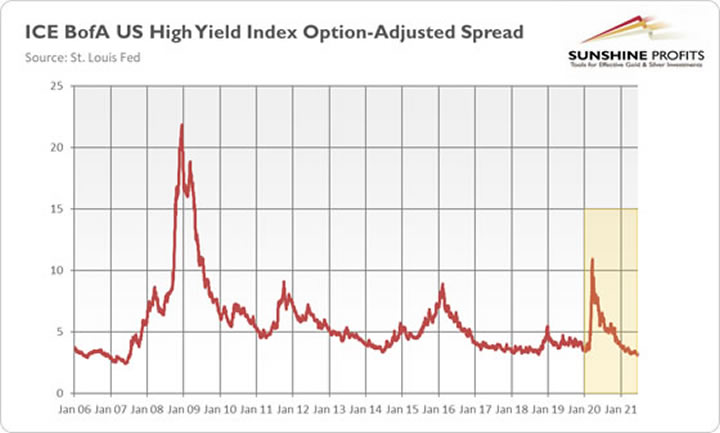

Why such a topic? It’s simple, just take a look at the chart below. As you can see, the ICE BofA US High Yield Index Option-Adjusted Spread, which is a proxy for a spread between the yield on below-investment-grade-rated corporate debt and Treasuries of the same duration, has recently declined to a very low level. To be more precise, the analyzed indicator slid from almost 11 in March 2020 to 3.1 at the end of June (the lowest reading since July 2007 , the time just before the Great Recession started).

Implications for Gold

OK, great, but what does this mean for the gold market? Well, this is a negative development for gold prices, but with a silver lining . Let me explain. When credit spreads are narrow or in a narrowing trend, it means that economic confidence is high or in a rising trend. In such an environment, risk appetite is strong and demand for safe-haven assets such as gold is low. The fact that credit spreads have reached their multi-decade lows indicates that the economic expansion is doing well. If the boom continues, the Fed will eventually normalize its monetary policy a bit, and the interest rates will increase. Additionally, US banks have cleared the Fed’s recent stress tests, which means that they will no longer face restrictions on how much they can spend buying back stock and paying dividends. This change might strengthen the financial sector, additionally boosting economic confidence among investors. And this is all bad for the yellow metal.

However, we can look at very low credit spreads from the other side. After all, they have already decreased profoundly and further significant declines are not very likely. Furthermore, the last time they were so narrow was mid-2007, i.e., just a couple of months before the outbreak of the global financial crisis .

Hence, it might be the calm before the storm . The economic crisis , by definition, occurs when confidence is high and almost nobody expects any problems. A related issue here is whether the markets are properly assessing the risk. The low risk premium partially results from the low Treasury yields, which push investors who seek profits into riskier securities.

Some analysts point out the risks related to the surge in the public debt or inflation . For example, David Goldman notes that the rising gap between prices paid by the producers and prices received by customers ( June Philadelphia Manufacturing Business Outlook Survey ) could depress output in the future, as companies wouldn’t be able to maintain profit margins in such an environment.

The bottom line is that the US economy has recovered and the economic expansion continues undisturbed. Given this trend and high economic confidence, despite the soaring prices and indebtedness, gold may struggle for some time .

However, credit spreads may widen abruptly when the next crisis hit, as they did in the aftermath of the collapse of the Lehman Brothers . In other words, although the economic confidence is strong, some important downside risks for the US economy are still present, and they could materialize later in the future . Perhaps investors know this – according to the WGC , we saw inflows to the gold ETFs last week, despite the plunge in gold prices. It shows that investors could have been taking advantage of lower prices to buy gold as a portfolio diversifier and protection against tail risks .

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.