Gold Time for Consolidation and Lower Volatility

Commodities / Gold and Silver 2021 Jun 14, 2021 - 04:13 PM GMTBy: Jordan_Roy_Byrne

Gold endured a 20% correction over eight months. A 15% rebound followed that in two months. It has retraced some, but not a majority of the losses.

This action is all part of the handle of a super bullish cup and handle pattern.

The handle itself is part of a much larger bullish consolidation, but the market is approaching resistance within the handle.

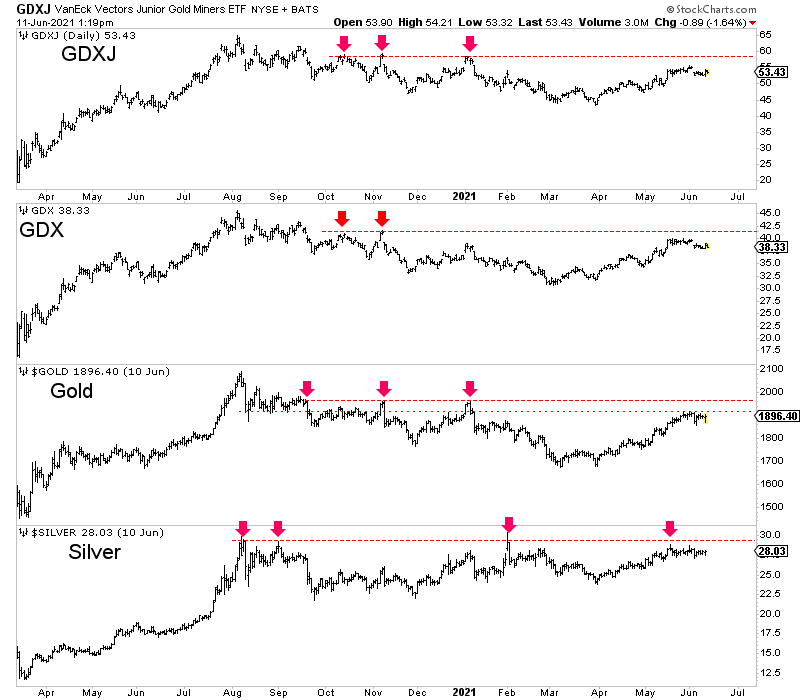

Below we plot GDXJ, GDX, Gold, and Silver.

As you can see, Gold has been contained by $1900 while Silver has yet to break above resistance at $28.50. It’s possible Gold could push up to resistance at $1920 or even $1950, which would align with the miners testing resistance from Q4 2020.

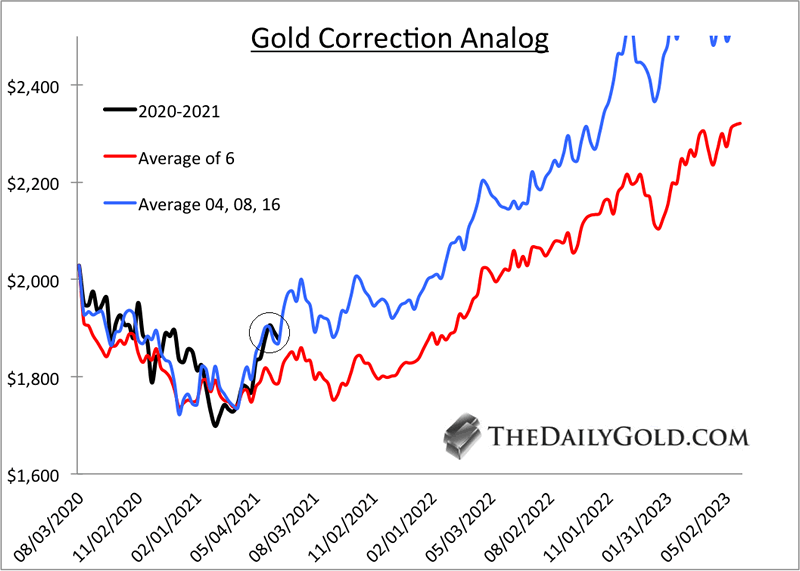

During a bull market, sustained corrections in Gold typically end in bullish consolidations. In other words, there is the initial decline, a rebound, and then consolidation.

In the chart below, we plot the average of six historical bull market corrections in Gold along with the average of the three corrections that could be most comparable to today.

Gold has not tracked any individual correction closely but has mirrored both averages, which now argue for a bullish consolidation into year-end.

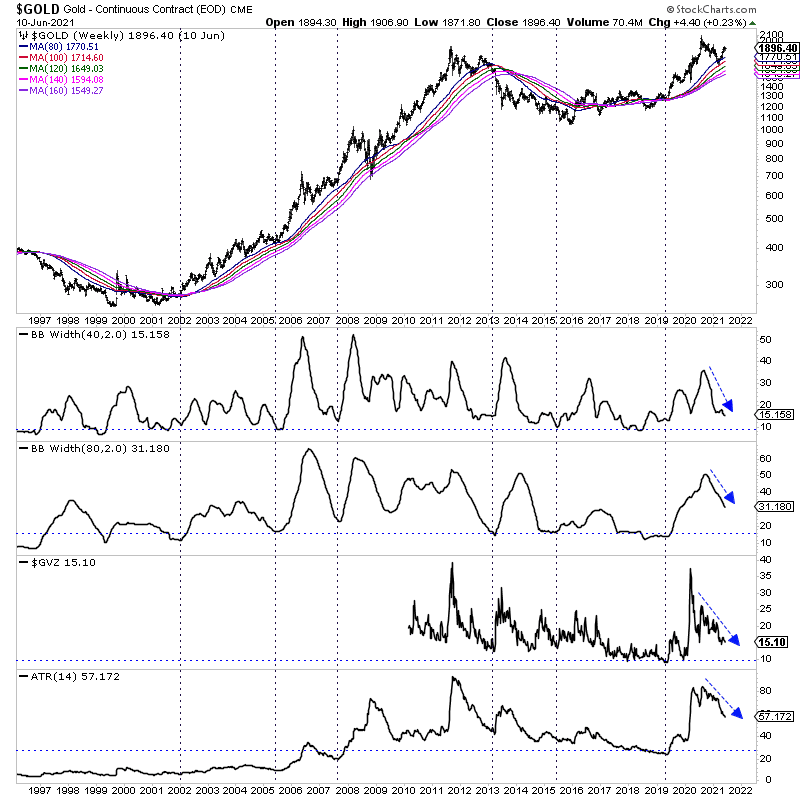

Consolidation and time can lead to declining and lower volatility, which is a necessary condition that facilitates big, impulsive moves.

We plot Gold below and several different indicators, including the Gold Vix (GVX) and Average True Range (ATR). The vertical lines show points from which Gold made big moves.

These indicators are declining, and I expect they will bottom out around the end of this year to early 2022.

The second half of the year could be the setup for the next leg higher in precious metals, which I anticipate could be one for the history books. There is time to prepare your portfolio, but some quality juniors have already started to move.

I’ve positioned myself in companies with the best combination of upside potential and fundamental quality. These are companies you can buy and hold for a few years that have the potential to be 5,7, and 10 baggers after Gold breaks past $2,100/oz.

In our premium service, we continue to identify and accumulate those quality juniors with considerable upside potential over the next 24 months.

To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.