Top 5 AI Tech Stocks Trend Analysis, Buying Levels, Ratings and Valuations

Companies / AI Jun 10, 2021 - 11:37 AM GMTBy: Nadeem_Walayat

This is part 2 of my recent extensive analysis focused on updated buying levels for my AI tech stocks portfolio going into the summer stock market correction, of what I will be looking to accumulate at what levels. Part 1 covered Tesla, ARk Funds and more - TESLA! Cathy Wood ARK Funds Bubble BURSTS!

Whilst the whole of this extensive analysis AI Stock Buying Levels, Ratings, Valuations and Trend Analysis into Market Correction was first been made available to Patrons who support my work.

Contents:

- TESLA

- Cathy Wood ARK Funds CRASH!

- India Apocalypse Heralds Catastrophe for Pakistan and Bangladesh

- Covid-19 in Italy in August 2019!

- Stock Market Early Summer Correction Trend Forecast

- Stocks Expensive or Cheap Indicator (EC)

- AI Stock Buy % Rating Review

- 1. GOOGLE - $2398

- 2. AMAZON - $3312

- 3. MICROSOFT - $252.5

- 4. APPLE - $130

- 5. FACEBOOK - $320

- 6. NVIDIA - $592.5

- 7. AMD - $78.8

- 11. IBM - $145.5

- 12. INTEL - $57.7

- AI Stocks Buying Levels Update May 2021

- So what am I going to do

- GPU Mining FREE MONEY!

- CHIA Crypto Farming with Your Hard Drives Insanity!

With the remaining Part 3 of 3 to follow in a few days time. However for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my most recent analysis: Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond!

- Invest and Forget

- Stock Market Early Summer Correction Review

- AI Stocks Strength vs Weakness

- RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

- HIGH RISK STOCK BUYING LEVELS

- RISK RATINGS

- WESTERN DIGITAL - WDC $71 - CHIA! - Risk 1

- Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

- Biotech stock 1 - Cheap Low Risk Pharma - Risk 1

- Biotech stock 2 - HIGH RISK GENE EDITING - Risk 9

- Biotech stock 3 - Low Risk 2

- Biotech stock 4 - X10 for Max Risk 10

- High Risk Stocks Portfolio Buying Levels

- Covid India Black Mold Epidemic

- Bitcoin and Raven Coin Buying Levels

With my next imminent analysis focused on accumulating during the crypto bear market of 2021.

DISCLAIMER - The analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any investing or trading activities

Firstly What are Buying Levels?

Buying levels are high probability technical levels that a stock 'could' trade down to during a correction i.e. an achievable technical chart level that could be used to for instance to put in buy limit orders at just above the buying level if one is eager to accumulate more stock into any particular company as an example last September the Buying Level for Google (Alphabet) was $1395, so a limit order at $1395 or higher would be the objective depending on how eager one is to gain exposure to Google i.e. If I really wanted to buy more Google at the time then the limit order would be OVER $1400 as stocks tend to find support at round numbers, whilst if I was less inclined to buy Google then the Buying level would be at $1395, lower than that and there is a decreasing probability that a buy will be triggered.

Stocks Expensive or Cheap Indicator (EC)

This basically condenses down some 12 financial indicators I track for most stocks to determine if they are expensive or cheap (EC), as stock prices are usually not a good indicator of value.

At it's most basic the higher the number the more expensive a stock is and conversely the lower the number the cheaper a stock is. Where a reading of 20-60 tends to be the sweet spot for most AI stocks as it implies earnings growth coupled with sustainable speculative interest and thus results in good trending charts with support during corrections, where value tends to be fair so as to enable one to accumulate stock.

Whilst readings above 60 increasingly indicate high levels of speculative interest in future earnings growth. However, this does not automatically mean that a stock trading over 60 should not be bought or sold, it just means that there is a lot of speculative interest in that stock so expect greater price volatility as investors are more likely to react to news events. So I would still invest in a stocks trading over 60 if they have a good reason to justify such speculative interest i.e. such as AMD and Nvidia as being higher risk stocks. Or Amazon of a say 6 months ago that was set to greatly profit from covid-19 lockdown's.

Over 100 is where stocks are becoming a bit to hot to handle where holding let alone buying depends on understanding what's in the pipeline, what it is driving the stocks into the stratospheric valuations such as AMD first killing Intel and now giving Nvidia a run for it's money. Whilst there will be some such as Amazon, I can't quite fathom the high valuation hence reduce my exposure to.

Whilst readings Under 20 suggests little speculative interest to drive stock prices significantly higher, so likely to expect trading ranges and thus tend to be sleeping giants in the AI mega-trend. Also could be signaling problems with the stocks i.e. such as Intel losing the CPU war to AMD which has has made Intel a disliked stock to hold whilst AMD has been heavily bid up into fever making it an expensive buy.

Buy % Rating

The the Buy percent indictor is how good of a buy a stock is right now which is based on valuations and short-term stock trends. So 100% means a VERY GOOD BUY, whilst 0% means a bad buy with 50% neutral. Note this is in terms of BUYING and NOT SELLING! So understand 0% is NOT a SELL rating, it just means that it's a good time to buy a particular stock in terms of price trend and valuation right now at the time of analysis.

