Is Gold Really an Inflation Hedge?

Commodities / Gold and Silver 2021 Jun 14, 2021 - 03:55 PM GMTBy: Arkadiusz_Sieron

Inflation is back, and that’s usually depicted as good for gold. But is the yellow metal still a hedge against inflation, or has something changed?

Inflation is back, and that’s usually depicted as good for gold. But is the yellow metal still a hedge against inflation, or has something changed?

Inflation has returned. This is partly understandable. After all, during the Covid recession , consumers and businesses accumulated a lot of cash as their spending was reduced, while revenues were sustained by money transfers from the government. These funds are now entering the economy, which makes demand grow much faster than supply, thus boosting prices. After some time, supply may catch up, curbing inflation. However, there is an important risk that inflation will turn out to be higher and/or more permanent than many analysts believe.

From the fundamental point of view, gold should benefit from higher inflation. But why? In theory, there are several channels by which inflation supports the yellow metal. First, the inflationary increase in the money supply makes all goods and services more expensive, including gold. Indeed, the scientific paper by Lucey and others finds a reliable long-run relationship between gold and the US money supply.

Second, gold is a real, tangible and rare good with limited supply that cannot be increased quickly or at will. These features make gold a key element during the so-called flight into real values or into hard assets, which happens when inflation gets out of control. In other words, gold is the ultimate store of value which proved to hold its worth over time , unlike paper currencies that are subject to inflation and lose their value systematically.

Third, inflation means the loss of purchasing power of the currency, so when the greenback depreciates quicker than its major peers, the dollar-denominated price of gold increases. Fourth, when inflation is unexpected or when the Fed remains behind the curve and doesn’t hike nominal interest rates , real interest rates decline, supporting gold prices.

Fifth, high inflation increases economic uncertainty, which increases safe-haven demand for gold . In other words, an outbreak of inflation introduces some turbulences and leads to portfolio rebalancing, thus increasing gold’s appeal as a portfolio diversifier . During inflation, bonds underperform, so gold’s attractiveness increases.

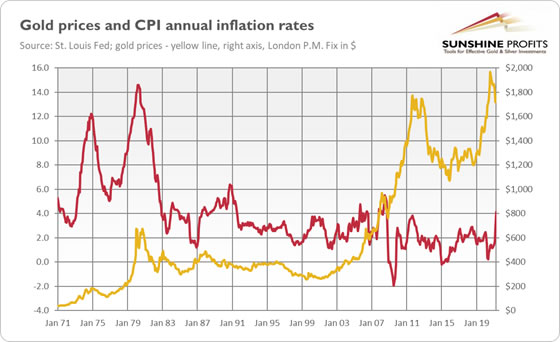

And last but definitely not least, gold is perceived as an inflation hedge . But is it really a good hedge against inflation? I analyzed this issue a few years ago – it would be nice to provide an update in light of more recent developments. So, let’s take a look at the chart below, which shows gold prices and CPI annual inflation rates.

As one can see, the relationship between these two series is far from being perfect. Actually, the correlation coefficient is significantly below zero (-0.41), which means that the correlation is negative ! It means that although there are certain long-term trends – for example, gold rallied during stagflation in the 1970s and entered a bear market during the disinflation period in the 1980s and 1990s – there is no positive relationship between the CPI annual percentage change and the price of gold on a monthly basis.

In other words, the data shows that gold may serve as an inflation hedge only in the long run , as gold indeed preserves its value over a long time (for example, in the period from 1895 to 1999, the real price of gold increased on average by 0.3% per year). It is a good choice for investors also when there is relatively high and accelerating inflation, usually accompanied by fears about the current state of the U.S. dollar and a lack of confidence in the Fed and the global monetary system based on fiat monies .

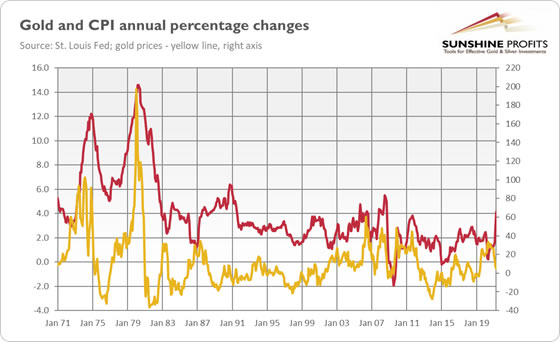

However, let’s not draw conclusions too hastily. The chart below also presents the CPI and gold – but this time both series are year-on-year percentage changes (previously we had gold prices, now we have annual percentage changes in these prices).

Have you noticed something? Yup, this time both series behave much more similarly . Indeed, the correlation coefficient is now positive (0.44). Hence, there is a positive relationship between gold and inflation although not always seen in absolute prices (but in changes in these prices), and not always seen in the CPI (as inflation has broader effects not limited only to consumer prices).

Summing up the above analysis, it seems justified to claim that gold could benefit from the current elevated levels of inflation, especially if it turns out to be more lasting than commonly believed. It will also be good for gold if the Fed remains dovish and tolerant of inflation surpassing its target significantly.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.