AI Stock Buy % Rating Review

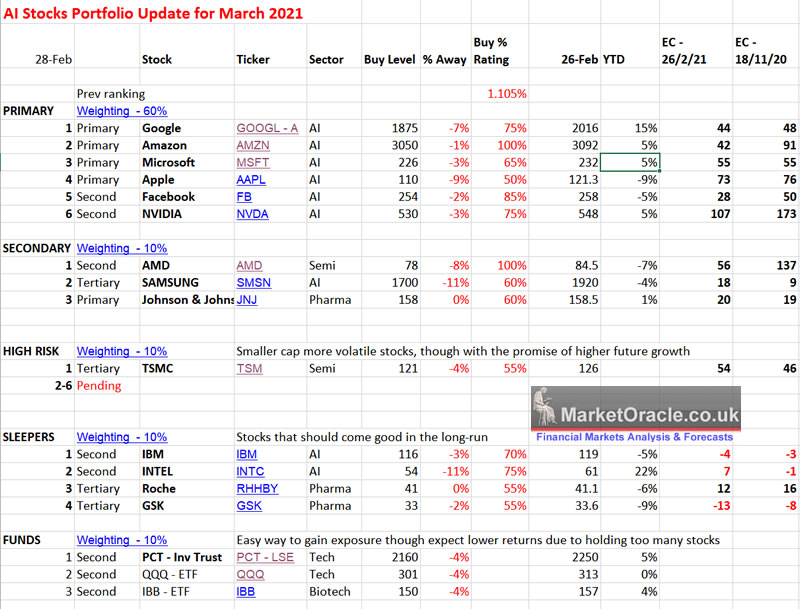

Here's a quick review of my last update of 28th Feb 2021 that incorporated the new short-term Buy % indicator.

AI Tech Stocks Buying Ratings, Levels and Valuations March 2021

So how did the buy % rating perform compared to what has subsequently transpired ?

100% Amazon $3312 vs $3092 +7.5%

100% AMD $78.8 vs $78 +1%

85% Facebook $319.8 vs $254 +26%

75% Google $2398 vs $2016 +19%

75% Intel $57.5 vs $61 - 5.5%

75% NVIDIA $592 vs $548 +8%

70% IBM $145.5 vs $119 +22%

65% Microsoft $252.5 vs $226 +11.7%

Overall the Buy % proved useful in identifying stocks that had a high probability for trending higher and thus to not risk waiting for lower prices before buying.

TOP AI Mega-trend Stocks Analysis

1. GOOGLE - $2398

Google has had a spectacular bull run to stand up 34% year to date! In terms of valuations Google's stock price is running a little ahead of itself on an EC of 49 against 44 in February. I consider a sweet buying spot for Google when EC is below 40 which would imply a fair price for Google around 2000. So Google is over priced at $2400, in terms of current earnings. In terms of a Buy %, Google is neutral on 50%.

(Charts courtesy of stockcharts.com)

The stock is overbought and likely to correct into the range of $2000 to $2100, i.e. fair value and support area. Therefore the buying level for Google is $2100 or about a 13% discount on it's current price. So again, I am NOT going to Sell Google stock to try and buy back at $2100. Because there is the risk that a correction does not materialise for Google and even if it does it will prove TEMPORARY, so why risk getting ones knickers in a twist for a marginal few percent against the risk of missing out on several hundreds of percent in long run by riding the Google gravy train

2. AMAZON - $3312

Amazons stock price is up 7.5% on my last update when I considered it fair value, though now it looking a little pricey with it's EC rising to 66, so I cannot see how Amazon can have much upside in the immediate future. Not a good buy at current levels so the Buy % is 35%.

Clearly Amazon is in a trading range pending a breakout higher, though I don't see how that breakout can happen right now, so the most probably destination is for Amazon to trade down towards the bottom end of the trading range of around $3000, a 10% drop which would make Amazon a much more attractive price to accumulate Amazon at just as was the case in February. Thus the Buying level for Amazon is $3020, with the price expect to spike down as low as $2900. Looking at the past, then it's possible that Amazon could spend the remainder of 2021 stuck in this trading range waiting for earnings to play catchup.

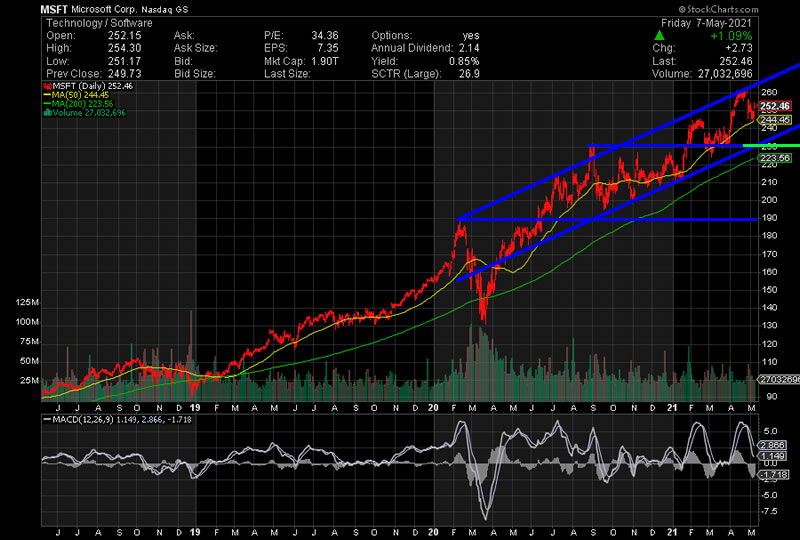

3. MICROSOFT - $252.5

Microsoft is up 12% since my last update, and is now over priced on an EC of 70, against fair value of 55. Unless I am missing something, the stock needs to consolidate it's powerful advance before considering going higher as it is not healthy for a stock to keep becoming more expensive. Maybe it's the 2.1% dividend yield that's attracting investors? But on an EC of 70 it is a little expensive for my taste. Not a good buy at current levels so the Buy % is 35%.

Downside during any correction appears limited to $230. Below which are a series of previous highs from 224 to 227. So there is heavy support under Microsoft. It's difficult to see Microsoft trading much lower than that. Therefore a probable buying level for MSFT is $230.

4. APPLE - $130

I have been bearish on the prospects for Apple to go higher since last November and so far Apple has lived upto my expectations, and it's the first big stock on my list to be down on the year. Apple is trading on an an EC of 81 that is even higher than the 76 of last November. So despite the stock having gone nowhere for the pasty 8 months, I can't see what's going to propel it higher in the near future. Not a good buy at current levels so the Buy % is 35%.

The Apple stock chart is looking weak as after the January high of $145, Apple fell to $116, and has just made a lower high at $137. So it is looking probable that Apple is going to break below the $116 low to target support in the 103 to 105 area. Therefore my buying level for apple is $109, about 16% lower then where it is trading right now.

5. FACEBOOK - $320

Facebook stock has rocketed higher which should not come as much surprise given my last analysis listing it as being CHEAP on an EC of just 28 vs 50 before. However, the surge in stock price has put Facebook back on fair value EC of 48. Will we we get another chance to buy Facebook on an temporary EC of 28? Hard to say because clearly it dawned on many investors during March and April that Facebook was relatively cheap at the time. The buy % for Facebook is 60%, so despite the surge higher Facebook is NOT expensive, which means it's going to be tough to expect much of a discount against it's current price.

Facebook has strong support at just under $300, and then a string of supporting highs all the way to $270. So Facebook has a ton of support under it which means it may not correct much. We can all dream of buying Facebook at $270 during a correction but I think the best we are actually going to get is to just under $300. So my buying level for Facebook is $299. The stock does not appear to have much downside.

The rest of this extensive analysis that concludes in buying levels for AI tech stocks. AI Stock Buying Levels, Ratings, Valuations and Trend Analysis into Market Correction has first been made available to Patrons who support my work.

Contents:

- TESLA

- Cathy Wood ARK Funds CRASH!

- India Apocalypse Heralds Catastrophe for Pakistan and Bangladesh

- Covid-19 in Italy in August 2019!

- Stock Market Early Summer Correction Trend Forecast

- Stocks Expensive or Cheap Indicator (EC)

- AI Stock Buy % Rating Review

- 1. GOOGLE - $2398

- 2. AMAZON - $3312

- 3. MICROSOFT - $252.5

- 4. APPLE - $130

- 5. FACEBOOK - $320

- 6. NVIDIA - $592.5

- 7. AMD - $78.8

- 11. IBM - $145.5

- 12. INTEL - $57.7

- AI Stocks Buying Levels Update May 2021

- So what am I going to do

- GPU Mining FREE MONEY!

- CHIA Crypto Farming with Your Hard Drives Insanity!

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including my most recent analysis: Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond!

- Invest and Forget

- Stock Market Early Summer Correction Review

- AI Stocks Strength vs Weakness

- RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

- HIGH RISK STOCK BUYING LEVELS

- RISK RATINGS

- WESTERN DIGITAL - WDC $71 - CHIA! - Risk 1

- Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

- Biotech stock 1 - Cheap Low Risk Pharma - Risk 1

- Biotech stock 2 - HIGH RISK GENE EDITING - Risk 9

- Biotech stock 3 - Low Risk 2

- Biotech stock 4 - X10 for Max Risk 10

- High Risk Stocks Portfolio Buying Levels

- Covid India Black Mold Epidemic

- Bitcoin and Raven Coin Buying Levels

My analysis schedule includes:

- Bitcoin and Crypto's Trend Forecast / Bear Market Accumulation Strategy - 80% Complete

- More X10 Biotech Tech Stocks - 50% done

- UK House Prices Trend Analysis - 15% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

And here's a taste of my forthcoming comprehensive analysis of the Crypto market and it's future prospects.

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.